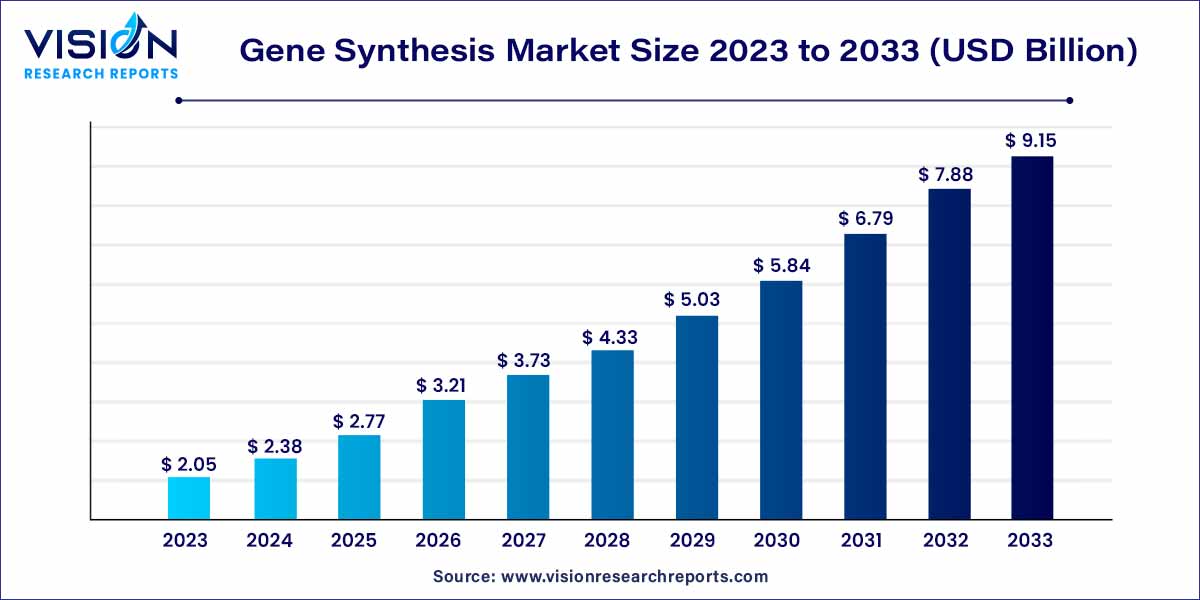

The global gene synthesis market size was estimated at around USD 2.05 billion in 2023 and it is projected to hit around USD 9.15 billion by 2033, growing at a CAGR of 16.14% from 2024 to 2033. The gene synthesis market is driven by advancements in molecular biology, biotechnology, and genetic engineering.

The growth of the gene synthesis market is propelled by several key factors. Firstly, the increasing demand for personalized medicine has become a significant growth driver, as researchers and healthcare professionals seek tailored genetic solutions for individualized therapeutic interventions. Secondly, advancements in CRISPR technology, particularly the revolutionary CRISPR-Cas9 gene editing system, have opened new avenues for gene synthesis applications. This technology's precision and efficiency in editing DNA sequences contribute to the market's expansion, especially in areas like gene therapy and functional genomics. Additionally, the trend towards customization and precision in gene synthesis services addresses the specific needs of researchers and industry professionals, fostering market growth. The integration of automation and high-throughput synthesis capabilities further accelerates the market, enhancing efficiency and supporting large-scale genomic projects. As these factors synergize, the gene synthesis market is positioned for sustained growth in the foreseeable future.

Solid-phase synthesis emerged as the dominant method in the gene synthesis market in 2023, experiencing increased adoption in recent years. This segment claimed approximately 36% of the revenue share in 2023, establishing itself as a prominent technology applicable across various fields and research purposes. Its versatility lies in the ability to create modified and canonical polymers of nucleic acids, specifically RNA or DNA.

The PCR-based enzyme segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR) during the forecast period. Factors such as precision, user-friendliness, and cost-effectiveness contribute to the anticipated growth of this segment by 2030. This method proves effective in generating the A+T-rich malaria genome.

Furthermore, PCR-based gene synthesis offers a straightforward solution to the challenge of producing substantial quantities of labeled protein for NMR spectroscopy, particularly when expressing the gene encoding the protein is challenging or unavailable. Consequently, the applications of this technique mentioned above contribute significantly to the growth of this segment.

In 2023, the antibody DNA synthesis segment commanded a significant market share of 61%. The prevalence of multiple market players providing antibody DNA synthesis services played a pivotal role in establishing the dominance of gene synthesis in the market during this period. These companies extend their services to research institutions and biotech/pharma firms, facilitating the cloning and synthesis of antibody chain sequences into various vectors.

A noteworthy development in April 2023 came from Twist Bioscience Corporation, which introduced a high-throughput antibody production platform. This innovative offering allows customers to transform digital DNA (dDNA) sequences into purified IgG antibodies through the antibody production workflow. Additionally, Codex DNA, Inc. showcased automated synthetic biology technologies in June 2023, aiming to expedite discovery workflows at the conference on antibody engineering and therapeutics in Europe.

The viral gene synthesis segment is anticipated to experience the swiftest growth rate, driven by increasing R&D activities related to virus vectors. Companies are actively engaged in synthesizing all structural and non-structural gene fragments or protein genes of SARS-CoV-2. In February 2023, Eleven Therapeutics and Twist Bioscience Corporation collaborated to develop a replicon tool. This tool can be utilized for investigating viral genome replication, conducting antiviral drug screening, and contributing to therapeutic and vaccine development.

In 2023, the gene and cell therapy development segment took command of the gene synthesis market, capturing a substantial 36% share of the revenue. This dominance is poised to expand the pipeline for advanced therapies geared towards treating chronic diseases. Notably, these therapies are gaining widespread acceptance among developers due to their efficacy in addressing diseases that were previously untreatable using conventional methods.

Numerous initiatives have been launched by biotechnology and pharmaceutical companies to promote the development of cell and gene therapy treatments. In January 2023, Century Therapeutics forged a collaboration with Bristol Myers Squibb Company to work on iPSC-derived allogeneic cell therapies.

The field of disease diagnosis is expected to experience the most rapid growth in the coming years. This is attributed to the increasing global disease burden and a rising demand for improvements in medical diagnostics. Synthetic biology offers bio-molecular engineering strategies that surpass the limitations of traditional antibody-based diagnostic platforms, which are often slow, expensive, and unsuitable for testing emerging pathogens or rare diseases.

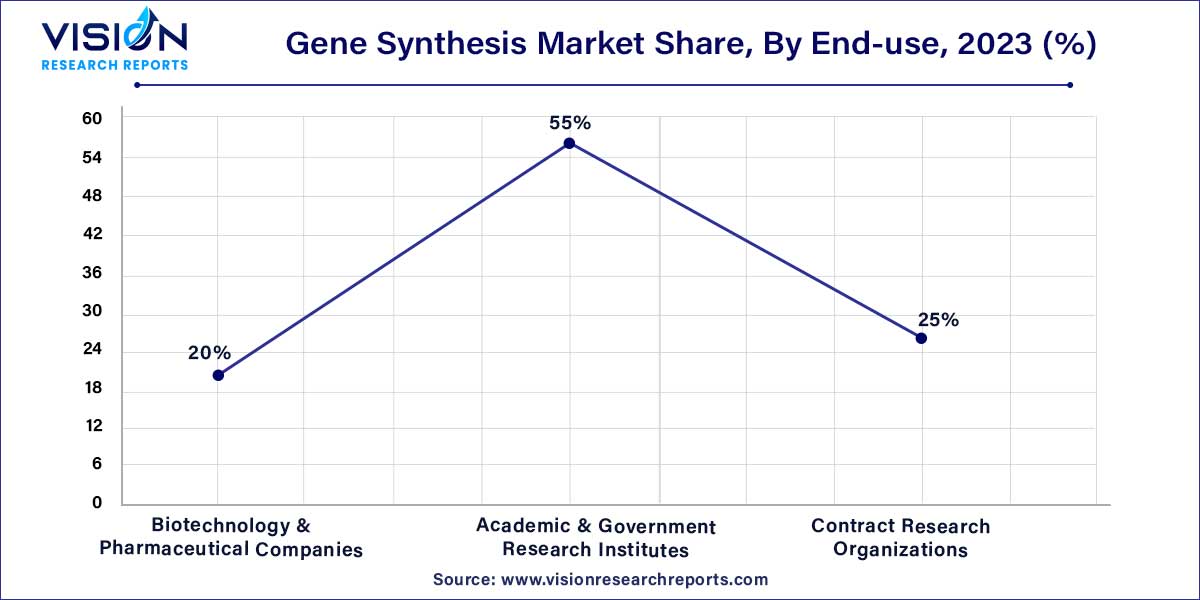

In 2023, academic and government research institutes emerged as leaders in the gene synthesis market in terms of revenue share. This dominance is attributed to the increasing utilization of gene synthesis services in research environments, with the segment holding a global revenue share of approximately 55% in 2023. Research institutes are actively engaging in collaborations with service providers to expedite their research programs, particularly those necessitating the characterization and synthesis of gene fragments.

Biotechnology and pharmaceutical companies are anticipated to experience substantial growth in the upcoming years. Major players in the industry are directing their efforts towards the development and introduction of new platforms designed to enhance the gene synthesis process. For instance, in August 2020, Codex DNA launched the BioXp 3250 system for synthetic biology workflows. This platform is geared towards expediting the development of new biologics and vaccines by enabling researchers to generate large DNA fragments, up to 7kb in size, at high speed without compromising accuracy. These factors are expected to further contribute to the growth of this segment.

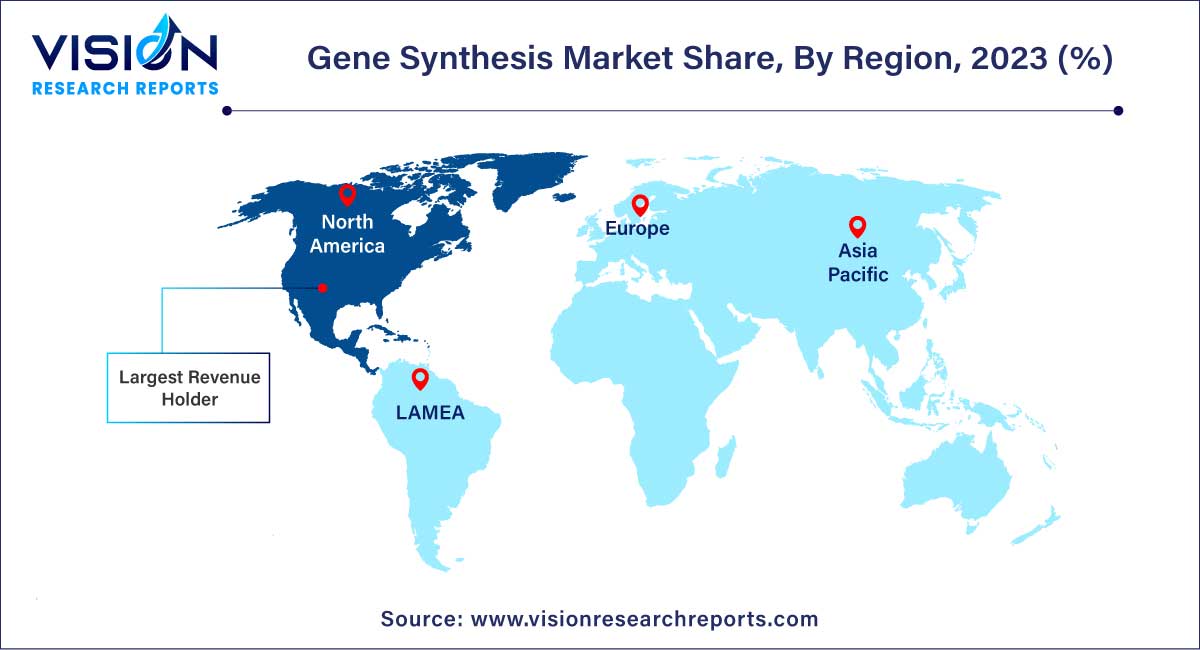

In 2023, North America secured the largest revenue share in the gene synthesis market. This can be attributed to various factors such as the presence of key market players offering gene synthesis services, the growing interest of major biotechnology and pharmaceutical companies in gene and cell therapy development, the expanding field of synthetic biology in the region, and the rising enthusiasm for gene synthesis within the molecular biology sphere.

Moreover, the region benefits from a substantial number of contract research organizations (CROs) providing gene synthesis services, contributing to the overall revenue growth. As an example, GenScript has established a significant presence across North America, offering a diverse range of services that include antibody drug development and custom gene synthesis services.

During the forecast period, Asia Pacific is expected to experience the highest growth rate in the gene synthesis market. This is driven by the surge in research activities aimed at developing effective therapeutics, coupled with a rising interest in synthetic biology research. Additionally, the region is witnessing an increase in the incidence of diseases attributed to lifestyle changes. The growth is further supported by improvements in healthcare infrastructure, the entry of large biotechnology organizations, and the expanding scope of research and development activities in the region.

By Method

By Services

By Application

By End-use

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others