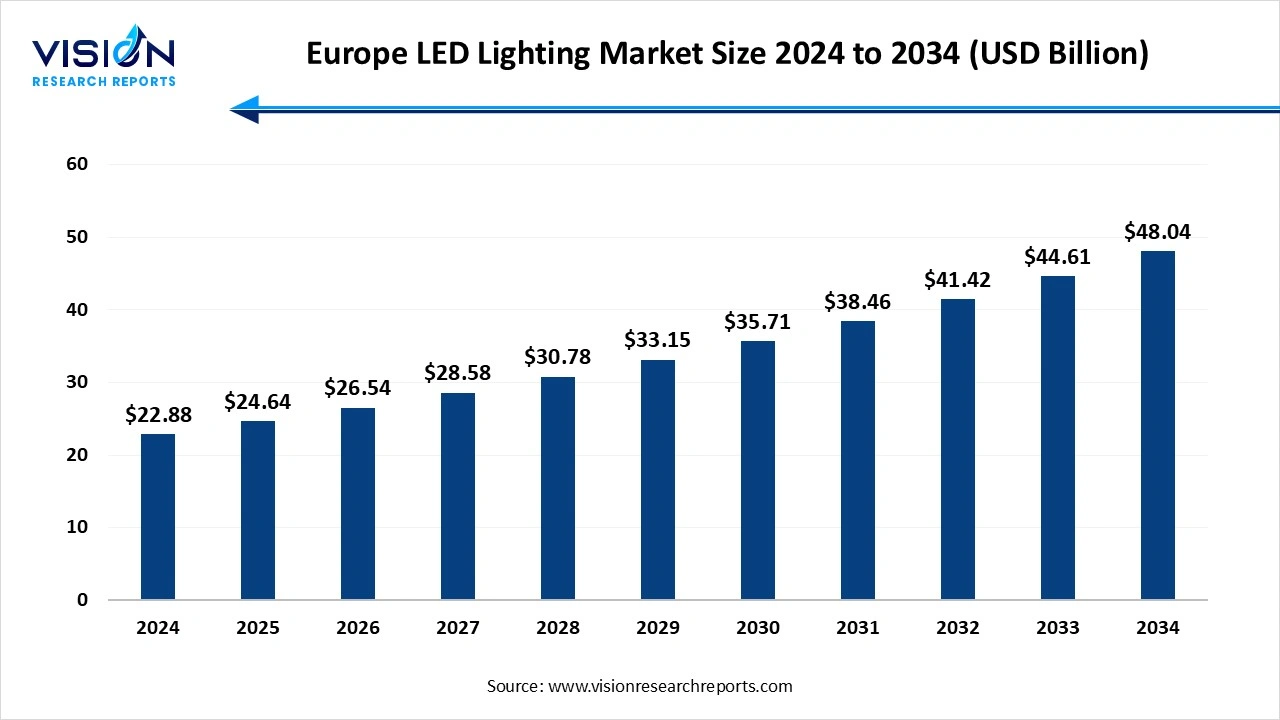

The Europe LED lighting market size was surpassed at around USD 22.88 billion in 2024 and it is projected to hit around USD 48.04 billion by 2034, growing at a CAGR of 7.70% from 2025 to 2034.

The Europe LED lighting market has witnessed substantial growth in recent years, driven by increasing environmental awareness, stringent energy efficiency regulations, and a growing demand for sustainable lighting solutions across residential, commercial, and industrial sectors. Governments across the region have implemented policies to phase out inefficient lighting technologies, encouraging the widespread adoption of LEDs due to their energy-saving potential and longer lifespan.

One of the primary growth factors driving the Europe LED lighting market is the region's strong regulatory framework promoting energy efficiency and environmental sustainability. European Union directives, such as the EcoDesign and Energy Labelling regulations, have significantly pushed manufacturers and consumers toward adopting energy-efficient lighting solutions like LEDs. These policies, combined with national initiatives offering subsidies and incentives for energy-saving upgrades, have fueled widespread LED deployment across both public infrastructure and private properties.

Another key growth driver is the increasing integration of LED lighting with smart technologies. As Europe advances toward smart city development, LED lighting systems with features like motion sensors, remote monitoring, and IoT-based controls are becoming essential components of urban infrastructure. The demand for smart lighting is especially prominent in commercial buildings, industrial facilities, and outdoor applications such as street lighting.

A notable trend in the Europe LED lighting market is the rapid adoption of smart and connected lighting systems. With the rise of smart homes, buildings, and cities across the region, LED lighting solutions integrated with IoT, sensors, and automation platforms are gaining popularity. These systems offer enhanced energy efficiency, remote management, and adaptive lighting capabilities, which are particularly valuable in commercial and municipal applications. Countries like Germany, the UK, and the Netherlands are leading in implementing smart street lighting and intelligent building solutions that rely heavily on advanced LED technologies.

Another emerging trend is the focus on human-centric and sustainable lighting design. European consumers and businesses are increasingly prioritizing lighting that supports well-being, productivity, and environmental goals. Human-centric lighting, which mimics natural light patterns to support circadian rhythms, is becoming popular in offices, schools, and healthcare facilities.

One of the key challenges facing the Europe LED lighting market is the high initial cost of advanced LED systems, particularly those integrated with smart technologies. While long-term savings in energy and maintenance are significant, the upfront investment for smart lighting infrastructure especially for large-scale commercial or municipal projects can be a barrier to adoption. This is particularly true for smaller businesses and local governments with limited budgets.

Another significant challenge is the fragmented regulatory landscape across Europe. Although the European Union promotes standardized energy efficiency goals, individual countries often implement varying regulations, certifications, and incentives. This inconsistency can create obstacles for manufacturers and suppliers trying to scale their products across multiple markets within the region.

The Europe LED lighting market is segmented into four key regions: the UK, Germany, and the Rest of Europe (RoE). In 2024, the Rest of Europe emerged as the leading region, capturing a substantial 74% share of the market. This dominance is primarily driven by proactive energy efficiency initiatives, rising consumer awareness, strong demand for sustainable lighting solutions, and the presence of established manufacturers. Additionally, favorable government policies and incentive programs have further supported the widespread adoption of LED technology, reinforcing the region’s leadership in the European market.

The lamp segment held the dominant position in the market, capturing a 55% share in 2024. LED lamps are designed to replace traditional incandescent, halogen, and compact fluorescent lamps, offering significantly higher energy efficiency and longer operational life. These lamps are typically used in general lighting applications such as homes, offices, hotels, and retail environments. The replacement demand, driven by regulatory bans on inefficient lighting and growing awareness of energy conservation, has fueled the rapid adoption of LED lamps across the region.

The luminaire segment is projected to record the highest CAGR of 9.6% throughout the forecast period. In the European market, LED luminaires are increasingly preferred for new installations in commercial, industrial, and public infrastructure projects. They offer greater design flexibility, superior light distribution, and reduced maintenance compared to traditional lighting systems. Luminaires are widely used in architectural lighting, street lighting, office spaces, and manufacturing facilities where performance and durability are essential.

The indoor application segment led the market, accounting for a 69% share in 2024. The demand for energy-efficient and long-lasting lighting solutions has led to a widespread shift from conventional lighting to LEDs in homes, offices, retail stores, educational institutions, and healthcare facilities. In residential spaces, LED lighting is favored for its versatility, aesthetic appeal, and lower energy bills. Commercial buildings increasingly rely on LED solutions for their ability to provide uniform illumination, reduce maintenance costs, and support smart lighting systems.

The outdoor application segment is anticipated to witness the highest CAGR of 11.2% during the forecast period. Governments and municipalities are actively replacing traditional streetlights with LED alternatives to reduce energy consumption and maintenance costs. LED lighting is widely used in street lighting, public parks, tunnels, parking lots, and building exteriors, offering superior durability, weather resistance, and visibility. The rise of smart city projects has also accelerated the deployment of connected outdoor lighting systems that allow remote monitoring, adaptive brightness control, and fault detection.

The commercial segment held the largest share of 53% in 2024 and is projected to maintain its lead in the coming years. Businesses across the region are increasingly adopting LED lighting to reduce operational costs, improve lighting quality, and meet sustainability goals. In office environments, LEDs provide uniform illumination that enhances employee productivity while offering features such as dimming and daylight sensing for optimized energy use. Retail spaces also benefit from the ability of LEDs to enhance product displays and create appealing ambiances, contributing to a better customer experience.

The residential segment of the European LED lighting market witnessed significant growth, registering a CAGR of 10.4% in 2024. Households across the region are adopting LED lighting due to its cost-saving benefits, environmental advantages, and availability in various designs and color temperatures. With the rise in smart home adoption, connected LED bulbs that offer features such as remote control, scheduling, and voice activation are gaining traction among European consumers.

By Design

By Application

By End-use

By Regional

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others