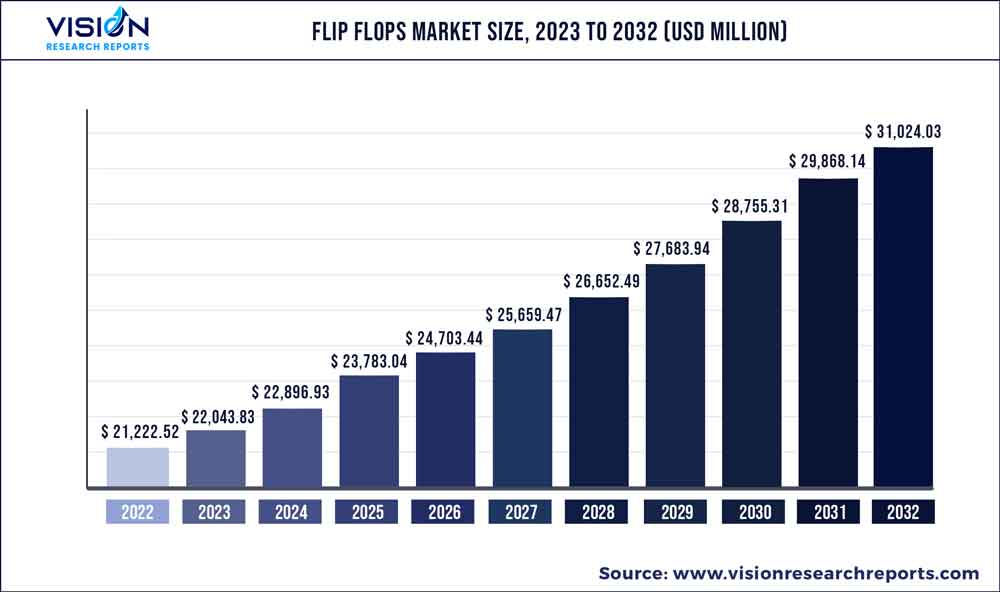

The global flip flops market was valued at USD 21,222.52 million in 2022 and it is predicted to surpass around USD 31,024.03 million by 2032 with a CAGR of 3.87% from 2023 to 2032. The flip flops market in the United States was accounted for USD 4.1 billion in 2022.

Key Pointers

Report Scope of the Flip Flops Market

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2022 | 35.12% |

| CAGR of North America | 4.76% |

| Revenue Forecast by 2032 | USD 31,024.03 million |

| Growth rate from 2023 to 2032 | CAGR of 3.87% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Havaianas; Skechers USA, Inc.; Crocs; Deckers Brands; Fat Face; Adidas AG; C. & J. Clark International Ltd.; Kappa; Nike, Inc.; Tory Burch LLC. |

Flip-flops are becoming more popular owing to the pandemic as a high population is working from home. As a result of this, the flip-flop market is anticipated to witness an increase in the revenue. Increased income levels and high investments in summer footwear and clothing, particularly in developing countries such as China, India, and Brazil, are expected to foster the growth of the flip flops market globally.

The COVID-19 outbreak has hampered export and import activity and restricted the movement of raw materials used in the production of flip flops. However, the market is likely to eventually return to pre-pandemic levels, since sales of clothing and other lifestyle products have seen an uptick in sales and will generate more demand over the forecast period.

Based on end-user, the female segment is estimated to lead the segmental share over the coming years due to millennials shifting buying interests towards theme-styled footwear and apparels. In regions like North America, flip-flops are marketed as the ideal beachwear that can be worn with floral dresses, shorts & tops, swimwear, and bikinis. In essence, flip-flops in North America are principally marketed/sold during summer trips.

Based on distribution channel, offline segment is expected to lead the segmental share in the forecast period as there is a greater expansion of footwear retail outlets in tier I, II, and III cities globally. The expansion of footwear establishments, both local and startup, has contributed to a larger contribution of offline channel sales in the global market.

Based on region, Asia Pacific is expected to foresee robust growth in the upcoming years with the advent of emerging manufacturing and production centers that manufacture footwear and clothing products to suit the increasing interest of the population towards such products. The footwear sector in China has been effective in retaining the country’s status as the world's largest footwear manufacturer and consumer. The flip-flops market in China has experienced an extreme transformation over the years. Owing to rising per-capita income of citizens and changing lifestyles, there has been a shift from traditional flip-flops to trendy ones in the country’s market.

The flip-flop industry is always changing and updating. To stay head-on in the market, players tend to launch new strategies more frequently. Major companies in the market include Havaianas; Skechers USA, Inc.; Crocs; Deckers Brands; Fat Face; Adidas AG, C. & J. Clark International Ltd.; Kappa; Nike, Inc.; and Tory Burch LLC. Companies are investing more in R&D to develop eco-friendly products with advanced features and unique designs and patterns to gain a higher market share.

End-user Insights

The female end-user segment accounts for the largest flip-flops market share of 73.85% in 2022 owing to the growing popularity of yoga among women. As a result flip flop brands globally are increasingly targeting the women’s segment to launch flip-flops for comfort and ease of doing yoga and other physical activities and are emphasizing launching sustainable footwear. For example, Solethreads.com, a casual footwear brand is focused on offering a wide range of grass flip-flops, graphic footwear, and yoga slings in its new product portfolio.

The male is also estimated to witness a CAGR of 3.34% over the forecasted period. The growth is attributed to high product demand in this segment as a result of increased awareness of the latest fashion trends.

Distribution Channel Insights

The offline distribution channel segment accounted for the largest revenue share of 68.04% in 2022. The offline channel is expected to expand further at a steady growth rate in the years to come. The rising number of offline channels, such as hypermarkets and brand stores, in emerging regions, will drive segment growth. Flip-flops are sold through various offline distribution channels globally. including departmental stores, discount shoe stores, small and large specialized retailers, and sporting-goods stores. The easy availability of flip-flops across street shops at low prices will also induce the offline segment's growth.

The online distribution channel is estimated to be the fastest-growing segment with a CAGR of 4.76% over the forecasted period. Internet retailing is expected to be the fastest-growing distribution channel, owing to benefits such as convenience, broad product range, and competitive pricing. Furthermore, the outbreak of COVID-19 is influencing consumers to make purchases through e-commerce retail stores.

Regional Insights

Asia Pacific dominated the flip flops market and accounted for revenue share of 35.12% in 2022. The growth can be attributed to growing consumer awareness about the latest fashion trends and increasing spending on fashionable clothing and footwear.Japan is a major contributor to the growth of the flip flops industry. Moreover, global flip flop brands focus on partnering with fashion labels to attract customers in different countries across Asia Pacific. In June 2020, Brazilian flip-flop brand Havaianas collaborated with Japanese fashion label, ‘mastermind’ to reinvent its original sandal. The unisex sandal, named the Tradi Zori, draws influence from both, The Zori and The Tradicional styles, to create an offering built for the streets.

The North American region is expected to be the fastest-growing region with a 4.76% CAGR from 2023 to 2032. Domestic players continue to benefit from a well-established distribution network spread across the country. Some of the major retailers and distribution partners in the U.S. flip flops market are American Diving, Athletes Foot, Annapolis Performance Sailing, McCully Bicycle, J&J Spearfishing Supplies, Island Paddler, Jim's Pier, Don Quijote, Deep C Outfitters, Daytona Board Store, Corolla Surf Shop, Champion Sporting Goods, Bluewater Cowboy Mercantile, Hale Nalu Beach & Bike, and 707 Street.

Flip Flops Market Segmentations:

By End-user

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Flip Flops Market

5.1. COVID-19 Landscape: Flip Flops Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Flip Flops Market, By End-user

8.1. Flip Flops Market, by End-user, 2023-2032

8.1.1. Female

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Male

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Flip Flops Market, By Distribution Channel

9.1. Flip Flops Market, by Distribution Channel, 2023-2032

9.1.1. Offline

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Online

9.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Flip Flops Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by End-user (2020-2032)

10.1.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by End-user (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by End-user (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by End-user (2020-2032)

10.2.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by End-user (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by End-user (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by End-user (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by End-user (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by End-user (2020-2032)

10.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by End-user (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by End-user (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by End-user (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by End-user (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by End-user (2020-2032)

10.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by End-user (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by End-user (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by End-user (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by End-user (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by End-user (2020-2032)

10.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by End-user (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by End-user (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 11. Company Profiles

11.1. Havaianas

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Skechers USA, Inc.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Crocs

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Deckers Brands

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Fat Face

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Adidas AG

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. C. & J. Clark International Ltd.

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Kappa

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Nike, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Tory Burch LLC.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others