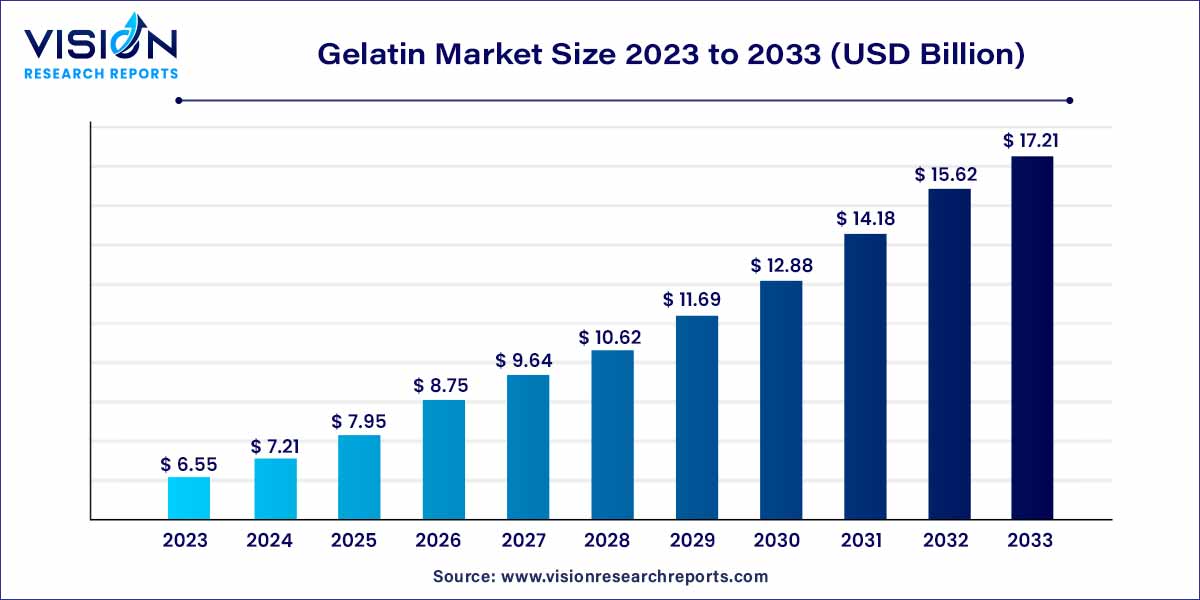

The global gelatin market size was estimated at around USD 6.55 billion in 2023 and it is projected to hit around USD 17.21 billion by 2033, growing at a CAGR of 10.14% from 2024 to 2033. The gelatin market in the United States was accounted for USD 1.33 billion in 2023.

Gelatin, a protein derived from collagen, serves as a crucial ingredient with widespread applications across various industries. Its unique functional properties make it an integral component in the food and beverage, pharmaceutical, cosmetic, and other sectors.

The growth of the gelatin market is propelled by several key factors contributing to its expanding influence across diverse industries. Firstly, the rising demand for natural and functional ingredients in the food and beverage sector has driven the increased utilization of gelatin as a versatile gelling and stabilizing agent. Additionally, the pharmaceutical industry's growth has significantly contributed to the market's expansion, with gelatin being a fundamental component in the production of capsules and drug delivery systems. The cosmetic and personal care sector also plays a pivotal role, leveraging gelatin's film-forming properties for texture enhancement in various products. Furthermore, the heightened awareness of collagen's health benefits has spurred the use of gelatin in the formulation of nutraceuticals and dietary supplements, further propelling market growth. As consumer preferences continue to evolve towards cleaner labels and natural alternatives, the multifunctional attributes of gelatin position it as a favored ingredient, fostering its sustained growth across global markets.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 17.21 billion |

| Growth Rate from 2024 to 2033 | CAGR of 10.14% |

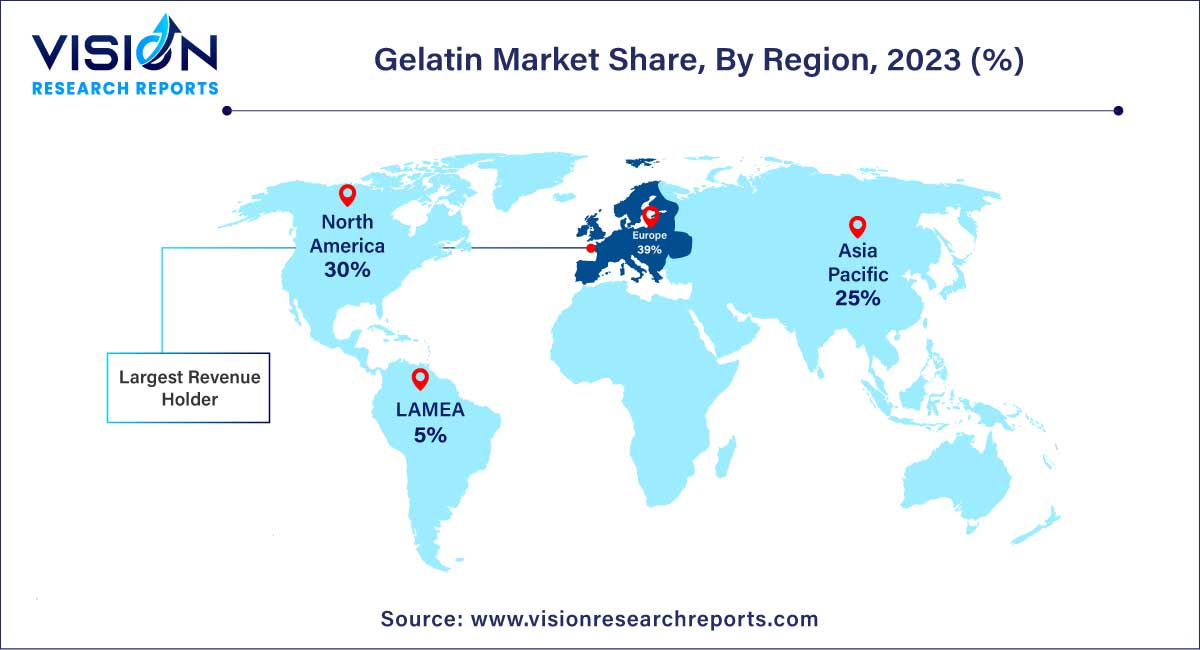

| Revenue Share of Europe in 2023 | 39% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

Gelatin Market Drivers

Gelatin Market Restraints

Gelatin Market Opportunities

The bovine source held the largest revenue share of 35% in 2023. This prominence is a result of the escalating utilization of bovine-based gelatin across diverse food and beverage applications. The market's growth is further fueled by the global surge in demand for dietary supplements, driven by consumers' increasing preference for a health-conscious and protein-rich diet.

Conversely, the market for bovine gelatin faces challenges due to the growing prevalence of vegan lifestyles worldwide, coupled with a decline in the slaughtering of animals such as cows and buffaloes. This shift is evidenced by a 2% reduction in commercial cow slaughtering in 2020 compared to 2019, as reported by the U.S. Department of Agriculture (USDA). Additionally, major producers, including Australia, New Zealand, and the European Union, experienced a decrease in bovine meat output due to limited animal availability, as highlighted by OECD-FAO. These factors collectively pose potential obstacles to the overall growth of the market.

Porcine-based gelatin, a traditionally utilized product, is sourced from pork skin and bones. The National Health Service (NHS) notes that the use of porcine-based products, particularly in vaccines and capsules, serves as a stabilizer, ensuring efficacy and safety, especially during storage and post-storage periods. This utilization is anticipated to be a key driver for the market's growth in the foreseeable future.

The stabilizer function had the largest market share of 41% in 2023. This notable share can be attributed to the exceptional properties of gelatin, particularly its emulsifying effects. Additionally, gelatin serves to enhance food texture, providing a desirable body to various food products. Its role extends to ensuring product uniformity and consistency while retaining flavoring compounds in dispersions. These versatile properties position gelatin as an ideal stabilizer for a wide range of products, including ice creams, margarine, spreads, dairy items, salad dressings, and mayonnaise.

Beyond its stabilizing function, gelatin plays a crucial role as a thickener, elevating the viscosity of solutions or mixtures without altering their inherent properties. As a food additive, gelatin contributes to enhancing taste and improving the suspension of other ingredients, thereby increasing overall product stability. Its incorporation into diverse food types such as soups, salad dressings, sauces, and gravies underscores its versatility in the culinary realm. Moreover, the utilization of thickeners in cosmetics and personal care products is anticipated to be a key driver for market growth in the foreseeable future.

Gelatin boasts additional functions, including its use for texturing, acting as a protective agent, and serving as an emulsifier. Emulsifiers, crucial for stabilizing emulsions, find increasing application in various food items such as bread, meat, chocolates, and ice creams. This expanding use of gelatin as an emulsifier is expected to further fuel market growth in the coming years.

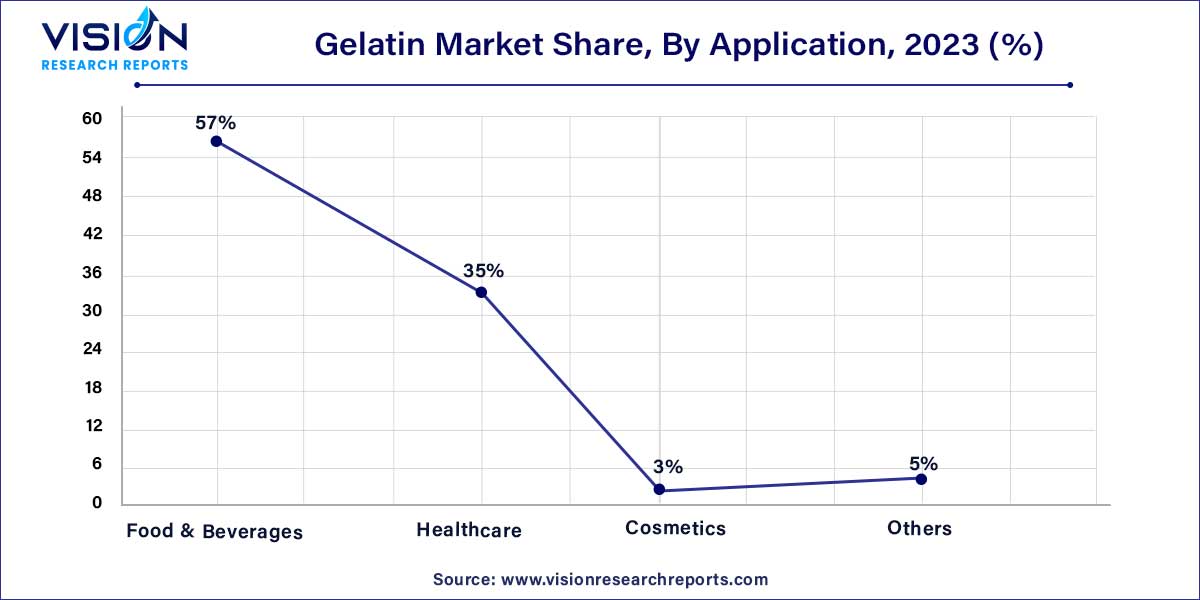

The food and beverages application generated the maximum market share of 57% in 2023. This significant share is primarily attributed to the escalating demand for a diverse array of food and beverage products worldwide, encompassing desserts, functional food items, functional beverages, confectionery products, and meat products.

The surge in popularity of functional food products is noteworthy, as these items offer enhanced nutritional properties that contribute to various health benefits, including improved immunity and reduced fatigue. The impact of the COVID-19 pandemic has prompted a heightened awareness of health, diet, and wellness among consumers, leading to a more conscious connection between eating habits and overall health. Notably, the demand for immunity-boosting products experienced a notable increase in response to the pandemic, a trend expected to persist and positively influence the market growth for functional food in the coming years.

Furthermore, gelatin finds substantial utility in the pharmaceutical and healthcare industry, playing a crucial role in the manufacturing of capsules, emulsions, syrups, and tablets. Its properties, including film-forming, thermo-reversible gelling, and adhesiveness, make it a preferred choice among manufacturers for capsule production. Moreover, gelatin holds approval from the Food and Drug Administration (FDA) for use in pharmaceutical and healthcare applications, further solidifying its position in these critical sectors.

Europe region dominated the market with the largest market share of 39% in 2023. This regional dominance is attributed to robust demand from key end-use industries, including cosmetics, food and beverages, and healthcare. The growth trajectory in the region is further accentuated by the presence of numerous manufacturing companies, such as Biogel AG, Prowico, and Gelita, among others.

The sourcing of gelatin in the United Kingdom commonly involves bovine or porcine origins, aligning with the high consumption levels of pork and beef in the region. The demand for gelatin in the U.K. is notably driven by the escalating sales of cosmetic products. Furthermore, the well-defined and established meat processing industry in the country contributes favorably to raw material sourcing for gelatin production. The convergence of well-established market players and abundant raw material supply is anticipated to stimulate production in the United Kingdom throughout the forecast period.

By Source

By Function

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Source Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Gelatin Market

5.1. COVID-19 Landscape: Gelatin Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Gelatin Market, By Source

8.1. Gelatin Market, by Source, 2024-2033

8.1.1 Bovine

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Porcine

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. Poultry

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Marine

8.1.4.1. Market Revenue and Forecast (2021-2033)

8.1.5. Others

8.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Gelatin Market, By Function

9.1. Gelatin Market, by Function, 2024-2033

9.1.1. Stabilizer

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Thickener

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Gelling Agent

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Gelatin Market, By Application

10.1. Gelatin Market, by Application, 2024-2033

10.1.1. Food & Beverages

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Healthcare

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Cosmetics

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Others

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Gelatin Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Source (2021-2033)

11.1.2. Market Revenue and Forecast, by Function (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Source (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Function (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Source (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Function (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Source (2021-2033)

11.2.2. Market Revenue and Forecast, by Function (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Source (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Function (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Source (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Function (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Source (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Function (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Source (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Function (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Source (2021-2033)

11.3.2. Market Revenue and Forecast, by Function (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Source (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Function (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Source (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Function (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Source (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Function (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Source (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Function (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Source (2021-2033)

11.4.2. Market Revenue and Forecast, by Function (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Source (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Function (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Source (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Function (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Source (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Function (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Source (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Function (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Source (2021-2033)

11.5.2. Market Revenue and Forecast, by Function (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Source (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Function (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Source (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Function (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. GELITA AG.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Rousselot.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. PB Leiner.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. STERLING GELATIN.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Weishardt Holding SA.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Junca Gelatines SL

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Nitta Gelatin, Inc.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. PAN Biotech GmbH

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Shanghai Al-Amin Biotechnology Co., Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. Tessenderlo Group

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others