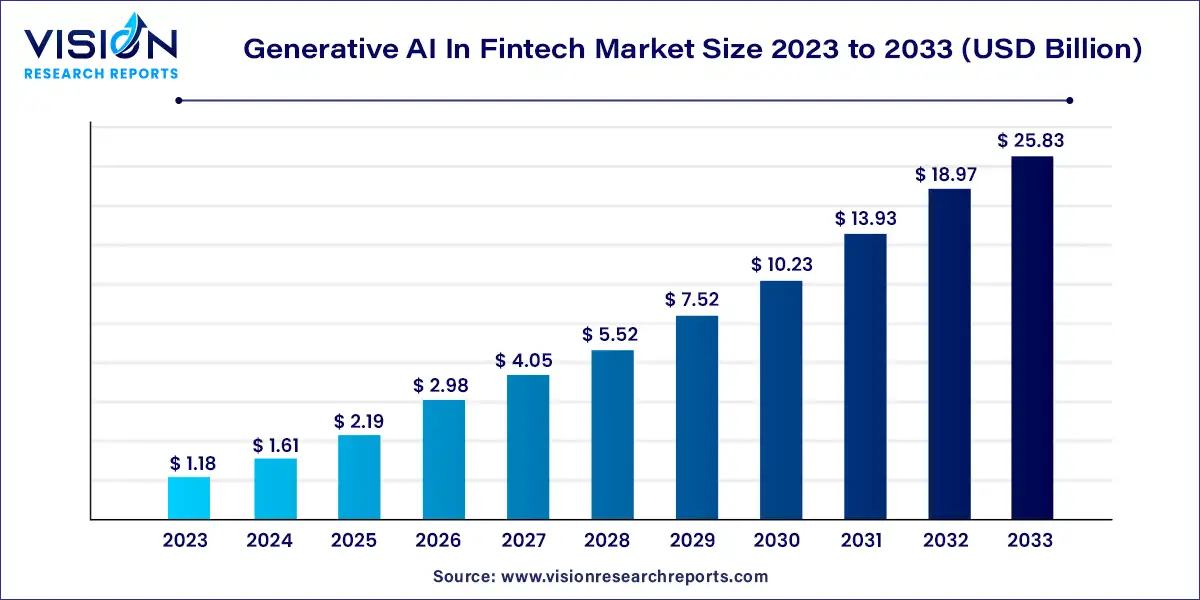

The global generative AI in fintech market size was estimated at around USD 1.18 billion in 2023 and it is projected to hit around USD 25.83 billion by 2033, growing at a CAGR of 36.15% from 2024 to 2033.

The growth of generative AI in the Fintech market is propelled by an exponential increase in available data, coupled with advancements in machine learning algorithms, has empowered Fintech companies to leverage generative AI for sophisticated data analysis and predictive modeling. Additionally, the growing demand for personalized financial services drives the adoption of generative AI solutions, enabling Fintech firms to deliver tailored recommendations and insights to customers. Moreover, the imperative for enhanced security and fraud detection mechanisms in the financial sector has spurred investment in generative AI-driven solutions to fortify cybersecurity measures. Furthermore, the relentless pursuit of operational efficiency and cost optimization incentivizes Fintech firms to deploy generative AI for automation and process optimization, thereby improving productivity and competitiveness.

| Report Coverage | Details |

| Revenue Share of North America in 2023 | 36% |

| CAGR of Asia Pacific from 2024 to 2033 | 44.27% |

| Revenue Forecast by 2033 | USD 25.83 billion |

| Growth Rate from 2024 to 2033 | CAGR of 36.15% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

In terms of component, the software segment dominated the market in 2023 with a revenue share of 64%. Trends and consumer behavior also influence the dominance of the software segment, and consumers are increasingly adopting digital solutions and want more individualized experiences. The software market enables fintech businesses to create unique solutions that address the preferences and demands of specific clients. The software category is predicted to grow fastest over the forecast period due to its flexibility and adaptability. Platforms for software-based generative AI are easily adaptable to shifting consumer preferences and expanding data quantities.

The service segment is estimated to register the highest CAGR of over 38.06% over the forecast period. The fraud detection and risk management service sector is experiencing a substantial movement towards AI-driven anomaly detection in the generative AI-powered fintech industry. Fintech organizations use generative AI algorithms to analyze enormous volumes of transactional and behavioral data to spot strange patterns and dubious behavior that might be signs of fraud or high-risk behavior. Anomaly detection models may be trained on various datasets owing to generative AI's capacity to produce synthetic data, which increases their accuracy and flexibility in response to changing fraud schemes.

In terms of deployment, the on-premises segment dominated the market in 2023 with a revenue share of 62%. Many financial organizations choose on-premises deployment of generative AI in fintech solutions for various reasons, including data security concerns, regulatory compliance requirements, and increased control over their systems. Customers are increasingly worried about the privacy of their data and are aware of where it is being held. On-premises deployment satisfies their preference for solutions that provide them with control over their data. The on-premises segment drives the market's expansion as demand for data security and compliance rises. Many businesses invest in on-premises generative AI systems because they understand the importance of securing crucially sensitive consumer data.

Using generative AI solutions on cloud platforms has become a significant trend in the quickly developing fintech business. Financial institutions are using the power of generative AI more and more to create personalized information that is realistic and customized, such as automated financial reporting, individualized investment advice, and bespoke client communications. These AI-driven systems can analyze enormous volumes of financial data in real time using the scalability and flexibility of cloud-based infrastructures, which results in better decision-making, better customer experiences, and more efficient operations. The fusion of generative AI with cloud technology promises to revolutionize the financial sector and drive further improvements in automation and personalization as the need for creative fintech solutions rises.

In terms of end-use, the investment banking segment dominated the market in 2023 with a market share of 32%. Investment banks are adopting generative AI to simplify their processes and gain an advantage over rivals. These AI-driven systems can analyze big datasets, produce insightful results, and automate challenging financial modeling activities. Investment banks may enhance decision-making speed and accuracy, optimize portfolio management, and spot profitable investment possibilities more quickly by introducing generative AI into their operations. Generative AI is anticipated to play a significant role in influencing the future of financial analysis and strategy development as the need for data-driven and technologically sophisticated solutions in the investment banking industry continues to increase.

Retail banks are leading the way in implementing generative AI technology to improve client experiences, optimize processes, and maintain competitiveness in the fast-moving fintech sector. Consumer trends and behavior also impact the success of the retail banking sector. Customers increasingly use online and mobile banking services for convenience and ease of use. Retail banks deploy generative AI technologies to create intuitive, user-friendly interfaces, make individualized suggestions, and deliver seamless digital banking experiences. Due to the rising demand for digital banking services and the requirement for flawless client experiences, the retail banking market is anticipated to develop quickly in the coming years.

In terms of application, the compliance & fraud detection segment dominated the market in 2023 with a revenue share of around 21%. With the increased usage of generative AI applications, the fintech industry's compliance & fraud detection section is undergoing a significant shift. Financial institutions are increasingly turning to generative AI to improve compliance measures and expand their fraud detection skills. These advanced AI algorithms can analyze huge amounts of financial data, spot intricate trends, and quickly identify fraudulent activity. Fintech businesses may use generative AI for compliance and fraud detection to reduce risks, protect against fraudulent transactions, and maintain regulatory compliance, which will increase consumer and investor confidence in the financial ecosystem.

Financial organizations increasingly use generative AI models to improve their predictive analysis skills. These advanced AI algorithms can analyze enormous volumes of financial history, spot hidden trends, and produce precise market trends, investment possibilities, and risk assessment predictions. Fintech organizations may make data-driven choices with increased accuracy and efficiency by integrating generative AI into their predictive analytic processes, which leads to smarter investment strategies, enhanced risk management, and better overall financial performance. Generative AI is anticipated to revolutionize predictive analysis as the fintech sector develops significantly, offering firms a competitive edge in the fast-moving financial landscape.

Based on region, the North America region held the highest revenue share of 36% in 2023. North American financial institutions and fintech companies are becoming increasingly aware of the potential of generative AI, which can lead to a complete transformation of the financial services sector. Generative AI enhances consumer experiences and increases operational effectiveness in various areas, including personalized financial services, risk assessment, and fraud detection. In addition, the developed cloud infrastructure in the area and its data-driven philosophy favor the development and use of generative AI solutions in the fintech industry. North America is anticipated to continue its growth in the generative AI revolution in fintech as it evolves, spurring innovation, and determining the direction of financial services in the region.

Asia Pacific is anticipated to emerge as the fastest-growing regional market, with the fastest CAGR of 44.27% over the forecast period. One significant trend in the Asia Pacific region for generative AI in the fintech business is the rising collaboration between established financial institutions and startups. Traditional banks and new fintech businesses have recently formed more collaborations and strategic alliances to use generative AI technology. Through these partnerships, major financial institutions' knowledge and client base will be combined with fintech startups' creativity and agility to create ground-breaking generative AI solutions that address a range of financial demands.

By Component

By Deployment

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Generative AI In Fintech Market

5.1. COVID-19 Landscape: Generative AI In Fintech Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Generative AI In Fintech Market, By Component

8.1. Generative AI In Fintech Market, by Component, 2024-2033

8.1.1. Service

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Software

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Generative AI In Fintech Market, By Deployment

9.1. Generative AI In Fintech Market, by Deployment, 2024-2033

9.1.1. On-premises

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Cloud

9.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Generative AI In Fintech Market, By Application

10.1. Generative AI In Fintech Market, by Application, 2024-2033

10.1.1. Compliance & Fraud Detection

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Personal Assistants

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Asset Management

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Predictive Analysis

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Insurance

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Business Analytics & Reporting

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Customer Behavioral Analytics

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.8. Others

10.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Generative AI In Fintech Market, By End-use

11.1. Generative AI In Fintech Market, by End-use, 2024-2033

11.1.1. Retail Banking

11.1.1.1. Market Revenue and Forecast (2021-2033)

11.1.2. Investment Banking

11.1.2.1. Market Revenue and Forecast (2021-2033)

11.1.3. Stock Trading Firms

11.1.3.1. Market Revenue and Forecast (2021-2033)

11.1.4. Hedge Funds

11.1.4.1. Market Revenue and Forecast (2021-2033)

11.1.5. Other Industries

11.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 12. Global Generative AI In Fintech Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component (2021-2033)

12.1.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.1.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.1.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.1.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.1.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component (2021-2033)

12.2.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.2.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.2.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component (2021-2033)

12.3.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.3.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.3.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.6.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.7.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.7.4. Market Revenue and Forecast, by End-use (2021-2033)

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component (2021-2033)

12.4.8.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.4.8.3. Market Revenue and Forecast, by Application (2021-2033)

12.4.8.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component (2021-2033)

12.5.5.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.5.4. Market Revenue and Forecast, by End-use (2021-2033)

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component (2021-2033)

12.5.6.2. Market Revenue and Forecast, by Deployment (2021-2033)

12.5.6.3. Market Revenue and Forecast, by Application (2021-2033)

12.5.6.4. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 13. Company Profiles

13.1. Open AI

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Microsoft Corporation

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. Google LLC

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Genie AI Ltd.

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. IBM Corporation

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. MOSTLY AI Inc.

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Veesual AI

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. Adobe Inc.

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Synthesis AI

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. Salesforce

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others