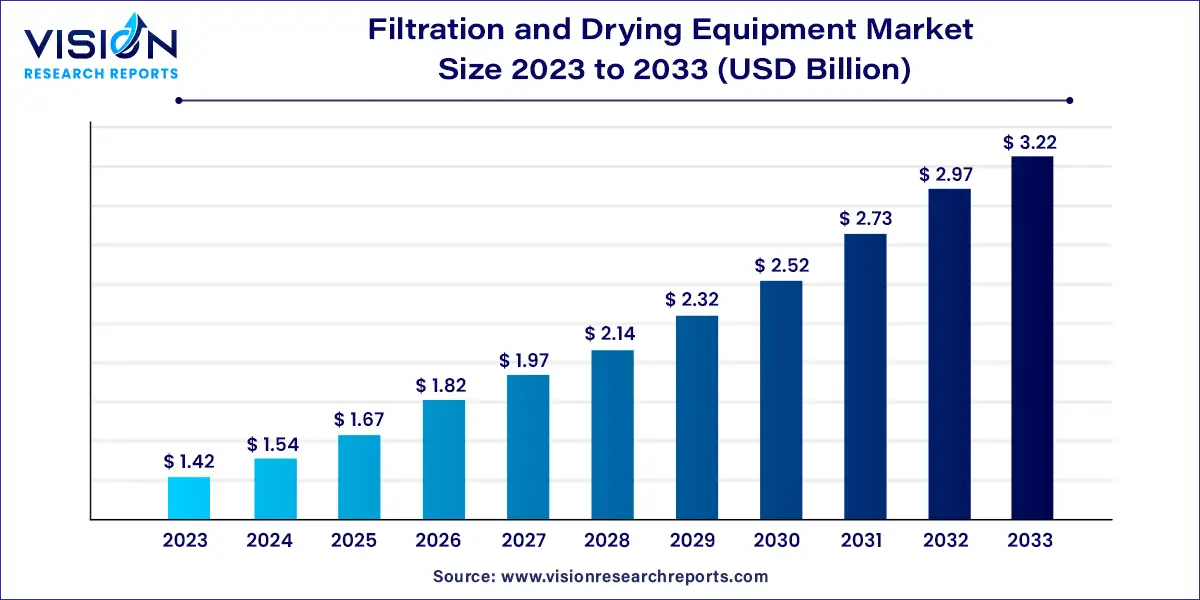

The global filtration & drying equipment market size was estimated at around USD 1.42 billion in 2023 and it is projected to hit around USD 3.22 billion by 2033, growing at a CAGR of 8.53% from 2024 to 2033. The filtration and drying equipment market plays a critical role in various industries, including pharmaceuticals, chemicals, food and beverages, and environmental management. This sector encompasses a diverse range of technologies and solutions designed to remove contaminants from liquids and gases and to efficiently dry materials in industrial processes.

The growth of the filtration and drying equipment market is primarily fueled by several key factors. Rapid industrialization and increasing manufacturing activities across various sectors, including pharmaceuticals, chemicals, and food processing, drive the demand for efficient filtration and drying solutions. Additionally, stringent environmental regulations and quality standards compel industries to adopt advanced equipment to ensure compliance and reduce emissions. Technological advancements in filtration media and drying techniques further enhance performance and efficiency, making these systems more attractive to a broader range of applications. Moreover, rising concerns about environmental sustainability and the need for effective waste management solutions contribute to the market’s expansion, as industries seek to minimize their ecological footprint while optimizing production processes.

The Asia Pacific region dominated the market with a 42% revenue share in 2023. The surge in demand for filtration and drying equipment in this region is driven by rapid industrialization and economic growth in countries like China, India, Japan, and South Korea. Expanding sectors such as pharmaceuticals, chemicals, food and beverages, and water treatment contribute significantly to this demand. The growing pharmaceutical sector, fueled by rising populations and increasing healthcare access, is particularly influential in driving the need for high-quality filtration and drying solutions.

In Central and South America, the demand for filtration and drying equipment is on the rise, supported by growth in pharmaceutical and chemical industries. The focus on environmental sustainability and wastewater management further boosts demand for advanced filtration solutions. As industrial activities and infrastructure projects expand in the region, the need for reliable and efficient filtration and drying technologies is expected to increase.

The Canadian market is anticipated to benefit from the growth in the pharmaceutical and food and beverage industries. After a period of contraction, the food and beverage sector has shown recovery, with significant increases in sales. Filtration and drying equipment are crucial for maintaining optimal conditions in food and beverage processing, ensuring product quality and extending shelf life.

The market in Germany is expected to grow due to the rising pharmaceutical production and stringent regulatory standards. Germany's pharmaceutical hubs, such as Karlsruhe and Freiburg, and the presence of major pharmaceutical companies drive the demand for filtration and drying equipment. Recent contracts, like those secured by Bachiller, highlight the ongoing investment in advanced filtration technologies.

The Chinese market is driven by an aging population, increased health awareness, and rising healthcare spending. The pharmaceutical industry is expanding rapidly, supported by major international players and government initiatives. This growth is fueling the demand for advanced filtration and drying equipment necessary for pharmaceutical applications.

The Brazilian market is anticipated to grow due to the expanding chemical industry, which includes renewable chemicals, agrochemicals, and cosmetics. Brazil's position as a leading ethanol producer enhances the demand for filtration and drying equipment within the chemical sector.

In Saudi Arabia, the market is driven by urbanization, industrial growth, and increasing water contamination issues. Stringent government regulations on water treatment and advancements in water treatment technology are boosting the demand for filtration and drying equipment. The focus on reducing water pollution and managing industrial waste further supports market growth.

In 2023, the agitated nutsche filter-dryer (ANFD) technology emerged as the market leader, capturing a substantial revenue share of 51%. The ANFD is highly valued in industrial applications due to its integrated approach, which combines filtration, washing, and drying in a single unit. This design minimizes the need for multiple pieces of equipment and enhances operational efficiency. The agitated mechanism of the ANFD improves heat and mass transfer, leading to rapid and effective drying, which is crucial for sectors such as pharmaceuticals and chemicals. Additionally, its ability to operate in inert gas environments protects sensitive products from unwanted reactions, ensuring high purity throughout the production process.

Centrifuges are also integral to both filtration and drying processes in industrial settings. Utilizing high-speed rotational forces, centrifuges efficiently separate solids from liquids, offering a swift and effective method for achieving high levels of clarification. In industries such as pharmaceuticals, chemicals, and food processing, centrifuges are essential for removing fine particles. Their versatility extends to drying applications as well, where techniques like centrifugal and spin-drying help expel excess liquid from wet solids. This dual functionality enhances their utility in optimizing industrial processes with high throughput and reduced cycle times.

In 2023, the chemical sector led the market, holding the largest revenue share. Filtration and drying equipment are crucial in the chemical industry, supporting key processes such as crystallization, by-product separation, and intermediate production. These technologies are adaptable to a wide range of chemical substances, from fine and specialty chemicals to bulk chemicals, underscoring their versatility and importance in achieving the desired product specifications.

Similarly, the pharmaceutical industry relies heavily on filtration and drying equipment to meet rigorous quality standards and regulatory requirements. These technologies are used in critical processes such as crystallization, separation, and purification, ensuring the production of consistent and high-quality pharmaceutical formulations. As the industry increasingly focuses on efficiency and compliance, the role of advanced filtration and drying solutions becomes even more pivotal.

By Technology

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Filtration And Drying Equipment Market

5.1. COVID-19 Landscape: Filtration And Drying Equipment Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Filtration And Drying Equipment Market, By Technology

8.1. Filtration And Drying Equipment Market, by Technology, 2024-2033

8.1.1. Centrifuges

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Agitated Nutsche Filter-Dryers (ANFD)

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Others

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Filtration And Drying Equipment Market, By End-use

9.1. Filtration And Drying Equipment Market, by End-use, 2024-2033

9.1.1. Pharmaceutical

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Chemicals

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Water and Wastewater Treatment

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Food & Beverages

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Filtration And Drying Equipment Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Technology (2021-2033)

10.1.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.1.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.1.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Technology (2021-2033)

10.2.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Technology (2021-2033)

10.3.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.4.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Technology (2021-2033)

10.4.6.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Technology (2021-2033)

10.5.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Technology (2021-2033)

10.5.3.2. Market Revenue and Forecast, by End-use (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Technology (2021-2033)

10.5.4.2. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 11. Company Profiles

11.1. HEINKEL Process Technology GmbH

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. GMM Pfaudler

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Tsukishima Kikai Co., Ltd.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. HLE Glascoat

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Amar Equipment Pvt. Ltd.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Charles Thompson Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Hosokawa Micron Powder Systems

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. 3V Tech S.p.A.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Zhejiang Yaguang Technology Co., Ltd

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Little Men Roaring, LLC

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others