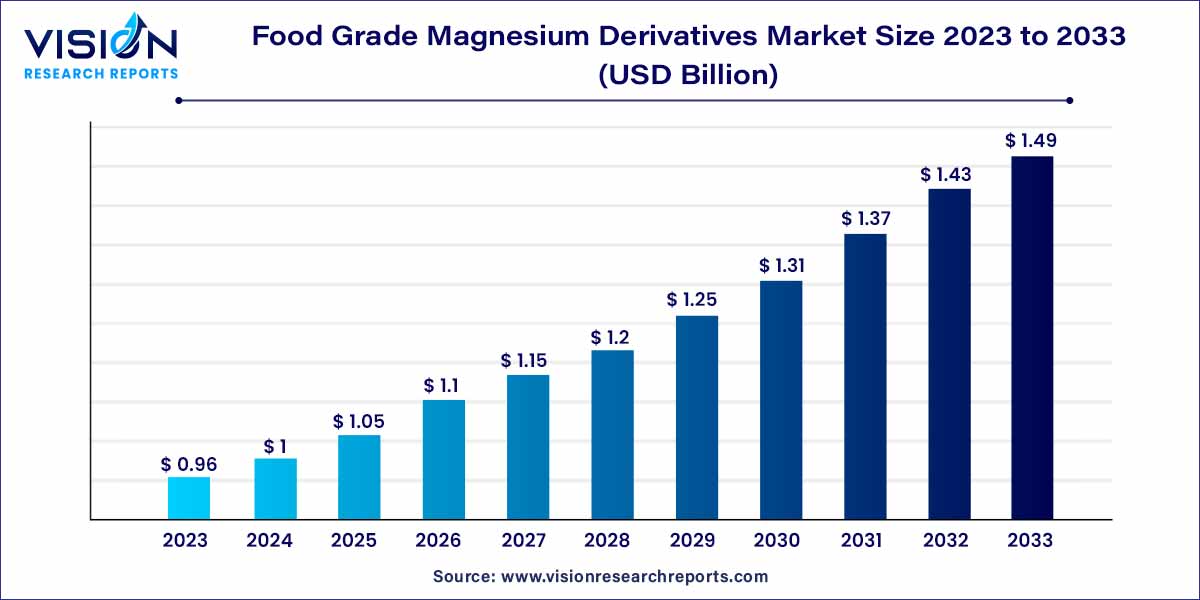

The global food grade magnesium derivatives market size was estimated at USD 0.96 billion in 2023 and it is expected to surpass around USD 1.49 billion by 2033, poised to grow at a CAGR of 4.52% from 2024 to 2033. The food grade magnesium derivatives market has experienced significant growth in recent years, driven by the increasing demand for high-quality, nutritionally enhanced food products.

Magnesium, an essential mineral, plays a pivotal role in various bodily functions, making it a valuable ingredient in the food industry. This overview provides insight into the key aspects shaping the food grade magnesium derivatives market.

The growth of the food grade magnesium derivatives market can be attributed to several key factors. Firstly, the increasing awareness among consumers about the importance of magnesium in maintaining good health has led to a growing demand for magnesium-fortified food products. Additionally, the rising trend of clean label and natural ingredients in food products has driven manufacturers to incorporate food grade magnesium derivatives, further fueling market growth. Moreover, the expanding application of these derivatives in various food categories such as bakery, dairy, and beverages has significantly contributed to the market's expansion. Stringent regulations and standards imposed by regulatory authorities to ensure the quality and safety of these derivatives have also bolstered market growth, instilling consumer confidence. Furthermore, the ongoing innovations in food processing technologies have enabled the development of new and diverse products, providing consumers with a wide range of options. These factors combined have created a conducive environment for the growth of the food grade magnesium derivatives market, offering both health-conscious consumers and manufacturers a mutually beneficial solution.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 4.52% |

| Market Revenue by 2033 | USD 1.49 billion |

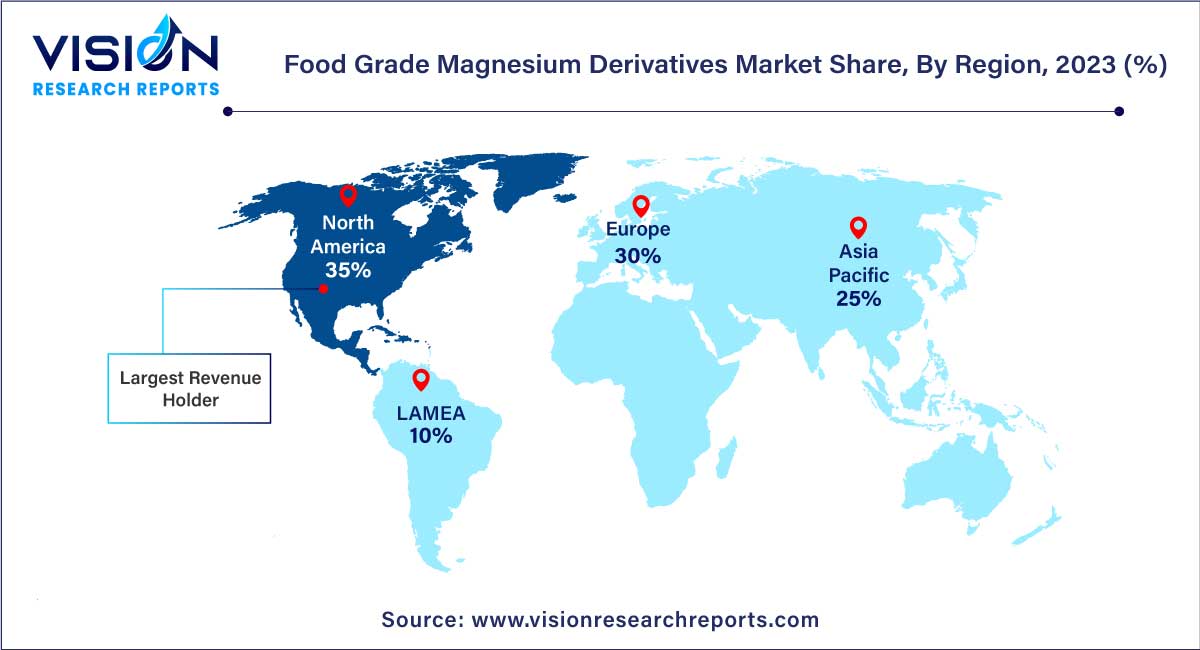

| Revenue Share of North America in 2023 | 35% |

| CAGR of Asia Pacific from 2024 to 2033 | 4.06% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The inorganic segment accounted for the highest revenue share of 57% in 2023. Inorganic magnesium derivatives, such as magnesium carbonate and magnesium hydroxide, are widely utilized for their neutralizing and buffering properties. They play a crucial role in regulating the pH levels in various food products, including bakery items, dairy products, and beverages. Additionally, inorganic magnesium derivatives are known for their anti-caking and anti-moisture properties, enhancing the texture and shelf life of processed foods.

The organic segment is expected to grow at a CAGR of 4.35% during the forecast period. Organic magnesium derivatives, including magnesium citrate and magnesium aspartate, are valued for their bioavailability and assimilation by the human body. These derivatives are commonly used in dietary supplements and nutraceuticals, providing a readily absorbable form of magnesium. Organic magnesium compounds are preferred in the formulation of health supplements due to their ease of digestion and minimal gastrointestinal irritation. Moreover, organic magnesium derivatives are often incorporated into functional foods, addressing magnesium deficiency in individuals following specific dietary patterns or restrictions.

The food segment held the largest revenue share of 67% in 2023. In the food sector, magnesium derivatives are widely employed as additives in bakery products. They act as stabilizers, aiding in maintaining the freshness and texture of baked goods. Additionally, magnesium derivatives serve as anti-caking agents, ensuring the proper flow and consistency of powdered products such as spices, seasoning blends, and baking mixes. In processed foods, these derivatives contribute to improving shelf life, preventing moisture absorption, and preserving the food's quality during storage and transportation.

In the beverage industry, food grade magnesium derivatives find extensive use in both non-alcoholic and alcoholic beverages. Magnesium compounds are incorporated into sports and energy drinks to replenish electrolytes lost during physical activities. These derivatives also act as pH regulators in various beverages, ensuring the right balance of acidity and enhancing the overall taste profile. Moreover, magnesium-fortified water and juices cater to health-conscious consumers seeking functional beverages with added nutritional benefits. The neutral taste of magnesium derivatives allows for their seamless integration into a wide range of beverages without compromising the original flavor.

North America dominated the global market with the largest market share of 35% in 2023. In North America, the market is driven primarily by the increasing demand for health-conscious food products. With consumers in this region becoming increasingly aware of the importance of a balanced diet, the incorporation of magnesium derivatives in various foods and beverages has gained traction. Furthermore, stringent regulatory frameworks and a robust food processing industry have contributed to the steady growth of the market in North America.

Europe is predicted to grow at a CAGR of 4.06% during the forecast period. Europe, with its emphasis on clean label and organic products, has witnessed a surge in the demand for food grade magnesium derivatives. The region's food manufacturers are focusing on natural ingredients, driving the use of organic magnesium derivatives in their products. Additionally, the European market benefits from extensive research and development activities, leading to innovations in magnesium-fortified foods and beverages. The presence of a health-conscious consumer base and a well-established food industry further propels market growth in Europe.

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Food Grade Magnesium Derivatives Market

5.1. COVID-19 Landscape: Food Grade Magnesium Derivatives Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Food Grade Magnesium Derivatives Market, By Product

8.1. Food Grade Magnesium Derivatives Market, by Product, 2024-2033

8.1.1. Inorganic

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Organic

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Magnesium Chelates

8.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Food Grade Magnesium Derivatives Market, By Application

9.1. Food Grade Magnesium Derivatives Market, by Application, 2024-2033

9.1.1. Food

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Beverages

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Food Grade Magnesium Derivatives Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Grecian Magnesite

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Sinwon Beverages Co., Ltd.

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Compass Minerals

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. OLE Chemical Co., Ltd.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Martin Marietta Magnesia Specialties

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Ibar Northeast

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. NikoMag

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. K + S Aktiengesellschaft

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Oksihim, Ltd.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Hawkins

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others