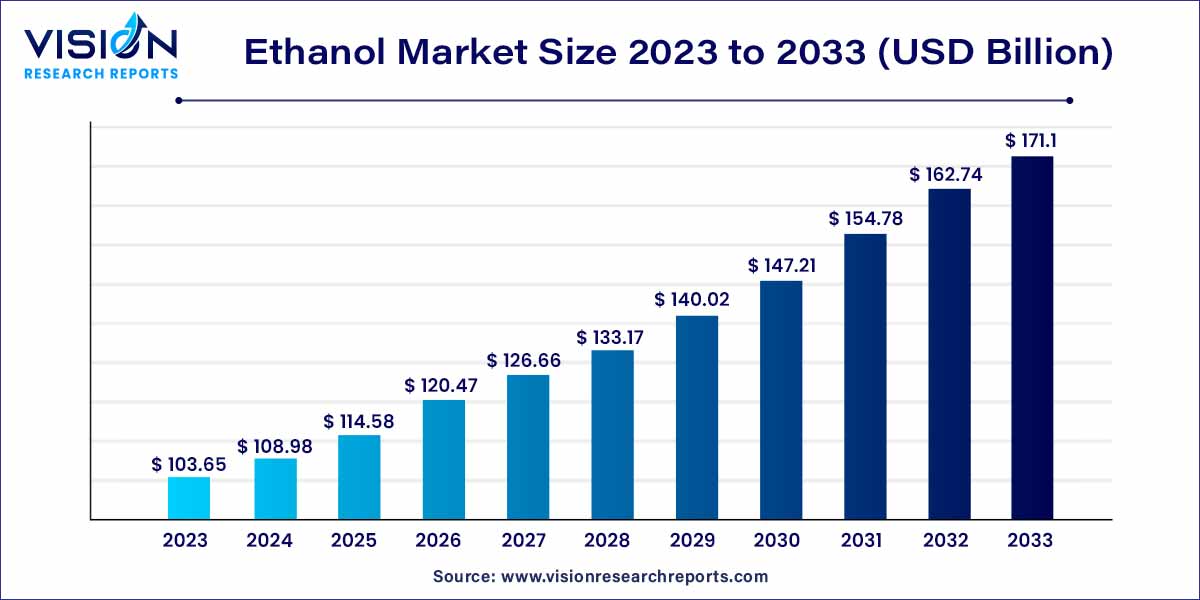

The global ethanol market size was estimated at USD 103.65 billion in 2023 and it is expected to surpass around USD 171.1 billion by 2033, poised to grow at a CAGR of 5.14% from 2024 to 2033. The ethanol market is driven by the product's increasing use as a biofuel is what is driving demand for it. An other significant driver of market expansion is the growing consumption of alcoholic beverages. Both natural and petrochemical feedstocks can be used to produce ethanol.

Ethanol, a versatile and widely-used alcohol, plays a pivotal role in various industries, including automotive, pharmaceuticals, beverages, and chemicals. Derived primarily from crops such as corn, sugarcane, and wheat, ethanol serves as a renewable and environmentally-friendly alternative to fossil fuels. This overview aims to provide insights into the dynamics, trends, and factors shaping the global ethanol market.

The growth of the ethanol market is propelled by various factors contributing to its expansion and development. One primary growth factor is the increasing global demand for renewable and environmentally friendly fuel sources. Ethanol, derived from renewable feedstocks such as corn, sugarcane, and wheat, offers a sustainable alternative to fossil fuels, aligning with efforts to mitigate climate change and reduce greenhouse gas emissions. Additionally, government policies and regulations mandating the use of ethanol-blended fuels further stimulate market growth. These regulations, aimed at reducing air pollution and promoting energy independence, create a supportive regulatory environment that incentivizes investment in ethanol production infrastructure. Moreover, technological advancements in ethanol production processes, including improvements in fermentation technologies and feedstock utilization efficiency, drive efficiency gains and cost reductions, making ethanol production more economically viable. Overall, the convergence of environmental concerns, regulatory support, and technological innovation fuels the growth trajectory of the ethanol market, positioning it as a key player in the transition to a more sustainable energy future.

In 2023, grain-based ethanol dominated the global ethanol market with the largest market share of 70% as the primary source. The significant increase in the production of ethyl alcohol using grain-based feedstocks serves as a major catalyst for the growth of this segment. Moreover, the sugar and molasses-based source segment is projected to experience a substantial Compound Annual Growth Rate (CAGR) throughout the forecast period. This growth is primarily attributed to the heightened adoption of sugar and molasses-based ethanol as an industrial solvent, which is expected to elevate the market share of sugar and molasses-based ethanol in the foreseeable future.

The denatured segment is projected to maintain a significant market share throughout the forecast period from 2024 to 2033. This dominance is attributed to the increasing demand for denatured ethanol in automotive and household applications across the globe. Denatured ethanol is primarily produced from feedstocks such as grains and starch. However, the undenatured segment is also expected to experience substantial growth at a noteworthy Compound Annual Growth Rate (CAGR) during the forecast period.

In terms of end-user segmentation, the global ethanol market is categorized into industrial solvents, beverages, personal care, fuel and fuel additives, disinfectants, and others. Among these, the fuel and fuel additives application segment held the largest revenue share of 46% in 2023. This dominance is fueled by the increasing demand from the automotive sector, coupled with stringent regulations concerning environmental safety in both developed and emerging economies. Moreover, the beverages application segment is expected to witness significant expansion at a notable Compound Annual Growth Rate (CAGR) over the forecast period. This growth is attributed to the rising demand for ethanol-based beverages in developed countries worldwide, thereby driving the growth of this segment.

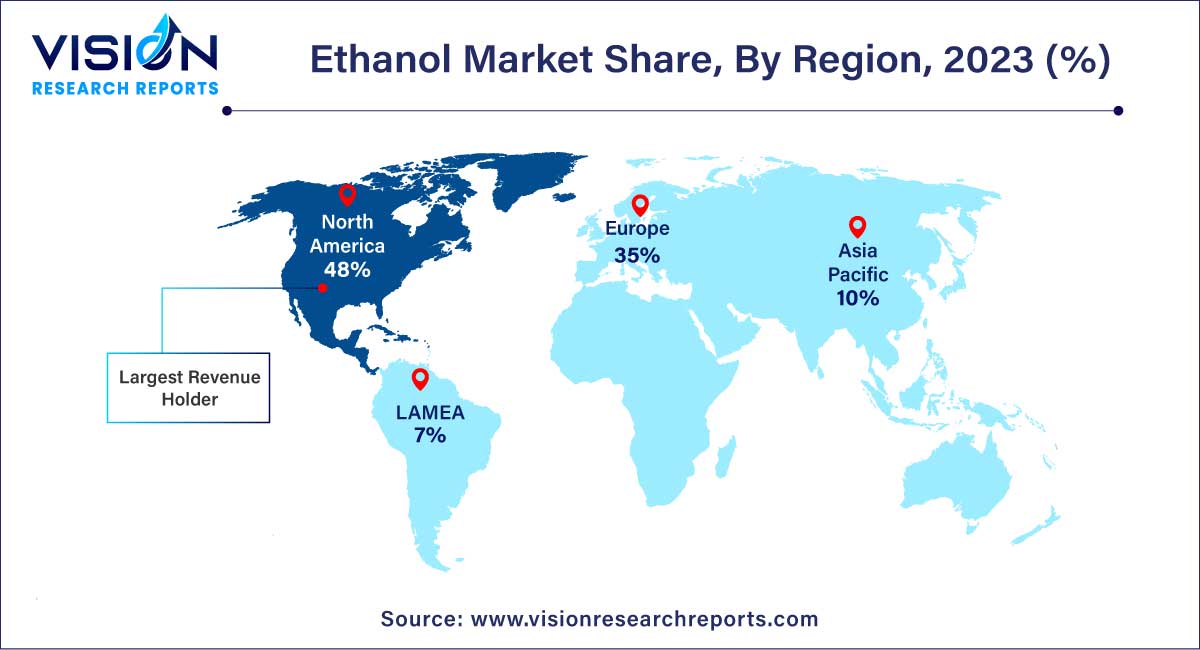

In 2023, North America emerged as the foremost regional market, commanding over 48% of the global share. It is anticipated to maintain its leading position throughout the forecast period. Conversely, Asia Pacific is poised to exhibit the swiftest Compound Annual Growth Rate (CAGR) from 2024 to 2033, propelled by escalating fuel consumption and heightened industrial activities. The region boasts a diverse industrial landscape and robustly growing economies, both of which are expected to contribute positively to market expansion. Fuel and industrial solvents are anticipated to be the primary application segments driving market growth in the region.

Latin America stands as one of the largest regional markets, owing to the abundant availability of raw materials and escalating product demand from the automotive sector. Anticipated alterations in environmental regulations within the region are forecasted to bolster ethanol consumption across various end-use industries.

By Source

By Purity

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others