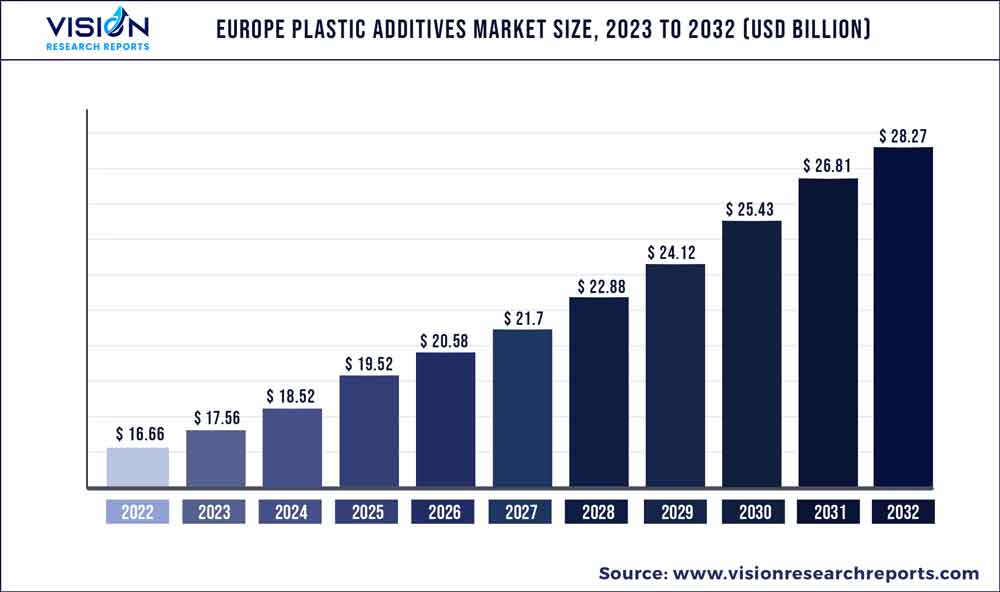

The Europe plastic additives market was valued at USD 16.66 billion in 2022 and it is predicted to surpass around USD 28.27 billion by 2032 with a CAGR of 5.43% from 2023 to 2032.

Key Pointers

Report Scope of the Europe Plastic Additives Market

| Report Coverage | Details |

| Market Size in 2022 | USD 16.66 billion |

| Revenue Forecast by 2032 | USD 28.27 billion |

| Growth rate from 2023 to 2032 | CAGR of 5.43% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | BASF SE; LyondellBasell Industries Holdings B.V.; NanoBioMatters Industries S.L.; Evonik Industries AG; Solvay S.A.; Avient Corporation; Milliken & Company; Dow Inc.; LANXESS; KANEKA CORPORATION; Avi Additives; Biesterfeld AG; SONGWON; FRILVAM S.P.A.; Nouryon; Gabriel-Chemie; RIFRA MASTERBATCHES S.p.A.; Eigenmann & Veronelli S.p.A.; SABIC; Clariant AG; ADEKA CORPORATION |

The rising population and rapid urbanization in emerging economies of Europe are likely to boost the growth of the end-use industries, which, in turn, is expected to escalate product demand over the forecast period.

The product demand is expected to increase majorly in the building & construction, medical, and packaging application industries. Rising demand for healthcare and packaging products, due to increased funding from the EU combined with support measures (such as tax breaks, subsidies, and incentives) adopted by various governments is expected to accelerate the growth of the construction sector in the region. In addition, the planning of various PPP projects in the country for the construction of roads, hospitals, schools, and airports is expected to increase the demand for plastic products in the aforementioned areas. These factors are expected to fuel the growth of the plastic additives market in Europe over the forecast period.

Based on function, the Europe plastic additives industry is segmented into plasticizers, flame retardants, impact modifiers, antioxidants, antimicrobials, UV stabilizers, color addition, and others. Plasticizers was the leading segment in 2022, accounting for over 46.0% of the revenue share. Plasticizers are low molecular weight substances that are added to a plastic solution to promote its flexibility and plasticity.

Plasticizers are the most common additives used in the plastic industry. Plasticizers are available as colorless and non-volatile liquids. They increase the thermoplasticity and fluidity of a polymer by reducing the polymer melt viscosity, glass transition temperature, elastic modulus, and melting temperature of the finished product without changing the basic chemical properties of the plasticized material.

The commodity plastics product segment dominated in 2022, accounting for a revenue share of over 42.0%. The increasing penetration of commodity plastics into consumer durables, packaging products, and medical applications is expected to be a significant growth driver. Commercial plastics are widely used for mass-producing disposable products such as drinking water bottles or packaging films.

However, these plastics can also be used in various other industries such as electrical & electronics, construction, and automotive. Surging demand for commercial plastics in consumer durables, such as weatherproof clothes, food packaging materials, containers, disposable tableware, personal care products, beverage bottles, and pharmaceutical products is expected to drive the growth commodity plastics segment of the plastic additives market in Europe over the forecast period.

The packaging application segment led the market and accounted for more than 21.0% of the revenue share in 2022. Packaging is essential and it is used extensively in various end-use industries. Packaging is available in various forms including flexible packaging, glass packaging, metal packaging, rigid plastic packaging, and paper container packaging.

The usage of plastic additives in packaging gives protection to the packed products against microbes, increases product shelf life, and enhances aesthetic value. The packaging industry is driven by rising demand for personal care products and packed food products, which, in turn, is anticipated to increase the consumption of plastic additives in packaging products.

Function Insights

Based on function, the Europe plastic additives market has been segmented into plasticizers, flame retardants, impact modifiers, antioxidants, antimicrobials, UV stabilizers, color addition, and others. Plasticizers led in 2022, accounting for over 46.01% of the revenue share.

Plasticizers are low molecular weight substances that are added to a plastic solution to promote its flexibility and plasticity. Plasticizers are the most common additives used in the plastic industry. Plasticizers are available as colorless and non-volatile liquids. They increase the thermoplasticity and fluidity of a polymer by reducing the polymer melt viscosity, glass transition temperature, elastic modulus, and melting temperature of the finished product without changing the basic chemical properties of the plasticized material.

After plasticizers, flame retardants held the maximum revenue share of over 11.02% in 2022. Flame retardant plastics are in high demand due to their growing use in applications including packaging, consumer products, construction, automotive, medical, and electrical & electronics. Rising demand for flame retardants from various applications such as medical and electrical & electronics, based on the growing demand for thermoplastics to reduce carbon emissions and increased investment in R&D, is expected to drive the segment.

The ability of a flame-retardant plastic to stop little sparks from igniting into large flames is a crucial advantage in product design. Electronic products have a potential ignition source created by critical components such as printed circuit boards, transformers, connectors, and batteries. Flame-retardant plastic helps to reduce the risk of fire to confirm that manufacturers comply with fire safety standards.

Application Type Insights

The packaging application segment led the market and accounted for more than 21.06% share of the global revenue in 2022. Packaging is essential and it is used extensively in various end-use industries. Packaging is available in various forms including flexible packaging, glass packaging, metal packaging, rigid plastic packaging, and paper container packaging.

The usage of plastic additives in packaging gives protection to the packed products against microbes, increases product shelf life, and enhances aesthetic value. The growth of the packaging industry is driven by the rising demand for personal care & packed food products, which, in turn, is anticipated to increase the consumption of plastic additives in packaging products.

Building & construction is the second dominating segment accounting for a revenue share of over 18% in 2022. The building & construction industry is growing owing to increasing urbanization, population, and infrastructural development plans. Moreover, rapid growth in public infrastructure, hospitals, schools, government accommodation, defense infrastructure, and airport expansion is further strengthening the construction industry in Europe.

The increasing trend of green construction projects along with the increasing use of modular & prefabricated construction, mainly in developed economies, is expected to drive the demand for plastic additives over the forecast period.

Plastic Type Insights

The commodity plastics product segment dominated the plastic additives market in Europe in 2022, accounting for a revenue share of over 42.04%. This trend is expected to continue over the forecast period as well and this segment is projected to account for a revenue share of over 43% in 2032. The engineering plastics product segment accounted for a revenue share of 24.39% in 2022 and is estimated to hold a revenue share of 24.15% in 2032.

The increasing penetration of commodity plastics into consumer durables, packaging products, and medical applications is expected to be a significant driver for the growth of this segment over the forecast period. Commercial plastics are widely used for mass-producing disposable products such as drinking water bottles or packaging films.

However, these plastics can also be used in various other industries such as electrical & electronics, construction, and automotive. Surging demand for commercial plastics in consumer durables, such as weatherproof clothes, food packaging materials, containers, disposable tableware, personal care products, beverage bottles, and pharmaceutical products is expected to drive the growth commodity plastics segment.

Engineering plastics have better mechanical and thermal properties than commodity plastics. There are five types of engineering plastics, namely, polyphenol, polyester, polyoxymethylene, polyamide, and polycarbonate available in the market. The engineering plastics segment is projected to grow at the highest CAGR over the forecast period in terms of revenue.

The growth of this segment can be attributed to the increasing adoption of engineering plastics as a replacement for traditional plastics and other materials in several end-use industries such as automotive, medical, packaging, and consumer goods owing to their easy processability, improved thermal stability, and superior mechanical, thermal, chemical, and electrical properties.

Europe Plastic Additives Market Segmentations:

By Function

By Plastic Type

By Application

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others