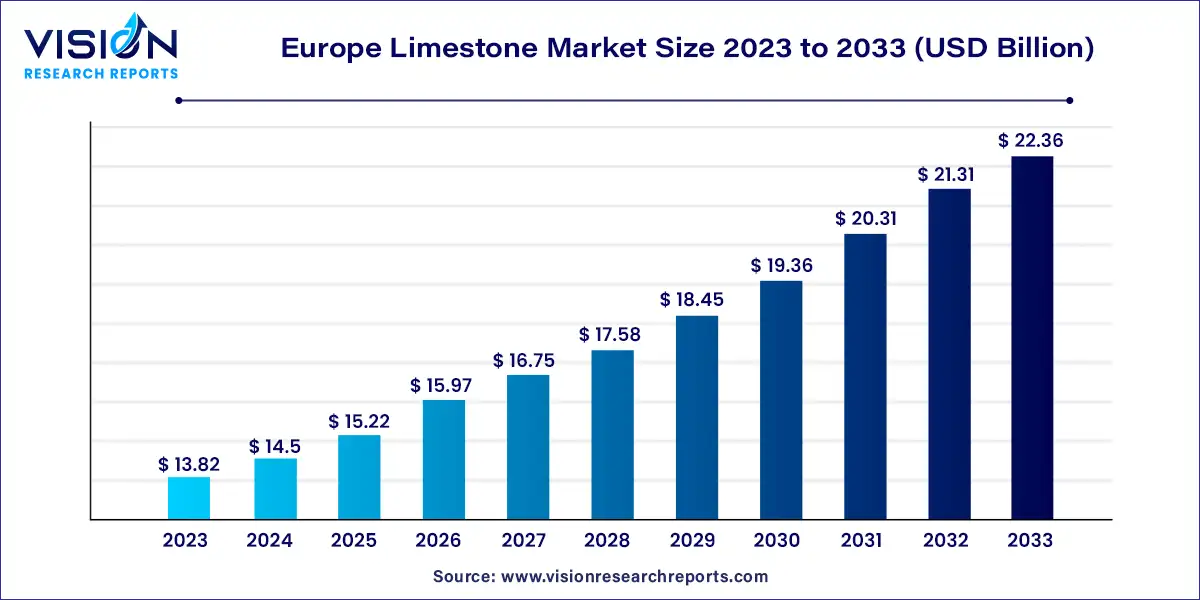

The Europe limestone market was valued at USD 13.82 billion in 2023 and it is predicted to surpass around USD 22.36 billion by 2033 with a CAGR of 4.93% from 2024 to 2033.

The limestone market in Europe exhibits a robust landscape characterized by a diverse range of applications across various industries. This overview aims to provide insights into the key factors driving the growth of the limestone market in Europe, along with an analysis of market trends, opportunities, and challenges.

The growth of the limestone market in Europe can be attributed to several key factors. Firstly, the thriving construction industry across the region is a significant driver, fueled by ongoing infrastructure projects and urban development initiatives. Additionally, the agricultural sector's increasing emphasis on soil health management and sustainable farming practices has led to a steady demand for limestone as a soil conditioner and pH stabilizer. Moreover, the versatile nature of limestone makes it indispensable in various industrial applications, including steel manufacturing, chemical production, and water treatment, further contributing to market growth. These factors collectively underscore the robust growth potential of the Europe limestone market, positioning it for continued expansion in the foreseeable future.

| Report Coverage | Details |

| Market Size in 2023 | USD 13.82 billion |

| Revenue Forecast by 2033 | USD 22.36 billion |

| Growth rate from 2024 to 2033 | CAGR of 4.93% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The construction segment held the largest revenue share of over 76% in 2023 of the overall market, and this trend is anticipated to continue over the forecast period. Limestone is used for manufacturing cement, construction aggregate, tiles, mortar & plaster, and other building materials. Construction and infrastructure needs are high in European countries mainly due to the ambitious policy agenda of the European Union since 2008, wherein they have set targets for improvement in energy efficiency, increase in renewable energy, and reduction in greenhouse gas emissions.

Agriculture is another growing segment for the market, where the product is used to neutralize acids in the soil for optimum soil conditions to foster crop growth. Rising agriculture production and agri-food exports in Europe are projected to drive the demand for limestone in agricultural applications. For instance, agri-food exports in the European Union reached EUR 229,428 million (USD 253,904.5 million) in 2022 compared to EUR 198,141 million (USD 219,279.7 million) in 2021, with a y-o-y increase of 15.8%.

Further, limestone is also used to produce GCC and PCC, which are used in a wide range of applications including paper, paints & coatings, plastics, and adhesives & sealants. The European paper industry has been witnessing steady growth over the past few years owing to the increasing sustainability trend in packaging. For instance, food & beverage companies are increasingly using paper packaging. This is expected to drive paper industry, thereby boosting the demand for calcium carbonate over the coming years.

By End-use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Europe Limestone Market

5.1. COVID-19 Landscape: Europe Limestone Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Europe Limestone Market, By End-use

8.1.Europe Limestone Market, by End-use Type, 2024-2033

8.1.1. Construction

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Iron & Steel

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Agriculture

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Chemical

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Europe Limestone Market, Regional Estimates and Trend Forecast

9.1. Europe

9.1.1. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 10. Company Profiles

10.1. Nordkalk

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. CARMEUSE

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Graymont

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. Lhoist

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. Sibelco

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Ognyanovo-K

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. WIG Wietersdorfer Holding GmbH

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Franzefoss Minerals

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

10.9. Kalkfabrik Netstal AG

10.9.1. Company Overview

10.9.2. Product Offerings

10.9.3. Financial Performance

10.9.4. Recent Initiatives

10.10. CARRIÈRES DU HAINAUT

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others