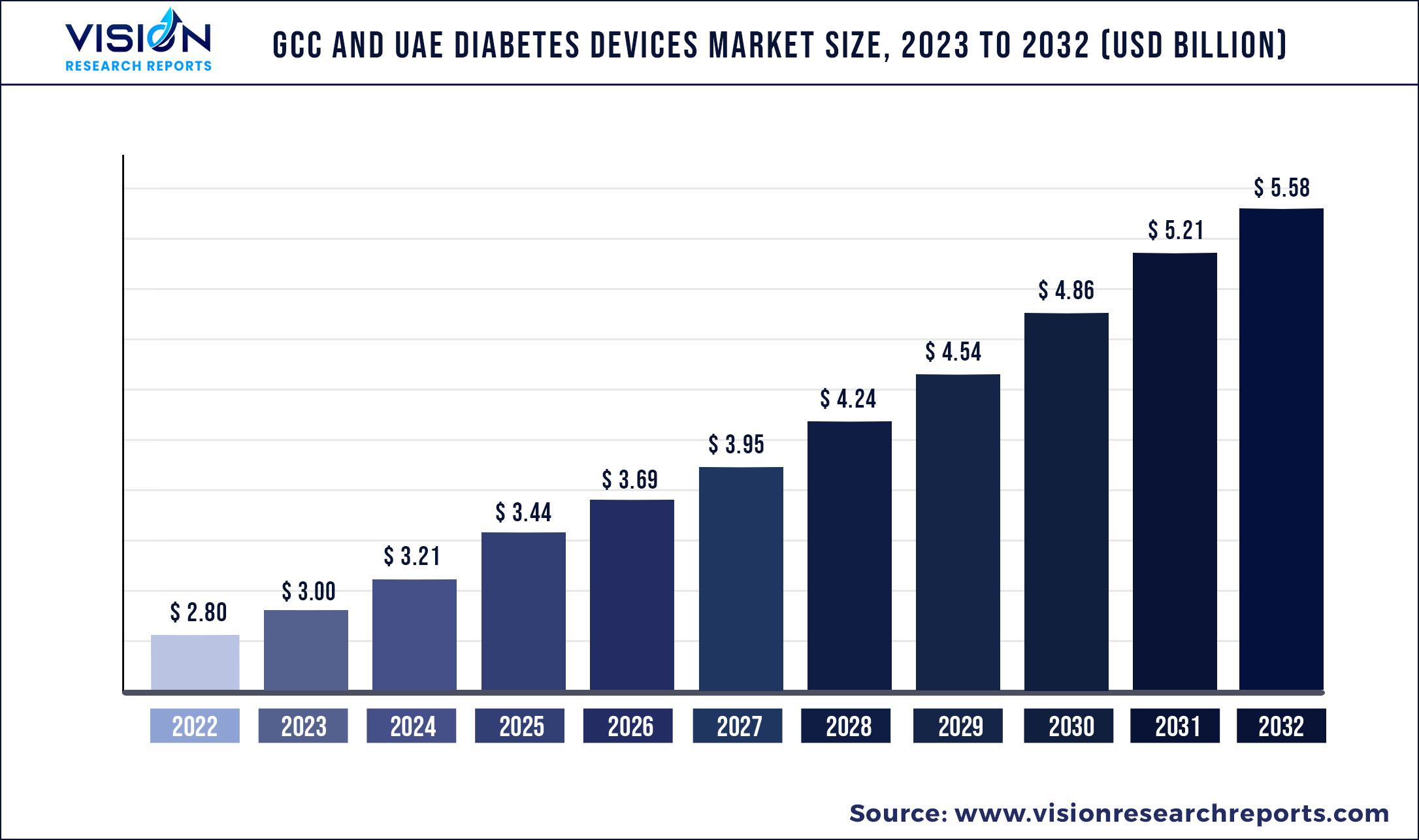

The GCC and UAE diabetes devices market was surpassed at USD 2.80 billion in 2022 and is expected to hit around USD 5.58 billion by 2032, growing at a CAGR of 7.14% from 2023 to 2032.

Key Pointers

| Report Coverage | Details |

| Market Size in 2022 | USD 2.80 billion |

| Revenue Forecast by 2032 | USD 5.58 billion |

| Growth rate from 2023 to 2032 | CAGR of 7.14% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Companies Covered | Medtronic; Abbott Laboratories; Ascensia Diabetes Care Holdings; Dexcom; F. Hoffmann- La Roche AG, Sanofi; Novo Nordisk A/S; Insulet Corporation; Ypsomed AG, Eli Lily; Astra Zeneca |

Key factors contributing to market growth include the rising incidences of diabetes, the growing adoption of advanced technology to treat & manage fluctuating blood glucose levels, and the increasing adoption of telehealth services during the COVID-19 pandemic. The market is further driven by growing awareness about diabetes preventive care, and government initiatives. Saudi Arabia’s government set a goal of achieving a 0% rise in diabetes-related mortality by 2025 and a 10% reduction in overall diabetes incidences by 2030. It has launched diabetes awareness initiatives and is actively promoting awareness regarding diabetes, which encourages healthcare practitioners to continue screening and early intervention efforts, including lifestyle changes.

Diabetes is a rapidly growing disease, which affects a large population in the Middle Eastern region, owing to an increase in unhealthy lifestyles and other associated risk factors. According to the International Diabetes Federation, in UAE the number of people suffering from diabetes is expected to reach 1.32 million in 2045 from 0.99 million in 2021. This disease prevalence can be prevented at an individual level by adopting healthier lifestyles and growing government initiatives.

For instance, in 2020, The Ministry of Health and Prevention (MoHAP) launched a drive-in awareness-raising project aimed at improving the quality of life of people suffering from diabetes and their ability to live with the disease. The Diabetes Prevention Program was also launched to provide information and training on diabetes-related healthy habits.

Gulf Cooperation Council countries have some of the world's highest diabetic prevalence rates. Over the past few decades, diabetes-related research activity has been observed to be low in this region. However, an increase in research funding and collaborations between local & international researchers and institutes are expected to boost the market growth.

The COVID-19 pandemic positively impacted the GCC & UAE diabetes market. Management of blood glucose levels became a critical task for patients admitted to hospitals with severe lung infections. Medications used to treat the disease led to significant changes in the patient blood glucose levels. Moreover, people living with diabetes with COVID-19 conditions were strictly admitted to critical care. Hence, the need for using diabetes monitoring devices significantly increased.

GCC And UAE Diabetes Devices Market Segmentations:

By Services

By Distribution Channel

By End-Use

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on GCC And UAE Diabetes Devices Market

5.1. COVID-19 Landscape: GCC And UAE Diabetes Devices Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. GCC And UAE Diabetes Devices Market, By Services

8.1. GCC And UAE Diabetes Devices Market, by Services, 2023-2032

8.1.1 Devices And Wearables

8.1.1.1. Market Revenue and Forecast (2019-2032)

8.1.2. Pharma, Drugs & Supplies

8.1.2.1. Market Revenue and Forecast (2019-2032)

8.1.3. Technology Platforms And Products

8.1.3.1. Market Revenue and Forecast (2019-2032)

8.1.4. Genomics And Multi-Omics

8.1.4.1. Market Revenue and Forecast (2019-2032)

8.1.5. Diabetes Prevention

8.1.5.1. Market Revenue and Forecast (2019-2032)

8.1.6. Diabetes Researches

8.1.6.1. Market Revenue and Forecast (2019-2032)

8.1.7. Primary Care

8.1.7.1. Market Revenue and Forecast (2019-2032)

Chapter 9. GCC And UAE Diabetes Devices Market, By Distribution Channel

9.1. GCC And UAE Diabetes Devices Market, by Distribution Channel, 2023-2032

9.1.1. Hospital Pharmacies

9.1.1.1. Market Revenue and Forecast (2019-2032)

9.1.2. Retail Pharmacies

9.1.2.1. Market Revenue and Forecast (2019-2032)

9.1.3. Diabetes Clinics/ Centers

9.1.3.1. Market Revenue and Forecast (2019-2032)

9.1.4. Online Pharmacies

9.1.4.1. Market Revenue and Forecast (2019-2032)

Chapter 10. GCC And UAE Diabetes Devices Market, By End-Use

10.1. GCC And UAE Diabetes Devices Market, by End-Use, 2023-2032

10.1.1. Hospitals

10.1.1.1. Market Revenue and Forecast (2019-2032)

10.1.2. Homecare

10.1.2.1. Market Revenue and Forecast (2019-2032)

10.1.3. Diagnostic Centers

10.1.3.1. Market Revenue and Forecast (2019-2032)

Chapter 11. GCC And UAE Diabetes Devices Market, Regional Estimates and Trend Forecast

11.1. GCC

11.1.1. Market Revenue and Forecast, by Services (2019-2032)

11.1.2. Market Revenue and Forecast, by Distribution Channel (2019-2032)

11.1.3. Market Revenue and Forecast, by End-Use (2019-2032)

11.2. UAE

11.2.1. Market Revenue and Forecast, by Services (2019-2032)

11.2.2. Market Revenue and Forecast, by Distribution Channel (2019-2032)

11.2.3. Market Revenue and Forecast, by End-Use (2019-2032)

Chapter 12. Company Profiles

12.1. Medtronic

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Abbott Laboratories

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Ascensia Diabetes Care Holdings

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Dexcom

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. F. Hoffmann- La Roche AG

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Sanofi

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Novo Nordisk A/S

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Insulet Corporation

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Ypsomed AG

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Eli Lily

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others