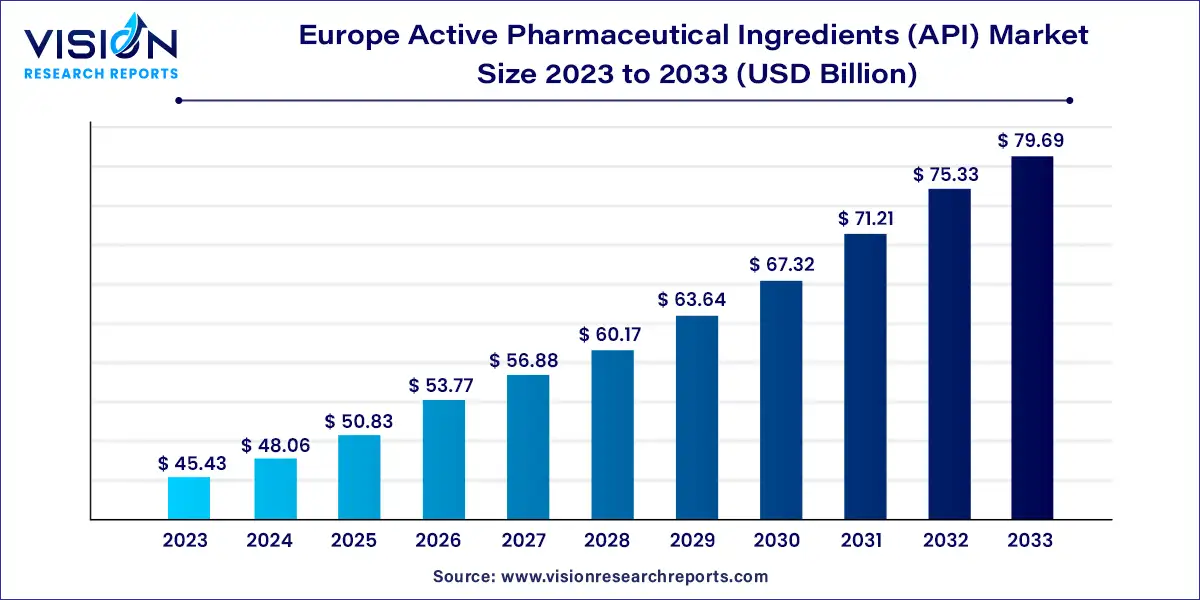

The Europe active pharmaceutical ingredients (API) market was estimated at USD 45.43 billion in 2023 and it is expected to surpass around USD 79.69 billion by 2033, poised to grow at a CAGR of 5.78% from 2024 to 2033.

The European market for active pharmaceutical ingredients (API) holds significant importance within the global pharmaceutical industry. With a rich history of pharmaceutical innovation and stringent regulatory standards, Europe remains a key hub for API manufacturing and distribution. This overview delves into the dynamics, trends, and key factors shaping the API market landscape across Europe.

The growth of the active pharmaceutical ingredients (API) market in Europe is propelled by an increasing demand for generic drugs, fueled by the expiration of patents on branded medications. This creates opportunities for pharmaceutical companies to produce and distribute affordable generic versions of popular drugs, driving market expansion. Additionally, Europe's aging population and rising prevalence of chronic diseases contribute to the growing need for pharmaceuticals, driving demand for APIs. Moreover, the region's robust infrastructure, skilled workforce, and adherence to stringent regulatory standards enhance its attractiveness for API manufacturing and distribution.

The synthetic segment dominated the market with the largest revenue share of 72% in 2023. Compared to natural molecules, the segment's dominance is attributed to its ready availability. Synthetic molecules offer consistency in terms of quality, purity, and potency. The manufacturing process of synthetic molecules can be standardized, which ensures that every batch of active pharmaceutical ingredients produced is identical in composition and quality. Furthermore, they are cost-effective. This is because the manufacturing process for natural molecules can be complex and time-consuming, which makes them more expensive to produce. In addition, the rising demand for generic drugs further boosts the API market growth. APIs for generic drugs generate high revenue for chemical and synthetic API manufacturing companies.

On the other hand, Biotech is expected to expand with the highest CAGR of 6.55% during the forecast period. The growth of the biotech API segment can be attributed to high investments in the biotechnology and biopharmaceutical sectors. This allows the innovation of new molecules that aid in the treatment of diseases such as cancer. Pharma companies are aiming to invest in biologics and scale up production capacities to meet the rising demand for biotech API-based products, which, in turn, is expected to drive the market.

The captive API segment dominated the market with the largest revenue share of 53% in 2023. The dominance is attributed due to high investment by market players to develop high-end manufacturing facilities. Captive APIs are often used by the major and bigger players in the market that have significant resources to invest in their infrastructure and technology. These organizations can create highly customized APIs that are tailored to their specific needs and can integrate them seamlessly with their products, manufacturing systems, and processes. Furthermore, captive APIs offer greater control over the quality and supply chain of products allowing the companies with their own API manufacturing to integrate backward and reduce reliance on suppliers.

The merchant API segment is anticipated to demonstrate the fastest growth rate over the forecast period, with a CAGR of 7.72%. Captive production of APIs is expensive; pharmaceutical manufacturing companies have initiated outsourcing of active pharmaceutical ingredients production to minimize expenses and eliminate the need for investing in expensive equipment and sophisticated infrastructure. The outsourcing trend is a major factor influencing the growth of regional contract manufacturers, such as Seqens.

The generic API segment dominated the market, accounting for the largest revenue share of 58% in 2023. The market is anticipated to expand at the fastest CAGR of 7.4% over the forecast period, attributable to the cost-effectiveness of generic APIs when compared to branded APIs, and thus aids in the reduction of cost for developing and manufacturing pharmaceutical products. Moreover, the patent expiry of branded molecules is a key factor that can be attributed to the lucrative growth of generic API-based drugs. As per European Fine Chemicals Group, Europe's major generic API manufacturing countries are Spain and Italy, with over 350 small- and large-scale companies in the region. These factors has helped to drive the growth of the generic API market in the region.

The innovative API segment is projected to show lucrative growth over the forecast period. These molecules are developed through a lengthy process that involves extensive research, testing, and clinical trials to determine their safety and effectiveness. Factors such as increasing demand for new and more effective treatments, advancements in technology and research, and growing investments in research and development by pharmaceutical companies drive the growth of innovative APIs.

The cardiology segment dominated the market in 2023 with a revenue share of 23% owing to the high prevalence of cardiovascular diseases and the increase in product availability. The prevalence of cardiovascular disorders is increasing due to several factors, such as lifestyle changes, obesity, and excessive alcohol use. Thus, early detection and effective treatment are crucial to reduce mortality. Europe has a highly advanced healthcare infrastructure, with well-equipped hospitals and clinics. This has led to increased adoption of advanced cardiovascular disease treatments, which has driven the demand for APIs and pharmaceuticals used in these treatments.

The oncology segment is anticipated to expand with the fastest CAGR of 7.45% over the forecast period owing to the rising prevalence of cancer in Europe. According to the ESMO report, 1.2 million people worldwide are projected to die from cancer in 2023. Several companies have been investing heavily in R&D to create medications that are tailored to novel biomarkers. The presence of various APIs in the marketplace for different types of cancer is expected to drive the segment growth further. Some oncology active pharmaceutical ingredients are Imatinib by Novartis AG and Trastuzumab, Bevacizumab, & Rituximab by F. Hoffmann-La Roche Ltd.

The prescription segment held the largest share of 80% in 2023. The dominance of this segment can be attributed to Europe’s stringent regulations for pharmaceuticals, including APIs. Prescription drugs require higher regulation and oversight levels than over-the-counter (OTC) drugs. These regulations ensure that the drugs are safe and effective, which helps to build trust among healthcare providers and patients.

Moreover, prescription drugs dominate the market in the oncology segment. Cancer is primarily treated using chemotherapy, immunotherapy, targeted therapy, and hormonal therapy. The number of prescriptions generated for targeted therapies is increasing rapidly, owing to the higher efficacy of novel targeted therapies. Major players are launching novel targeted therapies. For instance, in March 2021, Novartis announced the approval of ofatumumab in Europe, a unique product used to treat multiple sclerosis and can be self-administered.

The OTC segment is expected to expand with the fastest CAGR of 5.87% over the forecast period. The OTC segment is expected to continue growing in the coming years as more consumers seek self-care solutions for their health needs. However, consumers need to consult their healthcare provider before taking any OTC medication to ensure that it is safe and effective for their specific health conditions.

By Type of Synthesis

By Type of Manufacturer

By Type

By Type of Drug

By Application

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Europe Active Pharmaceutical Ingredients (API) Market

5.1. COVID-19 Landscape: Europe Active Pharmaceutical Ingredients (API) Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Europe Active Pharmaceutical Ingredients (API) Market, By Type of Synthesis

8.1. Europe Active Pharmaceutical Ingredients (API) Market, by Type of Synthesis, 2024-2033

8.1.1. Biotech

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Synthetic

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Europe Active Pharmaceutical Ingredients (API) Market, By Type of Manufacturer

9.1. Europe Active Pharmaceutical Ingredients (API) Market, by Type of Manufacturer, 2024-2033

9.1.1. Captive APIs

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Merchant APIs

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Europe Active Pharmaceutical Ingredients (API) Market, By Type

10.1. Europe Active Pharmaceutical Ingredients (API) Market, by Type, 2024-2033

10.1.1. Generic API

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Innovative API

10.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Europe Active Pharmaceutical Ingredients (API) Market, By Type of Drug

11.1. Europe Active Pharmaceutical Ingredients (API) Market, by Type of Drug, 2024-2033

11.1.1. Prescription Drugs

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Over-the-counter (OTC) Drugs

11.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Europe Active Pharmaceutical Ingredients (API) Market, By Application

12.1. Europe Active Pharmaceutical Ingredients (API) Market, by Application, 2024-2033

12.1.1. Cardiovascular Diseases

12.1.1.1. Market Revenue and Forecast (2021-2033)

12.1.2. Oncology

12.1.2.1. Market Revenue and Forecast (2021-2033)

12.1.3. CNS and Neurology

12.1.3.1. Market Revenue and Forecast (2021-2033)

12.1.4. Orthopedic

12.1.4.1. Market Revenue and Forecast (2021-2033)

12.1.5. Endocrinology

12.1.5.1. Market Revenue and Forecast (2021-2033)

12.1.6. Pulmonology

12.1.6.1. Market Revenue and Forecast (2021-2033)

12.1.7. Gastroenterology

12.1.7.1. Market Revenue and Forecast (2021-2033)

12.1.8. Nephrology

12.1.8.1. Market Revenue and Forecast (2021-2033)

12.1.9. Ophthalmology

12.1.9.1. Market Revenue and Forecast (2021-2033)

12.1.10. Others

12.1.10.1. Market Revenue and Forecast (2021-2033)

Chapter 13. Europe Active Pharmaceutical Ingredients (API) Market, Regional Estimates and Trend Forecast

1. Europe

13.1.1. Market Revenue and Forecast, by Type of Synthesis (2021-2033)

13.1.2. Market Revenue and Forecast, by Type of Manufacturer (2021-2033)

13.1.3. Market Revenue and Forecast, by Type (2021-2033)

13.1.4. Market Revenue and Forecast, by Type of Drug (2021-2033)

13.1.5. Market Revenue and Forecast, by Application (2021-2033)

13.1.6. UK

13.1.6.1. Market Revenue and Forecast, by Type of Synthesis (2021-2033)

13.1.6.2. Market Revenue and Forecast, by Type of Manufacturer (2021-2033)

13.1.6.3. Market Revenue and Forecast, by Type (2021-2033)

13.1.7. Market Revenue and Forecast, by Type of Drug (2021-2033)

13.1.8. Market Revenue and Forecast, by Application (2021-2033)

13.1.9. Germany

13.1.9.1. Market Revenue and Forecast, by Type of Synthesis (2021-2033)

13.1.9.2. Market Revenue and Forecast, by Type of Manufacturer (2021-2033)

13.1.9.3. Market Revenue and Forecast, by Type (2021-2033)

13.1.10. Market Revenue and Forecast, by Type of Drug (2021-2033)

13.1.11. Market Revenue and Forecast, by Application (2021-2033)

13.1.12. France

13.1.12.1. Market Revenue and Forecast, by Type of Synthesis (2021-2033)

13.1.12.2. Market Revenue and Forecast, by Type of Manufacturer (2021-2033)

13.1.12.3. Market Revenue and Forecast, by Type (2021-2033)

13.1.12.4. Market Revenue and Forecast, by Type of Drug (2021-2033)

13.1.13. Market Revenue and Forecast, by Application (2021-2033)

13.1.14. Rest of Europe

13.1.14.1. Market Revenue and Forecast, by Type of Synthesis (2021-2033)

13.1.14.2. Market Revenue and Forecast, by Type of Manufacturer (2021-2033)

13.1.14.3. Market Revenue and Forecast, by Type (2021-2033)

13.1.14.4. Market Revenue and Forecast, by Type of Drug (2021-2033)

13.1.15. Market Revenue and Forecast, by Application (2021-2033)

Chapter 14. Company Profiles

14.1. Cipla, Inc.

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Merck & Co., Inc.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Boehringer Ingelheim International GmbH

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Sun Pharmaceutical Industries Ltd.

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. AbbVie, Inc.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Bristol-Myers Squibb Company

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Teva Pharmaceutical Industries Ltd.

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Albemarle Corporation

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Aurobindo Pharma

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Viatris Inc.

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others