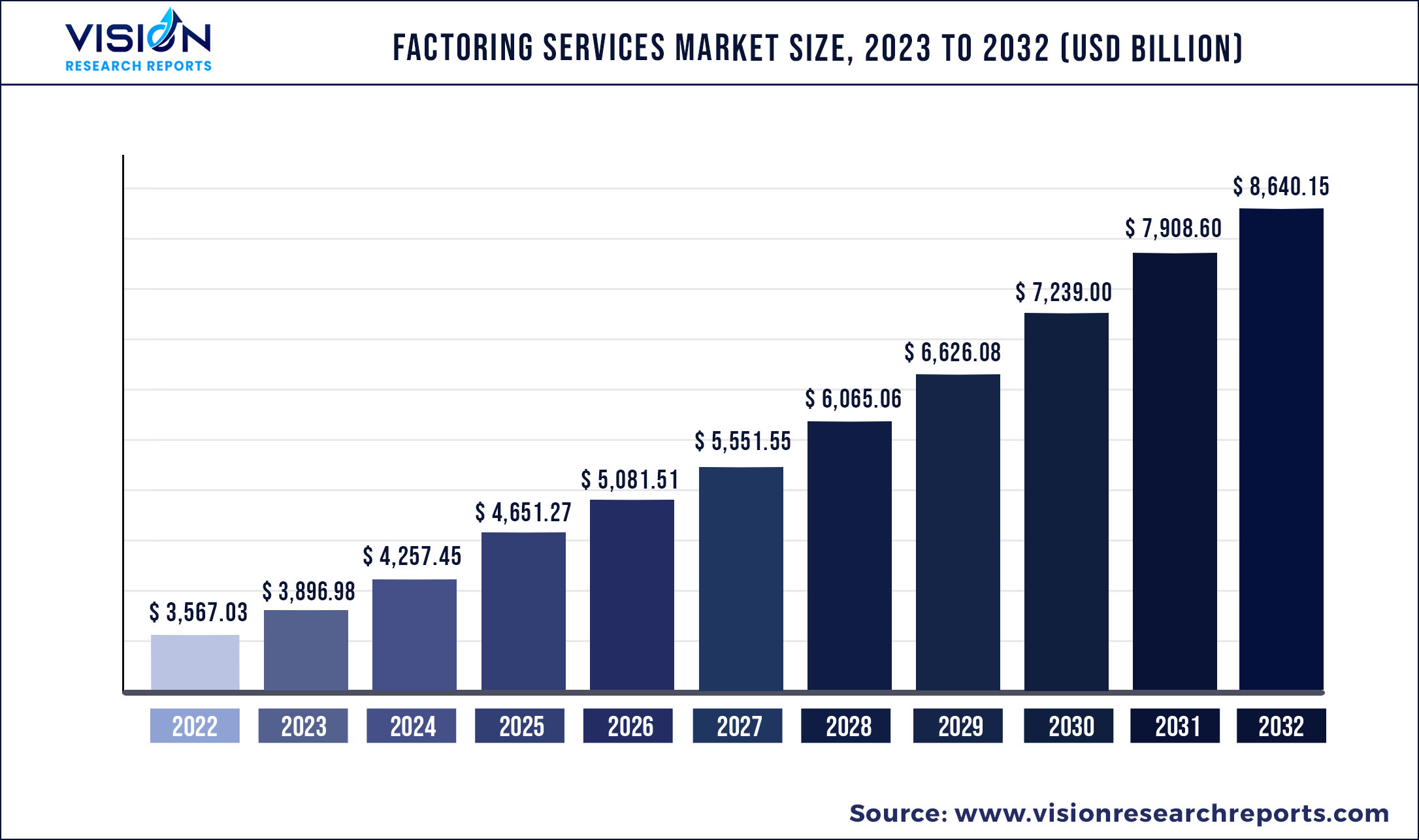

The global factoring services market was valued at USD 3,567.03 billion in 2022 and it is predicted to surpass around USD 8,640.15 billion by 2032 with a CAGR of 9.25% from 2023 to 2032.

Key Pointers

| Report Coverage | Details |

| Market Size in 2022 | USD 3,567.03 billion |

| Revenue Forecast by 2032 | USD 8,640.15 billion |

| Growth rate from 2023 to 2032 | CAGR of 9.25% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | China Construction Bank Corporation; Deutsche Factoring Bank; Barclays Bank PLC; BNP Paribas; Hitachi Capital (UK) PLC; Eurobank; HSBC Group; ICBC China; Kuke Finance; Mizuho Financial Group, Inc. |

The increasing need for alternative sources of financing for micro and small & medium enterprises is driving the growth of the market. Several organizations continue to take advantage of Machine Learning (ML), Natural Language Processing (NLP), and Artificial Intelligence (AI), which are expected to generate profitable growth prospects for the factoring services during the forecast period. The COVID-19 pandemic is expected to introduce a more collaborative approach, wherein banks and Supply Chain Finance (SCFs) firms are expected to work together to provide benefits to the client ecosystems. The factoring services industry is expected to shift towards digital documentation, with cloud-based and AI-based models improving the efficiency of services post-pandemic creating robust factoring services market opportunities.

Growing public awareness regarding developments in financial technology, such as government and factoring group lobbying and activities, cryptocurrency, increasing international trade, and widespread usage of digital platforms are some key factors driving the market growth. Businesses often have to wait for customers to pay which affects the cash flow, thus, to remediate this delay, factoring companies offer upfront cash in exchange for account receivables, which makes factoring services referable.

Businesses can reduce credit risk and acquire working capital loans with factoring services. Finance, Competitiveness, and Innovation (FCI) Global Practice is taking a series of steps to boost awareness, including hosting workshops to explain the relevance of factoring to government officials and other key stakeholders. It continues to support the establishment of effective assignment legislation, third-party rights safeguards, and the promotion of good governance to create a robust legal and regulatory environment to develop a solid legal infrastructure.

As a result, in April 2022, FCI launched the Edifactoring 2.0 platform, an online platform to support the two-factor business model for members of FCI through a set of Electronic Document Interchange (EDI) messages. The platform runs on FCI’s legal structure and helps to overcome the challenges in cross-bordering factoring.

Since factoring businesses serve a variety of industries; their pricing and levels of customer service can offer differentiated products depending on the end-user’s requirements. Moreover, the ability to complete the process and provide advance payment within 24-72 hours makes the service faster than bank loans. However, new technologies are assisting factoring companies in providing better customer service by offering consumers access to web portals and applications to review and respond to frequently asked inquiries about their accounts.

Low-profit margin and rising digital threats such as viruses, ransomware, spyware & Distributed denial of service (DDoS) attacks are expected to affect the factoring services market growth over the forecast period. Several organizations have incurred significant losses in terms of unplanned workforce reduction, brand reputation, revenue, and business disruptions due to data breaches.

Factoring Services Market Segmentations:

| By Category | By Type | By Financial Institution | By End-use |

|

Domestic International |

Recourse Non-recourse |

Banks Non-banking Financial Institutions |

Manufacturing Transport & Logistics Information Technology Healthcare Construction Others (Staffing Agencies, Advertising, Oilfield Services, And Commercial Food & Beverages) |

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Factoring Services Market

5.1. COVID-19 Landscape: Factoring Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Factoring Services Market, By Category

8.1. Factoring Services Market, by Category, 2023-2032

8.1.1. Domestic

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. International

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Factoring Services Market, By Type

9.1. Factoring Services Market, by Type, 2023-2032

9.1.1. Recourse

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Non-recourse

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Factoring Services Market, By Financial Institution

10.1. Factoring Services Market, by Financial Institution, 2023-2032

10.1.1. Banks

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Non-banking Financial Institutions

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Factoring Services Market, By End-use

11.1. Factoring Services Market, by End-use, 2023-2032

11.1.1. Manufacturing

11.1.1.1. Market Revenue and Forecast (2020-2032)

11.1.2. Transport & Logistics

11.1.2.1. Market Revenue and Forecast (2020-2032)

11.1.3. Information Technology

11.1.3.1. Market Revenue and Forecast (2020-2032)

11.1.4. Healthcare

11.1.4.1. Market Revenue and Forecast (2020-2032)

11.1.5. Construction

11.1.5.1. Market Revenue and Forecast (2020-2032)

11.1.6. Others (Staffing Agencies, Advertising, Oilfield Services, And Commercial Food & Beverages)

11.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 12. Global Factoring Services Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Category (2020-2032)

12.1.2. Market Revenue and Forecast, by Type (2020-2032)

12.1.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.1.4. Market Revenue and Forecast, by End-use (2020-2032)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Category (2020-2032)

12.1.5.2. Market Revenue and Forecast, by Type (2020-2032)

12.1.5.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.1.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Category (2020-2032)

12.1.6.2. Market Revenue and Forecast, by Type (2020-2032)

12.1.6.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.1.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Category (2020-2032)

12.2.2. Market Revenue and Forecast, by Type (2020-2032)

12.2.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.2.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Category (2020-2032)

12.2.5.2. Market Revenue and Forecast, by Type (2020-2032)

12.2.5.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.2.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Category (2020-2032)

12.2.6.2. Market Revenue and Forecast, by Type (2020-2032)

12.2.6.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.2.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Category (2020-2032)

12.2.7.2. Market Revenue and Forecast, by Type (2020-2032)

12.2.7.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.2.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Category (2020-2032)

12.2.8.2. Market Revenue and Forecast, by Type (2020-2032)

12.2.8.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.2.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Category (2020-2032)

12.3.2. Market Revenue and Forecast, by Type (2020-2032)

12.3.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.3.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Category (2020-2032)

12.3.5.2. Market Revenue and Forecast, by Type (2020-2032)

12.3.5.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.3.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Category (2020-2032)

12.3.6.2. Market Revenue and Forecast, by Type (2020-2032)

12.3.6.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.3.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Category (2020-2032)

12.3.7.2. Market Revenue and Forecast, by Type (2020-2032)

12.3.7.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.3.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Category (2020-2032)

12.3.8.2. Market Revenue and Forecast, by Type (2020-2032)

12.3.8.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.3.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Category (2020-2032)

12.4.2. Market Revenue and Forecast, by Type (2020-2032)

12.4.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.4.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Category (2020-2032)

12.4.5.2. Market Revenue and Forecast, by Type (2020-2032)

12.4.5.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.4.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Category (2020-2032)

12.4.6.2. Market Revenue and Forecast, by Type (2020-2032)

12.4.6.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.4.6.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Category (2020-2032)

12.4.7.2. Market Revenue and Forecast, by Type (2020-2032)

12.4.7.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.4.7.4. Market Revenue and Forecast, by End-use (2020-2032)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Category (2020-2032)

12.4.8.2. Market Revenue and Forecast, by Type (2020-2032)

12.4.8.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.4.8.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Category (2020-2032)

12.5.2. Market Revenue and Forecast, by Type (2020-2032)

12.5.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Category (2020-2032)

12.5.5.2. Market Revenue and Forecast, by Type (2020-2032)

12.5.5.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.5.5.4. Market Revenue and Forecast, by End-use (2020-2032)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Category (2020-2032)

12.5.6.2. Market Revenue and Forecast, by Type (2020-2032)

12.5.6.3. Market Revenue and Forecast, by Financial Institution (2020-2032)

12.5.6.4. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 13. Company Profiles

13.1. China Construction Bank Corporation

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Deutsche Factoring Bank

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Barclays Bank PLC

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. BNP Paribas

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Hitachi Capital (UK) PLC

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Eurobank

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. HSBC Group

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. ICBC China

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Kuke Finance

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Mizuho Financial Group, Inc.

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others