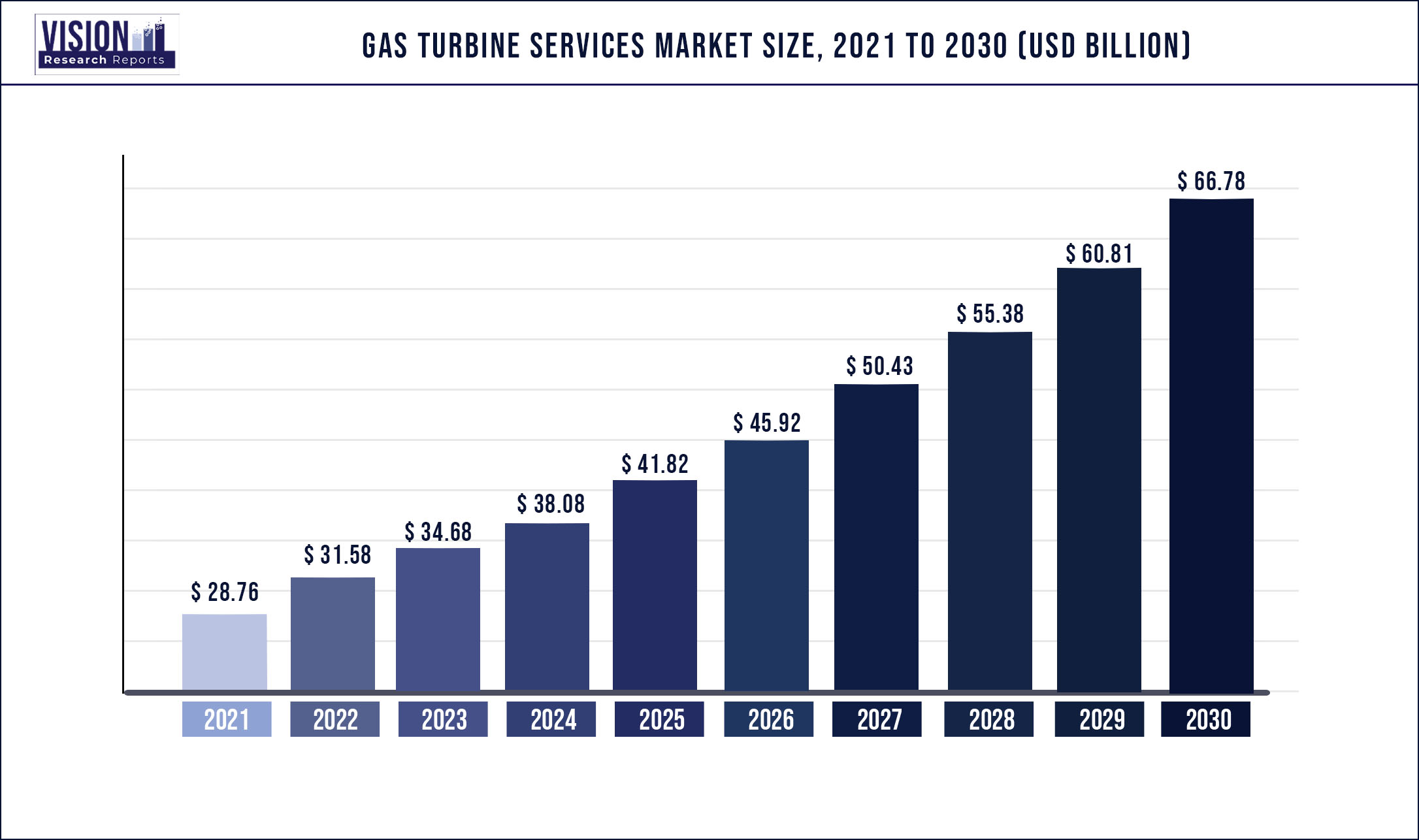

The global gas turbine services market was valued at USD 28.76 billion in 2021 and it is predicted to surpass around USD 66.78 billion by 2030 with a CAGR of 9.81% from 2022 to 2030.

Report Highlights

The increasing adoption of gas turbines on account of their ability to produce low exhaust gas pollution is expected to drive market growth. These systems are increasingly being used owing to their tremendous energy-producing capacity and multiple fuel capability. They also have the capacity to operate continuously at baseload for numerous hours. Furthermore, low operational cost and high efficiency and durability offered by these systems is expected to drive gas turbine service market growth.

Rapid industrialization and population growth have resulted in high demand for power globally. The energy sector is shifting from conventional systems toward clean power sources resulting in an increase in gas turbines installations. Furthermore, key countries plan to enhance the deployment of gas-based power plants in the future. Major equipment manufacturers are also signing multiyear contracts during the installation of these plants.

The heavy-duty segment dominated the global market in 2021 as these equipment offer cost-effective conversion of fuel to electricity and advanced systems provide improvement in terms of output and efficiency. The rise in new gas-based power plants for power generation has resulted in an increase in the deployment of heavy-duty systems which are preferred due to their higher power generating capacity as compared to its counterparts. These systems also find applications in chemical plants, refineries, and power utilities.

Maintenance and repair is projected to be the fastest-growing segment over the forecast period. Major vendors in the market are providing long-term service contracts to power plant owners which cover periodic and preventive maintenance under its scope. Long-term contracts are also considered as a more economical solution in the long term. Repairs solutions help eliminate steps and cost and increases the overall performance, thereby increasing the life-cycle of these systems. This is projected to drive the maintenance and repair segment in the coming years.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 28.76 billion |

| Revenue Forecast by 2030 | USD 66.78 billion |

| Growth rate from 2022 to 2030 | CAGR of 9.81% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Service, end user, region |

| Companies Covered |

General Electric, Siemens AG, Mitsubishi Hitachi Power Systems, Ltd. (MHPS), MAN Energy Solutions, Kawasaki Heavy Industries, Ltd., and Ansaldo Energia S.p.A |

Turbine Type Insights

Heavy duty turbines emerged as the largest segment, which accounted for a share of over 55.07% in the global market. It is also projected to witness the fastest growth rate over the forecast period. The growth of the segment is mainly attributed to the wide application scope of these turbines in chemical plants, refineries, and power utilities. Furthermore, heavy-duty turbines provide improved thermodynamic cycles and an optimized production process. Advancements in technology have also enhanced the power output, efficiency, and environmental compatibility of these turbines. These factors are projected to drive the demand for heavy-duty turbine services over the forecast period.

Industrial turbines accounted for a share of more than 39.44% in 2021 and are projected to register the second-highest CAGR over the forecast period. The segment is expected to witness growth owing to the ongoing development in industrial activities across the globe. Positive trends regarding the development of key manufacturing sectors across the globe are supporting the growth potential for industrial gas turbine services. This is due to the development of both heavy and light industries, which is projected to increase the need for services for gas turbines. Moreover, the growing population and rapid urbanization are creating an increased demand for electricity, which in turn drives the demand for industrial gas turbines and the subsequent need for services for these systems.

Turbine Capacity Insights

The >200 MW segment emerged as the largest segment with a share of over 41.03% in 2021. The development of the power generation sector along with an increased focus on generating electricity through sustainable energy resources is the major growth driver for this segment. Growing urbanization has a significant impact on the development of the building and cement industries. The projected growth of these end-use industries is estimated to drive the demand for large and heavy-duty turbines. Moreover, key OEMs such as General Electric and Siemens AG are expanding their operations, distribution, and aftersales facilities globally. They also offer multiyear maintenance contracts during the installation of new gas-based power plants.

The 100 to 200 MW segment accounted for the second-largest share in 2021. This is primarily attributed to the growth of end-use industries such as sugar mills, pharmaceuticals, oil and gas, plastic and resin manufacturing, glass manufacturing, and intermediate chemicals. On the other hand, the growth of the <100 MW segment is primarily driven by the rise in aerospace activities and the increasing application scope of turbines in the oil and gas sector. The smaller size of <100 MW turbines makes them an ideal product for offshore locations where the power-to-weight ratio is an important parameter while determining which turbine unit would be the most suitable option. The oil and gas industry is projected to regain its momentum shortly and would act as a major demand driver for <100 MW capacity turbines.

Service Type Insights

Spare parts supply emerged as the largest service type segment, which accounted for a share of more than 67.11% of the global gas turbine services market in 2021. This trend is projected to continue throughout the forecast period. The components of the gas turbine have a specific lifespan after which they require periodic replacement, thereby driving the growth of the segment.

Maintenance and repair emerged as the second-largest segment based on service type. Maintenance and repair activities are performed regularly in developed regions such as Europe and North America. The rise in awareness regarding the benefits of periodic maintenance and development in data collection technologies are expected to drive the growth of this segment over the forecast period.

An overhaul is projected to be the second-fastest-growing segment in the global market from 2020 to 2030. Overhaul comprises the inspection, repair, replacement, and disassembly of subcomponents. A gas turbine operates under harsh operating conditions which include corrosion, temperature, and stress. The power turbine and generator of the unit are exposed to high-temperature gases, along with vibration and thermal cycling which produce mechanical and thermal stress in turbine components. Exposure to combustion gases results in the corrosion of the power turbine and gas generator units and therefore requires replacing after a certain interval. These factors are expected to drive the need for overhaul services over the forecast period.

Service Provider Insights

OEM dominated the service provider segment of the market in 2021. This dominance is mainly attributed to factors such as technological capability, wide geographical presence, skilled workforce, and brand value of original equipment manufacturers (OEMs). In addition, OEMs have well-established R&D infrastructure as well as data management centers that enable them to observe the unit from remote locations to determine the accurate real-time health of the unit. OEMs also offer multiyear service agreements to buyers which cover a range of services. Also, OEMs generally offer multiyear agreements to buyers during new gas turbine installations. Most buyers prefer OEMs owing to their technological and service capabilities and opt for multiyear agreements, further enabling OEMs to consolidate their market position.

Furthermore, OEMs are aggressively expanding their presence by acquiring small-scale companies. For instance, GE Power acquired Alstom’s power and grid business, further enabling GE Power’s transformation into a digital industrial company. Similarly, Siemens AG acquired the aero-derivative gas turbine business of Rolls-Royce. Owing to these factors, OEMs will continue to maintain its dominant position in the market.

Non-OEMs service providers accounted for a market share of about 42.02% in 2021. They have a presence in price-sensitive markets such as India, China, and Thailand as consumers in emerging countries are shifting from OEMs to independent service providers to cut operational costs. This factor would support the growth of non-OEMs in price-sensitive areas in the future.

End-use Insights

Power generation emerged as the largest end-use segment in the global market with a share of over 64.1% in 2021. The increasing need for electricity drives the demand for gas turbines in the power generation sector. This segment is projected to register a CAGR of 9.1% over the forecast period. However, key competitors are still skeptical regarding the demand for gas turbines in the power generation segment. Volatility in the prices of natural gas acts as a restraint for the growth of the market in this segment.

Factors such as growing population, rise in industrial activities, and increasing vehicle ownership ratio are leading to high demand for oil production. This is projected to increase the application of gas turbines in the oil and gas industry, which faced a major challenge in the past owing to the drop in oil prices. In 2014 for instance, a barrel of oil cost over USD 100.0. The price, however, became less than USD 40.0 at the beginning of 2019. In contrast, oil prices started to recover after 2019 and started to increase at a slight rate as of 2021. These developments indicate a recovery in the oil and gas sector, thereby driving the growth of the segment.

Regional Insights

The Asia Pacific emerged as the largest market for gas turbine services in 2021. The regional market is driven by the demand for these services in China, Japan, Indonesia, and India owing to rapid urbanization and the increasing middle-class population. Furthermore, the rising demand for clean energy sources for power generation in these countries is expected to drive the regional market growth.

China has been heavily dependent on coal. However, coal consumption in this region witnessed a declining trend from 2016 to 2019 as the Chinese government initiated a national action plan for halting the growth of coal consumption and limiting emissions overall. This contributed to the progressive rise in gas turbine installations, primarily in medium- and large-scale industries in China.

North America, led by the U.S., Mexico, and Canada, accounted for a share of more than 20.0% of the global market in 2021. The market is primarily driven by shale gas reserves and technological advancements in extraction and mining technology, which consistently help lower the operational cost of extraction. Mexico is expected to witness a significant growth rate over the forecast period owing to the launch of the Development Program of the National Electric System for 2021-2032. Under this program, the government plans to add about 66.9 GW of additional power capacity across the country to meet the expected power demand until 2032. Under the newly installed capacity, combined cycle power plants will account for a share of around 42.0%. Moreover, 48 combined cycle power projects would be deployed until 2032, which would boost the demand for gas turbine services in the country.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Gas Turbine Services Market

5.1. COVID-19 Landscape: Gas Turbine Services Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Gas Turbine Services Market, By Turbine Type

8.1. Gas Turbine Services Market, by Turbine Type, 2022-2030

8.1.1. Heavy Duty

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Industrial

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Aeroderivative

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Gas Turbine Services Market, By Turbine Capacity

9.1. Gas Turbine Services Market, by Turbine Capacity, 2022-2030

9.1.1. <100 MW

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. 100 to 200 MW

9.1.2.1. Market Revenue and Forecast (2017-2030)

9.1.3. >200 MW

9.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Gas Turbine Services Market, By Service Type

10.1. Gas Turbine Services Market, by Service Type, 2022-2030

10.1.1. Maintenance & Repair

10.1.1.1. Market Revenue and Forecast (2017-2030)

10.1.2. Overhaul

10.1.2.1. Market Revenue and Forecast (2017-2030)

10.1.3. Spare parts supply

10.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 11. Global Gas Turbine Services Market, By Service Provider

11.1. Gas Turbine Services Market, by Service Provider, 2022-2030

11.1.1. OEM

11.1.1.1. Market Revenue and Forecast (2017-2030)

11.1.2. Non-OEM

11.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 12. Global Gas Turbine Services Market, By End-use

12.1. Gas Turbine Services Market, by End-use, 2022-2030

12.1.1. Power Generation

12.1.1.1. Market Revenue and Forecast (2017-2030)

12.1.2. Oil & Gas

12.1.2.1. Market Revenue and Forecast (2017-2030)

12.1.3. Other Industrial

12.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 13. Global Gas Turbine Services Market, Regional Estimates and Trend Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.1.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.1.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.1.4. Market Revenue and Forecast, by Service Provider (2017-2030)

13.1.5. Market Revenue and Forecast, by End-use (2017-2030)

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.1.6.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.1.6.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.1.6.4. Market Revenue and Forecast, by Service Provider (2017-2030)

13.1.7. Market Revenue and Forecast, by End-use (2017-2030)

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.1.8.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.1.8.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.1.8.4. Market Revenue and Forecast, by Service Provider (2017-2030)

13.1.8.5. Market Revenue and Forecast, by End-use (2017-2030)

13.2. Europe

13.2.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.2.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.2.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.2.4. Market Revenue and Forecast, by Service Provider (2017-2030)

13.2.5. Market Revenue and Forecast, by End-use (2017-2030)

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.2.6.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.2.6.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.2.7. Market Revenue and Forecast, by Service Provider (2017-2030)

13.2.8. Market Revenue and Forecast, by End-use (2017-2030)

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.2.9.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.2.9.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.2.10. Market Revenue and Forecast, by Service Provider (2017-2030)

13.2.11. Market Revenue and Forecast, by End-use (2017-2030)

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.2.12.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.2.12.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.2.12.4. Market Revenue and Forecast, by Service Provider (2017-2030)

13.2.13. Market Revenue and Forecast, by End-use (2017-2030)

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.2.14.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.2.14.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.2.14.4. Market Revenue and Forecast, by Service Provider (2017-2030)

13.2.15. Market Revenue and Forecast, by End-use (2017-2030)

13.3. APAC

13.3.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.3.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.3.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.3.4. Market Revenue and Forecast, by Service Provider (2017-2030)

13.3.5. Market Revenue and Forecast, by End-use (2017-2030)

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.3.6.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.3.6.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.3.6.4. Market Revenue and Forecast, by Service Provider (2017-2030)

13.3.7. Market Revenue and Forecast, by End-use (2017-2030)

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.3.8.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.3.8.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.3.8.4. Market Revenue and Forecast, by Service Provider (2017-2030)

13.3.9. Market Revenue and Forecast, by End-use (2017-2030)

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.3.10.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.3.10.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.3.10.4. Market Revenue and Forecast, by Service Provider (2017-2030)

13.3.10.5. Market Revenue and Forecast, by End-use (2017-2030)

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.3.11.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.3.11.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.3.11.4. Market Revenue and Forecast, by Service Provider (2017-2030)

13.3.11.5. Market Revenue and Forecast, by End-use (2017-2030)

13.4. MEA

13.4.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.4.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.4.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.4.4. Market Revenue and Forecast, by Service Provider (2017-2030)

13.4.5. Market Revenue and Forecast, by End-use (2017-2030)

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.4.6.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.4.6.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.4.6.4. Market Revenue and Forecast, by Service Provider (2017-2030)

13.4.7. Market Revenue and Forecast, by End-use (2017-2030)

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.4.8.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.4.8.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.4.8.4. Market Revenue and Forecast, by Service Provider (2017-2030)

13.4.9. Market Revenue and Forecast, by End-use (2017-2030)

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.4.10.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.4.10.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.4.10.4. Market Revenue and Forecast, by Service Provider (2017-2030)

13.4.10.5. Market Revenue and Forecast, by End-use (2017-2030)

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.4.11.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.4.11.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.4.11.4. Market Revenue and Forecast, by Service Provider (2017-2030)

13.4.11.5. Market Revenue and Forecast, by End-use (2017-2030)

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.5.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.5.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.5.4. Market Revenue and Forecast, by Service Provider (2017-2030)

13.5.5. Market Revenue and Forecast, by End-use (2017-2030)

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.5.6.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.5.6.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.5.6.4. Market Revenue and Forecast, by Service Provider (2017-2030)

13.5.7. Market Revenue and Forecast, by End-use (2017-2030)

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Turbine Type (2017-2030)

13.5.8.2. Market Revenue and Forecast, by Turbine Capacity (2017-2030)

13.5.8.3. Market Revenue and Forecast, by Service Type (2017-2030)

13.5.8.4. Market Revenue and Forecast, by Service Provider (2017-2030)

13.5.8.5. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 14. Company Profiles

14.1. General Electric

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Siemens AG

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. Mitsubishi Hitachi Power Systems, Ltd. (MHPS)

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. MAN Energy Solutions

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. Kawasaki Heavy Industries, Ltd.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. Ansaldo Energia S.p.A

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. Appendix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others