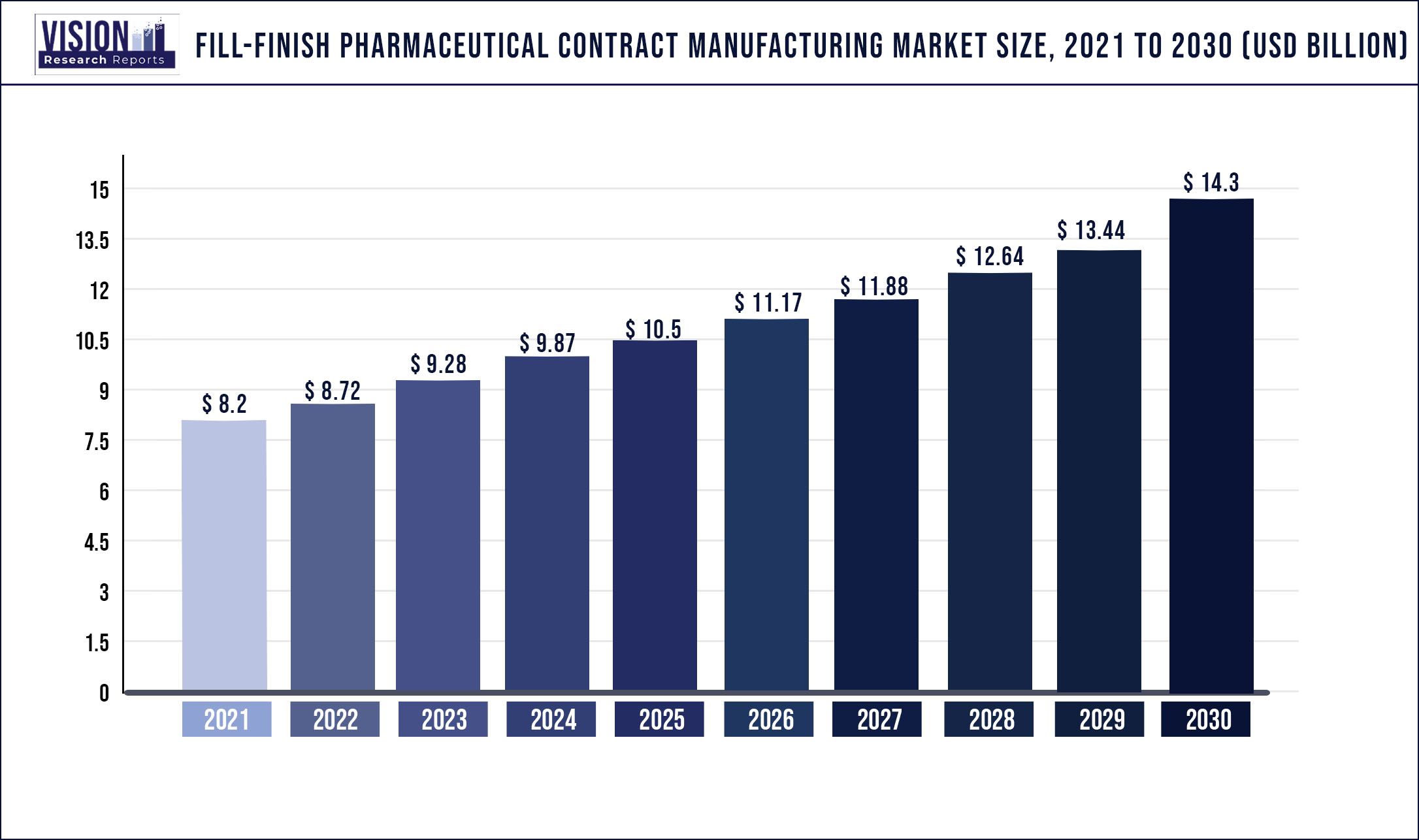

The global fill-finish pharmaceutical contract manufacturing market was surpassed at USD 8.2 billion in 2021 and is expected to hit around USD 14.3 billion by 2030, growing at a CAGR of 6.37% from 2022 to 2030.

Increasing demand for drugs across global market and advantage of the reduction in the overall investment for developing drugs with contract manufacturing are the key factors driving the growth of the market. Contract fill-and-finish services are one of the most commonly outsourced services presently. Almost all pharmaceutical and biotech firms outsource at least some of their fill-and-finish requirements.

Unpredicted demand, second source policies, and better matching scale with need are all factors to consider when utilizing a CMO's capacity. Highly specialized capabilities like prefilled syringes, lyophilization, and cartridges, as well as novel therapeutics, necessitate specialized manufacturing that is more cost-effective to outsource. Firms with in-house aseptic fill/finish capacity outsource 39% of their fill and finish requirements, according to contract pharma. Furthermore, filling accounts for 59% of the market, while lyophilization accounts for 24%.

However, the COVID-19 pandemic spurred the development of COVID-19 vaccines, antibody therapy, antiviral drugs, and a variety of other related pharmaceutical products. The pandemic severely impacted countries such as Brazil, India, the U.S., and major European countries, increasing demand for biopharmaceutical products and, as a result, drug production. Vaccines and biologics require special manufacturing and fill-finish equipment and procedures to ensure product quality and safety, necessitating advanced analytical competencies and adaptable aseptic fill-finish technologies. This resulted in the positive impact of covid-19 on the market.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 8.2 billion |

| Revenue Forecast by 2030 | USD 14.3 billion |

| Growth rate from 2022 to 2030 | CAGR of 6.37% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Product type, molecule type, end-user, region |

| Companies Covered | AbbVie Inc.; Boehringer Ingelheim; Pfizer; Catalent Inc; Recro Pharma, Inc.; Baxter’s BioPharma Solutions; Eurofins Scientific; Symbiosis Pharmaceutical Service; MabPlex International Co. Ltd.; Recipharm AB; Fresenius Kabi Contract Manufacturing; Novartis |

Product Type Insights

The prefilled syringes segment is expected to witness a fastest CAGR of 6.6% in the market for fill-finish pharmaceutical contract manufacturing over the forecast period. Prefilled syringes are a well-established technique of drug delivery for both new complex biologic drugs as well as traditional small molecule drugs. They have several benefits over other container types, such as reduced medication errors, fast and safe administration and preparation, longer storage, and a lower risk of overfill, all of which result in development costs and reduced batch volumes. Hence, due to the aforementioned factors, the segment is poised to witness considerable growth across the forecast period.

The vials segment on the other hand is anticipated to hold the highest market share across the forecast period. High shares of the segment is majorly due to increasing technological advancements amongst the vial filling equipment’s. Moreover, it is evident that majority of biologics and vaccines are filled in vials for extreme safety and to avoid leakage. Thus, the segment has held the highest share across the analysis timeframe. Additionally, several CMOs are focusing on the development of novel vial filling technologies for efficient and safe fill finish process. For instance, in February 2022, Recro Pharma, Inc. a CDMO, announced the addition of new lyophilization capabilities to its wide range of contract manufacturing offerings. The company’s fill finish aseptic suite will feature an automated, sterile, vial filling platform with the capacity of filling 2,000 presterilized vials per hour.

Molecule Insights

The large molecules segment dominated the market for fill-finish pharmaceutical contract manufacturing and accounted for the maximum revenue share of 67.3% in 2021. Large-molecule sector is evolving as the next era of therapeutics in biopharma, putting it at the frontline of drug development due to the potential for biologics have potential to treat unmet medical needs. The rising popularity and importance of biologics can be seen in the increasing number of biologics approvals: in 2020, FDA Center for Drug Evaluation and Research approved 53 new molecular entities (NMEs), 13 of which were large molecules (25%). According to Evaluate Vantag, new FDA drug approvals are also expected to generate considerable value in 2021, with ten drugs expected to achieve prospective Broadway status by 2026, five of which are large molecules. Moreover, the fill finish services are majorly done for biologics or large molecules, which are mostly commercialized in the form of injectable. Hence, the increasing demand for such drug products are simultaneously supporting the demand for its fill finish services, thus augmenting segmental growth.

The small molecules pharmaceutical industry is reflecting a significant surge in demand across the forecast timeframe. Increasing number of small molecules being developed across the past decade, will strongly support small molecules-based fill finish segment’s growth. Moreover, several pharmaceutical companies have a robust pipeline of small molecules-based products that are in their late-stage clinical development phase, thus reflecting a lucrative growth for the segment.

End-user Insights

The biopharmaceutical companies segment dominated the market for fill-finish pharmaceutical contract manufacturing and accounted for the revenue share of 54.9% in 2021. Increase in the development of the drugs and vaccines are the key factors for the growth of the market. There are several challenges during the fill-finish manufacturing such as special processes, complex mechanical equipment (filling, dispensing, and sealing systems) to address this biopharma companies to collaborate with CDMOs/ CMOs that specializes in high-volume injectable fill-finish development and manufacturing. This would drive the growth of the market.

Companies typically consider outsourcing biopharmaceutical fill-and-finish to a CMO to gain access to production capacity or specialized manufacturing capabilities. Pharmaceutical companies with intrinsic fill-and-finish capabilities outsource 40% of their necessities on average. Growing production of small molecule drugs has led to the surge in demand for third party and contract manufacturing services of small molecules among the pharmaceutical companies as well. Sterile fill-finish is considered among the most vital steps in the pharmaceutical manufacturing process. Moreover, the complex development process of small molecule APIs has further boosted demand for suitable sterile fill finish processes across the pharmaceutical companies, thus boosting demand for outsourcing services in the pharma industry.

Regional Insights

In Asia Pacific, the fill-finish pharmaceutical contract manufacturing market is projected to witness a CAGR of 6.3% over the forecast period. The region is also accounted for the largest market share of 35.3% in 2021 due to factors such as increasing investment by the companies in clinical research, improving healthcare infrastructure, larger number of CMOs expanding and increasing number of fill-finish facilities being constructed in the region. For instance, In August 2021, Lonza is adding capacity at its biologics manufacturing facility in Guangzhou, China, by installing a new fill-finish line. Moreover, wages and material cost is cheaper in China and India that drives the market for fill-finish pharmaceutical contract manufacturing. The rapid expansion of the biopharmaceutical industry could be a major factor driving up demand for fill-finish manufacturing in the region.

However, with increasing demand for products to treat COVID-19 infection, biopharmaceutical and pharmaceutical companies in countries such as India and China, which are the largest exporters to western companies, have increased their production of APIs. For instance, in august 2020, Wockhardt Ltd under a deal announced with the U.K. government would supply millions of doses of numerous COVID-19 vaccines, as well as those being formed by AstraZeneca and Oxford University. As part of the deal, the company had also confined fill-and-finish capacity, which is the final production step of putting vaccines into syringes or vials and packaging them.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Fill-finish Pharmaceutical Contract Manufacturing Market

5.1. COVID-19 Landscape: Fill-finish Pharmaceutical Contract Manufacturing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Fill-finish Pharmaceutical Contract Manufacturing Market, By Product Type

8.1. Fill-finish Pharmaceutical Contract Manufacturing Market, by Product Type, 2022-2030

8.1.1 Prefilled Syringes

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Vials

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Cartridges

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Fill-finish Pharmaceutical Contract Manufacturing Market, By Molecule Type

9.1. Fill-finish Pharmaceutical Contract Manufacturing Market, by Molecule Type, 2022-2030

9.1.1. Large Molecules

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Small Molecules

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Fill-finish Pharmaceutical Contract Manufacturing Market, By End-user

10.1. Fill-finish Pharmaceutical Contract Manufacturing Market, by End-user, 2022-2030

10.1.1. Biopharmaceutical Companies

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Pharmaceutical Companies

10.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Fill-finish Pharmaceutical Contract Manufacturing Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.1.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.1.3. Market Revenue and Forecast, by End-user (2017-2030)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.1.4.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.1.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.1.5.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.1.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.2.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.2.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.2.4.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.2.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.2.5.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.2.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.2.6.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.2.6.3. Market Revenue and Forecast, by End-user (2017-2030)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.2.7.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.2.7.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.3.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.3.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.3.4.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.3.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.3.5.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.3.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.3.6.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.3.6.3. Market Revenue and Forecast, by End-user (2017-2030)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.3.7.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.3.7.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.4.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.4.4.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.4.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.4.5.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.4.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.4.6.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.4.6.3. Market Revenue and Forecast, by End-user (2017-2030)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.4.7.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.4.7.3. Market Revenue and Forecast, by End-user (2017-2030)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.5.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.5.3. Market Revenue and Forecast, by End-user (2017-2030)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.5.4.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.5.4.3. Market Revenue and Forecast, by End-user (2017-2030)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product Type (2017-2030)

11.5.5.2. Market Revenue and Forecast, by Molecule Type (2017-2030)

11.5.5.3. Market Revenue and Forecast, by End-user (2017-2030)

Chapter 12. Company Profiles

12.1. Boehringer Ingelheim

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Catalent Inc

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Recro Pharma, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Baxter’s BioPharma Solutions

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Eurofins Scientific

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Symbiosis Pharmaceutical Service

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. MabPlex International Co. Ltd.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Recipharm AB

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Fresenius Kabi Contract Manufacturing

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Novartis

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others