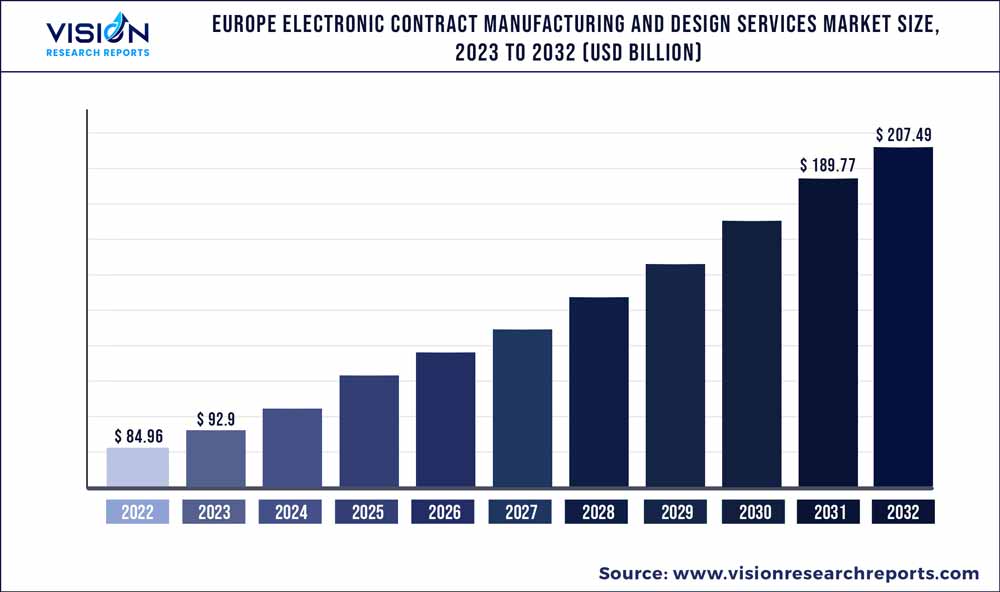

The Europe electronic contract manufacturing and design services market was estimated at USD 84.96 billion in 2022 and it is expected to surpass around USD 207.49 billion by 2032, poised to grow at a CAGR of 9.34% from 2023 to 2032.

Key Pointers

Report Scope of the Europe Electronic Contract Manufacturing And Design Services Market

| Report Coverage | Details |

| Market Size in 2022 | USD 84.96 billion |

| Revenue Forecast by 2032 | USD 207.49 billion |

| Growth rate from 2023 to 2032 | CAGR of 9.34% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Benchmark Electronics; Cicor Management AG; Enis; Flex Ltd.; Hon Hai Precision Industry Co., Ltd. (Foxconn Technology Group); Jabil Inc.; Kitron ASA; Neways; NORBIT ASA; NOTE AB; Sanmina Corp.; Scanfil; USI; VIDEOTON HOLDING ZRt; Zollner Elektronik |

The growth of the market can be attributed to the continued adoption of work-from-home and remote working practices, which has gained traction in the wake of the outbreak of the COVID-19 pandemic and has triggered the demand for high-end servers, storage devices, switches, routers, and other computing devices. The growth can also be attributed to the fact that remote working and work-from-home trends are expected to evolve as a new norm over the next few years.

The strong emphasis of Original Equipment Manufacturers (OEMs) on outsourcing electronics manufacturing to focus more on their core competencies is also expected to emerge as a long-term factor contributing to the market growth over the forecast period.The outbreak of the COVID-19 pandemic prompted several governments in Europe to impose lockdowns and restrictions on the movement of people and goods as part of the efforts to curb the spread of the coronavirus. This resulted in severe disruption in supply chains and temporary suspension of manufacturing activities at several production facilities, whichled to production delays. Nevertheless, order backlogs and sales to new customers in eastern European countries, notably Sweden, Finland, the Netherlands, and Denmark, gradually aided in a market recovery.

As a result, the slump in sales noted in H1/2020 was partially offset in H2/2020. The rising preference for localized supply chains and the need for a highly efficient manufacturing process bodes well for the growth of the market. Electronic Manufacturing Services (EMS) vendors can manufacture electronics products at a reduced total cost to OEMs. EMS companies can particularly manufacture customized products on a large scale while focusing on reducing manufacturing costs and leveraging higher capacity utilization. EMS vendors are also integrating the latest technologies, such as AI and 3D digital printing, into their production processes as part of the efforts to reduce their capital investment in inventory, facilities, and equipment used in manufacturing.

Such strategic initiatives being pursued by EMS vendors are expected to encourage OEMs to consider outsourcing electronics manufacturing to EMS vendors and focus on their core competencies.The continued adoption of cloud computing infrastructure and the rollout of smart city projects coupled with the rising popularity of smart homes are some of the other factors that are expected to contribute to the growth of the market. Vendors are aggressively adopting big data and implementing predictive maintenance technologies in all areas of EMS. The Internet of Things (IoT) can play a crucial role in predictive technology and big data by aiding in collecting, processing, and analyzing data in real-time, thereby helping in increasing productivity and efficiency. Predictive maintenance envisages linking factories through the internet to monitor and control processes remotely using mobile devices or personal computers.

Predictive maintenance helps EMS vendors in accelerating production, gain greater control over quality, and reduce costs. The proliferation of IoT networks is driving the demand for highly efficient smart applications and devices, thereby paving the way for the growth of the market. The strong emphasis on reducing the time to market is anticipated to drive the market over the forecast period. The time the product takes to reach the OEMs’ facilities from the EMS providers’ facilities is turning out to be a major concern for the OEMs. As a result, OEMs are particularly hesitant to deal with EMS providers located at longer distances. Hence, EMS providers are exploring the alternative of micro-logistics to meet the OEMs’ demands for accelerated delivery and are investing heavily in improving their logistics to ensure the timely delivery of products.

Service Insights

The electronic manufacturing service segment accounted for the largest revenue share of 45% in 2022. This type of service helps industries with a continuous supply of services, reduces operational costs, and mitigates risks. The growing technological advancements with the rising adoption of electronic devices across sectors, such as aerospace, healthcare, automotive, and telecommunication, in the region have increased the need for electronic manufacturing services.

The electronic design & engineering service segment is anticipated to grow at a CAGR of 11.12% during the forecast period owing to the growing demand for electronic systems among the industries, such as aerospace, healthcare, automation, and telecommunication. Furthermore, stringent regulatory compliance in Europe for product safety, privacy, and environmental stability has anticipated the need for suitable electronic design & engineering services, leading to market growth.

End-Use Insights

The IT & telecom segment accounted for the largestrevenue share of 48% in 2022. The IT & telecom industry is identified as the most evolving sector of the market. The sector is continuously adopting advanced technology solutions for fulfilling growing customer demands. The electronic contract manufacturing and design services offer enhanced scalability and flexibility to manufacture electronic devices as per consumer demands. The sector mainly outsources these services to offer customized and specialized services and efficiently handle large-scale productions and customer variation requirements. The healthcare segment is anticipated to grow at a CAGR of 11.2% during the forecast period.

The growth of the segment can be attributed to the rising demand for advanced medical devices, including Computed Tomography (CT) scanner assemblies, ultrasound imaging systems, and blood analyzers. The increasing geriatric population in European countries, such as Italy, Greece, and Portugal, is typically driving the demand for ambient-assisted devices. The high costs associated with the manufacturing of these devices are prompting healthcare OEMs to opt for contract manufacturing. The rising demand for patient care devices and sophisticated diagnostics devices, particularly in the wake of the COVID-19 pandemic, also bodes well for market growth.

Europe Electronic Contract Manufacturing And Design Services Market Segmentations:

By Service

By End-Use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Europe Electronic Contract Manufacturing And Design Services Market

5.1. COVID-19 Landscape: Europe Electronic Contract Manufacturing And Design Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Europe Electronic Contract Manufacturing And Design Services Market, By Service

8.1. Europe Electronic Contract Manufacturing And Design Services Market, by Service, 2023-2032

8.1.1. Electronic Design & Engineering

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Electronics Assembly

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Electronic Manufacturing

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Europe Electronic Contract Manufacturing And Design Services Market, By End-Use

9.1. Europe Electronic Contract Manufacturing And Design Services Market, by End-Use, 2023-2032

9.1.1. Healthcare

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Automotive

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Industrial

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Aerospace & Defense

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. IT & Telecom

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Power & Energy

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Consumer Electronics

9.1.7.1. Market Revenue and Forecast (2020-2032)

9.1.8. Others

9.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Europe Electronic Contract Manufacturing And Design Services Market, Regional Estimates and Trend Forecast

10.1. Europe

10.1.1. Market Revenue and Forecast, by Service (2020-2032)

10.1.2. Market Revenue and Forecast, by End-Use (2020-2032)

Chapter 11. Company Profiles

11.1. Benchmark Electronics

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Cicor Management AG

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Enis

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Flex Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Hon Hai Precision Industry Co., Ltd. (Foxconn Technology Group)

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Jabil Inc.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Kitron ASA

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Neways

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. NORBIT ASA

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. NOTE AB

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others