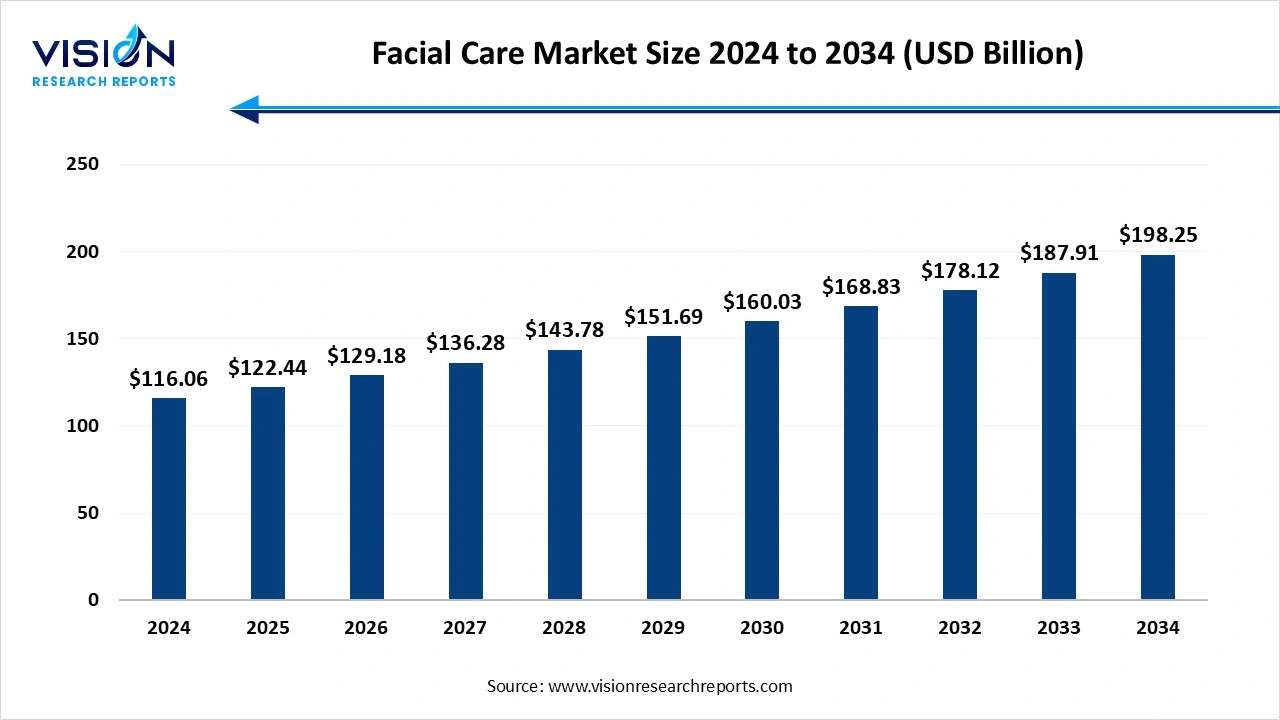

The global facial care market size was valued at USD 116.06 billion in 2024 and is anticipated to reach around USD 198.25 billion by 2034, growing at a CAGR of 5.50% from 2025 to 2034.

The facial care market has witnessed significant growth in recent years, driven by rising consumer awareness about skincare and an increasing emphasis on personal grooming across all age groups. Innovations in product formulations, including the incorporation of natural and organic ingredients, have further fueled demand. the proliferation of social media and beauty influencers has played a pivotal role in shaping consumer preferences and boosting market penetration. Key segments such as anti-aging creams, moisturizers, cleansers, and sunscreens continue to dominate the market, while emerging trends like sustainable packaging and multifunctional products are gaining traction.

The growth of the facial care market is primarily driven by increasing consumer awareness about skincare and the rising demand for products that promote healthy, youthful skin. As consumers become more informed about the harmful effects of pollution, UV radiation, and aging, there is a growing preference for products that offer protection, hydration, and anti-aging benefits. Additionally, the rise of social media platforms and beauty influencers has played a significant role in educating consumers and shaping trends, leading to higher product adoption across diverse age groups.

Another key growth factor is the innovation in product formulations and packaging, which enhances consumer appeal and convenience. The development of multifunctional products that combine several benefits, Such as moisturizer with SPF or anti-aging serum with antioxidants caters to busy lifestyles and evolving consumer needs.

The facial care market faces several challenges that can hinder its growth and innovation. One major challenge is the rising competition and market saturation, making it difficult for new entrants and smaller brands to establish a foothold. Consumer skepticism regarding product efficacy and ingredient safety often leads to hesitation in trying new or unfamiliar products.The growing demand for natural and organic products presents formulation challenges, as maintaining product stability and effectiveness without synthetic preservatives or chemicals can be complex. The high cost of premium ingredients and sustainable packaging also impacts pricing, potentially limiting accessibility for a broader consumer base. Lastly, the rapid pace of innovation and changing consumer preferences require brands to stay agile and invest heavily in research and development to remain competitive in this dynamic market.

The Asia-Pacific facial care market generated the highest revenue share in 2024. The region is known for its dynamic beauty industry, with consumers embracing multi-step skincare routines and showing a strong interest in products infused with natural and traditional ingredients. K-Beauty (Korean Beauty) and J-Beauty (Japanese Beauty) have gained global recognition, influencing skincare trends worldwide. Rapid urbanization, increasing disposable incomes, and the influence of beauty influencers contribute to the market’s expansion in this region.

In Europe, the facial care market benefits from a long-standing tradition of skincare, with countries like France, Germany, and the United Kingdom leading in both consumption and innovation. European consumers exhibit a strong preference for dermatologically tested products, often seeking formulations that combine luxury with proven efficacy. Natural and organic products are particularly popular, reflecting the region's growing commitment to sustainability and environmentally friendly practices.

The lotions, face creams, and moisturizers segment held the highest market revenue share, accounting for 46% in 2024. These products are essential for maintaining skin hydration, improving texture, and protecting against environmental stressors. As consumers become more conscious of skin health, the demand for formulations that offer additional benefits such as anti-aging, brightening, and soothing properties has increased substantially.

Sunscreen and sun care products represent another crucial segment within the facial care market, driven by the growing awareness of the harmful effects of ultraviolet (UV) radiation. Increasing concerns over skin cancer, premature aging, and pigmentation issues have pushed consumers to prioritize sun protection as a fundamental part of their daily skincare routines. Modern sunscreens not only provide broad-spectrum UV protection but also incorporate moisturizing and anti-aging ingredients, making them multifunctional.

The women facial care segment accounted for the highest revenue share in 2024. Women’s facial care products are diverse, ranging from basic cleansers and moisturizers to advanced serums, anti-aging treatments, and specialized masks. The high demand in this segment is driven by the growing focus on skincare routines, influenced by beauty influencers, celebrity endorsements, and rising awareness about the importance of skin health. Skincare brands continuously innovate to cater to women’s specific needs, offering products for different skin types, concerns, and age groups.

On the other hand, the men's facial care segment has experienced rapid growth in recent years, fueled by evolving grooming habits and a shift in perception regarding male skincare. No longer limited to basic shaving creams or aftershaves, men’s facial care now encompasses a wide range of products, including cleansers, moisturizers, anti-aging creams, and sunscreens. Brands have recognized the need to formulate products specifically suited to men’s skin, which tends to be thicker and more prone to oiliness.

The supermarkets & hypermarkets distribution segment generated the maximum market share in 2024. The global facial care market relies on a variety of distribution channels, each playing a pivotal role in reaching diverse consumer bases. Supermarkets and hypermarkets remain a dominant distribution channel, providing consumers with the convenience of purchasing facial care products alongside their regular household shopping. These large retail outlets offer a wide assortment of facial care products, ranging from mass-market brands to premium options, all available under one roof. Their ability to provide consumers with direct access to products, along with periodic discounts and promotional offers, makes them an attractive option for budget-conscious buyers.

In contrast, online distribution has emerged as a rapidly growing channel for facial care products, particularly among tech-savvy consumers. E-commerce platforms provide unparalleled convenience, allowing consumers to browse, compare, and purchase products from the comfort of their homes. The online distribution of facial care products has been further boosted by targeted advertising, personalized recommendations, and the influence of social media.

By Product

By End Use

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Facial Care Market

5.1. COVID-19 Landscape: Facial Care Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Facial Care Market, By Product

8.1. Facial Care Market, by Product

8.1.1 Online

8.1.1.1. Market Revenue and Forecast

8.1.2. Lotion Face, Creams & Moisturizers

8.1.2.1. Market Revenue and Forecast

8.1.3. Cleansers & Face Wash

8.1.3.1. Market Revenue and Forecast

8.1.4. Facial Serums

8.1.4.1. Market Revenue and Forecast

8.1.5. Face sheet masks

8.1.5.1. Market Revenue and Forecast

8.1.6. Sunscreen/ Sun care

8.1.6.1. Market Revenue and Forecast

Chapter 9. Global Facial Care Market, By End Use

9.1. Facial Care Market, by End Use

9.1.1. Women

9.1.1.1. Market Revenue and Forecast

9.1.2. Men

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global Facial Care Market, By Distribution Channel

10.1. Facial Care Market, by Distribution Channel

10.1.1. Supermarkets/ Hypermarkets

10.1.1.1. Market Revenue and Forecast

10.1.2. Convenience stores

10.1.2.1. Market Revenue and Forecast

10.1.3. Pharmacy & drugstore

10.1.3.1. Market Revenue and Forecast

10.1.4. Online

10.1.4.1. Market Revenue and Forecast

10.1.5. Others

10.1.5.1. Market Revenue and Forecast

Chapter 11. Global Facial Care Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product

11.1.2. Market Revenue and Forecast, by End Use

11.1.3. Market Revenue and Forecast, by Distribution Channel

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product

11.1.4.2. Market Revenue and Forecast, by End Use

11.1.4.3. Market Revenue and Forecast, by Distribution Channel

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product

11.1.5.2. Market Revenue and Forecast, by End Use

11.1.5.3. Market Revenue and Forecast, by Distribution Channel

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product

11.2.2. Market Revenue and Forecast, by End Use

11.2.3. Market Revenue and Forecast, by Distribution Channel

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product

11.2.4.2. Market Revenue and Forecast, by End Use

11.2.4.3. Market Revenue and Forecast, by Distribution Channel

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product

11.2.5.2. Market Revenue and Forecast, by End Use

11.2.5.3. Market Revenue and Forecast, by Distribution Channel

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product

11.2.6.2. Market Revenue and Forecast, by End Use

11.2.6.3. Market Revenue and Forecast, by Distribution Channel

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product

11.2.7.2. Market Revenue and Forecast, by End Use

11.2.7.3. Market Revenue and Forecast, by Distribution Channel

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product

11.3.2. Market Revenue and Forecast, by End Use

11.3.3. Market Revenue and Forecast, by Distribution Channel

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product

11.3.4.2. Market Revenue and Forecast, by End Use

11.3.4.3. Market Revenue and Forecast, by Distribution Channel

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product

11.3.5.2. Market Revenue and Forecast, by End Use

11.3.5.3. Market Revenue and Forecast, by Distribution Channel

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product

11.3.6.2. Market Revenue and Forecast, by End Use

11.3.6.3. Market Revenue and Forecast, by Distribution Channel

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product

11.3.7.2. Market Revenue and Forecast, by End Use

11.3.7.3. Market Revenue and Forecast, by Distribution Channel

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product

11.4.2. Market Revenue and Forecast, by End Use

11.4.3. Market Revenue and Forecast, by Distribution Channel

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product

11.4.4.2. Market Revenue and Forecast, by End Use

11.4.4.3. Market Revenue and Forecast, by Distribution Channel

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product

11.4.5.2. Market Revenue and Forecast, by End Use

11.4.5.3. Market Revenue and Forecast, by Distribution Channel

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product

11.4.6.2. Market Revenue and Forecast, by End Use

11.4.6.3. Market Revenue and Forecast, by Distribution Channel

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product

11.4.7.2. Market Revenue and Forecast, by End Use

11.4.7.3. Market Revenue and Forecast, by Distribution Channel

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product

11.5.2. Market Revenue and Forecast, by End Use

11.5.3. Market Revenue and Forecast, by Distribution Channel

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product

11.5.4.2. Market Revenue and Forecast, by End Use

11.5.4.3. Market Revenue and Forecast, by Distribution Channel

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product

11.5.5.2. Market Revenue and Forecast, by End Use

11.5.5.3. Market Revenue and Forecast, by Distribution Channel

Chapter 12. Company Profiles

12.1. L’Oréal S.A. (France)

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Procter & Gamble Co. (P&G) (United States).

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Unilever (United Kingdom/Netherlands)

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Estée Lauder Companies Inc. (United States).

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Shiseido Company, Limited (Japan).

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Beiersdorf AG (Germany)

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Johnson & Johnson Consumer Inc. (United States)

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. LVMH (Moët Hennessy Louis Vuitton) (France)

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Coty Inc. (United States).

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Amorepacific Corporation (South Korea)

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others