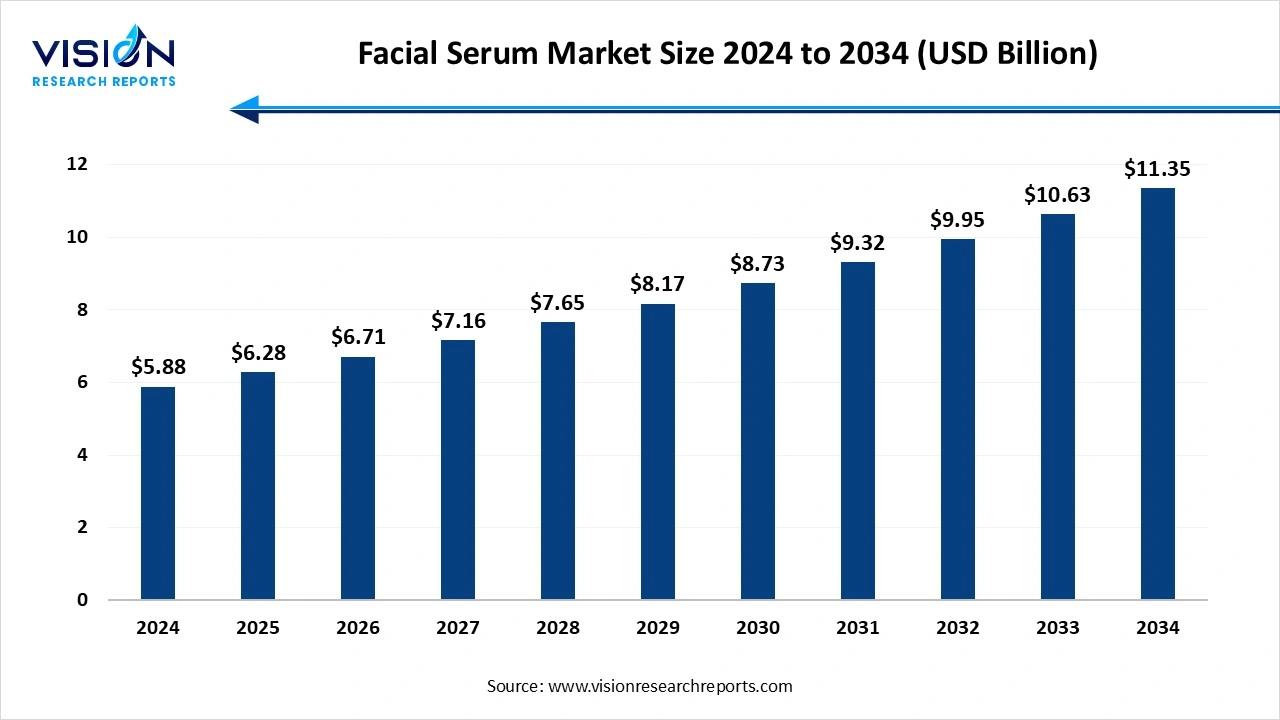

The global facial serum market size was valued at USD 5.88 billion in 2024 and is expected to hit around USD 11.35 billion by 2034, growing at a CAGR of 6.80% from 2025 to 2034.

The global facial serum market has witnessed significant growth in recent years, driven by increasing consumer awareness about skincare, rising disposable incomes, and the growing demand for premium beauty products. Facial serums, known for their concentrated formulations targeting specific skin concerns such as aging, hydration, acne, and pigmentation, have become a staple in skincare routines worldwide. Key players in the industry continue to innovate with new ingredients like hyaluronic acid, vitamin C, retinol, and plant-based extracts, catering to a diverse customer base. Furthermore, the expanding e-commerce sector and the popularity of clean, organic, and sustainable beauty products have further fueled the market’s growth trajectory.

The facial serum market is experiencing significant growth due to increasing consumer awareness about skincare benefits, such as hydration, anti-aging, and skin brightening. With the rise of social media and beauty influencers, consumers are becoming more knowledgeable about skincare routines, driving the demand for high-performance products like serums. Additionally, the growing popularity of clean beauty and natural ingredients is pushing brands to innovate, creating products that are both effective and free from harmful chemicals.

Rapid advancements in skincare technology have enabled manufacturers to develop serums with high concentrations of active ingredients, delivering visible results faster. This has attracted consumers looking for targeted solutions for specific skin concerns, such as acne, pigmentation, and fine lines. Moreover, the increasing availability of facial serums through e-commerce platforms has made them accessible to a broader audience. Rising disposable income, especially in developing regions, has also contributed to the market's growth, allowing consumers to spend more on premium skincare products.

Europe led the global facial serum market, accounting for 32% of total revenue in 2024. Countries such as France, Germany, and the United Kingdom are notable for their sophisticated consumer base and thriving luxury skincare market. Regulatory frameworks in Europe tend to be stringent, which encourages innovation and safety in serum formulations, further attracting discerning consumers.

The Asia Pacific facial serum market is projected to experience the highest compound annual growth rate (CAGR) of 8% from 2025 to 2034. This surge is propelled by rising disposable incomes, increasing urbanization, and expanding middle-class populations in countries like China, India, Japan, and South Korea. The strong cultural emphasis on skincare, coupled with the influence of K-beauty trends, has fueled demand for innovative facial serums, including those with natural and herbal ingredients.

Anti-aging serums captured 32% of the total revenue share in 2024. As the global population ages and the desire for youthful skin persists, consumers increasingly seek effective anti-aging solutions that deliver noticeable results. Anti-aging serums are typically enriched with potent ingredients like retinol, peptides, hyaluronic acid, and antioxidants, which help promote collagen production, enhance skin firmness, and protect against environmental damage.

The skin brightening serum market is expected to experience a compound annual growth rate (CAGR) of 7.6% between 2025 and 2034. These serums are formulated with active ingredients like vitamin C, niacinamide, alpha arbutin, and licorice extract, which help reduce hyperpigmentation, dark spots, and dullness. The rising awareness of the damaging effects of pollution and sun exposure on skin health has further accelerated the demand for skin brightening solutions.

Water-based facial serums led the market, accounting for 45% of the total revenue in 2024. These serums are primarily formulated with a water base, making them ideal for individuals seeking hydration without the heaviness associated with richer products. Their non-greasy nature appeals especially to consumers with oily or combination skin types, as well as those living in humid climates where heavier formulations can feel uncomfortable. Water-based serums often incorporate hydrating ingredients such as hyaluronic acid, glycerin, and botanical extracts, which work to replenish moisture, soothe the skin, and improve overall texture.

The demand for oil-based facial serums is projected to grow at a compound annual growth rate (CAGR) of 7.7% between 2025 to 2034. These serums typically combine natural oils such as jojoba, argan, rosehip, and marula with active ingredients to deliver intense moisture and improve skin barrier function. The rich texture of oil-based serums helps lock in hydration and provides a protective layer against environmental stressors, which is particularly beneficial in colder or drier climates.

Supermarkets and hypermarkets accounted for 30% of total market sales in 2024. These large-format retail stores offer a wide range of skincare products, including facial serums, providing customers with the convenience of one-stop shopping. The advantage of purchasing from supermarkets and hypermarkets lies in the ability to physically examine products, compare prices, and often take advantage of promotional offers and discounts.

Online retailers are projected to experience the fastest growth, with a compound annual growth rate (CAGR) of 7.8% from 2025 to 2034. E-commerce platforms offer consumers unparalleled convenience, enabling them to browse extensive product selections, read detailed descriptions, and access user reviews from the comfort of their homes. The rise of digital marketing, influencer endorsements, and personalized recommendation algorithms further boosts the appeal of online purchasing. This channel is particularly favored by younger, tech-savvy consumers who value time efficiency and a wider variety of niche and international brands that may not be readily available in physical stores.

Mass-market facial serums captured a 50% share of total revenue in 2024. These products are typically priced competitively to attract price-sensitive consumers who seek effective yet budget-friendly options. Mass-market serums often focus on popular ingredients such as vitamin C, hyaluronic acid, and basic antioxidants, providing accessible formulations that address common skincare concerns like hydration, dullness, and early signs of aging.

The demand for luxury facial serums is projected to grow at a robust CAGR of 7.6% by 2034. These serums often feature cutting-edge ingredients such as rare botanicals, peptides, retinol derivatives, and proprietary complexes designed to deliver visible, long-lasting results. The packaging and branding of luxury serums emphasize exclusivity, sophistication, and indulgence, often accompanied by meticulous research and clinical testing to support product claims.

By Type

By Form

By Distribution Channel

By Price Point

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Facial Serum Market

5.1. COVID-19 Landscape: Facial Serum Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Facial Serum Market, By Type

8.1. Facial Serum Market, by Type

8.1.1. Anti-Aging Serums

8.1.1.1. Market Revenue and Forecast

8.1.2. Skin Brightening Serums

8.1.2.1. Market Revenue and Forecast

8.1.3. Acne Fighting Serums

8.1.3.1. Market Revenue and Forecast

8.1.4. Hydrating Face Serums

8.1.4.1. Market Revenue and Forecast

8.1.5. Exfoliating Face Serums

8.1.5.1. Market Revenue and Forecast

Chapter 9. Global Facial Serum Market, By Form

9.1. Facial Serum Market, by Form

9.1.1. Oil based

9.1.1.1. Market Revenue and Forecast

9.1.2. Gel based

9.1.2.1. Market Revenue and Forecast

9.1.3. Water based

9.1.3.1. Market Revenue and Forecast

9.1.4. Others

9.1.4.1. Market Revenue and Forecast

Chapter 10. Global Facial Serum Market, By Distribution Channel

10.1. Facial Serum Market, by Distribution Channel

10.1.1. Supermarkets & Hypermarkets

10.1.1.1. Market Revenue and Forecast

10.1.2. Drugstores & Pharmacies

10.1.2.1. Market Revenue and Forecast

10.1.3. Specialty Beauty Stores

10.1.3.1. Market Revenue and Forecast

10.1.4. Online Retailers

10.1.4.1. Market Revenue and Forecast

10.1.5. Others

10.1.5.1. Market Revenue and Forecast

Chapter 11. Global Facial Serum Market, By Price Point

11.1. Facial Serum Market, by Price Point

11.1.1. Mass-Market

11.1.1.1. Market Revenue and Forecast

11.1.2. Premium

11.1.2.1. Market Revenue and Forecast

11.1.3. Luxury

11.1.3.1. Market Revenue and Forecast

Chapter 12. Global Facial Serum Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type

12.1.2. Market Revenue and Forecast, by Form

12.1.3. Market Revenue and Forecast, by Distribution Channel

12.1.4. Market Revenue and Forecast, by Price Point

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type

12.1.5.2. Market Revenue and Forecast, by Form

12.1.5.3. Market Revenue and Forecast, by Distribution Channel

12.1.5.4. Market Revenue and Forecast, by Price Point

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type

12.1.6.2. Market Revenue and Forecast, by Form

12.1.6.3. Market Revenue and Forecast, by Distribution Channel

12.1.6.4. Market Revenue and Forecast, by Price Point

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type

12.2.2. Market Revenue and Forecast, by Form

12.2.3. Market Revenue and Forecast, by Distribution Channel

12.2.4. Market Revenue and Forecast, by Price Point

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type

12.2.5.2. Market Revenue and Forecast, by Form

12.2.5.3. Market Revenue and Forecast, by Distribution Channel

12.2.5.4. Market Revenue and Forecast, by Price Point

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type

12.2.6.2. Market Revenue and Forecast, by Form

12.2.6.3. Market Revenue and Forecast, by Distribution Channel

12.2.6.4. Market Revenue and Forecast, by Price Point

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type

12.2.7.2. Market Revenue and Forecast, by Form

12.2.7.3. Market Revenue and Forecast, by Distribution Channel

12.2.7.4. Market Revenue and Forecast, by Price Point

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type

12.2.8.2. Market Revenue and Forecast, by Form

12.2.8.3. Market Revenue and Forecast, by Distribution Channel

12.2.8.4. Market Revenue and Forecast, by Price Point

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type

12.3.2. Market Revenue and Forecast, by Form

12.3.3. Market Revenue and Forecast, by Distribution Channel

12.3.4. Market Revenue and Forecast, by Price Point

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type

12.3.5.2. Market Revenue and Forecast, by Form

12.3.5.3. Market Revenue and Forecast, by Distribution Channel

12.3.5.4. Market Revenue and Forecast, by Price Point

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type

12.3.6.2. Market Revenue and Forecast, by Form

12.3.6.3. Market Revenue and Forecast, by Distribution Channel

12.3.6.4. Market Revenue and Forecast, by Price Point

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type

12.3.7.2. Market Revenue and Forecast, by Form

12.3.7.3. Market Revenue and Forecast, by Distribution Channel

12.3.7.4. Market Revenue and Forecast, by Price Point

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type

12.3.8.2. Market Revenue and Forecast, by Form

12.3.8.3. Market Revenue and Forecast, by Distribution Channel

12.3.8.4. Market Revenue and Forecast, by Price Point

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type

12.4.2. Market Revenue and Forecast, by Form

12.4.3. Market Revenue and Forecast, by Distribution Channel

12.4.4. Market Revenue and Forecast, by Price Point

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type

12.4.5.2. Market Revenue and Forecast, by Form

12.4.5.3. Market Revenue and Forecast, by Distribution Channel

12.4.5.4. Market Revenue and Forecast, by Price Point

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type

12.4.6.2. Market Revenue and Forecast, by Form

12.4.6.3. Market Revenue and Forecast, by Distribution Channel

12.4.6.4. Market Revenue and Forecast, by Price Point

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type

12.4.7.2. Market Revenue and Forecast, by Form

12.4.7.3. Market Revenue and Forecast, by Distribution Channel

12.4.7.4. Market Revenue and Forecast, by Price Point

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type

12.4.8.2. Market Revenue and Forecast, by Form

12.4.8.3. Market Revenue and Forecast, by Distribution Channel

12.4.8.4. Market Revenue and Forecast, by Price Point

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type

12.5.2. Market Revenue and Forecast, by Form

12.5.3. Market Revenue and Forecast, by Distribution Channel

12.5.4. Market Revenue and Forecast, by Price Point

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type

12.5.5.2. Market Revenue and Forecast, by Form

12.5.5.3. Market Revenue and Forecast, by Distribution Channel

12.5.5.4. Market Revenue and Forecast, by Price Point

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type

12.5.6.2. Market Revenue and Forecast, by Form

12.5.6.3. Market Revenue and Forecast, by Distribution Channel

12.5.6.4. Market Revenue and Forecast, by Price Point

Chapter 13. Company Profiles

13.1. L'Oréal Group

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Estée Lauder Companies Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Shiseido Company, Limited

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Unilever

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Procter & Gamble (P&G)

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Amorepacific Corporation

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. The Ordinary (DECIEM)

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Clinique (Estée Lauder)

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Coty Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Beiersdorf AG (NIVEA)

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others