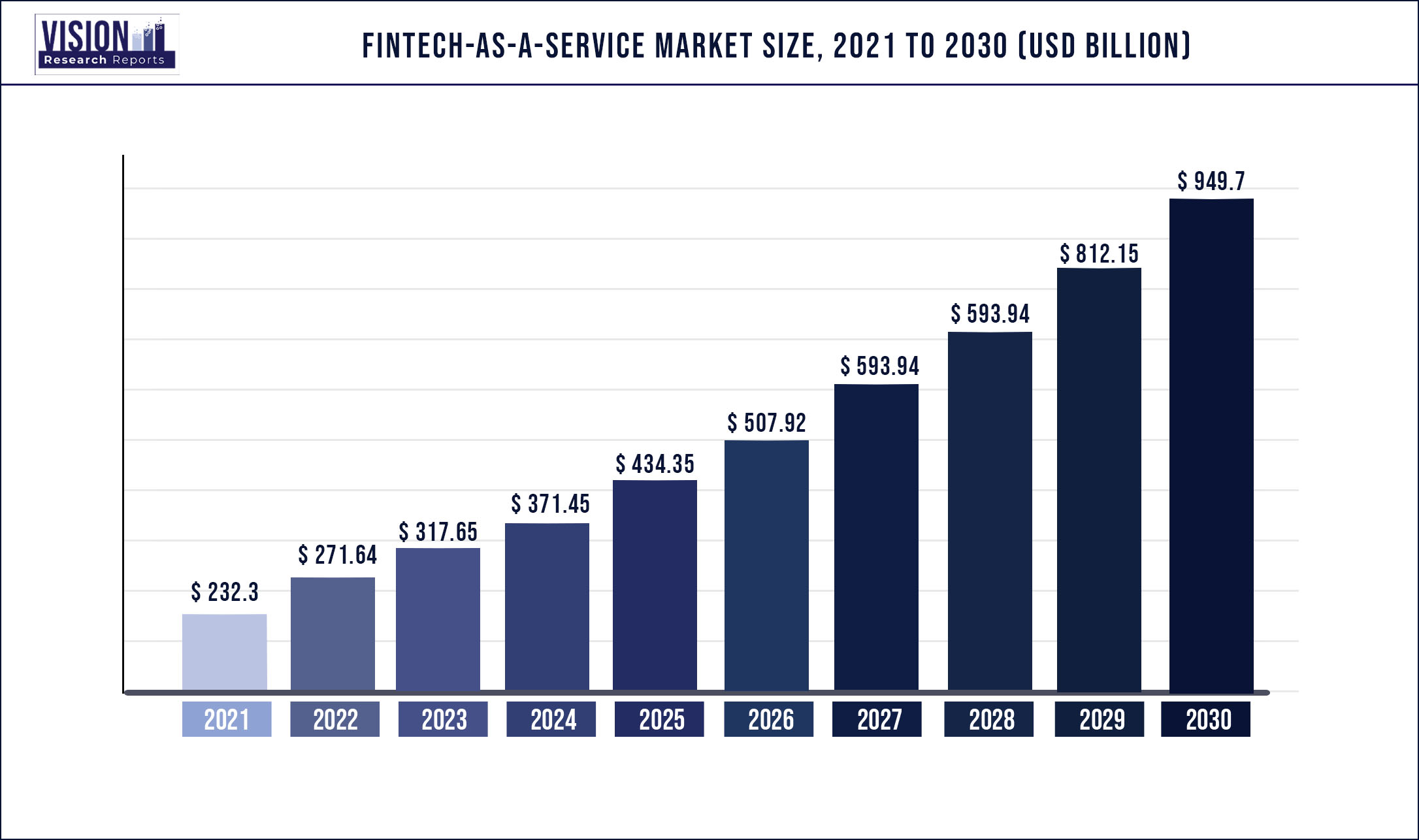

The global fintech-as-a-service market was valued at USD 232.3 billion in 2021 and it is predicted to surpass around USD 949.7 billion by 2030 with a CAGR of 16.94% from 2022 to 2030.

Report Highlights

The increasing adoption of financial technology-based solutions and platforms globally is anticipated to drive the growth of the market. The increasing adoption of artificial intelligence, cloud-based software, and big data integrated with financial services is expected to drive the growth of the market for fintech-as-a-service.

The growing utilization of smartphones for online transactions and fintech-related services through digital platforms is anticipated to drive the growth of the market. For Instance, approximately 44% of the payments were done through a mobile app, according to the statistics provided by Emizentech. In addition, according to a recent study conducted by Tipalti Inc., 64% of consumers worldwide use one or more fintech platforms as a service as of 2021.

The investments made in financial technology companies are estimated to generate opportunities for market growth over the forecast period. For example, an API developer, Railsbank Technology Ltd, raised USD 70 million in a fundraising event headed by Anthos Capital, a U.S.-based investment company, in July 2021. The funds would be used to develop the company's Fintech-as-a-service platform and to provide customers with various product development solutions.

The outbreak of the COVID-19 pandemic is expected to play a crucial role in driving the growth of the Fintech-as-a-Service platform market over the forecast period. The increasing demand for digital financial services increased drastically during the pandemic. Financial institutions and banks were looking at innovative ways to provide their services online during the pandemic which propelled the growth of the market.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 232.3 billion |

| Revenue Forecast by 2030 | USD 949.7 billion |

| Growth rate from 2022 to 2030 | CAGR of 16.94% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Type, technology, application, end-use, region |

| Companies Covered |

PayPal Holdings, Inc.; Block, Inc.; Mastercard Incorporated; Envestnet, Inc.; Upstart Holdings, Inc.; Rapyd Financial Network Ltd.; Solid Financial Technologies, Inc.; Railsbank Technology Ltd.; Synctera Inc.; Braintree |

Type Insights

The payment segment dominated the market in 2021 and accounted for a share of 40.3% of the global revenue. The increasing integration of AI technology and API into mobile-based payment services for traditional banking is anticipated to push the segment's growth. The innovative efforts being deployed by various tech-based companies to enhance their respective products also bodes well for the segment growth. For example, Google introduced the release of voice-to-text features in November 2021, allowing users to use voice commands to add their account information to the platform to initiate payments.

The fund transfer segment is anticipated to witness significant growth during the forecast period. Fund transfer is mainly associated with transferring and receiving money using technology-based payment systems. The growing popularity of fund transfer apps worldwide is expected to trigger the demand thereby driving the growth of the segment. The efforts are being pursued by various fintech companies worldwide to develop fund transfer apps with modern user interfaces that ensure a better customer experience. These factors are fueling the segment growth.

Technology Insights

The blockchain segment dominated the market in 2021 and accounted for a share of more than 28.3% of the global revenue. The increasing demand for blockchain technology is particularly rising among large enterprises. Several large enterprises are trying to adopt blockchain due to its greater transparency and its automation benefits. Financial institutions are adopting blockchain technology for the enhanced security and efficiency it offers. With blockchain technology, users can be sole owners of their wealth, and only they can access their assets which provide added security to both financial institutions and end-users. The benefits offered by blockchain are expected to drive the growth of the segment.

The artificial intelligence segment is expected to register the fastest growth during the forecast period. The rising adoption of AI among various companies due to improved decision making, query resolution, less processing time, and better efficiency is driving the segment growth. Moreover, AI drives innovation among companies which is resulting in customized, fast, and safer services with a higher level of customer satisfaction and global reach. Such enhancements being pursued by several companies to gain a competitive advantage and strengthen their market position are expected to drive the growth of the segment.

Application Insights

The compliance and regulatory support segment dominated the market in 2021 and accounted for a share of over 31.9% of the global revenue. Several financial institutions worldwide are rolling out customer support within the app as part of the efforts to streamline their operations and enhance customer experience. Furthermore, rising incidents of fraud and money laundering across the globe are also forcing these companies to offer better customer support. Thereby, driving the segment growth during the forecast period.

The KYC verification segment is anticipated to grow at a promising CAGR of 17.88% during the forecast period. The increasing illegal activities and number of frauds are among the major factors that are expected to drive the growth of the segment. KYC is an important and regulatory aspect that validates the personal information provided by users to verify their credibility. Moreover, KYC also ensures that the business evaluates clients’ financial situations and tracks their accounts for fraudulent transactions.

End-use Insights

The insurance segment dominated the market in 2021 and accounted for a share of 30.1% of the global revenue. The use of fintech-as-a-service platforms helps insurance companies to get accurate risk calculation and claim processing which is expected to drive the growth of the segment. Furthermore, insurers are partnering with fintech enterprises to lower processing costs and time to retain clients. The growing demand for fintech-as-a-service platforms in the insurance industry is anticipated to drive the market during the forecast period.

The financial lending companies are expected to register a CAGR of 17.11% during the forecast period. The rising consumer preference for using financial instruments at convenience from their home is boosting the segment growth. In addition, tech-enabled platforms help financial institutions to offer services such as lending, borrowing, fixed deposits, and others. Moreover, the rising adoption of digital lending platforms bodes well for the growth of the market.

Regional Insights

North America dominated the fintech-as-a-service market in 2021 and accounted for a share of over 34.64% of the global revenue. The growing preference for digital financial services across North America is projected to propel the growth of the regional market. For instance, according to MasterCard Contactless Consumer Polling, 51% of U.S. customers use some type of contactless payment option. The changing consumer preference toward digital payment methods and fintech services is driving the market’s growth.

Asia Pacific is expected to grow at the highest CAGR of 18.03% during the forecast period. The growth of the regional market is attributed to rising awareness about the benefits of FaaS platforms in countries such as China, India, and Japan. Governments and venture capitalists are aggressively funding fintech firms to promote the use of digital services and fintech-as-a-service platforms. For instance, in 2022, funding for fintech companies in the Asia Pacific region raised USD 3.3 billion in the first quarter.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Fintech-as-a-Service Market

5.1. COVID-19 Landscape: Fintech-as-a-Service Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Fintech-as-a-Service Market, By Type

8.1. Fintech-as-a-Service Market, by Type, 2022-2030

8.1.1. Payment

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Fund Transfer

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Loan

8.1.3.1. Market Revenue and Forecast (2017-2030)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Fintech-as-a-Service Market, By Technology

9.1. Fintech-as-a-Service Market, by Technology, 2022-2030

9.1.1. API

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Artificial Intelligence

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. RPA

9.1.3.1. Market Revenue and Forecast (2017-2030)

9.1.4. Blockchain

9.1.4.1. Market Revenue and Forecast (2017-2030)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Fintech-as-a-Service Market, By Application

10.1. Fintech-as-a-Service Market, by Application, 2022-2030

10.1.1. KYC Verification

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Fraud Monitoring

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Compliance & Regulatory Support

10.1.3.1. Market Revenue and Forecast (2017-2030)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Fintech-as-a-Service Market, By End-use

11.1. Fintech-as-a-Service Market, by End-use, 2022-2030

11.1.1. Banks

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Financial Lending Companies

11.1.2.1. Market Revenue and Forecast (2017-2030)

11.1.3. Insurance

11.1.3.1. Market Revenue and Forecast (2017-2030)

11.1.4. Others

11.1.4.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Fintech-as-a-Service Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Type (2017-2030)

12.1.2. Market Revenue and Forecast, by Technology (2017-2030)

12.1.3. Market Revenue and Forecast, by Application (2017-2030)

12.1.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Type (2017-2030)

12.1.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.1.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.1.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Type (2017-2030)

12.1.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.1.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.1.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Type (2017-2030)

12.2.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Type (2017-2030)

12.2.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Type (2017-2030)

12.2.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Type (2017-2030)

12.2.7.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.7.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Type (2017-2030)

12.2.8.2. Market Revenue and Forecast, by Technology (2017-2030)

12.2.8.3. Market Revenue and Forecast, by Application (2017-2030)

12.2.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Type (2017-2030)

12.3.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Type (2017-2030)

12.3.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Type (2017-2030)

12.3.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Type (2017-2030)

12.3.7.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.7.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Type (2017-2030)

12.3.8.2. Market Revenue and Forecast, by Technology (2017-2030)

12.3.8.3. Market Revenue and Forecast, by Application (2017-2030)

12.3.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Type (2017-2030)

12.4.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Type (2017-2030)

12.4.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Type (2017-2030)

12.4.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.6.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Type (2017-2030)

12.4.7.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.7.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.7.4. Market Revenue and Forecast, by End-use (2017-2030)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Type (2017-2030)

12.4.8.2. Market Revenue and Forecast, by Technology (2017-2030)

12.4.8.3. Market Revenue and Forecast, by Application (2017-2030)

12.4.8.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Type (2017-2030)

12.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Type (2017-2030)

12.5.5.2. Market Revenue and Forecast, by Technology (2017-2030)

12.5.5.3. Market Revenue and Forecast, by Application (2017-2030)

12.5.5.4. Market Revenue and Forecast, by End-use (2017-2030)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Type (2017-2030)

12.5.6.2. Market Revenue and Forecast, by Technology (2017-2030)

12.5.6.3. Market Revenue and Forecast, by Application (2017-2030)

12.5.6.4. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 13. Company Profiles

13.1. PayPal Holdings, Inc.

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Block, Inc.

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Mastercard Incorporated

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Envestnet, Inc.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Upstart Holdings, Inc.

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. Rapyd Financial Network Ltd.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Solid Financial Technologies, Inc.

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Railsbank Technology Ltd.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Synctera Inc.

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Braintree

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others