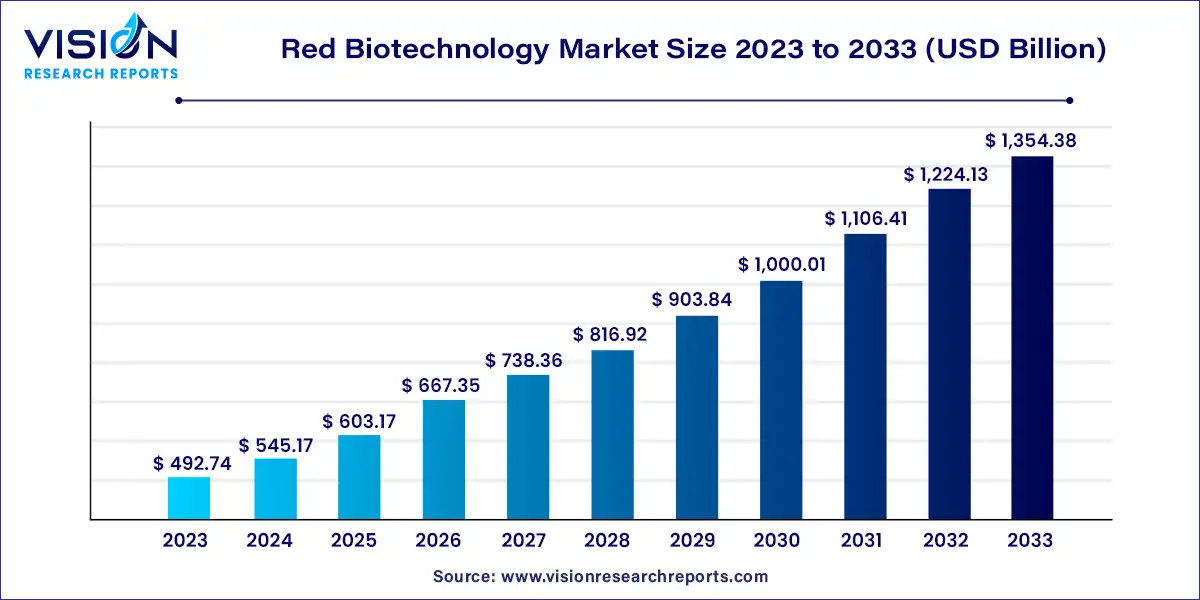

The global red biotechnology market size was estimated at around USD 492.74 billion in 2023 and it is projected to hit around USD 1,354.38 billion by 2033, growing at a CAGR of 10.64% from 2024 to 2033.

Red biotechnology, also known as medical biotechnology, encompasses the development and application of biotechnological techniques to improve human health and well-being. This sector focuses on medical advancements, including pharmaceuticals, diagnostics, medical devices, and regenerative medicine. The red biotechnology market plays a pivotal role in revolutionizing healthcare by offering innovative solutions to address various diseases and medical conditions.

The growth of the red biotechnology market is propelled by an advancements in biotechnological research and development have led to the discovery of novel therapeutic solutions, including biologics, gene therapies, and regenerative medicine techniques. These innovative approaches offer targeted treatments for various diseases, driving demand and market expansion. Additionally, the increasing prevalence of chronic diseases and age-related conditions necessitates the development of effective medical interventions, further fueling growth in the red biotechnology sector. Moreover, rising healthcare expenditure, coupled with government initiatives to promote biopharmaceutical innovation, creates a conducive environment for market growth. Furthermore, collaborations between pharmaceutical companies, research institutions, and academic centers facilitate knowledge exchange and accelerate the development of new therapies, contributing to the expansion of the red biotechnology market.

Monoclonal antibodies held the major share of the red biotechnology market with 44% in 2023. The rising prevalence of chronic diseases such as cardiovascular disease, cancer, etc. is increasing the demand for biologics, which is expected to serve as a key factor driving the segment's growth. Furthermore, the COVID-19 pandemic has fueled the development of several mAbs directed against the SARS-CoV-2 virus, which has increased market expansion prospects. The mAbs are a promising alternative for COVID-19 mitigation due to their safety and effectiveness, several of these antibodies have received emergency use authorizations from the U.S. FDA.

Gene therapy products are likely to witness the fastest growth in the market. It is expected to expand at a CAGR of 24.35% between 2024 and 2033. The growth can be attributed to factors such as the expansion of gene delivery technologies and advanced therapies, as well as the development of progressive competition among major market players focused on the commercialization of their therapies. According to the American Society of Gene & Cell Therapy (ASGCT), approximately 1,986 gene therapy products are in development, including genetically modified cell therapies and CAR T-cell therapies.

Pharmaceutical & biotechnology companies are expected to account for the largest market share in 2023. Pharmaceutical and biotechnology companies are dealing with a variety of challenging trends. The global demand for COVID-19 vaccines and therapeutics is increasing rapidly, placing an added burden on the industry. The company's ability to find an innovative way to provide COVID-19 vaccines while still meeting overall demand is remarkable, but rising global demand remains a significant long-term challenge for the industry. These businesses are experiencing a wave of innovation, from new treatment modalities to advanced analytics, smart machines, and digital connectivity.

CMOs & CROs is the fastest-growing sub-segment. It is expected to expand at a CAGR of 12.85% between 2024 and 2033. The increasing investment in the biotechnology industry by prominent players to enhance their efficiency and productivity has driven biopharmaceutical manufacturers to increase their focus on outsourcing services. Mergers and acquisitions allow CMOs to offer inclusive bioprocessing services, making CMOs/CROs a feasible option for rapid product launches. The market for CMOs and CROs is still in its early stages, but the introduction of novel therapeutics, new bioprocessing tools, and product priority shifts in the bio/pharmaceutical industry has increased the pressure on contract bio manufacturers.

North America accounted for the largest share of 39% in the market in 2023. The large share is mainly attributed to an increase in R&D activities and technological advancements in the field of biotechnology. The U.S. is among the key markets in the biotechnology industry. Major factors such as developed infrastructure, and the rise in the incidence of various diseases are driving the market growth in the region. For instance, In June 2023, a gene therapy developed by Bluebird Bio received support from advisors and is currently being evaluated by the U.S. FDA for the treatment of cerebral adrenoleukodystrophy in patients under the age of 18.

Asia Pacific will likely emerge as the fastest region during the study period. The emerging economies of Asia Pacific countries such as India, and China are majorly contributing to the growth of this region. These countries are involved into private-public collaborations, and government initiatives that are propelling the growth of Asian market.

By Product

By End-User

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others