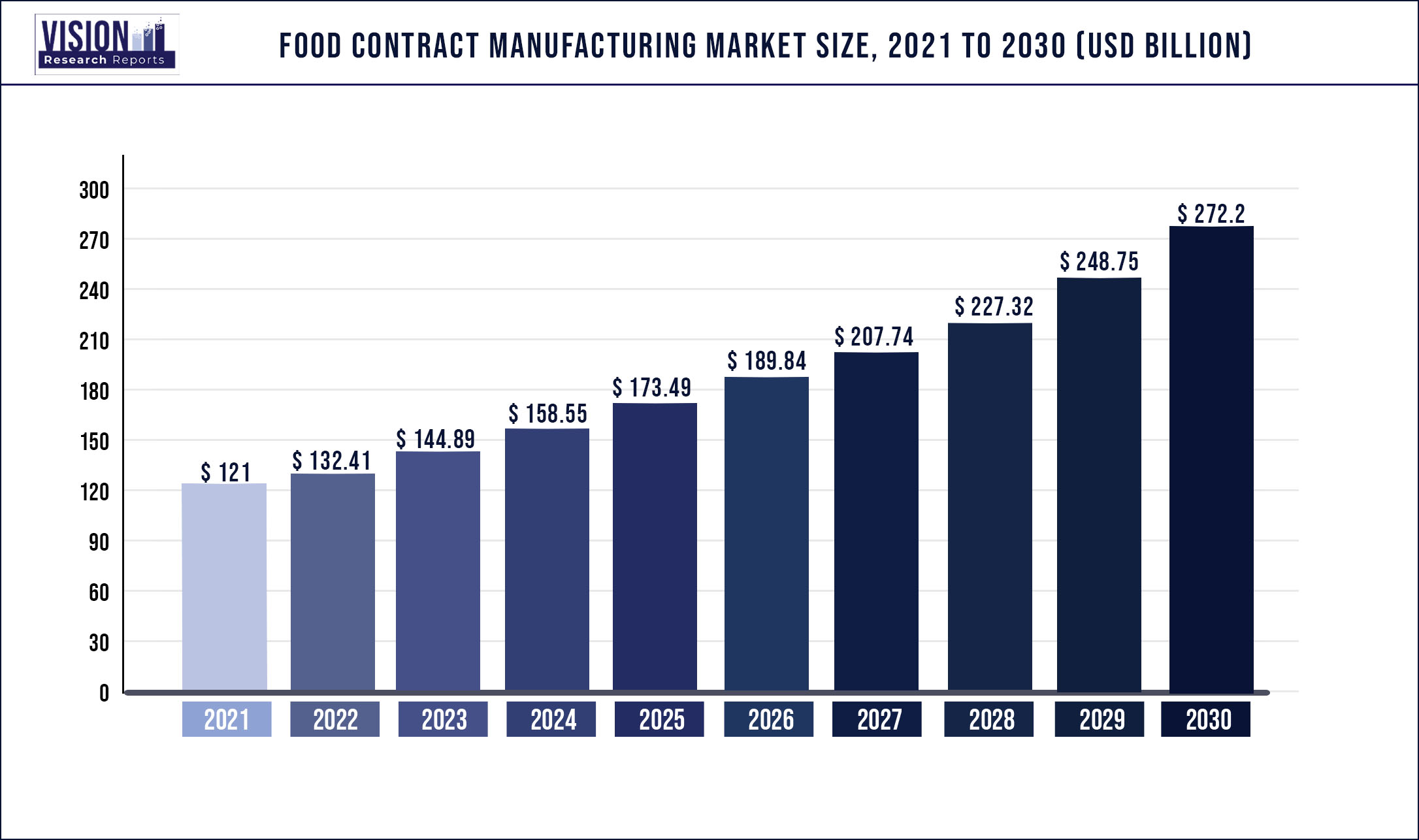

The global food contract manufacturing market was surpassed at USD 121 billion in 2021 and is expected to hit around USD 272.2 billion by 2030, growing at a CAGR of 9.43% from 2022 to 2030.

Rising demand for manufacturing capabilities from OEMs coupled with increasing requirement of convenience foods and dietary supplements are the factors expected to drive the industry growth.

The COVID-19 pandemic has resulted in panic buying of comfort foods and restructuring of supply chains, which has positively impacted the contract manufacturing market. However, contract manufacturers had to deal with additional worker security, wherein more focus was given to current Good Manufacturing Practices, which resulted in hindering the industry growth.

Food businesses were unable to fulfill the increased food demand during the COVID-19 pandemic in 2020, thereby increasing the dependence on contract manufacturing. Companies providing these services are focusing on increasing private equity investments and securing long-term contracts, thereby obtaining a competitive edge in the industry.

Food firms have gotten more adept at leveraging contract manufacturers in order to avoid the extra expenses, associated with the production. It also enables food processing companies to free up cash flows, which were critical during the pandemic, creating a favorable climate for the contract manufacturers to flourish.

Food companies were unable to react to the demand surge when the restrictions were lifted in 2020 caused due to the supply chain failure. The food manufacturing supply chain is expected to be transformed with the help of food contract manufacturing as food companies prefer to manufacture food products locally.

Food contract manufacturers are beginning to take active participation in the custom formulation of the food products. Market players are focusing on healthy and plant-based food alternatives in line with the increasing demand for healthy food. Moreover, the flexibility and the ability to pivot to new projects are expected to augment the industry growth.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 121 billion |

| Revenue Forecast by 2030 | USD 272.2 billion |

| Growth rate from 2022 to 2030 | CAGR of 9.43% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Service, region |

| Companies Covered | Fibro Foods; Hindustan Foods Limited; Hearthside Food Solutions LLC; Nikken Foods; Christy Quality Foods (CQF); De Banketgroep B.V.; HACO AG; SK Food Group; Pacmoore Products Inc.; Cremica; Kilfera Food Manufacturers Ltd; Nutra science Labs, Inc; Thrive Foods LLC.; Orion Food Co., Ltd; Omni blend |

Service Insights

The manufacturing service led the market and accounted for 66.5% of the global revenue share in 2021. Food companies looking to enhance value and efficiency, production constraints, the rise of e-commerce, and private equity investment have been the key factors in augmenting the industry growth.

Food contract manufacturers, through their manufacturing as a core service, offer different processes, which include dry blending, spray drying, and extrusion. Some food companies also offer a specific recipe for food processing, which is expected to boost the industry's growth.

The packaging service for these products majorly involves primary forms of packaging those mainly used to protect the product from contamination. These include stand-up pouches, shrink-wrapping, blister packs, and jars. These manufacturers are also focusing on adding secondary packaging to create a one-stop shop for food manufacturing.

Custom formulation and R&D are estimated to witness growth at a CAGR of 11.2% from 2022 to 2030, in terms of revenue. Small and medium-scale food companies often do not have a dedicated R&D team to formulate new products or the consumer insights needed to further growth. Food contract manufacturers have the personnel, equipment, and expertise to assist them.

Regional Insights

Asia Pacific led the market and accounted for over 52.7% of the global revenue in 2021. Rising population, increase in household income and industrialization has rapidly transformed the food industry. This has created a huge requirement for food manufacturers in the region. China dominates the market share due to the global demand for food products.

North America especially in the U.S. is under a transition phase. Food companies are becoming more reliant on contract manufacturers for product formulation, quality control, and production capabilities. Moreover, this industry consolidation is happening rapidly which is expected to boost industry growth.

Manufacturers are benefiting from the robust food processing equipment industry in Europe. The BREXIT and the pandemic are expected to prompt food companies to restructure their supply chains relying on Asia Pacific countries, which is expected to open up capacity expansions for this industry in Europe.

The demand for convenience foods in the manufacturing service in Australia is estimated to witness growth at a CAGR of 9.1% during the forecast period. Favorable government support, focus on quality and producing clean and natural food products are some of the factors, expected to result in augmenting the industry growth within the country.

Key Players

Market Segmentation

Chapter 1.Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2.Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3.Executive Summary

3.1.Market Snapshot

Chapter 4.Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1.Raw Material Procurement Analysis

4.3.2.Sales and Distribution Channel Analysis

4.3.3.Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Food Contract Manufacturing Market

5.1.COVID-19 Landscape: Food Contract Manufacturing Industry Impact

5.2.COVID 19 - Impact Assessment for the Industry

5.3.COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6.Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1.Market Drivers

6.1.2.Market Restraints

6.1.3.Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1.Bargaining power of suppliers

6.2.2.Bargaining power of buyers

6.2.3.Threat of substitute

6.2.4.Threat of new entrants

6.2.5.Degree of competition

Chapter 7.Competitive Landscape

7.1.1.Company Market Share/Positioning Analysis

7.1.2.Key Strategies Adopted by Players

7.1.3.Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8.Global Food Contract Manufacturing Market, By Service

8.1.Food Contract Manufacturing Market, by Service Type, 2020-2027

8.1.1.Manufacturing

8.1.1.1.Market Revenue and Forecast (2016-2027)

8.1.2.Packaging

8.1.2.1.Market Revenue and Forecast (2016-2027)

8.1.3.Custom formulation and R&D

8.1.3.1.Market Revenue and Forecast (2016-2027)

Chapter 9.Global Food Contract Manufacturing Market, Regional Estimates and Trend Forecast

9.1.North America

9.1.1.Market Revenue and Forecast, by Service (2016-2027)

9.1.2.U.S.

9.1.3.Rest of North America

9.1.3.1.Market Revenue and Forecast, by Service (2016-2027)

9.2.Europe

9.2.1.Market Revenue and Forecast, by Service (2016-2027)

9.2.2.UK

9.2.2.1.Market Revenue and Forecast, by Service (2016-2027)

9.2.3.France

9.2.3.1.Market Revenue and Forecast, by Service (2016-2027)

9.2.4.Rest of Europe

9.2.4.1.Market Revenue and Forecast, by Service (2016-2027)

9.3.APAC

9.3.1.Market Revenue and Forecast, by Service (2016-2027)

9.3.2.India

9.3.2.1.Market Revenue and Forecast, by Service (2016-2027)

9.3.3.China

9.3.3.1.Market Revenue and Forecast, by Service (2016-2027)

9.3.4.Japan

9.3.4.1.Market Revenue and Forecast, by Service (2016-2027)

9.3.5.Rest of APAC

9.3.5.1.Market Revenue and Forecast, by Service (2016-2027)

9.4.MEA

9.4.1.Market Revenue and Forecast, by Service (2016-2027)

9.4.2.GCC

9.4.2.1.Market Revenue and Forecast, by Service (2016-2027)

9.4.3.North Africa

9.4.3.1.Market Revenue and Forecast, by Service (2016-2027)

9.4.4.South Africa

9.4.4.1.Market Revenue and Forecast, by Service (2016-2027)

9.4.5.Rest of MEA

9.4.5.1.Market Revenue and Forecast, by Service (2016-2027)

9.5.Latin America

9.5.1.Market Revenue and Forecast, by Service (2016-2027)

9.5.2.Brazil

9.5.2.1.Market Revenue and Forecast, by Service (2016-2027)

9.5.3.Rest of LATAM

9.5.3.1.Market Revenue and Forecast, by Service (2016-2027)

Chapter 10.Company Profiles

10.1.Fibro Foods

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2.Hindustan Foods Limited

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3.Hearthside Food Solutions LLC

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4.Nikken Foods

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5.Christy Quality Foods (CQF)

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6.De Banketgroep B.V.

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7.HACO AG

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8.SK Food Group

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9.Pacmoore Products Inc.

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10.Cremica

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1.About Us

12.2.Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others