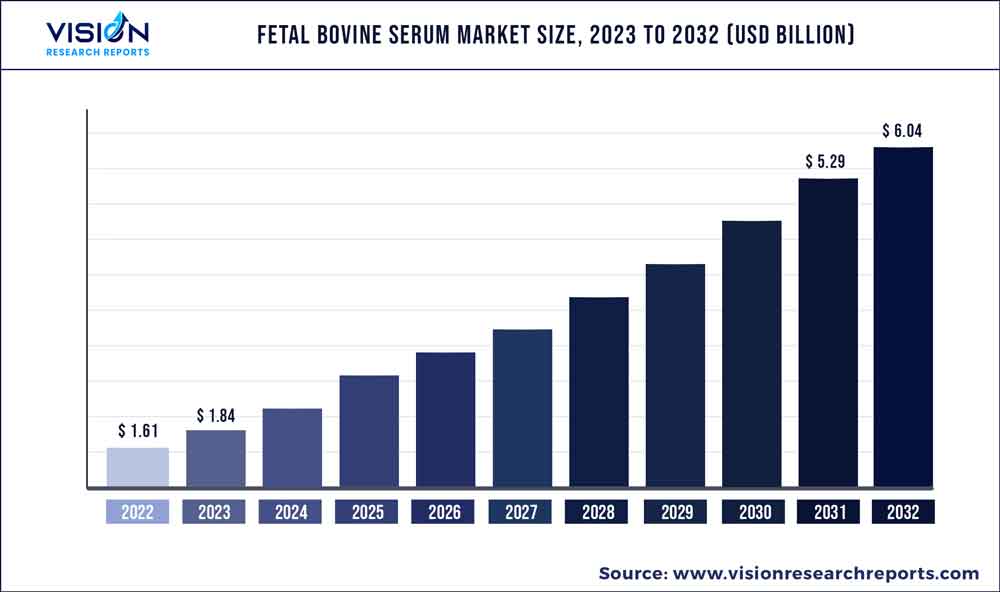

The global fetal bovine serum market was estimated at USD 1.61 billion in 2022 and it is expected to surpass around USD 6.04 billion by 2032, poised to grow at a CAGR of 14.14% from 2023 to 2032. The fetal bovine serum market in the United States was accounted for USD 548.8 million in 2022.

Key Pointers

Report Scope of the Fetal Bovine Serum Market

| Report Coverage | Details |

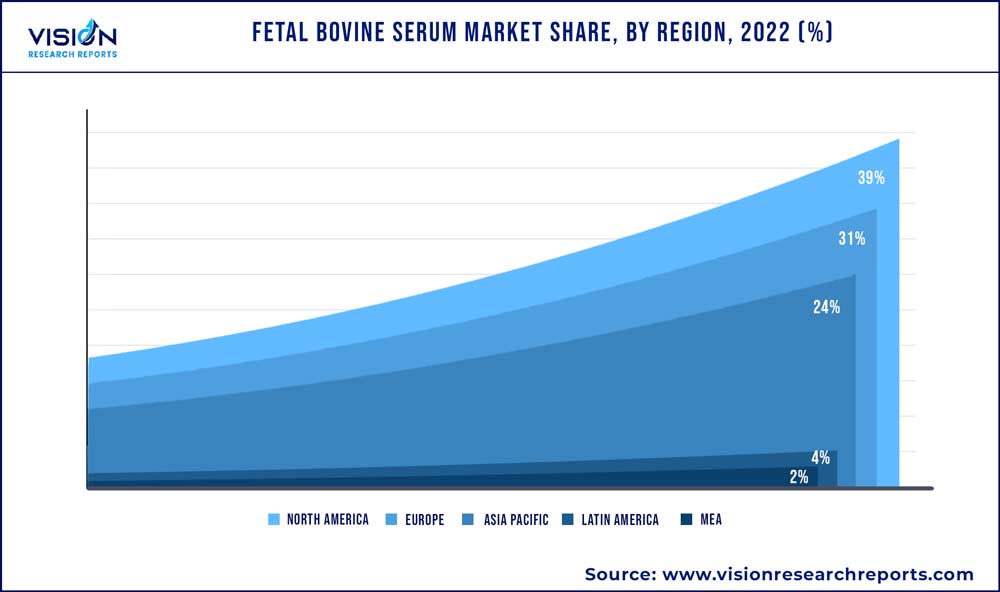

| Revenue Share of North America in 2022 | 31% |

| CAGR of Asia Pacific from 2023 to 2032 | 15.64% |

| Revenue Forecast by 2032 | USD 6.04 billion |

| Growth Rate from 2023 to 2032 | CAGR of 14.14% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Thermo Fisher Scientific Inc.; Sartorius AG; Danaher Corporation; Merck KGaA; HiMedia Laboratories; Bio-Techne; PAN-Biotech; Atlas Biologicals, Inc.; Rocky Mountain Biologicals; Biowest |

Factors such as the expansion of the biopharmaceutical industry in developing countries as well as established markets is expected to spur the demand for fetal bovine serum (FBS) in coming years. Furthermore, increasing R&D activities and expenditure by key players for the introduction of new products in the market are some of the major factors driving the market growth. Moreover, the increasing application of fetal bovine serum in drug discovery, and vaccine production is leading to a rise in demand for fetal bovine serum products. The COVID-19 pandemic had a positive impact on the global market. The pandemic led to a heightened demand for the development of vaccines to curb the spread of the virus and reduce its severe effects. Fetal bovine serum is extensively used in developing vaccines and therefore rise in demand for vaccine development had a direct impact on the market and led to an increase in sales of fetal bovine serum. For instance, according to the data from the Ministry of Commerce,India imported close to USD 0.28 million worth of cattle serum products over 2019-20 for the production of COVID-19 vaccines.

In addition, the fetal bovine serum is also used in a number of other applications such as drug discovery, cell-based research, diagnostics, etc. The rising focus of the pharma industry to develop and introduce new drugs in the market due to the rising prevalence of acute and chronic diseases is also augmenting the growth of the market. According to a research study published in January 2023, between 2012 and 2021, FDA approved an average of 44 drugs per week skewed upwards by the 50+ annual tally between 2018 and 2021. Overall, it was a golden decade, with 445 new biologics and small molecule medicines, up 76% from the previous ten years.

The expansion of the biopharmaceutical industry in developing countries as well as established markets is creating lucrative opportunities and leading to a rise in the adoption rate of fetal bovine serum. For instance, according to a report and survey of Biopharmaceutical and Manufacturing Capacity and Production published in 2021, there were about 1900 facilities worldwide with an estimated capacity of more than 17.3 million liters, including over 720 facilities with more than 2000 L capacity.

On the other hand, although cell culture is vital in biological research, the high cost of fetal bovine serum makes it an expensive process which is limiting the growth of the market. Market players are therefore developing cost-effective alternatives. For instance, Cytiva markets two products that can be used as an alternative to fetal bovine serum, this includes Hyclone Bovine Growth Serum and Hyclone Calf Serum. Another factor limiting the growth of the market is the increasing preference by manufacturers to develop serum-free media. This is due to the number of problems that can be caused by animal serum in cell culture such as high costs associated with raw materials and post-production processing and heightened regulatory concerns as a result of the potential for contamination by adventitious agents present in animal serum.

Application Insights

In 2022, vaccine production segment dominated the global market by generating USD 448.65 million in revenues. FBS is a commonly used supplement in vaccine manufacturing. It is a rich source of growth factors and nutrients that promote cell growth and proliferation, which are essential for the production of certain types of vaccines. The advent of COVID-19 pandemic resulted in increased research activities for vaccine development. This resulted in a sudden increase in the demand for FBS for vaccine manufacturing and research.

In-vitro fertilization is expected to emerge as the most lucrative segment of all. The segment is expected to grow at a CAGR of 16.52% from 2023 to 2032. FBS provides essential nutrients, hormones, and growth factors that are necessary for the growth and development of embryos. It is often used in combination with other supplements, such as human serum albumin, to optimize embryo culture conditions and improve embryo quality. Increasing number of IVF cycles being done across the globe, the demand for FBS is expected to grow in the coming years.

End-user Insights

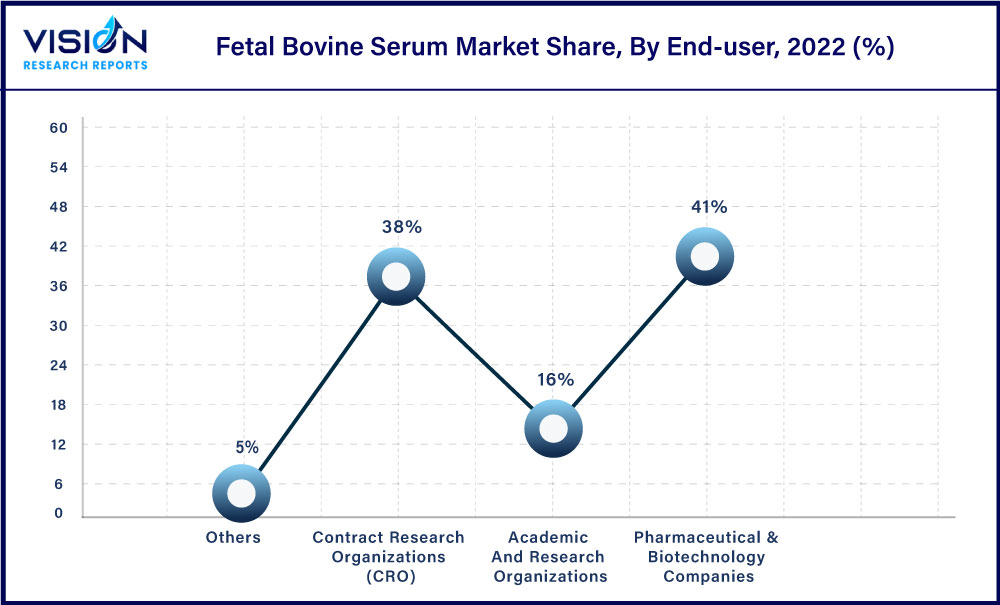

The pharmaceutical & biotechnology companies segment held the highest market share of 41% in 2022. This is due to the increasing adoption of fetal bovine serum in drug development. The increasing prevalence of chronic diseases like cancer demands elevated research activities and the rising adoption of fetal bovine serum for this purpose by pharmaceutical and biotechnology companies is driving the segment growth.

The Contract Research Organizations (CRO’s) segment is anticipated to register the fastest CAGR of 15.63% from 2023 to 2032. The adoption of CRO offers various benefits that will help the manufacturer to conduct a successful clinical development program which represents lucrative growth opportunities for this segment over the forecast period. Factors such as better global reach, the presence of necessary resources in place and easy delegation of duties and functions to the CRO are driving the growth of the segment. Due to these advantages, an increasing number of manufacturers are opting to hand over research programs to CRO’s rather than doing it in-house which is helping the segment gain significant growth and sustain a relatively stronger position in the market.

Regional Insights

North America dominated the global market with a share of 39% in 2022. Increasing expenditure on R&D by government agencies is one of the major factors contributing towards the growth of the market. The U.S. is considered to have the strongest R&D ecosystem in the world. For Instance, according to a news article published in July 2022, the biotechnology industry grew its research and development expenditure by 94% from 2016 to 2021, to a total of USD 88.6 billion. Additionally, other factors such as a rise in focus to develop biopharmaceutical products, the presence of established players in the region, and strong healthcare infrastructure is also driving the market growth.

The Asia Pacific is anticipated to undergo maximum growth with a CAGR of 15.64% from 2023 to 2032. This is due to the increasing number of biopharmaceutical manufacturers in developing countries like India, South Korea, and China. These companies are experiencing rapid growth by serving their domestic and regional markets. Other factors include the rising number of academic institutes and clinical research organizations within the region.

Fetal Bovine Serum Market Segmentations:

By Application

By End-user

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Fetal Bovine Serum Market

5.1. COVID-19 Landscape: Fetal Bovine Serum Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Fetal Bovine Serum Market, By Application

8.1. Fetal Bovine Serum Market, by Application, 2023-2032

8.1.1. Drug Discovery

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. In-vitro Fertilization

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Vaccine Production

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Cell-based Research

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Diagnostics

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Others

8.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Fetal Bovine Serum Market, By End-user

9.1. Fetal Bovine Serum Market, by End-user, 2023-2032

9.1.1. Pharmaceutical & Biotechnology Companies

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Contract Research Organizations (CRO)

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Academic And Research Organizations

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Fetal Bovine Serum Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.2. Market Revenue and Forecast, by End-user (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.3.2. Market Revenue and Forecast, by End-user (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.1.4.2. Market Revenue and Forecast, by End-user (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.2. Market Revenue and Forecast, by End-user (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.3.2. Market Revenue and Forecast, by End-user (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.4.2. Market Revenue and Forecast, by End-user (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.5.2. Market Revenue and Forecast, by End-user (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Application (2020-2032)

10.2.6.2. Market Revenue and Forecast, by End-user (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.2. Market Revenue and Forecast, by End-user (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.3.2. Market Revenue and Forecast, by End-user (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.4.2. Market Revenue and Forecast, by End-user (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.5.2. Market Revenue and Forecast, by End-user (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Application (2020-2032)

10.3.6.2. Market Revenue and Forecast, by End-user (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.2. Market Revenue and Forecast, by End-user (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.3.2. Market Revenue and Forecast, by End-user (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.4.2. Market Revenue and Forecast, by End-user (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.5.2. Market Revenue and Forecast, by End-user (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Application (2020-2032)

10.4.6.2. Market Revenue and Forecast, by End-user (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Application (2020-2032)

10.5.2. Market Revenue and Forecast, by End-user (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Application (2020-2032)

10.5.3.2. Market Revenue and Forecast, by End-user (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Application (2020-2032)

10.5.4.2. Market Revenue and Forecast, by End-user (2020-2032)

Chapter 11. Company Profiles

11.1. Thermo Fisher Scientific Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Sartorius AG

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Danaher Corporation

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Merck KGaA

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. HiMedia Laboratories

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Bio-Techne

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. PAN-Biotech

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Atlas Biologicals, Inc.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Rocky Mountain Biologicals

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Biowest

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others