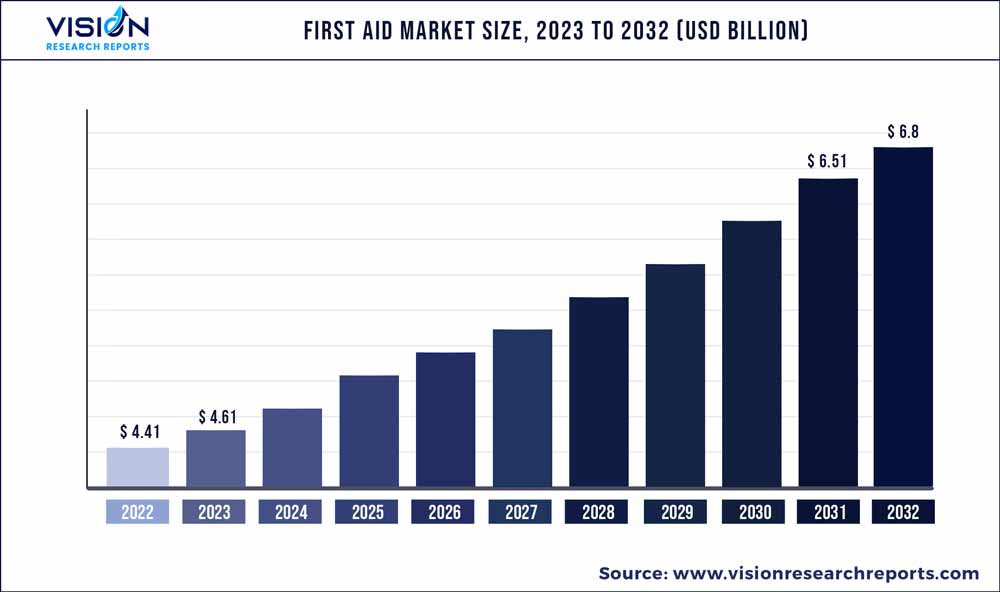

The global first aid market size was estimated at around USD 4.41 billion in 2022 and it is projected to hit around USD 6.8 billion by 2032, growing at a CAGR of 4.43% from 2023 to 2032. The first aid market in the United States was accounted for USD 1.7 billion in 2022.

Key Pointers

Report Scope of the First Aid Market

| Report Coverage | Details |

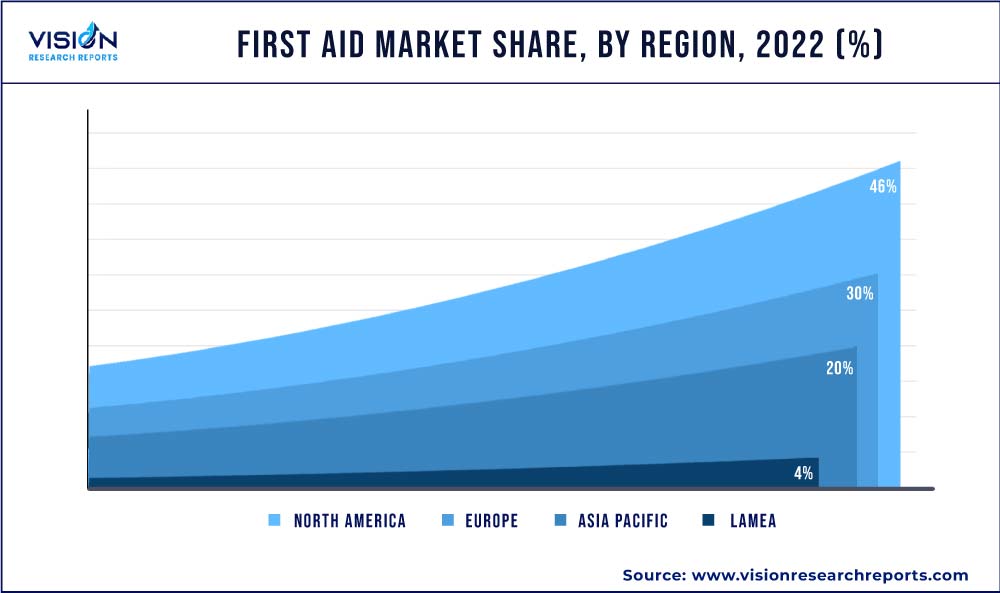

| Revenue Share of North America in 2022 | 46% |

| Revenue Forecast by 2032 | USD 6.8 billion |

| Growth Rate from 2023 to 2032 | CAGR of 4.43% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | 3M; Paul Hartmann AG; Johnson & Johnson Services, Inc.; Coloplast Corp.; Stryker; Smith & Nephew; ConvaTec; Mölnlycke Health Care AB |

Key market drivers include the increasing number of accidents & injuries, growing demand for first aid training & certifications, growing awareness regarding first aid, and advancements in first aid products. The rising number of accidents and injuries is a major factor driving the growth of the market. Accidents and injuries can occur at home, on the road, and at the workplace. Major accident cases are observed on the road. For instance, as per Association for Safe International Road Travel, approximately 1.35 million people die every year in a road crash, whereas on average 3,700 people lose their life every day on the road. The high number of accidents and injuries creates a significant demand for first-aid products and services to help people manage injuries. Furthermore, according to the Royal Society for the Prevention of Accidents, around 14,000 people die in the UK and around 700,000 people are admitted to the hospital with major injuries. The high number of accidents and injuries puts pressure on the market to provide products and services to help people in such emergencies. The demand for first aid training and certification is increasing, as people are recognizing the importance of being prepared to respond to medical emergencies.

Due to the rising awareness about health and safety, people are willing to learn basic first aid skills, which is expected to lead to a surge in the demand for training and certification programs. Due to the pandemic, online training courses for CRP, AED, and first aid are more popular, with people understanding the importance of being ready for emergencies. According to the American Red Cross report, the demand for online training courses has increased after the pandemic and people are striving to be better equipped to respond to medical emergencies. Several new & innovative mobile applications and online resources have been launched in the market, which makes it easier for individuals to access first aid information and training, allowing them to respond more effectively to medical emergencies.

For instance, in September 2022, DrySee created a patented bandage that changes color when it is time to change, improving wound care. The color-changing feature helps users visually identify the moisture and determine when dressings and bandages need replacement. Furthermore, recently, researchers from the University of California, Los Angeles have developed a Smart Bandage that uses electrical stimulation to enhance the wound healing process and decrease the chances of infection. These types of advancements continue to drive growth in the first aid industry and make first aid more accessible and effective for everyone.

Product Insights

On the basis of products, the market is segmented into first aid supplies – workplace, first aid supplies – consumer, first aid room equipment, sports care/braces, medicinal products, topicals, first aid training products, and automated external defibrillators. The first aid supplies – workplace segment dominated the market in 2022 by capturing a share of 28% owing to the growing number of injuries and accidents occurring at the workplace, coupled with the growing awareness about first aid procedures. The sports care/braces segment is expected to grow at the fastest CAGR over the forecast period due to the growing awareness about the benefits of sports & fitness. Metal-detectable and X-ray-detectable products are essential tools for ensuring workplace safety for employees.

These products are specifically designed to detect and help prevent contamination incidents in hospitals and other healthcare settings. Metal-detectable first aid products, such as bandages, gauzes, and dressings, are made with a special type of metal that can be easily detected by metal detectors. This ensures that any metal debris or fragments from the product can be quickly identified and removed. X-ray-detectable products, such as sponges, needles, and instruments, are made with materials that can be easily seen on X-rays, making it easier for medical professionals to locate and remove any foreign objects that may have been left inside the patient’s body during surgery. These products can improve the treatment of workplace injuries.

End-Use Insights

On the basis of end-use, the market is segmented into hospital & clinics, home & office, fire department, military, sports & recreation, warehouse (manufacturing), food preparation, and others. The hospital & clinics segment held the largest revenue share of 25% in 2022. This is attributed to factors, such as the increasing number of people visiting emergency departments. Moreover, hospitals and clinics are increasingly investing in first aid products to enhance their emergency response. However, the sports and recreation segment is expected to exhibit the fastest growth rate of 6.39% during the forecast period.

Injuries and accidents can occur at any time, whether at home or in the workplace. Therefore, having access to basic first aid supplies can make a significant difference in preventing further injury or illness. The demand for first aid in the home and office end-use segment has been on the rise due to the increasing emphasis on workplace safety and outdoor activities. By law, employers are obligated to provide first aid supplies in the workplace and many companies are investing in comprehensive first aid measures to ensure the safety of their employees.

Regional Insights

North America held the dominant revenue share of 46% in 2022 and is expected to continue its dominance over the forecast period. This can be attributed to the presence of a highly developed healthcare infrastructure and major global players along with continuous strategic initiatives undertaken by these players to maintain their market share. North America is also anticipated to register lucrative growth owing to initiatives that promote the deployment of public access Automated External Defibrillators (AEDs) and other development efforts by key market players. For instance, in January 2023, Avive Solutions, Inc. obtained premarket approval from the U.S. FDA for Avive AED, an innovative AED.

The company estimates that over 4 million AEDs have been deployed nationwide, aiming to offer speedy and life-saving support during Out-of-Hospital Cardiac Arrest (OHCA). The regulatory process for product approvals is comparatively less stringent in China than in Western countries, which facilitates easy entry of advanced products into the market. In addition, the availability of resources enables advancements in technology at cheaper costs, which has boosted the number of local manufacturing facilities.

In addition, Order 650 (former Order 276), Regulations for the Supervision and Administration of Medical Devices to restrict foreign investment in the country, significantly protects local medical devices & product manufacturing companies. Hence, the number of local first aid manufacturers is anticipated to increase, driving the market over the forecast period. However, COVID-19 restrictions are projected to continue to strongly influence hospital access and procedural volumes in China.

First Aid Market Segmentations:

By Product

By End-Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on First Aid Market

5.1. COVID-19 Landscape: First Aid Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global First Aid Market, By Product

8.1. First Aid Market, by Product, 2023-2032

8.1.1. First Aid Supplies - Workplace

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. First Aid Supplies - Consumer

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. First Aid Room Equipment

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Sports Care/Braces

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Medicinal Products

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Topicals

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. First Aid Training Products

8.1.7.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global First Aid Market, By End-Use

9.1. First Aid Market, by End-Use, 2023-2032

9.1.1. Hospital & Clinics

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Home & Offices

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Fire Department

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Military

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Sports & Recreation

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Warehouse (Manufacturing)

9.1.6.1. Market Revenue and Forecast (2020-2032)

9.1.7. Food Preparation

9.1.7.1. Market Revenue and Forecast (2020-2032)

9.1.8. Others

9.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global First Aid Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.3.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.4.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.3.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.4.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.5.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.6.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.3.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.4.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.5.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.6.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.3.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.4.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.5.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.6.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.3.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.4.2. Market Revenue and Forecast, by End-Use (2020-2032)

Chapter 11. Company Profiles

11.1. 3M

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Paul Hartmann AG

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Johnson & Johnson Services, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Coloplast Corp.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Stryker

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Smith & Nephew

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. ConvaTec

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Mölnlycke Health Care AB

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others