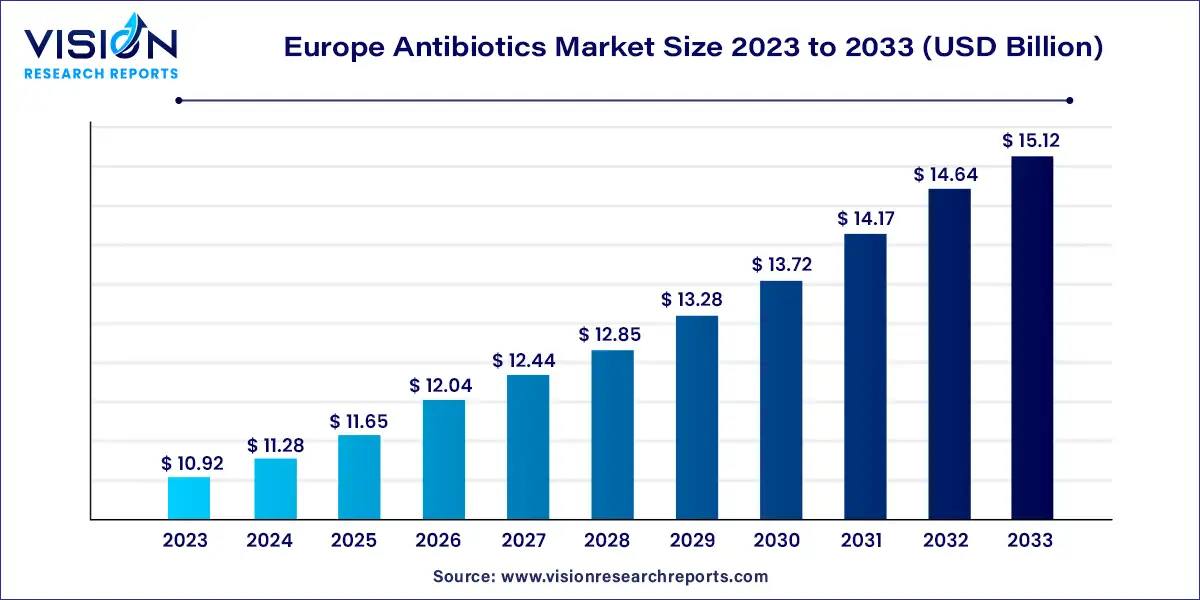

The Europe antibiotics market size was estimated at around USD 10.92 billion in 2023 and it is projected to hit around USD 15.12 billion by 2033, growing at a CAGR of 3.31% from 2024 to 2033.

The Europe antibiotics market stands as a critical segment within the pharmaceutical industry, characterized by its indispensable role in combating bacterial infections and preserving public health. Antibiotics, also known as antibacterials, are medications that either inhibit the growth of bacteria or destroy them outright.

The growth of the Europe antibiotics market is propelled by an increasing prevalence of infectious diseases across the region drives the demand for antibiotics as essential treatments. Additionally, advancements in technology and biotechnology have led to the development of more effective antibiotics, further boosting market growth. Moreover, rising healthcare expenditure and a growing emphasis on healthcare infrastructure contribute to the expansion of the antibiotics market in Europe. Furthermore, the urgent need to combat antibiotic resistance through the development of novel antibiotics and innovative treatment strategies presents opportunities for market growth. Regulatory initiatives aimed at ensuring the safety, efficacy, and quality of antibiotics also play a crucial role in driving market expansion. Overall, these factors collectively contribute to the steady growth of the Europe antibiotics market, underscoring its significance in maintaining public health and combating bacterial infections.

In 2023, the penicillin segment emerged as the market leader, commanding a significant revenue share of 26%. Penicillin remains a cornerstone in the treatment arsenal, widely employed against various diseases, notably those caused by streptococci, staphylococci, listeria, and clostridium. Its mechanism of action involves inhibiting cell wall synthesis or disrupting the formation of the peptidoglycan layer, effectively treating conditions such as skin infections, pharyngitis, gonorrhea, otitis media, and bronchitis. Penicillins often serve as the primary line of defense against bacterial infections. For instance, as per the ECDC's 2021 study, the European population's average ratio of broad-spectrum penicillins, cephalosporins, macrolides, and fluoroquinolones to narrow-spectrum penicillins, cephalosporins, and erythromycin usage locally exceeded 3.5.

The cephalosporin segment is anticipated to demonstrate substantial growth at a promising compound annual growth rate (CAGR) during the forecast period. Cephalosporins, belonging to the beta-lactam group of antibiotics, exhibit activity against both gram-negative and gram-positive bacteria, targeting pathogens like Klebsiella pneumoniae, Bacteroides fragilis, and Pseudomonas aeruginosa.

In 2023, generic antibiotics emerged as the market leader by type, commanding a significant revenue share of 82%. The branded antibiotics segment is anticipated to exhibit the fastest Compound Annual Growth Rate (CAGR) during the forecast period. The dominance of generic antibiotics can be attributed to several factors, including the affordability of generic formulations, the presence of numerous manufacturers leading to increased buyer bargaining power, and supportive regulatory frameworks. Additionally, favorable reimbursement policies promoting the use of generic formulations and easy accessibility to generic drugs are driving the growth of this segment.

Moreover, regulatory initiatives aimed at ensuring the safety and efficacy of antibiotics further bolster the segment's growth. For example, in June 2022, Venus Remedies received approval from its German subsidiary, Venus Pharma, to market its 2g, 1g, and 500mg antibiotic injections in Spain. This approval aims to strengthen the company's presence in the European market and underscores the importance of regulatory support in facilitating market expansion.

In 2023, the cell wall synthesis segment emerged as the market leader based on action mechanism, capturing the largest revenue share. Cell wall synthesis inhibitors represent widely used antibiotics known for their broad-spectrum activity against both gram-negative and gram-positive bacteria. These medications work by inhibiting the synthesis of the peptidoglycan layer, essential for the functional integrity of the bacterial cell wall. The segment is poised for substantial growth over the forecast period, driven by increased research efforts and government funding in administration.

Meanwhile, the RNA synthesis segment is projected to exhibit the fastest compound annual growth rate (CAGR) during the forecast period. This growth is attributed to factors such as the availability of nucleotides and the presence of regulatory elements like promoters and enhancers. Europe has been a significant contributor to RNA synthesis research, with European scientists leading discoveries and characterizations of key components of the RNA synthesis machinery. Their work has advanced our understanding of transcription regulation mechanisms and the diverse roles of RNA synthesis in various biological processes.

In 2023, the Europe antibiotics market accounted for a 23% share of the global antibiotics market. This significant share can be attributed to a rising number of patients grappling with infectious diseases and the ongoing clinical trials conducted by pharmaceutical companies. Moreover, the introduction of innovative and advanced potential molecules, along with unique combination therapies to address antibiotic-resistant bacterial infections, is anticipated to offer substantial valuable opportunities for market participants.

By Drug Class

By Type

By Action Mechanism

By Country

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others