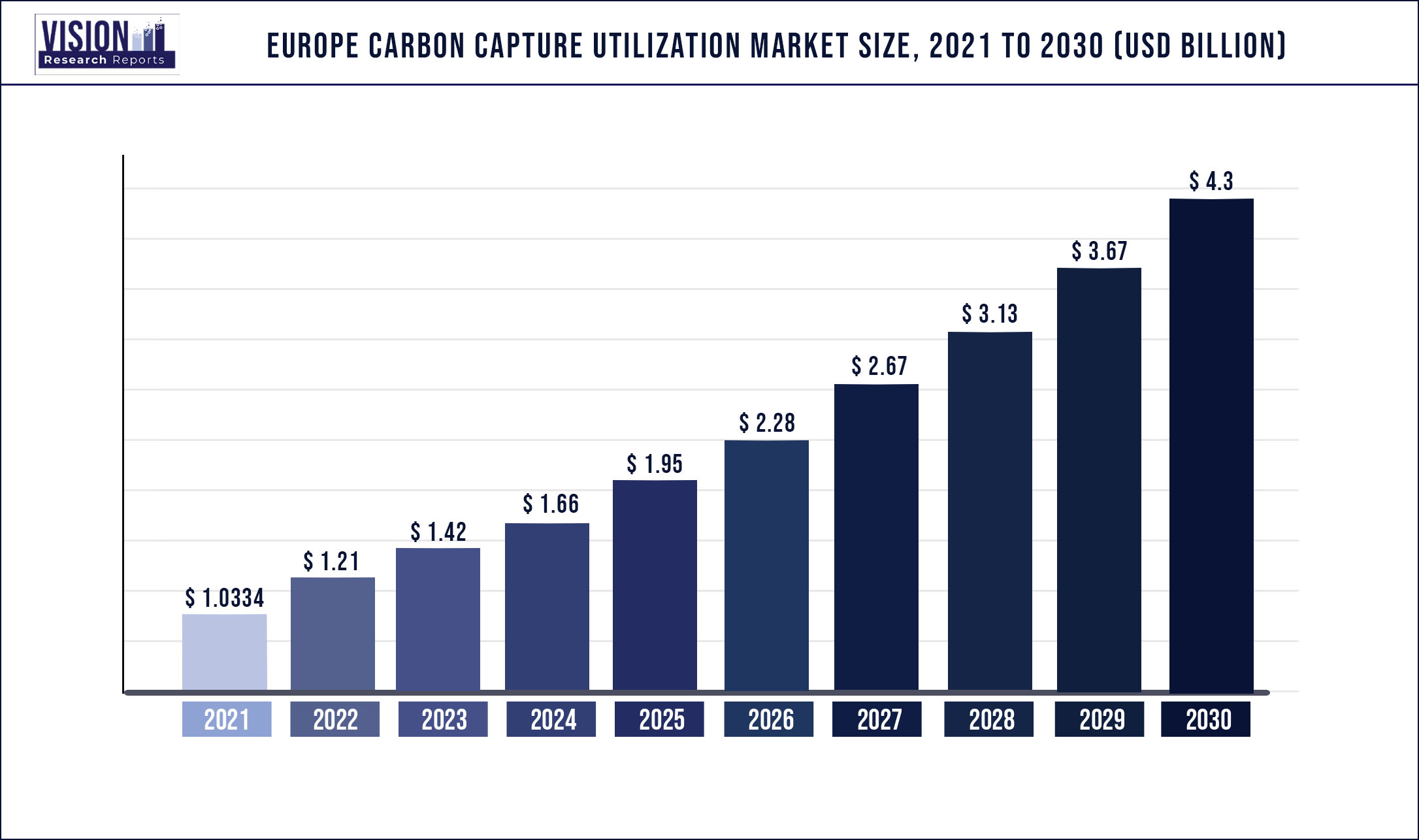

The Europe carbon capture utilization market was surpassed at USD 1,033.4 million in 2021 and is expected to hit around USD 4.3 billion by 2030, growing at a CAGR of 17.17% from 2022 to 2030

Report Highlights

Increasing applications of CCU in the enhanced oil recovery (EOR) in the oil and gas segment are expected to contribute to the growth of the market. Further, the food and beverages, chemicals, cement, and other industries are anticipated to be the major application segments that are expected to contribute to the growth of the market over the forecast period.

Industrial emerged as the largest market share in 2020 in terms of value for application segment as it is used in the industries such as cement, chemicals, power, steel, food, and beverages to capture carbon and utilize it for a better purpose. In terms of value, cement in the industrial application segment emerged as the largest segment in 2020 as many companies are showing interest in the adoption of carbon capture and utilization technologies in their manufacturing plants in the form of pilot-scale projects to evaluate the technology and economics of carbon capture and recovery, which is expected to contribute to the growth of the market in the coming years.

The demand for carbon dioxide has been experiencing a dip in sectors such as beverage manufacturing as restaurants and bars across Europe have shut operations. Also, reduced demand for oil has resulted in halted operations in oil production in some of the exploration sites of oil & gas vendors that employ carbon dioxide-based EOR techniques. Further, the demand for industrial-grade carbon dioxide has also been on the lower side as industrial activities have slowed down in states badly affected by COVID-19.

However, the demand for CCU for the utilization of carbon dioxide has been on a higher side from medical and fire-fighting applications in Europe. The requirement for a large number of COVID care centers across the country, along with a number of medical applications of carbon dioxide, has resulted in high demand for medical-grade carbon dioxide in the region in recent times. Further, the requirement for fire-fighting equipment in newly developed hospitals and centers and upgrade in safety standards in existing facilities have resulted in increased demand for carbon dioxide in firefighting applications in the country.

Significant technological advancements in non-power sectors, such as petroleum refining, chemical, cement manufacturing, and metal foundry, in mature economies, such as the Netherlands, the U.K., and Norway, have led to the implementation of CCU technologies in small or pilot phases. Such favorable initiatives, coupled with increasing awareness among policymakers across various industrial sectors regarding the benefits of such techniques to curtail CO2 emissions are likely to provide immense opportunities for future investments.

The industrial application segment dominated the market and accounted for a revenue share of 41.6% in 2020. The cement industry emits a significant amount of CO2 during the calcination of limestone (CaCO3) to form CaO, which is the main precursor for cement production. The growing number of regulatory measures undertaken by the local governments to limit carbon emissions has created lucrative opportunities for the carbon capture utilization market.

Moreover, carbon dioxide is widely used for upstream well servicing applications such as hydraulic fracturing and Enhanced Oil Recovery (EOR) applications such as miscible oil displacement in the oil & gas industry. Carbon dioxide is injected into the rock pores to recover crude oil. CO2 is miscible with crude oil and is comparatively less expensive than other similar miscible fluids used for these applications, making it a preferred choice for EOR applications.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 1,033.4 million |

| Revenue Forecast by 2030 | USD 4.3 billion |

| Growth rate from 2022 to 2030 | CAGR of 17.17% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Application, country |

| Companies Covered | Royal Dutch Shell; Aker Solutions; Equinor ASA; Linde Plc; Siemens Energy; Fluor Corporation; Sulzer Ltd.; Mitsubishi Heavy Industries Ltd. (MHI) |

Application Insights

The industrial application segment led the market for carbon capture utilization in Europe and accounted for more than 41.7% revenue share in 2021 and is anticipated to maintain its dominance over the forecast period. The industrial segment is further sub-segmented into applications such as Properties such as higher toughness and impact strength, light transmittance, protection from Ultraviolet (UV) radiations, and chemical and heat resistance make recycled PC resins suitable for use in electrical and electronic device components such as television frames, mobile cases, electrical housing, and others. The global demand for recycled PC polymer in electrical and electronics is expected to rise in the forthcoming years.

Carbon capture utilization in EOR is one of the significant industries, which has a growth rate of 18.8% from 2022 to 2030. The strong underpinning expertise and the availability of high-end technologies are the most crucial factors favoring the adoption of carbon capture utilization across the oil & gas industry. Furthermore, factors such as comprehensive value chain relationships, access to low-cost finance, and revenues generated by the market players, are used to fund to adopt the carbon capture utilization in the oil and gas industry.

Country Insights

Germany dominated the Europe carbon capture utilization market and accounted for the largest revenue share of 21.06% in 2021. Germany led the market in 2021, in terms of both volume and revenue in the region. The country’s carbon capture utilization Market is driven by the chemical industry which has a highly developed structure in terms of infrastructure, research and production facilities, and access to the national and market. As a global leader in the chemical industry and a well-trained workforce, Germany is a mature partner for foreign investment. In 2019, there were a total of about 2,900 chemical companies in Germany. Thus, there is a huge potential for CCU installation providers to install CCU facilities at the premises of chemical plants due to government support and increased spending in capturing carbon emission technology.

Moreover, in France, the implementation of the carbon tax largely depends on the tax revenue allocation used to fund energy transition. In 2018, the carbon tax was set on a rising price trajectory toward USD 97/tCO2e, however, in 2022, this plan has been modified on account of social protests opposing the rising fuel prices and carbon tax rates, resulting in the implementation of CCU technology in a phased manner.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Europe Carbon Capture Utilization Market

5.1. COVID-19 Landscape: Europe Carbon Capture Utilization Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Global Europe Carbon Capture Utilization Market, By Application

8.1.Europe Carbon Capture Utilization Market, by Application Type, 2020-2027

8.1.1. Enhanced Oil Recovery (EOR)

8.1.1.1.Market Revenue and Forecast (2016-2027)

8.1.2. Industrial

8.1.2.1.Market Revenue and Forecast (2016-2027)

8.1.3. Agriculture

8.1.3.1.Market Revenue and Forecast (2016-2027)

Chapter 9. Global Europe Carbon Capture Utilization Market, Regional Estimates and Trend Forecast

9.1.Europe

9.1.1. Market Revenue and Forecast, by Application (2016-2027)

9.1.2. UK

9.1.2.1.Market Revenue and Forecast, by Application (2016-2027)

9.1.3. France

9.1.3.1.Market Revenue and Forecast, by Application (2016-2027)

9.1.4. Rest of Europe

9.1.4.1.Market Revenue and Forecast, by Application (2016-2027)

Chapter 10.Company Profiles

10.1.Aker Solutions

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2.Equinor ASA

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3.Fluor Corporation

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4.Linde Plc

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5.Mitsubishi Heavy Industries Ltd. (MHI)

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6.Royal Dutch Shell

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7.Siemens Energy

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8.Sulzer Ltd.

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1.About Us

12.2.Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others