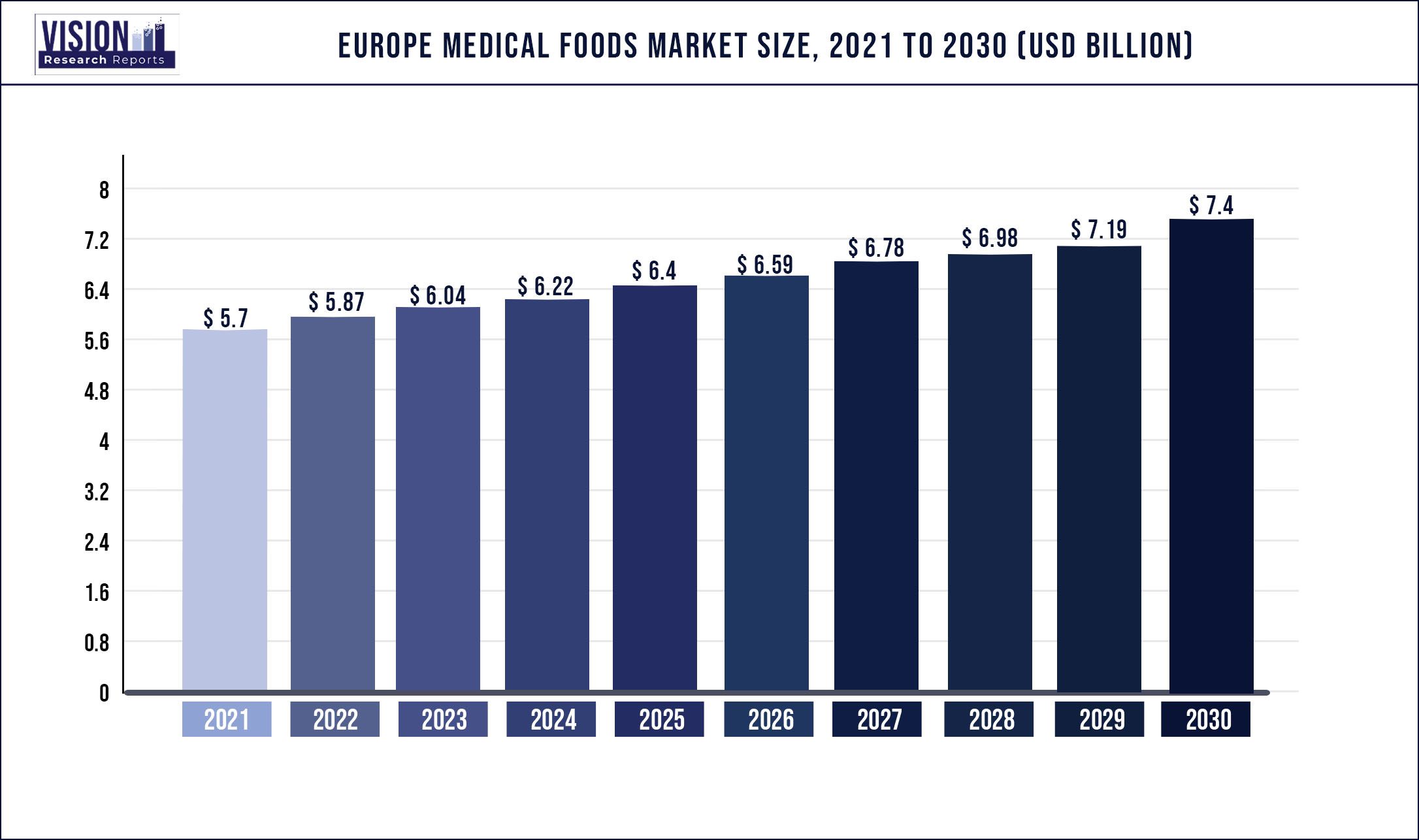

The Europe medical foods market was surpassed at USD 5.7 billion in 2021 and is expected to hit around USD 7.4 billion by 2030, growing at a CAGR of 2.94% from 2022 to 2030.

The ever-increasing burden of chronic diseases and the growing geriatric population across Europe are primary reasons for the market to flourish. In 2021, the oral route of administration accounted for the largest revenue share of 69.5%. Ease of use and high availability of medical foods in this form has contributed to the high revenue. The enteral route of administration is expected to register the fastest growth. This can be attributed to the growing geriatric population suffering from chronic diseases who are unable to consume food orally. The enteral route of administration seems to be the preferred way of administrating nutrients through medical foods to the specific needs of geriatric patients.

In the product type, the powder formulations held the largest revenue share in 2021. Owing to the vast product portfolios available in this formulation this segment has grown to a large extent. Powder formulations include nutrient mixes, protein shakes, and infant feeding formulas. The highest growth was registered by the liquid formulations due to the diversification of product portfolios of the key players in the medical foods industry. Chemotherapy-induced diarrhea had the largest revenue share in 2021 in the applications segment. Nutritional deficiency in cancer patients is a major concern and can be managed through proper nutrient management via medical foods and is a major factor in its growth. The fastest-growing sub-segment is diabetic neuropathy, high prevalence, and has been a key driver for its fast growth.

The largest sales channel for 2021 was institutional sales, owing to the dependency of key players on representatives who directly provide products to physicians and clinicians at hospitals and clinics has accounted for the growth. The fastest-growing sales channel is online sales due to the ease of use of this channel, consumers can directly purchase specific needs FSMP products from the company websites or third-party websites reducing the number of visits to care centers and hospitals. The pandemic has made people realize the importance of good health and nutrition. Even though the supply chain of almost every business was affected, the market is expected to recover at a fast pace owing to the surge in demand for medical foods. An increase in demand for immunity-boosting foods and an increase in the number of people suffering from chronic illnesses have had a positive impact on the market.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 5.7 billion |

| Revenue Forecast by 2030 | USD 7.4 billion |

| Growth rate from 2022 to 2030 | CAGR of 2.94% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Route of administration, product type, application, sales channel, country |

| Companies Covered | Danone; Nestlé; Abbott; Fresenius Kabi AG; Targeted Medical Pharma, Inc.; Mead Johnson & Company, LLC |

Route of Administration Insights

In 2021, the oral segment accounted for the largest revenue share of 69.5 %. The growth in this segment can be attributed to the ease of this mode of administration and the preference of consumers as well. The majority of the medical foods available in the market are oral supplements which are attributable to the dominant market share.

Studies have shown that malnutrition induced due to certain medical conditions in absence of nutritional supplementation by medical foods, costs billions per year in medical costs. The rising awareness among practitioners and increase in prescriptions of medical foods has resulted in overall market growth. Enteral feeding, the fastest-growing sub-segment which is mostly preferred in specific need patients, can be due to the rise in the burden of chronic diseases among the older generation. This route of administration reduces the chances of contamination and has better results than the oral route resulting in wider adoption of this method.

Product Type Insights

In 2021, the powder segment dominated the market for medical foods in Europe and accounted for the largest revenue share of 35.4%. The growth in this segment is due to higher product availability and more portfolio product launches by the companies in the market. The current medical foods market has more powdered formulations catering to all generations, infants, and adults alike. Powder formulations of medical foods include pre-mixed meal replacements for adults, the formula for infants, and other such products which can be consumed easily by consumers.

The liquids segment has recorded the fastest growth in the product type segment of medical foods. The availability of liquid formulations is also increasing along with the new launches which are driving market growth in the sub-segment. Liquid foods are available in the form of nutrition shakes and protein shakes along with other food supplements.

Application Insights

The chemotherapy-induced diarrhea segment dominated the market for medical foods in Europe and accounted for the largest revenue share of 15.2% in 2021. According to WHO, more than 3.7 million new cases of cancer are recorded every year in Europe. One-fourth of global cancer cases are from Europe. The importance of proper management of cancer is high, more than 40% of cancer-related deaths can be prevented if managed properly. Nutritional deficiency in cancer patients is very common. Thus, management with nutritionally enhanced foods is highly recommended and has become a more frequent form of management, thus acting as a potential factor for market growth.

The fastest-growing segment was diabetic neuropathy. With the increase in lifestyle diseases all over the globe, IDF projects an increase from 9.2% to 13% in diabetes prevalence across Europe. The majority of diabetes cases can be managed with proper nutrition through medical foods. Diabetic neuropathy has a prevalence range of 6% to 34% in Europe, according to a study conducted in 2015. The numbers along with rising consumer awareness are responsible for the growth of this sub-segment.

Sales Channel Insights

The institutional sales segment accounted for the largest revenue share of 41.8% in 2021, in the sales channel segment. The huge burden of chronic diseases that can be managed through medical foods has been a key driving factor for this market. The high market share for institutional sales can be attributed to the fact that the majority of key players depend on the institutional sales channel accessed via a group of representatives who provide medical foods directly to clinicians and healthcare professionals at clinics, hospitals, and care centers.

The fastest-growing segment was the online sales channel, this can be attributed to the fact that a vast majority of the population is becoming increasingly aware of proper nutrition to manage chronic diseases and for overall health. With the market size expanding for the medical food industry as whole ease of availability becomes a key factor for growth. There has been a paradigm shift in the sales for a plethora of products from physical to online stores and key players in the medical food industry are taking advantage of the sales channel to further enhance their sales numbers.

Regional Insights

As of 2021, the Rest of Europe (ROE) region accounted for the largest revenue share of 45.9% in the Europe region. The U.K. is anticipated to register the fastest growth with a CAGR of 4.3% for the forecast period of 2022-2030. This can be attributed to the rise in the geriatric population and the increase in the burden of chronic diseases, which has led to escalating healthcare costs. The British Specialist Nutrition Association Ltd. has been taking steps toward improving the current situation and estimates that the adoption of oral nutritional supplementation, a form of enteral feeding can save up to USD 131.8 million per year in England alone.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Europe Medical Foods Market

5.1.COVID-19 Landscape: Europe Medical Foods Industry Impact

5.2.COVID 19 - Impact Assessment for the Industry

5.3.COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Europe Medical Foods Market, By Product

8.1.Europe Medical Foods Market, by Product Type, 2022-2030

8.1.1. Pills

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Powders

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Europe Medical Foods Market, By Route of Administration

9.1.Europe Medical Foods Market, by Route of Administration, 2022-2030

9.1.1. Oral

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Enteral

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10.Global Europe Medical Foods Market, By Application Type

10.1.Europe Medical Foods Market, by Application Type, 2022-2030

10.1.1.Chronic Kidney Disease

10.1.1.1.Market Revenue and Forecast (2017-2030)

10.1.2.Minimal Hepatic Encephalopathy

10.1.2.1.Market Revenue and Forecast (2017-2030)

10.1.3.Chemotherapy-Induced Diarrhea

10.1.3.1.Market Revenue and Forecast (2017-2030)

10.1.4.Pathogen Related Infections

10.1.4.1.Market Revenue and Forecast (2017-2030)

10.1.5.Diabetic Neuropathy

10.1.5.1.Market Revenue and Forecast (2017-2030)

10.1.6.ADHD

10.1.6.1.Market Revenue and Forecast (2017-2030)

10.1.7.Depression

10.1.7.1.Market Revenue and Forecast (2017-2030)

10.1.8.Alzheimer's Disease

10.1.8.1.Market Revenue and Forecast (2017-2030)

10.1.9.Nutritional Deficiency

10.1.9.1.Market Revenue and Forecast (2017-2030)

10.1.10. Orphan Diseases

10.1.10.1.Market Revenue and Forecast (2017-2030)

10.1.11. Wound Healing

10.1.11.1.Market Revenue and Forecast (2017-2030)

10.1.12. Chronic Diarrhea

10.1.12.1.Market Revenue and Forecast (2017-2030)

10.1.13. Constipation Relief

10.1.13.1.Market Revenue and Forecast (2017-2030)

10.1.14. Protein Booster

10.1.14.1.Market Revenue and Forecast (2017-2030)

10.1.15. Dysphagia

10.1.15.1.Market Revenue and Forecast (2017-2030)

10.1.16. Other Diseases

10.1.16.1.Market Revenue and Forecast (2017-2030)

Chapter 11.Global Europe Medical Foods Market, By Sales Channel

11.1.Europe Medical Foods Market, by Sales Channel, 2022-2030

11.1.1.Online Sales

11.1.1.1.Market Revenue and Forecast (2017-2030)

11.1.2.Retail Sales

11.1.2.1.Market Revenue and Forecast (2017-2030)

11.1.3.Institutional Sales

11.1.3.1.Market Revenue and Forecast (2017-2030)

Chapter 12.Global Europe Medical Foods Market, Regional Estimates and Trend Forecast

12.1.Europe

12.1.1.Market Revenue and Forecast, by Product (2017-2030)

12.1.2.Market Revenue and Forecast, by Route of Administration (2017-2030)

12.1.3.Market Revenue and Forecast, by Application Type (2017-2030)

12.1.4.Market Revenue and Forecast, by Sales Channel (2017-2030)

12.1.5.UK

12.1.5.1.Market Revenue and Forecast, by Product (2017-2030)

12.1.5.2.Market Revenue and Forecast, by Route of Administration (2017-2030)

12.1.5.3.Market Revenue and Forecast, by Application Type (2017-2030)

12.1.5.4.Market Revenue and Forecast, by Sales Channel (2017-2030)

12.1.6.Germany

12.1.6.1.Market Revenue and Forecast, by Product (2017-2030)

12.1.6.2.Market Revenue and Forecast, by Route of Administration (2017-2030)

12.1.6.3.Market Revenue and Forecast, by Application Type (2017-2030)

12.1.6.4.Market Revenue and Forecast, by Sales Channel (2017-2030)

12.1.7.France

12.1.7.1.Market Revenue and Forecast, by Product (2017-2030)

12.1.7.2.Market Revenue and Forecast, by Route of Administration (2017-2030)

12.1.7.3.Market Revenue and Forecast, by Application Type (2017-2030)

12.1.7.4.Market Revenue and Forecast, by Sales Channel (2017-2030)

12.1.8.Rest of Europe

12.1.8.1.Market Revenue and Forecast, by Product (2017-2030)

12.1.8.2.Market Revenue and Forecast, by Route of Administration (2017-2030)

12.1.8.3.Market Revenue and Forecast, by Application Type (2017-2030)

12.1.8.4.Market Revenue and Forecast, by Sales Channel (2017-2030)

Chapter 13.Company Profiles

13.1.Danone

13.1.1.Company Overview

13.1.2.Product Offerings

13.1.3.Financial Performance

13.1.4.Recent Initiatives

13.2.Nestlé

13.2.1.Company Overview

13.2.2.Product Offerings

13.2.3.Financial Performance

13.2.4.Recent Initiatives

13.3.Abbott

13.3.1.Company Overview

13.3.2.Product Offerings

13.3.3.Financial Performance

13.3.4.Recent Initiatives

13.4.Fresenius Kabi AG

13.4.1.Company Overview

13.4.2.Product Offerings

13.4.3.Financial Performance

13.4.4.Recent Initiatives

13.5.Targeted Medical Pharma, Inc.

13.5.1.Company Overview

13.5.2.Product Offerings

13.5.3.Financial Performance

13.5.4.Recent Initiatives

13.6.Mead Johnson & Company, LLC

13.6.1.Company Overview

13.6.2.Product Offerings

13.6.3.Financial Performance

13.6.4.Recent Initiatives

Chapter 14.Research Methodology

14.1.Primary Research

14.2.Secondary Research

14.3.Assumptions

Chapter 15.Appendix

15.1.About Us

15.2.Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others