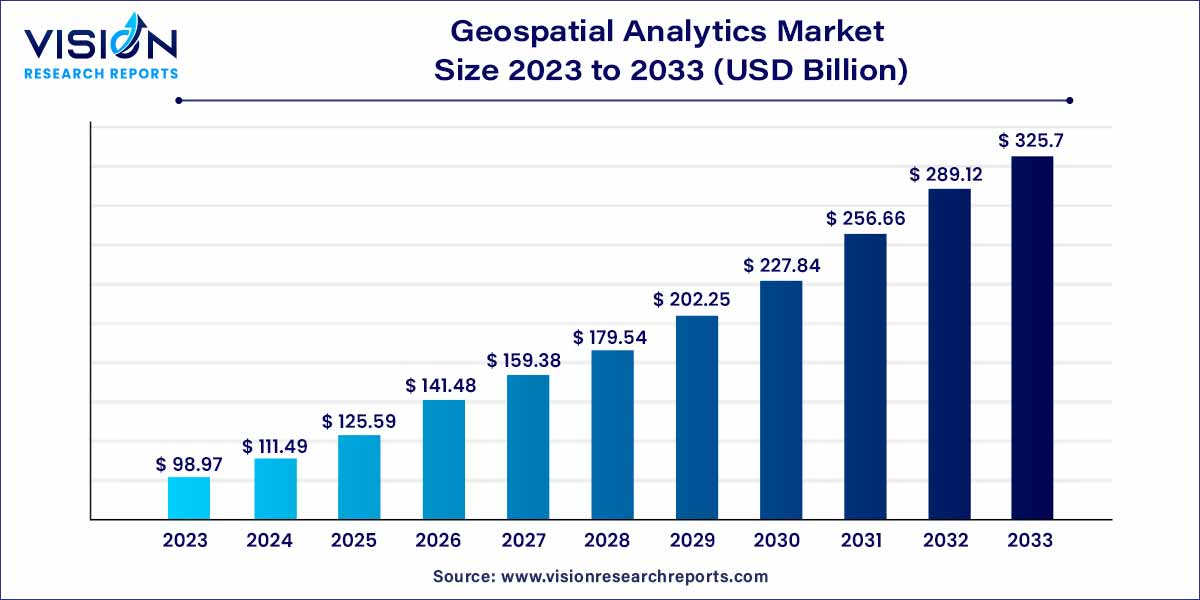

The global geospatial analytics market size was estimated at USD 98.97 billion in 2023 and it is expected to surpass around USD 325.7 billion by 2033, poised to grow at a CAGR of 12.65% from 2024 to 2033. The geospatial analytics market has emerged as a pivotal force in the data-driven decision-making, offering valuable insights derived from geographic data. Geospatial analytics, an amalgamation of geographic information systems (GIS), satellite imagery, GPS technology, and advanced data analysis techniques, has transformed the way businesses, government agencies, and researchers perceive and utilize spatial information. This overview provides a comprehensive insight into the key aspects, trends, and dynamics shaping the geospatial analytics market.

The growth of the geospatial analytics market can be attributed to several key factors driving its expansion. Firstly, rapid advancements in technology, including satellite imaging, GIS software, and data analytics algorithms, have significantly enhanced the accuracy and efficiency of geospatial analysis. Secondly, the increasing demand for location-based services across diverse sectors, such as transportation, agriculture, and urban planning, has fueled the adoption of geospatial analytics solutions. Additionally, the integration of geospatial analytics with emerging technologies like IoT and big data has opened new avenues for real-time spatial data analysis, driving market growth further. Moreover, supportive government initiatives and policies promoting geospatial infrastructure development have played a crucial role in expanding the market.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 12.65% |

| Market Revenue by 2033 | USD 325.7 billion |

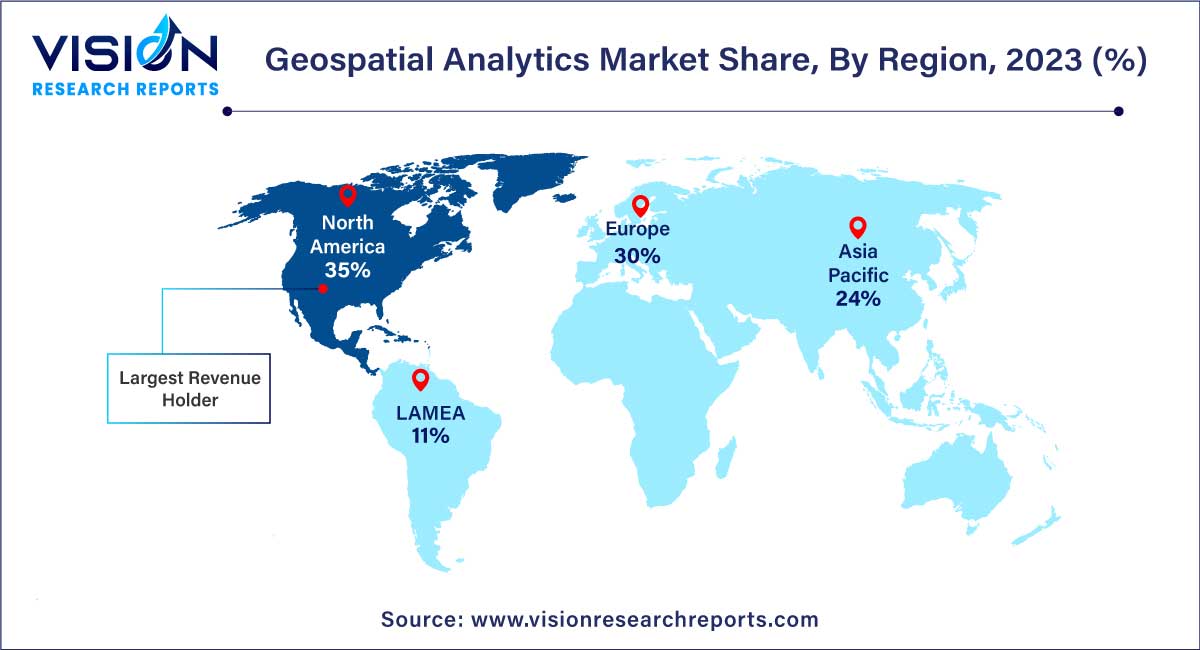

| Revenue Share of North America in 2023 | 34% |

| CAGR of Asia Pacific from 2024 to 2033 | 17.67% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

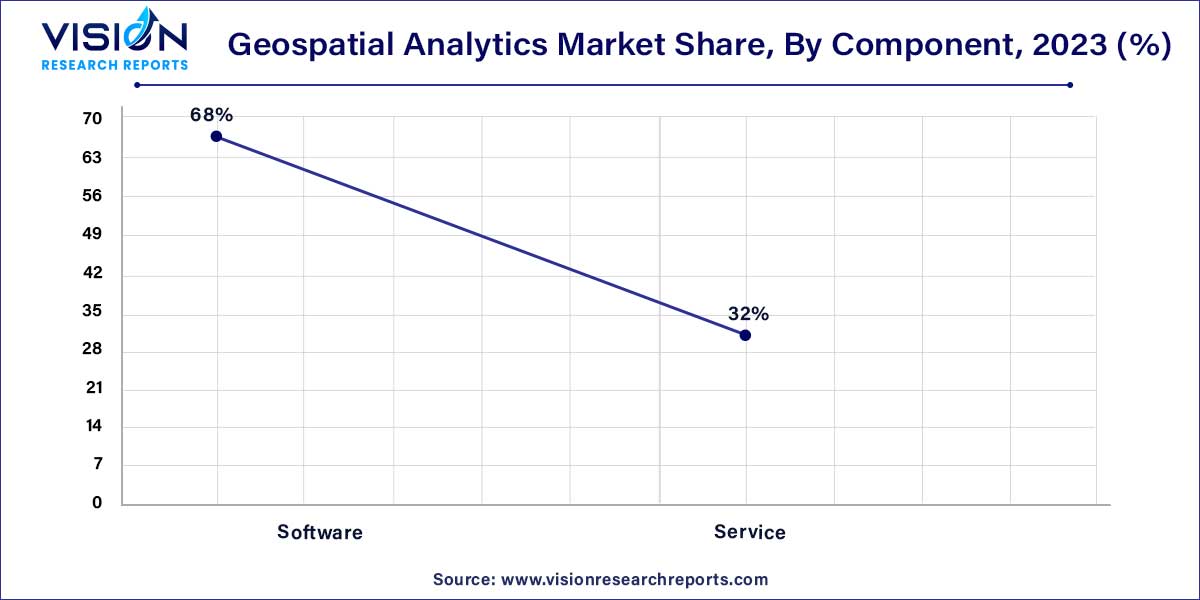

The software segment accounted for the largest revenue share of 67% in 2023. These software solutions encompass a wide array of applications, including Geographic Information Systems (GIS), remote sensing software, and spatial data analytics platforms. GIS software enables the creation of detailed maps, spatial analysis, and geographic modeling, aiding various sectors such as urban planning, natural resource management, and disaster response.

The services segment is expected to expand at the fastest CAGR of 13.45% during the forecast period. Services play a pivotal role in the market. Geospatial analytics services encompass a diverse range of offerings, including consulting, implementation, training, and support. Geospatial consultants provide expertise to businesses, helping them understand their specific geospatial needs and tailor solutions accordingly. Implementation services involve the integration of geospatial technology into existing systems, ensuring seamless functionality and data flow.

The surface & field analytics segment contributed the largest market share of 59% in 2023. Surface & Field Analytics delve deep into the physical landscape, focusing on the intricate details of terrains, soil quality, and environmental conditions. This type of analytics is indispensable for industries like agriculture and environmental conservation, where understanding the nuances of the Earth's surface is critical. Surface & Field Analytics provide valuable information for precision agriculture, enabling farmers to optimize irrigation, assess soil health, and enhance crop productivity.

The network & location analytics segment is estimated to register the fastest CAGR of 13.75% over the forecast period. Network & Location Analytics focus on the connectivity and relationships within geographic data. This type of analytics is instrumental in optimizing routes, managing transportation networks, and enhancing logistics operations. Industries such as transportation and urban planning leverage Network & Location Analytics to streamline traffic flow, plan efficient transportation routes, and reduce congestion in metropolitan areas.

The surveying segment generated the maximum market share of 22% in 2023 and is expected to grow at the fastest CAGR of 14.25% over the forecast period. Geospatial analytics in surveying have revolutionized traditional methods, offering precise and efficient ways to gather topographical data, map terrains, and assess land features. Surveyors leverage advanced tools and techniques to create accurate digital maps, enabling urban planners, engineers, and architects to make well-informed decisions. From infrastructure development to environmental conservation, geospatial analytics in surveying play a pivotal role in ensuring that projects are executed with precision, minimizing risks and optimizing resources.

Military intelligence, geospatial analytics have become indispensable tools for defense and national security agencies. By harnessing satellite imagery, GIS technology, and spatial data analysis, military professionals can gain valuable insights into enemy movements, strategic locations, and geopolitical developments. Geospatial analytics provide real-time situational awareness, enabling military commanders to make swift and informed decisions on the battlefield. Military intelligence agencies also utilize geospatial analytics for threat analysis, mission planning, and disaster response. The ability to visualize and analyze geographical data enhances military operations, ensuring the safety of personnel and the success of missions.

North America dominated the market with the largest revenue share of 34% in 2023. North America, with its robust technological infrastructure and early adoption of advanced analytics, stands as a prominent hub for geospatial innovations. The presence of major industry players and extensive government investments in research and development contribute significantly to the region's market growth. The region's applications span various sectors, including agriculture, transportation, and urban planning, fostering a dynamic ecosystem for geospatial analytics solutions.

Asia Pacific is predicted to grow at the remarkable CAGR of 17.67% during the forecast period. Asia Pacific, characterized by its rapid economic growth and urbanization, presents vast opportunities for geospatial analytics adoption. Countries like China and India are witnessing substantial investments in infrastructure development, agriculture, and environmental conservation, driving the need for precise spatial insights. Geospatial analytics find applications in land-use planning, natural resource management, and disaster risk reduction efforts across the region. The presence of a burgeoning technology sector and increasing awareness about the benefits of geospatial analytics further fuel market expansion in Asia Pacific.

In April 2023, Hexagon AB launched the HxGN AgrOn Control Room. It is a mobile app that allows managers and directors of agricultural companies to monitor all field operations in real time. It helps managers identify and address problems quickly, saving time and money. Additionally, the app can help to improve safety by providing managers with a way to monitor the location and status of field workers.

In December 2022, ESRI India announced the availability of Indo ArcGIS offerings on Indian public clouds and services to provide better management, collecting, forecasting, and analyzing location-based data.

In May 2022, Trimble announced the launch of the Trimble R12i GNSS receiver, which has a powerful tilt adjustment feature. It enables land surveyors to concentrate on the task and finish it more quickly and precisely.

By Component

By Type

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Component Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Geospatial Analytics Market

5.1. COVID-19 Landscape: Geospatial Analytics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Geospatial Analytics Market, By Component

8.1. Geospatial Analytics Market, by Component, 2024-2033

8.1.1 Software

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Service

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Geospatial Analytics Market, By Type

9.1. Geospatial Analytics Market, by Type, 2024-2033

9.1.1. Surface & Field Analytics

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Network & Location Analytics

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Geovisualization

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Others

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Geospatial Analytics Market, By Application

10.1. Geospatial Analytics Market, by Application, 2024-2033

10.1.1. Surveying

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Medicine & Public Safety

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Military Intelligence

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Disaster Risk Reduction & Management

10.1.4.1. Market Revenue and Forecast (2021-2033)

10.1.5. Marketing Management

10.1.5.1. Market Revenue and Forecast (2021-2033)

10.1.6. Climate Change Adaption (CCA)

10.1.6.1. Market Revenue and Forecast (2021-2033)

10.1.7. Urban Planning

10.1.7.1. Market Revenue and Forecast (2021-2033)

10.1.8. Others

10.1.8.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Geospatial Analytics Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.1.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Component (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.2.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Component (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.3.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.6.3. Market Revenue and Forecast, by Application (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Component (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Type (2021-2033)

11.4.7.3. Market Revenue and Forecast, by Application (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Component (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.4.3. Market Revenue and Forecast, by Application (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Component (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Type (2021-2033)

11.5.5.3. Market Revenue and Forecast, by Application (2021-2033)

Chapter 12. Company Profiles

12.1. Alteryx, Inc.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Bentley Systems Incorporated.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. ESRI.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Fugro N.V.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. General Electric Company.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Google LLC

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Foursquare.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Trimble

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Maxar Technologies.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. SAP SE

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others