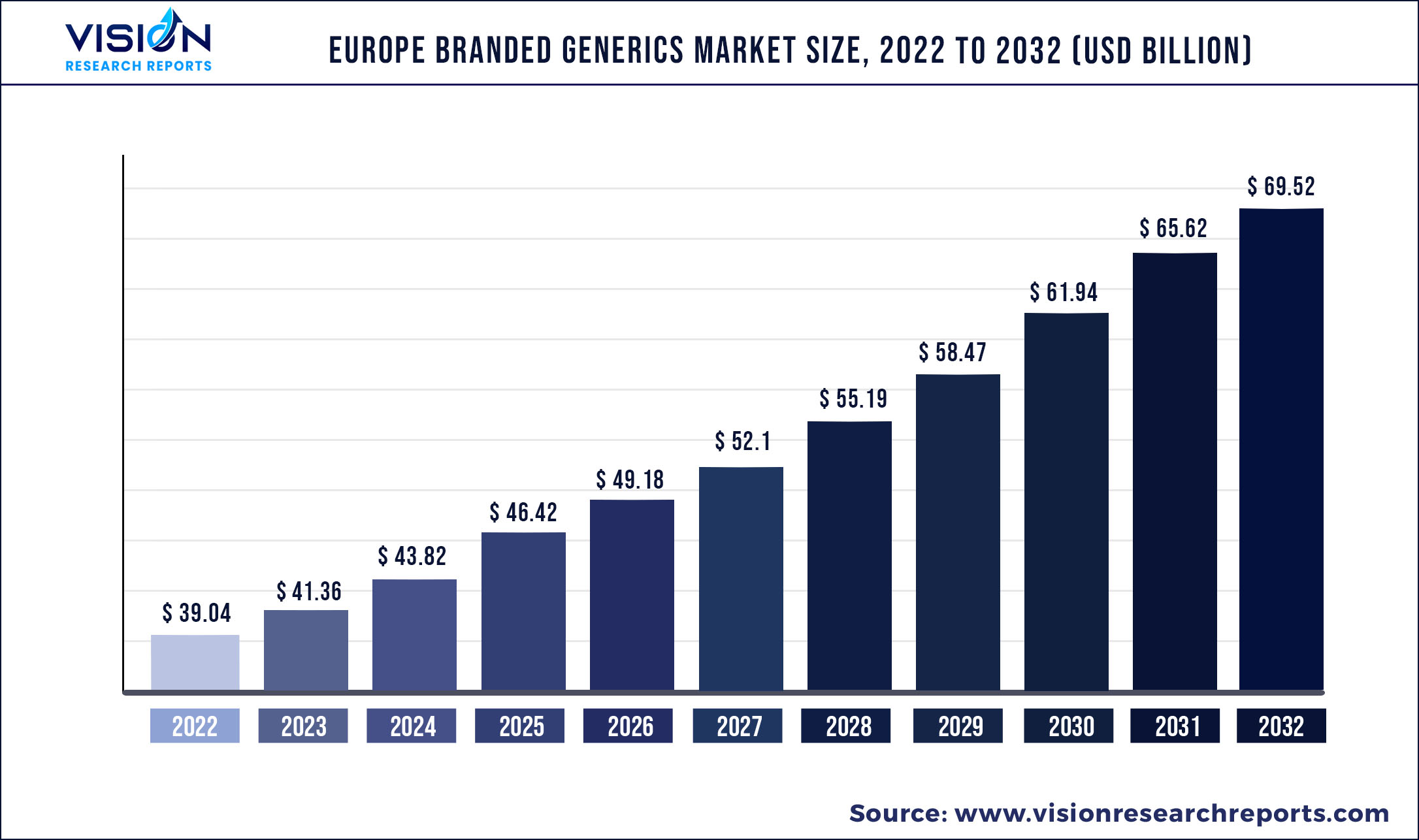

The Europe branded generics market was surpassed at USD 39.04 billion in 2022 and is expected to hit around USD 69.52 billion by 2032, growing at a CAGR of 5.94% from 2023 to 2032.

Key Players

| Report Coverage | Details |

| Market Size in 2022 | USD 39.04 billion |

| Revenue Forecast by 2032 | USD 69.52 billion |

| Growth rate from 2023 to 2032 | CAGR of 5.94% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Segmentation | Drug Class, Application, Route of Administration, Distribution Channel |

| Companies Covered | Teva Pharmaceutical Industries Ltd, Lupin, Sanofi, Sun Pharmaceutical Industries Ltd., Dr. Reddy’s Laboratories Ltd, Endo International plc., GlaxoSmithKline plc, Wockhardt, Viatris, Inc., Apotex, Inc. |

The rising prevalence of chronic diseases across the region is expected to contribute to market growth. The increasing burden of infectious & non-infectious diseases coupled with the growing geriatric population, which is more susceptible to chronic diseases, such as diabetes, hypertension, and obesity, is expected to positively impact market growth. In 2021, there were around 2.2 million people affected with HIV in WHO Europe Region, and around 57.0% of the newly diagnosed patients were from the Russian Federation. Competitive rivalry in the Europe branded generics market is likely to be high due to the various strategies adopted by the key players such as merger & acquisition and expansion of the business to strengthen their position in the market. Many established companies are engaged in the development of a generic version of branded drugs.

In October 2022, Aspire Pharma, a portfolio company of H.I.G. Capital, LLC acquired Morningside Pharmaceuticals and Morningside Healthcare, a leading provider of branded and generic specialty pharmaceuticals. Morningside has more than 80 product families of multiple therapeutic areas such as central nervous system (CNS), gastrointestinal diseases (GID), psychiatry, infectious, and endocrine. This acquisition is expected to drive Europe branded generics market.

Furthermore, in 2020, the EU strategically took steps to increase access to biosimilars and generic medicines. This included initiatives such as removing barriers that delay market entry of generics, increasing access to health systems, and digitalization of medicine regulatory systems to expedite processes ensuring ease of market entry. This initiative also boosted the production of branded generics by encouraging pharmaceutical companies to develop and manufacture these medicines and support the growth of Europe branded generics market.

The generic drug manufacturers have warned they may halt production of making low priced generic drugs due to surging electricity costs and the raising prices of drugs. For instance, in September 2022, Medicines for Europe sent an open letter to the Europe Union member states energy and health ministers regarding tackling Europe’s energy crisis, with a gas price cap on the table and a tax on profits of fossil fuel companies. This factor restrains the growth of the Europe branded generics market.

Europe Branded Generics Market Segmentations:

| By Drug Class | By Application | By Route of Administration | By Distribution Channel |

|

Alkylating Agents Antimetabolites Hormones Anti-hypertensive & Lipid lowering drugs Anti-depressants Anti-psychotics Anti-epileptics Others |

Oncology Cardiovascular Diseases Neurological Diseases Gastrointestinal Diseases Dermatological diseases Acute and Chronic Pain Others |

Topical Oral Parenteral Others |

Hospital Pharmacy Retail Pharmacy Online Pharmacy & Others |

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Europe Branded Generics Market

5.1. COVID-19 Landscape: Europe Branded Generics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Europe Branded Generics Market, By Drug Class

8.1. Europe Branded Generics Market, by Drug Class, 2023-2032

8.1.1. Alkylating Agents

8.1.1.1. Market Revenue and Forecast (2019-2032)

8.1.2. Antimetabolites

8.1.2.1. Market Revenue and Forecast (2019-2032)

8.1.3. Hormone

8.1.3.1. Market Revenue and Forecast (2019-2032)

8.1.4. Anti-hypertensive & Lipid lowering drugs

8.1.4.1. Market Revenue and Forecast (2019-2032)

8.1.5. Anti-depressants

8.1.5.1. Market Revenue and Forecast (2019-2032)

8.1.6. Anti-psychotics

8.1.6.1. Market Revenue and Forecast (2019-2032)

8.1.7. Anti-epileptics

8.1.7.1. Market Revenue and Forecast (2019-2032)

8.1.8. Others

8.1.8.1. Market Revenue and Forecast (2019-2032)

Chapter 9. Europe Branded Generics Market, By Application

9.1. Europe Branded Generics Market, by Application, 2023-2032

9.1.1. Oncology

9.1.1.1. Market Revenue and Forecast (2019-2032)

9.1.2. Cardiovascular Diseases

9.1.2.1. Market Revenue and Forecast (2019-2032)

9.1.3. Neurological Diseases

9.1.3.1. Market Revenue and Forecast (2019-2032)

9.1.4. Gastrointestinal Diseases

9.1.4.1. Market Revenue and Forecast (2019-2032)

9.1.5. Dermatological diseases

9.1.5.1. Market Revenue and Forecast (2019-2032)

9.1.6. Acute and Chronic Pain

9.1.6.1. Market Revenue and Forecast (2019-2032)

9.1.7. Others

9.1.7.1. Market Revenue and Forecast (2019-2032)

Chapter 10. Europe Branded Generics Market, By Route of Administration

10.1. Europe Branded Generics Market, by Route of Administration, 2023-2032

10.1.1. Topical

10.1.1.1. Market Revenue and Forecast (2019-2032)

10.1.2. Oral

10.1.2.1. Market Revenue and Forecast (2019-2032)

10.1.3. Parenteral

10.1.3.1. Market Revenue and Forecast (2019-2032)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2019-2032)

Chapter 11. Europe Branded Generics Market, By Distribution Channel

11.1. Europe Branded Generics Market, by Distribution Channel, 2023-2032

11.1.1. Hospital Pharmacy

11.1.1.1. Market Revenue and Forecast (2019-2032)

11.1.2. Retail Pharmacy

11.1.2.1. Market Revenue and Forecast (2019-2032)

11.1.3. Online Pharmacy & Others

11.1.3.1. Market Revenue and Forecast (2019-2032)

Chapter 12. Europe Branded Generics Market, Regional Estimates and Trend Forecast

12.1. Europe

12.1.1. Market Revenue and Forecast, by Drug Class (2019-2032)

12.1.2. Market Revenue and Forecast, by Application (2019-2032)

12.1.3. Market Revenue and Forecast, by Route of Administration (2019-2032)

12.1.4. Market Revenue and Forecast, by Distribution Channel (2019-2032)

12.1.5. UK

12.1.5.1. Market Revenue and Forecast, by Drug Class (2019-2032)

12.1.5.2. Market Revenue and Forecast, by Application (2019-2032)

12.1.5.3. Market Revenue and Forecast, by Route of Administration (2019-2032)

12.1.5.4. Market Revenue and Forecast, by Distribution Channel (2019-2032)

12.1.6. Germany

12.1.6.1. Market Revenue and Forecast, by Drug Class (2019-2032)

12.1.6.2. Market Revenue and Forecast, by Application (2019-2032)

12.1.6.3. Market Revenue and Forecast, by Route of Administration (2019-2032)

12.1.6.4. Market Revenue and Forecast, by Distribution Channel (2019-2032)

12.1.7. France

12.1.7.1. Market Revenue and Forecast, by Drug Class (2019-2032)

12.1.7.2. Market Revenue and Forecast, by Application (2019-2032)

12.1.7.3. Market Revenue and Forecast, by Route of Administration (2019-2032)

12.1.7.4. Market Revenue and Forecast, by Distribution Channel (2019-2032)

12.1.8. Rest of Europe

12.1.8.1. Market Revenue and Forecast, by Drug Class (2019-2032)

12.1.8.2. Market Revenue and Forecast, by Application (2019-2032)

12.1.8.3. Market Revenue and Forecast, by Route of Administration (2019-2032)

12.1.8.4. Market Revenue and Forecast, by Distribution Channel (2019-2032)

Chapter 13. Company Profiles

13.1. Teva Pharmaceutical Industries Ltd

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Lupin

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Sanofi

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Sun Pharmaceutical Industries Ltd.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Dr. Reddy’s Laboratories Ltd

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Endo International plc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. GlaxoSmithKline plc

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Wockhardt

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Viatris, Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Apotex, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others