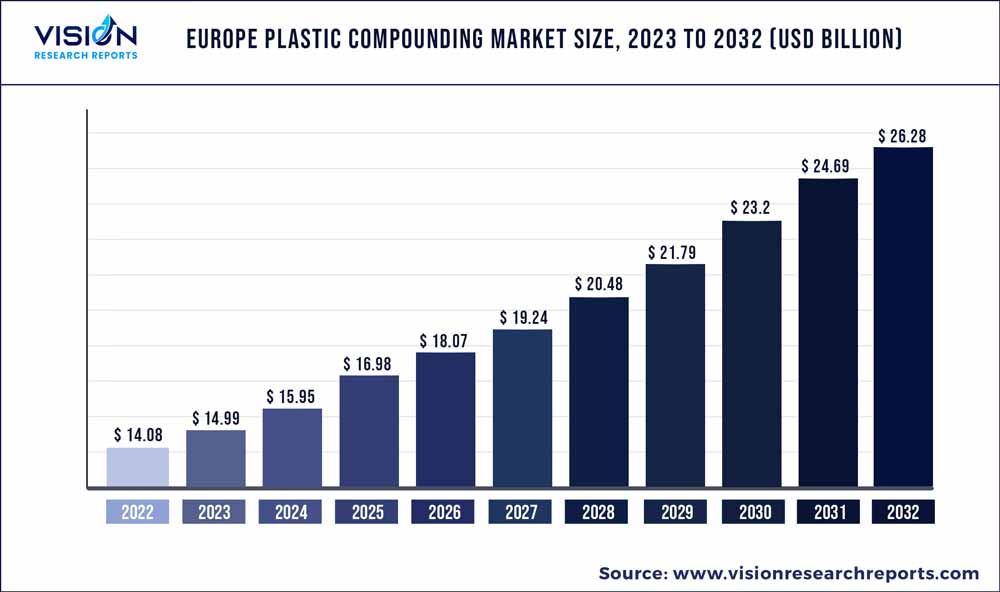

The Europe plastic compounding market was surpassed at USD 14.08 billion in 2022 and is expected to hit around USD 26.28 billion by 2032, growing at a CAGR of 6.44% from 2023 to 2032.

Key Pointers

Report Scope of the Europe Plastic Compounding Market

| Report Coverage | Details |

| Market Size in 2022 | USD 14.08 billion |

| Revenue Forecast by 2032 | USD 26.28 billion |

| Growth rate from 2023 to 2032 | CAGR of 6.44% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | BASF SE; SABIC; Dow, Inc.; Hanwha Azdel Inc.; Lear Corporation; Owens Corning; Magna International, Inc.; Momentive Performance Materials, Inc.; DuPont de Nemours, Inc.; Covestro AG |

Plastic consumption has increased rapidly in automotive and electrical and electronics industries. This can be attributed to regulatory intervention to improve fuel efficiency by reducing vehicle weight, thus reducing carbon emissions. This trend has driven automotive OEMs to adopt plastics as a substitute for metals such as steel and aluminum for fabricating automotive components.

The compounding industry is a key component of the Europe plastics industry. The number of compounders in Central and Eastern Europe is increasing rapidly. Of the total compounding facilities in Europe, only 10% are fully integrated. However, these compounders manage about 50% of the overall demand in the region. Exports from Poland and Hungary have witnessed a significant increase since 2016.

The European market has witnessed a progressive increase in consumption of white goods, especially in the electronics industry. Plastics are used extensively in manufacturing white goods due to its properties such as electrical insulation, heat insulation, lightweight, design flexibility, durability, and energy-efficiency.

They are used in the production of hygienic and attractive knobs, liners, handles, door facings and internal fittings on refrigerators, housings tops, and lids or closures of dishwashers and washing machines. Increasingly aging European population and cost pressures on the healthcare sector have further increased need for electronic innovations.

Application Insights

The automotive segment accounted for more than 25.05% share of the overall revenue of Europe in 2022. Increasing the integration of electronics into automobiles, coupled with rising demand for wearable devices among youth, is driving demand for plastic compounds in the region. The automotive industry has witnessed rising sales of passenger cars and light commercial vehicles. Polypropylene compounds are used to reduce the overall vehicle weight and increase fuel economy. Plastic compounds are also used extensively in the interiors of automobiles, further driving demand.

The construction industry in Europe has depicted significant growth post-2020 and is driven by economic recovery and a steady rise in per capita disposable income. Plastic compounds are widely used for dome lights, glazing, and sound walls. Its impact strength, moldability, and availability in optically transparent grades have been instrumental in penetrating construction applications.

PVC is the most preferred material in the construction industry and has successfully replaced traditional materials such as metal, wood, clay, and concrete. It is used in constructing components such as window frames, pipes, and roofing foils owing to its cheap cost and high resistance. Government initiatives to reduce real estate prices and recover housing permits add to the economic stability of the region. These initiatives have largely benefited the construction industry, thereby fuelling the Europe plastic compounding market.

Product Insights

The polypropylene segment led the market and accounted for more than 29.07% share of the European revenue in 2022. European market owing to their application in core manufacturing sectors such as automotive, construction, and electrical and electronics. Rapid growth in the regional automotive industry is the primary factor behind the growing demand for polypropylene compounds. Widespread acceptance of these products can be attributed to their cost-effectiveness, good chemical resistance, excellent mechanical properties, and moldability.

PET is the most commonly used product in Europe as well as globally and has been witnessing a rapidly increasing demand. These compounds are used across automotive, packaging, textiles, and other industries. Its rising demand has led various leading companies to develop methods to recycle PET, thus addressing issues pertaining to its disposal. The development of bio-based PET is expected to provide a much-needed solution for internal substitution.

Europe Plastic Compounding Market Segmentations:

By Application

By Product

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Europe Plastic Compounding Market

5.1. COVID-19 Landscape: Europe Plastic Compounding Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Europe Plastic Compounding Market, By Application

8.1. Europe Plastic Compounding Market, by Application, 2023-2032

8.1.1. Automotive

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Construction

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Electrical & Electronics

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Packaging

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Consumer Goods

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Industrial Machinery

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. Medical Devices

8.1.7.1. Market Revenue and Forecast (2020-2032)

8.1.8. Optical Media

8.1.8.1. Market Revenue and Forecast (2020-2032)

8.1.9. Appliances

8.1.9.1. Market Revenue and Forecast (2020-2032)

8.1.10. Others

8.1.10.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Europe Plastic Compounding Market, By Product

9.1. Europe Plastic Compounding Market, by Product, 2023-2032

9.1.1. Polyethylene (PE)

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Polypropylene (PP)

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Thermoplastic Vulcanizates (TPV)

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Thermoplastic Polyolefins (TPO)

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Polyvinyl Chloride (PVC)

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Polystyrene (PS)

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Polyethylene Terephthalate (PET)

9.1.7.1. Market Revenue and Forecast (2020-2032)

9.1.8. Polybutylene Terephthalate (PBT)

9.1.8.1. Market Revenue and Forecast (2020-2032)

9.1.9. Polyamide (PA)

9.1.9.1. Market Revenue and Forecast (2020-2032)

9.1.10. Polycarbonate (PC)

9.1.10.1. Market Revenue and Forecast (2020-2032)

9.1.11. Acrylonitrile Butadiene Systems (ABS)

9.1.11.1. Market Revenue and Forecast (2020-2032)

9.1.12. Others

9.1.12.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Europe Plastic Compounding Market, Regional Estimates and Trend Forecast

10.1. Europe

10.1.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.2. Market Revenue and Forecast, by Product (2020-2032)

Chapter 11. Company Profiles

11.1. BASF SE

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. SABIC

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Dow, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Hanwha Azdel Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Lear Corporation

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Owens Corning

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Magna International, Inc.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Momentive Performance Materials, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. DuPont de Nemours, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Covestro AG

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others