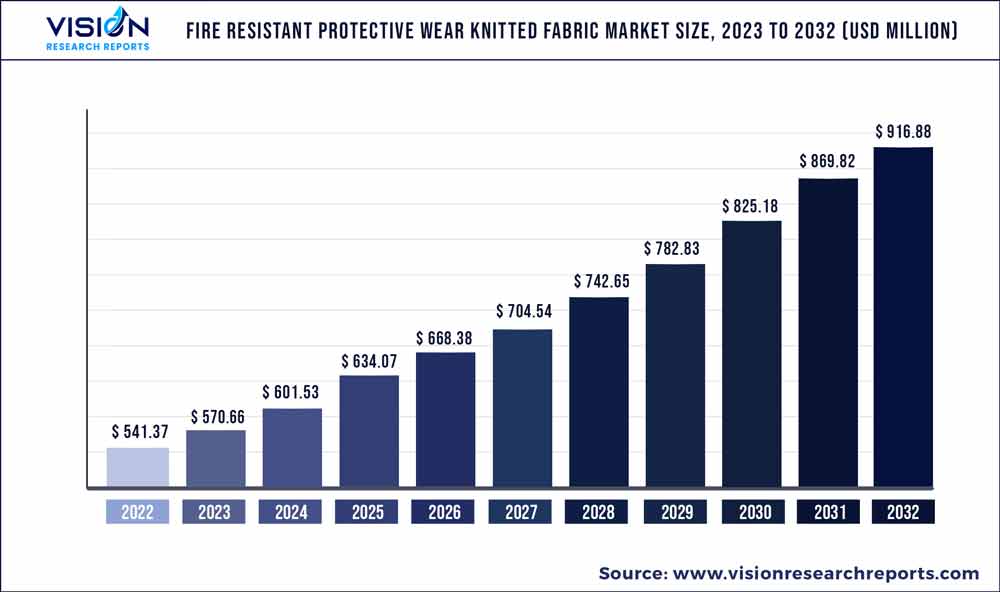

The global fire resistant protective wear knitted fabric market was valued at USD 541.37 million in 2022 and it is predicted to surpass around USD 916.88 million by 2032 with a CAGR of 5.41% from 2023 to 2032.

Key Pointers

Report Scope of the Fire Resistant Protective Wear Knitted Fabric Market

| Report Coverage | Details |

| Market Size in 2022 | USD 541.37 million |

| Revenue Forecast by 2032 | USD 916.88 million |

| Growth rate from 2023 to 2032 | CAGR of 5.41% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | DuPont; Nam Liong Global Corp.; Hai Huei International Corp.; Henan Zhuoer Protective Technology; Shanghai Tanchain New Material; Technology Co., Ltd.; XM Textiles; Baltex; ARGAR Srl;Sintex Inc.; Hornwood Inc.; Refinery Work Wear;Beverly Knits, Inc.; Gehring-Tricot Corp.; 4F France; Toledo Fabrics;Marback Tricot AB; Orneule OY; CP Aluart, SL; Trikaby AB; Sampaio & Filhos Texteis; Sontex DK; Arıteks A.Ş.; Antex Knitting Mills |

The rising product demand is attributed to the growing number blue-collar workers in developing countries along with increasing stringent regulation for worker safety around the globe. The major industry players are focusing on the use of multifunctional fabrics, such as carbon nanofiber, which is antistatic, flame-resistant (FR), and also offers high visibility & protection against oil, water, and soil. A knitted combination of fibers, including both natural and synthetic, as well as different mechanical & chemical processing techniques are used to make these fabrics with enhanced properties & scope of utilization.

In industries, such as metallurgy, chemical, and oil & gas, there is a higher risk of accidents. The demand for multifunctional knitted fabrics is likely to grow with the rising need for safety & protection from more than one type of hazard at workplaces. These factors, coupled with ongoing steps taken by companies to ensure the maximum safety of their workers, are likely to increase the demand for multifunctional FR knitted fabrics over the coming years.There has been a growing product demand from Asia Pacific and the Middle Eastowing to the rising manufacturing activities in these regions. The rapid urbanization in emerging markets, such as Taiwan, India, and Indonesia, is expected to increase spending on infrastructure, manufacturing, power, and transportation, thereby supporting market growth. The Middle East economy is overly dependent on oil & gas and petrochemicals in the manufacturing sector.

In recent years, the Middle Eastern government had diversified and expanded its manufacturing sector to fulfill the growing local and regional demand and position itself on the export platform. The growing domestic consumption of FR protective wear in the Middle East region, on account of the growing oil & gas, industrial, automotive, and energy industries, has forced the regional government to build manufacturing facilities to cater to the rising demand. FR protective wear is essential for workers at the site because the severity of burns to the body can be considerably decreased by wearing protective gear. The incidence of flash fires in the oil & gas industry is very high. Flash fires usually have a short duration but are extremely dangerous and can be possibly fatal if protective wear is not used. This would also escalate the demand for quality FR protective wear knitted fabrics over the forecast period.

Fiber Type Insights

On the basis of fiber type, the aramid blend segment accounted for the largest revenue share of 55.52% in 2022. Aramid fibers are synthetic fibers that exhibit superior strength and heat-resistant properties. Thus, these fabrics neither ignite nor melt in a normal level of oxygen. In addition, the evolution of advanced knitted para-aramid and meta-aramid brands, such as Kevlar, & Nomex, which have strong heat resistance have provided comfortable protective wear for workers in the utility, chemical, and metallurgy sectors. Aramid fiber demand in protective wear knitted fabric is anticipated to witness growth on account of the rising need for security and protective measures in various end-use industries, such as mining, oil & gas, chemicals manufacturing, and military.

Moreover, the growing concerns pertaining to military personnel safety and the rising defense budget are anticipated to augment the demand for aramid fibers in FR protective wear over the forecast period. The cotton FR blend segment accounted for a significant volume share in 2022 and the segment is estimated to grow at the fastest CAGR from 2023 to 2032. Fire-resistant protective wear made up of 100% cotton has a chance of flammability in high temperatures owing to its loose, fluffy pile, or brushed nap. Thus, the cotton FR protective wear is knitted with other synthetic materials like polyester and is chemically treated. The adoption of chemically treated cotton FR protective wear knitted fabric is high in developing countries owing to its affordable price in comparison to other materials.

Application Insights

On the basis of application, the industrial manufacturing segment accounted for the highest revenue share of 47.56% in 2022. The product finds application in the oil & gas, chemical, metallurgy, and utility industries as well. Product adoption is high in these industries as the workers are exposed to extremely high temperatures. Other manufacturing industries like automotive, shipbuilding, etc., also have a high product demand due to stringent regulations by various governments making it mandatory to provide suitable safety equipment at the workplace. The rapid industrialization in developing economies, especially in China and India, due to cheap labor would increase the workforce in the manufacturing sector, which would result in increased demand for protective wear knitted fabric over the coming years.

The firefighting application segment is expected to grow at the highest CAGR from 2023 to 2032. Firefighters are the frontline workers who are directly exposed to fire and smoke in cases of serious hazards; they primarily require protective wear to avoid flame and burn injuries. The majority of the fire departments use chemically-treated cotton FR protective gears, which can easily break down when exposed to certain temperatures. This has generated the need for comfortable and high-quality materials in protective wear, which are more advanced, chemically treated, or inherently possess fire-resistant properties.

Regional Insights

North America dominated the market with the highest revenue share of 40.58% in 2022. The government bodies in North America are focused on the fire safety of workers, and are making it mandatory for industries to follow fire protection guidelines provided by the NFPA and OSHA. Conventional knitted fabrics do not offer adequate safety during fire accidents in household, industrial, or defense settings; these require advanced knitted fabric materials. Due to the rising health hazards in operational settings within various industries, all the countries in North America have started following the National Fire Protection Association (NFPA) standards and have developed fire safety regulations that mandate compliance by FR fabric manufacturers.

In addition, industries are becoming more concerned about the safety of their employees as per the guidelines of the International Labor Organization (ILO), which has congruently augmented the product demand in the industrial segment. In addition, regulatory agencies are promoting the use of necessary safety equipment to avoid any mishaps during industrial operations. The Asia Pacific region is expected to register the fastest CAGR from 2023 to 2032.

This is due to the growth of various manufacturing industries, such as oil & gas, chemical, mining, metallurgy, and construction, especially in countries, such as China, India, and South Korea. The availability of cheap and low production costs is driving multinational companies to set up their production facilities in developing countries, including China and India. However, these economies have experienced a significant increase in injuries and fatalities across industries due to the lack of superior-quality knitted fabric protective wearables. This leads to high compensation costs for employers in the long term, which is anticipated to accelerate the expansion of the market in the region.

Fire Resistant Protective Wear Knitted Fabric Market Segmentations:

By Fiber Type

By Application

By Regional

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others