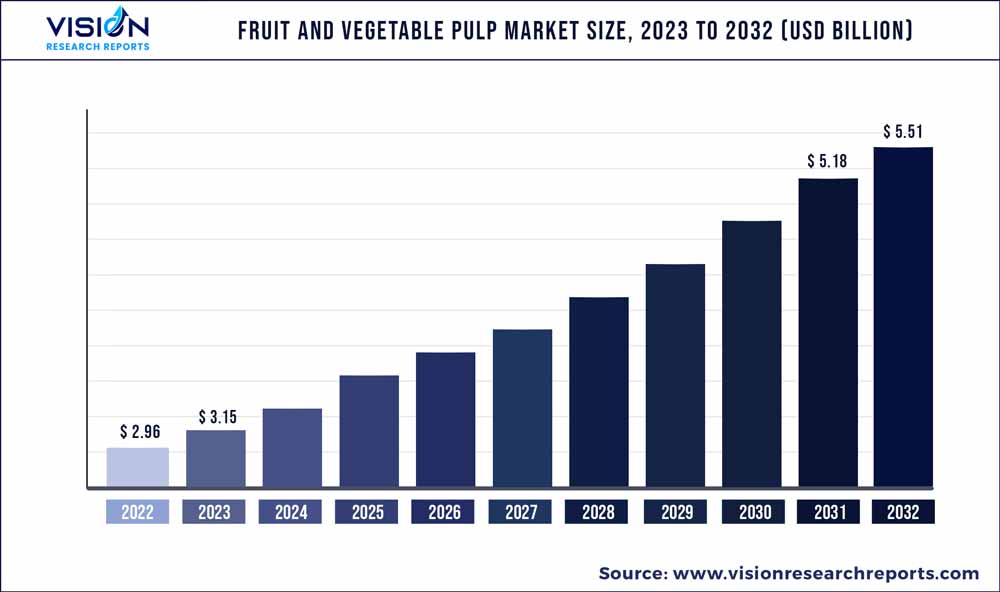

The global fruit and vegetable pulp market was estimated at USD 2.96 billion in 2022 and it is expected to surpass around USD 5.51 billion by 2032, poised to grow at a CAGR of 6.42% from 2023 to 2032. The fruit and vegetable pulp market in the United States accounted for USD 2.9 billion in 2022.

Key Pointers

Report Scope of the Fruit And Vegetable Pulp Market

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2022 | 48% |

| CAGR of North America from 2023 to 2032 | 6.62% |

| Revenue Forecast by 2032 | USD 5.51 billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.42% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Keventer Group; Conagra Brands Inc.; Pepsico; ABC Fruits; Dohler GmBH; Agrana Group; Pursuit; Iprona AG; Kiril Mischeff Limited; Ingredion; Sunimpex |

The growth of the market is attributed to a shift in consumer preference toward natural drinks and juices made from fruit and vegetable pulp. Additionally, fruit and vegetable pulps are derived solely from plant sources, making them suitable for these dietary preferences and expanding their applications in plant-based food and beverage products. The demand for organic and sustainably sourced food products is also propelling the demand for the fruit and vegetable pulp industry. The growing trend toward clean-label products is gaining momentum among consumers. Several consumers are increasingly preferring food and beverages that are minimally processed and free of natural additives.

Fruit and vegetables are ideal ingredients that require less processing and chemical alterations thereby creating opportunities for manufacturers to produce clean-label products. Growing consumer interest in low-sugar and sugar-free products is acting as an opportunity for manufacturers to utilize naturally sourced fruits and vegetables to explore alternative sweeteners derived from fruits. As a result, several manufacturers have started utilizing fruit pulps as a healthier substitute for snacks and confectionery products. Also, the rising demand for naturally derived food sources has prompted manufacturers to utilize fruits and vegetables for natural flavor and color applications. Furthermore, the rise in the pool of health-conscious consumers is propelling the demand for the overall market. The U.S. Department of Agriculture highlights the importance of including vegetables and fruits in a healthy diet as they help prevent diseases such as cancer, diabetes, and obesity.

Furthermore, the production of fruit & vegetable offers several benefits such as preservation of flavor for longer periods, and act as ideal ingredients for ice cream, jellies, smoothies, cakes, and candies. To address the demand for naturally sourced ingredients, several companies are utilizing by products of the production process for newer products. For instance, Nestle SA is utilizing the use of cocoa pulp, coffee fruit, and other by products.

Source Insights

In terms of source, the market is segmented into fruit and vegetable pulp. The fruit pulp segment is likely to register the fastest CAGR of 6.91% during the forecast period. The rise in the number of consumers experimenting with new flavors of smoothies has also boosted the demand for the fruit pulp segment. The utilization of fruit pulp in smoothies offers consumers a convenient and time-saving solution. For instance, a Canada-based provider of fruit bars, ‘Outshine’ has launched smoothie cubes in three flavors - gut supporter, glow to, and go-getter smoothie cubes. The cubes contain a blend of different fruit purees and chia seeds.

The vegetable pulp segment is expected to register a significant CAGR of 5.72% during the forecast period. Changing consumer preference towards nutritious foods coupled with the adoption of healthier lifestyles by the younger populace are the major factors driving the demand for the segment. In addition, advances in the packaging of food products have further boosted the demand for vegetable pulp. Several companies are utilizing the pulp of different vegetables and fruits to create healthier juice options for consumers. For example, in April 2021, Dabur announced the launch of Real Activ vegetable juice in carton packaging. The juices are available in Beetroot and carrots, spinach and cucumber, and orange and carrot flavors.

Application Insights

The food segment is anticipated to hold the largest share of 49% in 2022. The growing trend of using natural fruit and vegetable pulp in food applications such as baking, beverages, jams, and fillings is anticipated to drive the demand for the segment. Manufacturers engaged in the production of vegetable and fruit pulp are constantly enhancing product properties to cater to the changing consumer demand. In November 2020, Netherlands-based Sun Impex announced the launch of fruit drinks in flavors such as guava, litchi, mango, mixed fruit, pineapple, and others. The drinks have low calories and sugar.

The health & wellness segment is expected to showcase the fastest CAGR of 7.43% during the forecast period. The growing usage of vegetable and fruit pulp in the production of nutritional supplements, functional food & beverages, and detox juices is significantly driving the demand for the segment.Fruit and vegetable pulps are added to functional beverages such as smoothies, detox drinks, and probiotic drinks. These beverages offer a combination of nutrients, and antioxidants, providing a convenient way to support overall well-being. For instance, in February 2021, PepsiCo announced the launch of bottled fruit juice targeted at teens. Its range includes strawberry kiwi, apple grape, and fruit punch flavors. Through the launch of the product, the company aims to cater to the demand for nutritious and healthy drinks for teens.

Distribution Channel Insights

The distribution channel segment is bifurcated into B2B and B2C segment. The B2B segment holds the largest share of 62% in 2022. The growing consumer awareness and emphasis on health and nutrition have significantly impacted the demand for fruit and vegetable pulp in the B2B segment. Businesses across various industries, including food and beverage, are increasingly prioritizing the incorporation of natural and nutritious ingredients into their products.

The B2C segment is anticipated to grow at a CAGR of 6.22% during the forecast period. The B2C segment includes online channels, supermarkets, hypermarkets, specialty stores, and other convenience stores. The proliferation of hypermarkets, supermarkets, and other convenience stores is benefiting the sales of vegetable and fruit pulp products through these channels.

The availability of a diverse variety of fruit and vegetable pulp in baby foods, juices, and other condiments is benefiting the segment. In March 2021, Nestle SA announced the launch of the Incoa bar made from cocoa pulp. The company aims to launch the cocoa bar in Europe through supermarkets in Netherlands and France.

Regional Insights

The Asia Pacific market held a dominant revenue share of 48% in 2022 owing to the region’s large production capacity of grains coupled with favorable farming conditions for diverse varieties of fruits and vegetables. The growing preference among consumers in the region towards organic food products such as juices and foods coupled with the heightened awareness among consumers of synthetic ingredients in packaged juices has propelled the demand for sustainably sourced organic products.

Furthermore, India’s fruit & vegetable pulp market showcased the fastest CAGR of 8.71% over the forecast period. Favorable initiatives by the government coupled with rising consumer demand for healthier products is promoting the demand for fruit & vegetable pulp in the country. Moreover, the shifting consumer demand for low-sugar products is accelerating the demand for low-calorie and low-sugar-based fruit juices and beverages. For instance, in November 2021, India-based Dole Sunshine announced the launch of natural pineapple juice with no preservatives and no added sugar.

The North America fruit & vegetable pulp market is expected to grow at a CAGR of 6.62% from 2023 to 2032. The adoption of vegan and plant-based diets has witnessed a notable surge in North America, with an increasing number of individuals choosing to exclude animal products from their food choices. This trend has accelerated the demand for organic products sourced from fruits and vegetables.

Europe is expected to witness a steady growth rate of 8.22% owing to the increasing consumer awareness and demand for naturally sourced food products. The demand for fruit & vegetable Pulp in the region is primarily driven by two factors the increasing consumption of exotic fruit pulps and the growing awareness of sustainably sourced ingredients.

Fruit And Vegetable Pulp Market Segmentations:

By Source

By Application

By Distribution

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Source Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Fruit And Vegetable Pulp Market

5.1. COVID-19 Landscape: Fruit And Vegetable Pulp Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Fruit And Vegetable Pulp Market, By Source

8.1. Fruit And Vegetable Pulp Market, by Source, 2023-2032

8.1.1 Fruit Pulp

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Vegetable Pulp

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Fruit And Vegetable Pulp Market, By Application

9.1. Fruit And Vegetable Pulp Market, by Application, 2023-2032

9.1.1. Food

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Animal Feed

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Health & Wellness

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Fruit And Vegetable Pulp Market, By Distribution

10.1. Fruit And Vegetable Pulp Market, by Distribution, 2023-2032

10.1.1. B2B

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. B2C

10.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Fruit And Vegetable Pulp Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Source (2020-2032)

11.1.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Source (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.4.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Source (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.1.5.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Source (2020-2032)

11.2.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Source (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.4.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Source (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.5.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Source (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.6.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Source (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.2.7.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Source (2020-2032)

11.3.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Source (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.4.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Source (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.5.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Source (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.6.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Source (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.3.7.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Source (2020-2032)

11.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Source (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.4.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Source (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.5.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Source (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.6.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Source (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Application (2020-2032)

11.4.7.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Source (2020-2032)

11.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Source (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.4.3. Market Revenue and Forecast, by Distribution (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Source (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Application (2020-2032)

11.5.5.3. Market Revenue and Forecast, by Distribution (2020-2032)

Chapter 12. Company Profiles

12.1. Keventer Group

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Conagra Brands Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Pepsico

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. ABC Fruits

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Dohler GmBH

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Agrana Group

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Pursuit

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Iprona AG

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Kiril Mischeff Limited

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. LatitudePay

12.10.1. Ingredion

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others