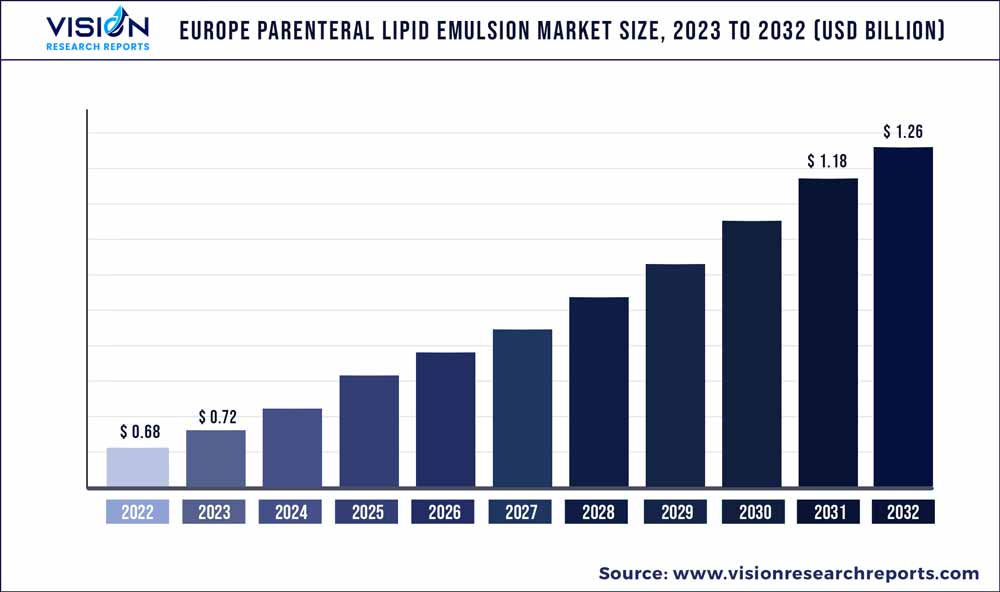

The Europe parenteral lipid emulsion market was surpassed at USD 0.68 billion in 2022 and is expected to hit around USD 1.26 billion by 2032, growing at a CAGR of 6.35% from 2023 to 2032.

Key Pointers

Report Scope of the Europe Parenteral Lipid Emulsion Market

| Report Coverage | Details |

| Market Size in 2022 | USD 0.68 billion |

| Revenue Forecast by 2032 | USD 1.26 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.35% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Baxter; Braun Melsungen AG; Fresenius SE & Co. KGaA; Grifols S.A. |

Growing incidence of hospital malnutrition, the rising prevalence of cancer, gastrointestinal disorders, and other chronic disorders are some of the major factors contributing to the market growth. Hospital malnutrition is a significant concern in hospitals across Europe. It can lead to a range of negative outcomes, such as longer hospital stays, increased risk of complications, and higher mortality rates. According to Specialized Nutrition Europe, 40% of adult hospital patients in the EU are malnourished. The economic burden of malnourishment is estimated at USD 136.8 billion (EUR 120 billion) across Europe. Furthermore, as per the National Library of Medicine, recent publications on hospital malnutrition in Europe reveal that the incidence and prevalence of malnutrition remain alarmingly high at 21% and 37%, respectively. Furthermore, the rising geriatric population is boosting the demand for parenteral lipid emulsion. According to several NCBI studies, individuals aged over 65 years are at a greater risk of developing chronic illnesses such as Parkinson’s and nervous system disorders. The risk of malnutrition and frailty among the geriatric population with comorbidities, such as stroke, depression, and dementia, is much higher, mainly owing to various age-related changes in body composition and muscle mass. This results in a reduced ability to perform Activities of Daily Living (ADLs), thereby increasing the risk of falls or injuries. Also, the incidence of Alzheimer’s disease is constantly rising due to the increase in the number of people aged 65 and above in Europe. According to ScienceDirect research estimates, the prevalence of Alzheimer's disease in Europe is 5.05%, with a higher prevalence observed in women (7.13%) than in men (3.31%). The prevalence of Alzheimer's disease also increases with age. Thus, the rapid rise in the elderly population and increase in the prevalence of age-related chronic diseases and medical conditions are factors expected to contribute to the growth of the market.

Gastrointestinal disorder is another major factor impelling the demand for parenteral lipid emulsion. Gastrointestinal disease significantly impacts a patient's ability to absorb nutrients from food, resulting in malnutrition and other complications. In cases where the patient is unable to consume food orally, parenteral nutrition may be necessary to meet their nutritional needs. Lipid emulsions are a type of parenteral nutrition that can be used to provide a source of essential fatty acids and calories. This can be especially beneficial for patients with severe gastrointestinal diseases, such as inflammatory bowel disease, pancreatitis, or intestinal obstruction, who are unable to absorb nutrients from food or tolerate enteral nutrition.

In addition, the rising prevalence of cancer is boosting the demand for parenteral lipid emulsion. The European continent recorded approximately four million new cases of cancer in 2020, with an estimated 1.9 million fatalities attributed to the disease. This figure is consistent with the estimates from 2018.The prevalence of cancer varies among European countries, with some countries having higher rates than others. For example, according to the latest available data, the highest cancer incidence rates in Europe are found in Denmark, Belgium, and the Netherlands, while the lowest rates are found in countries such as Albania, Macedonia, and Bosnia and Herzegovina. As per the European Society for Medical Oncology new research published in Annals of Oncology, a prominent cancer journal, has projected that in 2023, the number of cancer-related deaths in the EU-27 is likely to be 1,261,990, while in the UK, it is estimated to be 172,314.Cancer generally leads to stomach ulcers and disorientation in the normal functioning of the gastrointestinal tract and the development of physical obstructions, leading to the need for parenteral lipid emulsions, which are essential components of PN.

The COVID-19 pandemic had a significant impact on the healthcare industry, including the market for parenteral lipid emulsion. Critically ill patients, particularly those who tested positive for COVID-19, were highly sensitive and required specialized care. COVID-19 had weakened a patient's immune system and caused respiratory and other system disruptions. For instance, according to an article published in Elsevier Public Health Emergency Collection, around half of the critically ill COVID-19 patients developed gastrointestinal problems such as gastrointestinal hypomotility. In addition, patients experienced various other abdominal problems, leading to an increase in the adoption of PN at global and country levels. In addition, several studies justified the use of PN for patients suffering from malnutrition problems that increased during the pandemic, leading to market growth. For instance, according to an article published in the Journal of the Academy of Nutrition and Dietetics, many patients admitted to the ICU for COVID-19 treatment suffered from acute malnourishment. Hence, the usage of PN products increased in the market during the pandemic.

Ingredient Insights

The 1st generation parenteral lipid emulsion segment dominated the market with a 37% share in 2022 owing to the increasing geriatric population and the growing burden of non-communicable diseases on healthcare. The 1st generation products include soybean-based lipid emulsions, which can significantly reduce dependence on dextrose (major source of nonprotein calories) in parenteral nutrition. In addition, these formulations have been a go-to product for decades among malnourished patients of all age groups when the enteral feeding route is inhibited, insufficient, or impossible.

However, the 3rd generation is expected to grow at the fastest rate of 7.44% over the forecast period owing to the increasing administration of fish oil parenteral lipid emulsions. This is due to the availability of EPA and DHA, which offer demonstrable effects on inflammatory processes and cell membranes and help decrease the length of stay among critically ill patients. In addition, the administration of fish oil-enriched parenteral nutrition formulations is increasing among patients undergoing major surgical procedures to help lower postoperative inflammatory response. For instance, suppression of proinflammatory cytokine IL-6 has been reported following parenteral fish oil administration in elderly patients undergoing hip surgery when compared to the absence of intravenous fish oil administration. This, in turn, is driving demand for fish oil lipid emulsions, thereby, aiding market growth.

Europe Parenteral Lipid Emulsion Market Segmentations:

By Ingredient

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Europe Parenteral Lipid Emulsion Market

5.1. COVID-19 Landscape: Europe Parenteral Lipid Emulsion Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Europe Parenteral Lipid Emulsion Market, By Ingredient

8.1.Europe Parenteral Lipid Emulsion Market, by Ingredient Type, 2023-2032

8.1.1. 1st Generation Lipid Emulsions

8.1.1.1.Market Revenue and Forecast (2020-2032)

8.1.2. 2nd Generation Lipid Emulsions

8.1.2.1.Market Revenue and Forecast (2020-2032)

8.1.3. 3rd Generation Lipid Emulsions

8.1.3.1.Market Revenue and Forecast (2020-2032)

Chapter 9. Europe Parenteral Lipid Emulsion Market, Regional Estimates and Trend Forecast

9.1. Europe

9.1.1. Market Revenue and Forecast, by Ingredient (2020-2032)

Chapter 10.Company Profiles

10.1. Baxter

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. Braun Melsungen AG

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. Fresenius SE & Co. KGaA

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. Grifols S.A.

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others