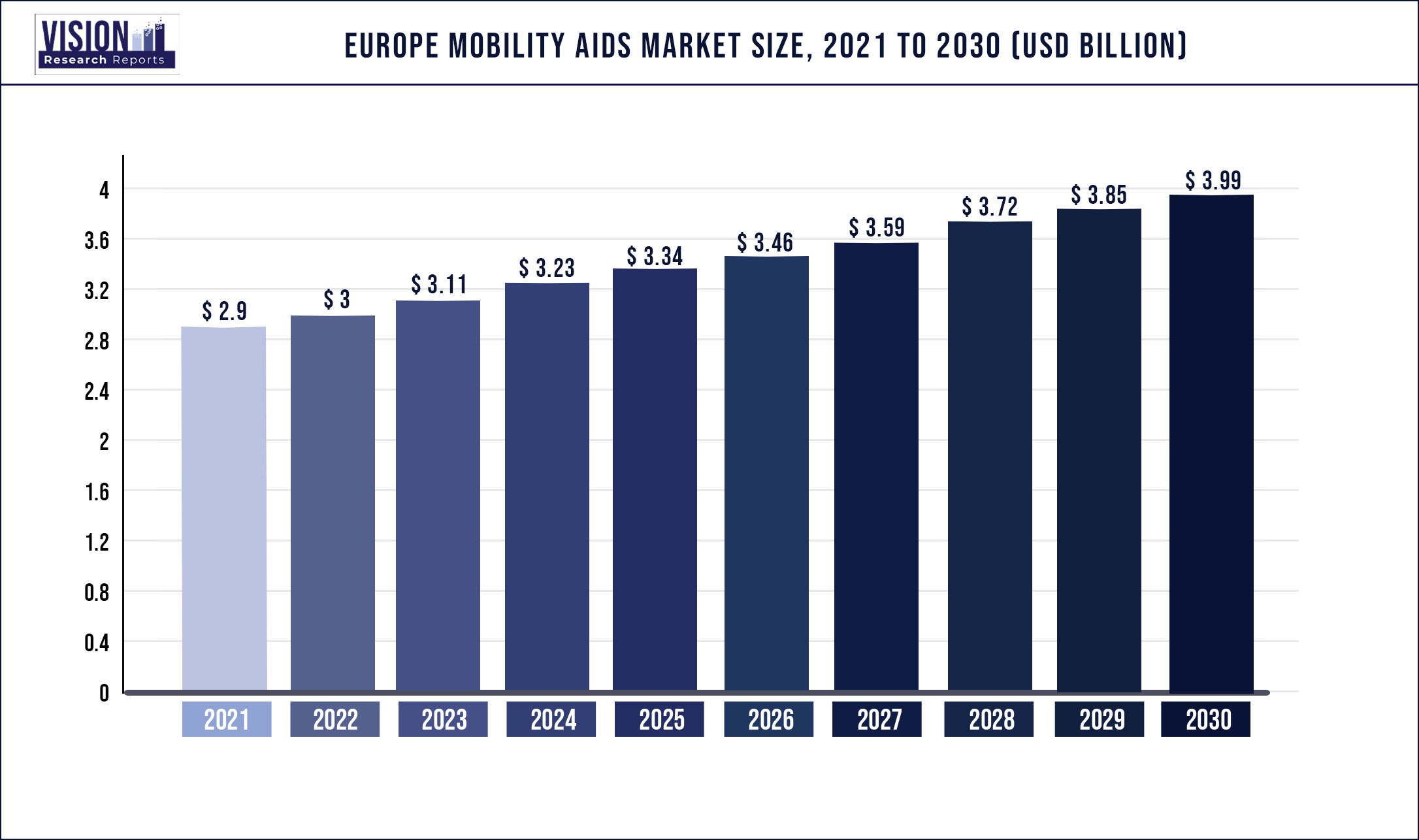

The Europe mobility aids market was valued at USD 2.9 billion in 2021 and it is predicted to surpass around USD 3.99 billion by 2030 with a CAGR of 3.61% from 2022 to 2030.

The high demand for home healthcare and an increase in the geriatric population requiring Long-term Care (LTC) are expected to propel the market growth during the forecast period. In addition, technical advancements in mobility aids are likely to boost product usage, resulting in market expansion. The introduction of new mobility support devices by key market players is anticipated to increase the number of products available in the market. This, in turn, will help facilitate the growth of the market.

Furthermore, the aging population in the U.K. has increased significantly in the past five decades. As per the statistics published by Age U.K., in 2020, around 18.65% of people in the country were aged 65 years or over. Moreover, around 4 million older citizens in the U.K. were estimated to suffer from long-term illnesses severely affecting their mobility. The increasing geriatric population is a key growth-driving factor for mobility aids. The pandemic has had an ongoing adverse impact on various industries across the globe. Stay-at-home mandates, transportation bans, and workforce crunch have resulted in the disruption of supply chains. Although the market was not significantly affected, the supply chain bottlenecks and restrictions on the product as well as patient movement caused a decrease in sales revenues.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 2.9 billion |

| Revenue Forecast by 2030 | USD 3.99 billion |

| Growth rate from 2022 to 2030 | CAGR of 3.61% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product, sector, type of split, distribution channels, region |

| Companies Covered | Drive DeVilbiss Healthcare; Sunrise Medical; Invacare Corp.; Roma Medical; Human Care |

Product Insights

The wheelchairs segment dominated the market in 2021 and accounted for the largest revenue share of more than 33.00% of the revenue. This can be attributed to the high preference for wheelchairs as mobility assistive devices among the geriatric and disabled population. On the basis of products, the market has been broadly categorized into rollators, walkers, wheelchairs, and long-term care beds for home use. The wheelchairs segment has been further bifurcated into manual and powered wheelchairs. The manual wheelchair segment is sub-segmented into active, bariatric, rehabilitation, and others.

The manual wheelchair segment spearheaded the market in 2021. It accounted for a significant market share in the same year. On the other hand, the rollators segment is estimated to register the fastest growth rate during the forecast period due to various technological advancements, which have led to the availability of rollators with adjustable handle heights that enable the most comfortable and correct walking postures for patients, thereby increasing their adoption. HUMAN CARE, B, TOPRO, and Eurovema AB are some of the prominent players operating in the market for rollators.

Sector Insights

The public sector segment dominated the Europe market in 2021 and accounted for the maximum revenue share of more than 60.0% in the same year. The segment is anticipated to retain its leading position throughout the forecast years registering the fastest growth rate. This growth can be attributed to the presence of established market players, such as Invacare Corporation, which have a strong local and international distribution network. In the U.K., the public healthcare system—the National Health Service (NHS)—finances all the mobility aid devices and their services for free and is funded through taxation.

The NHS owns the devices and also pays for the repair and maintenance of the same. The patients can apply for mobility devices like wheelchairs and mobility scooters through referrals of the doctors and it is provided to the patients by NHS after assessment. The private sector is anticipated to witness substantial growth over the forecast period. The public sector is characterized by the presence of a large number of privately held companies in the market. These market players offer an array of innovative products and are actively involved in the launch of new products to outperform the market competition.

Every country in Europe has an established private sector that is involved in the funding of healthcare services to patients. For instance, in France, even though there is a compulsory social health insurance system that is financed through taxes and employee & employer payroll contributions, 90% of the population has opted for private health insurance (voluntary) that covers the remaining expenses.

Distribution Channels Insights

The offline distribution channel segment accounted for the largest revenue share of more than 66.00% in 2021. This growth was attributed to a higher preference for the offline purchase of mobility aids. Furthermore, the offline channel enables the patients to assess the comfort, seating settings, and positioning feel, thereby aiding in the selection of appropriate assistive devices, especially for a first-time user. Choosing a wheelchair also depends majorly on the lifestyle of the patient upon which he can base his requirements, for instance, indoor or outdoor use, frequency of usage, etc. These factors have resulted in increased offline purchases of assistive devices.

The online segment is anticipated to register the fastest growth over the forecast period. The major e-commerce sites offering mobility aids are Wayfair and Amazon. Moreover, the manufacturers of mobility assistive devices have their e-commerce distribution channels or online sales sites for these products. The easy availability of these products on e-commerce and online sites is anticipated to boost the market growth. Many companies like Invacare, Sunrise Medicals, Meyra, and Rehasense provide wide options for assistive medical aid devices online with products ranging from manual wheelchairs to power wheelchairs, mobility scooters, and LTS beds.

Type Of Split Insights

On the basis of type of splits, the global market has been bifurcated into rehabilitation and aged care. The aged care type of split segment dominated the global market in 2021 and accounted for the maximum revenue share of more than 48.5% in the same year. The increasing geriatric population coupled with favorable government initiatives are the key factors driving the segment growth. For instance, according to Eurostat, the population aged above 80 years is estimated to account for nearly 14.6% of the total EU population by 2100, thereby increasing the demand for mobility aids.

The rehabilitation segment is anticipated to register the fastest growth rate in the forecast period. This growth can be attributed to the increasing demand for rehabilitation activities. Furthermore, the increasing prevalence of chronic diseases, road accidents, and spinal cord injuries has led to a rise in the demand for long-term care eventually increasing the demand for rehabilitation equipment. In addition, in 2019, the EU accounted for nearly 15.4% of the global GDP and Germany accounted for nearly 3.7% of the global GDP. The high GDP is indicative of the high purchasing power in this region and is thus, anticipated to contribute to the affordability of rehabilitation devices.

Regional Insights

The Europe regional market has been further segmented into Germany, U.K., Italy, France, Spain, Switzerland, and Poland. Germany accounted for the largest revenue share of more than 24.5% of the total market in 2021. The market in the country is also anticipated to witness lucrative growth over the forecast period. This can be attributed to the presence of advanced technologies, easy product availability, favorable reimbursement structure, and a strong healthcare system. Furthermore, Germany is one of the largest medical equipment markets, which is anticipated to contribute to the country’s overall market share.

As per the OECD data, approximately 33% of the population in Germany will be above 65 years of age and nearly 15% of the population is expected to be above 80 years of age by 2050. German residents are required to have health insurance, and around 73.2 million people are covered by statutory health insurance (Gesetzliche Krankenversicherung) (GV) Around 8.7 million Germans have private health insurance, while the rest are supported by government subsidies. The rapidly aging population is anticipated to increase the demand for mobility assistive devices and thereby drive the market growth in the country.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Antimicrobial Plastics Market

5.1.COVID-19 Landscape: Antimicrobial Plastics Industry Impact

5.2.COVID 19 - Impact Assessment for the Industry

5.3.COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Antimicrobial Plastics Market, By Product

8.1.Antimicrobial Plastics Market, by Product Type, 2022-2030

8.1.1. Rollators

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Walkers

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Wheelchairs

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. LTC Beds (Home)

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Antimicrobial Plastics Market, By Sector

9.1.Antimicrobial Plastics Market, by Sector, 2022-2030

9.1.1. Private

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Public

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10.Global Antimicrobial Plastics Market, By Type of Split

10.1.Antimicrobial Plastics Market, by Type of Split, 2022-2030

10.1.1.Rehabilitation

10.1.1.1.Market Revenue and Forecast (2017-2030)

10.1.2.Aged Care

10.1.2.1.Market Revenue and Forecast (2017-2030)

Chapter 11.Global Antimicrobial Plastics Market, By Distribution Channels

11.1.Antimicrobial Plastics Market, by Distribution Channels, 2022-2030

11.1.1.Online

11.1.1.1.Market Revenue and Forecast (2017-2030)

11.1.2.Offline

11.1.2.1.Market Revenue and Forecast (2017-2030)

Chapter 12.Antimicrobial Plastics Market, Regional Estimates and Trend Forecast

12.1.Europe

12.1.1.Market Revenue and Forecast, by Product (2017-2030)

12.1.2.Market Revenue and Forecast, by Sector (2017-2030)

12.1.3.Market Revenue and Forecast, by Type of Split (2017-2030)

12.1.4.Market Revenue and Forecast, by Distribution Channels (2017-2030)

12.1.5.UK

12.1.5.1.Market Revenue and Forecast, by Product (2017-2030)

12.1.5.2.Market Revenue and Forecast, by Sector (2017-2030)

12.1.5.3.Market Revenue and Forecast, by Type of Split (2017-2030)

12.1.5.4.Market Revenue and Forecast, by Distribution Channels (2017-2030)

12.1.6.Germany

12.1.6.1.Market Revenue and Forecast, by Product (2017-2030)

12.1.6.2.Market Revenue and Forecast, by Sector (2017-2030)

12.1.6.3.Market Revenue and Forecast, by Type of Split (2017-2030)

12.1.6.4.Market Revenue and Forecast, by Distribution Channels (2017-2030)

12.1.7.France

12.1.7.1.Market Revenue and Forecast, by Product (2017-2030)

12.1.7.2.Market Revenue and Forecast, by Sector (2017-2030)

12.1.7.3.Market Revenue and Forecast, by Type of Split (2017-2030)

12.1.7.4.Market Revenue and Forecast, by Distribution Channels (2017-2030)

12.1.8.Rest of Europe

12.1.8.1.Market Revenue and Forecast, by Product (2017-2030)

12.1.8.2.Market Revenue and Forecast, by Sector (2017-2030)

12.1.8.3.Market Revenue and Forecast, by Type of Split (2017-2030)

12.1.8.4.Market Revenue and Forecast, by Distribution Channels (2017-2030)

Chapter 13.Company Profiles

13.1.Human Care HC AB

13.1.1.Company Overview

13.1.2.Product Offerings

13.1.3.Financial Performance

13.1.4.Recent Initiatives

13.2.Drive DeVilbiss Healthcare

13.2.1.Company Overview

13.2.2.Product Offerings

13.2.3.Financial Performance

13.2.4.Recent Initiatives

13.3.Roma Medical

13.3.1.Company Overview

13.3.2.Product Offerings

13.3.3.Financial Performance

13.3.4.Recent Initiatives

13.4.Day’s Mobility Ltd.

13.4.1.Company Overview

13.4.2.Product Offerings

13.4.3.Financial Performance

13.4.4.Recent Initiatives

13.5.Van Os Medical

13.5.1.Company Overview

13.5.2.Product Offerings

13.5.3.Financial Performance

13.5.4.Recent Initiatives

13.6.Invacare Corp.

13.6.1.Company Overview

13.6.2.Product Offerings

13.6.3.Financial Performance

13.6.4.Recent Initiatives

13.7.Z-Tec Mobility

13.7.1.Company Overview

13.7.2.Product Offerings

13.7.3.Financial Performance

13.7.4.Recent Initiatives

13.8.Sunrise Medical

13.8.1.Company Overview

13.8.2.Product Offerings

13.8.3.Financial Performance

13.8.4.Recent Initiatives

13.9.Karma Mobility

13.9.1.Company Overview

13.9.2.Product Offerings

13.9.3.Financial Performance

13.9.4.Recent Initiatives

13.10.TOPRO Ltd.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

13.11.Remploy (RHealthcare)

13.11.1. Company Overview

13.11.2. Product Offerings

13.11.3. Financial Performance

13.11.4. Recent Initiatives

Chapter 14.Research Methodology

14.1.Primary Research

14.2.Secondary Research

14.3.Assumptions

Chapter 15.Appendix

15.1.About Us

15.2.Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others