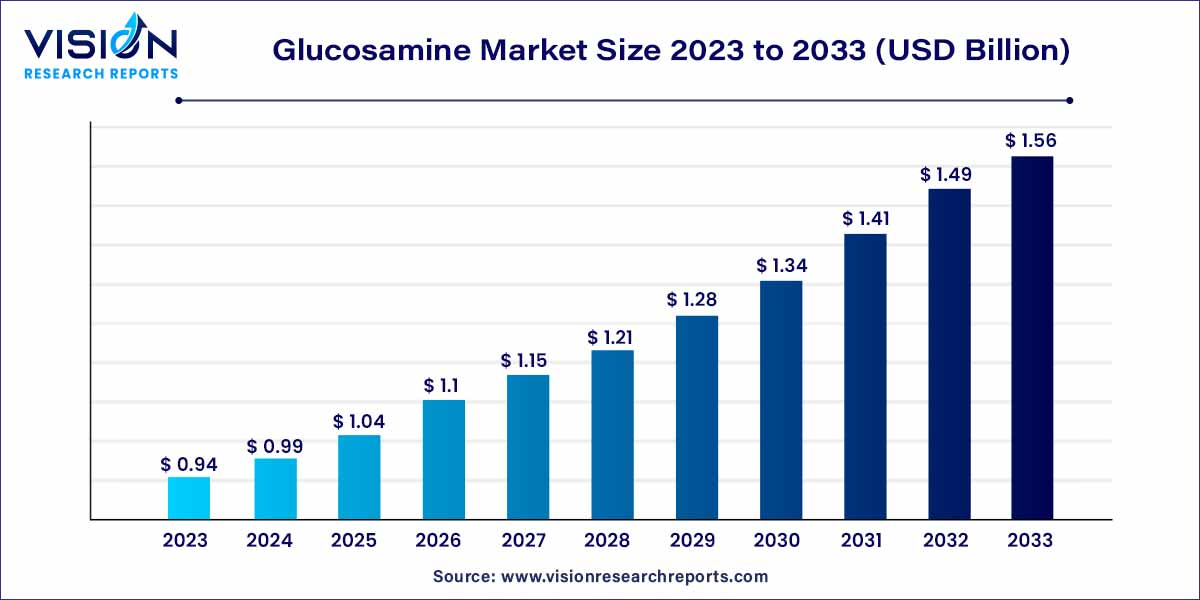

The global glucosamine market size was estimated at around USD 0.94 billion in 2023 and it is projected to hit around USD 1.56 billion by 2033, growing at a CAGR of 5.22% from 2024 to 2033.

Glucosamine, a naturally occurring compound found in healthy cartilage, serves as a fundamental building block for joint and cartilage maintenance. It plays a pivotal role in supporting joint flexibility and mobility, making it a popular choice for individuals suffering from joint-related ailments such as osteoarthritis. Glucosamine supplements, derived from shellfish shells or produced synthetically, have gained widespread popularity for their potential benefits in promoting overall joint health and alleviating discomfort.

The Glucosamine market is experiencing robust growth due to several key factors. Firstly, the rising aging population worldwide has led to an increased prevalence of joint-related ailments, driving the demand for Glucosamine supplements and products. Secondly, growing awareness about health and wellness, coupled with a proactive approach towards preventive healthcare, has spurred consumer interest in joint health solutions. Additionally, advancements in research and development have resulted in innovative formulations and efficient delivery systems, enhancing the efficacy of Glucosamine-based products. Moreover, the expanding market penetration of pharmaceutical and nutraceutical industries, along with strategic marketing initiatives, has further accelerated the market growth. These factors collectively contribute to the upward trajectory of the Glucosamine market, offering promising opportunities for manufacturers and stakeholders in the industry.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 1.56 billion |

| Growth Rate from 2024 to 2033 | CAGR of 5.22% |

| Revenue Share of Asia Pacific in 2023 | 48% |

| CAGR of Europe from 2024 to 2033 | 5.46% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The glucosamine sulfate segment accounted for the largest revenue share of 62% in 2023. Glucosamine Sulfate, derived from the shells of shellfish, is a widely utilized form known for its potential in managing joint-related ailments, particularly osteoarthritis. It is revered for its ability to help rebuild damaged cartilage and reduce joint pain and inflammation. Glucosamine Sulfate supplements are often preferred by individuals seeking natural remedies for joint health due to their perceived effectiveness in promoting overall joint flexibility and mobility. Moreover, this form of Glucosamine is commonly found in various dietary supplements, making it easily accessible to consumers looking to alleviate joint discomfort and enhance their quality of life.

The glucosamine hydrochloride segment is expected to grow at the fastest CAGR of 5.25% over the forecast period. Glucosamine Hydrochloride, another prevalent variant in the market, is often sourced from the chitin of shellfish shells. It is valued for its bioavailability, meaning the body can absorb and utilize it efficiently. Glucosamine Hydrochloride is widely used in dietary supplements and pharmaceutical formulations due to its stability and effectiveness. While both Glucosamine Sulfate and Glucosamine Hydrochloride share similar joint health benefits, the choice between them often depends on individual preferences, dietary restrictions, and specific health requirements. Some consumers opt for Glucosamine Hydrochloride supplements due to its slightly higher concentration of Glucosamine per weight, which can lead to smaller, easier-to-swallow pills.

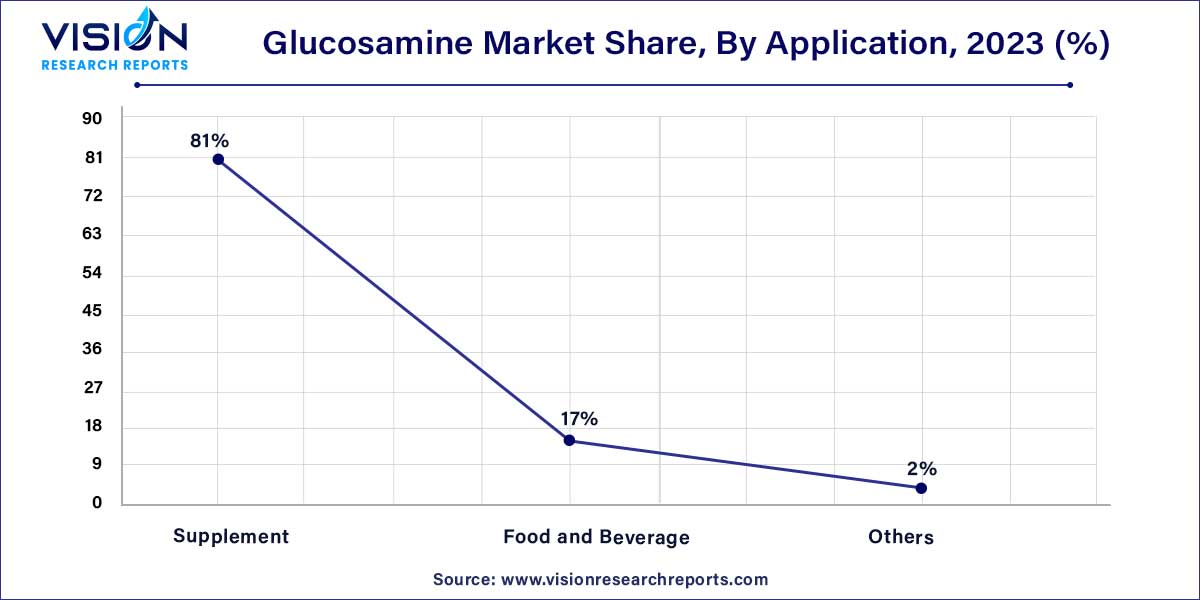

The supplement segment held the largest revenue share of 81% in 2023. As a dietary supplement, Glucosamine is widely recognized for its potential in promoting joint health and alleviating symptoms associated with joint-related conditions, particularly osteoarthritis. Many individuals turn to Glucosamine supplements to manage discomfort, enhance joint flexibility, and support overall mobility. The supplement industry has responded by offering a diverse range of Glucosamine products, including capsules, tablets, soft gels, and even liquid formulations. These supplements are often combined with other beneficial ingredients, catering to various consumer preferences and health needs. Moreover, Glucosamine supplements are readily available over-the-counter, making them accessible to a wide demographic seeking joint health solutions.

The food and beverages segment is expected to grow at the fastest CAGR of 4.46% over the forecast period. In the food and beverage sector, Glucosamine has found its way into functional foods and beverages, capitalizing on the growing trend of health-conscious consumers seeking wellness-enhancing products. Functional foods fortified with Glucosamine offer a convenient way for individuals to incorporate joint health support into their daily diet. These products range from fortified juices and energy drinks to snacks and meal replacement bars. By integrating Glucosamine into everyday food items, manufacturers have tapped into a broader market, appealing to consumers who prefer obtaining their nutrients through dietary choices rather than traditional supplements. The incorporation of Glucosamine into food and beverages aligns with the shift towards preventive healthcare, allowing consumers to proactively manage their joint health while enjoying everyday products.

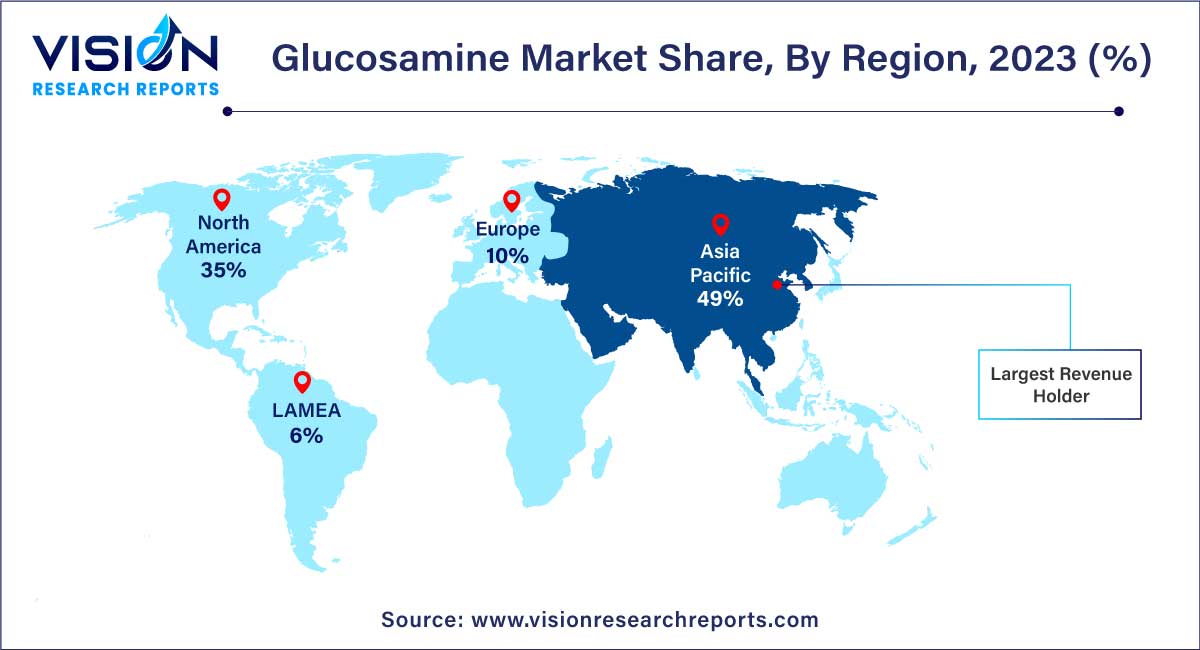

Asia Pacific dominated the market with the largest market share of 49% in 2023. Asia-Pacific, led by countries such as China, Japan, and India, is emerging as a lucrative market for Glucosamine. The region's vast population, coupled with rising disposable incomes and awareness about health and wellness, has created a substantial market demand. Traditional medicine practices, particularly in countries like China, have also contributed to the acceptance of Glucosamine supplements as part of holistic health management. Furthermore, the influence of e-commerce platforms has made Glucosamine products more accessible to consumers in remote areas, driving market expansion.

Europe is expected to grow at the fastest CAGR of 5.46% over the forecast period. In Europe, countries like Germany, France, and the United Kingdom have witnessed a surge in Glucosamine consumption, driven by a growing elderly population and an increasing trend towards preventive healthcare. The European market is characterized by a strong emphasis on natural remedies, aligning perfectly with Glucosamine supplements' appeal as a natural solution for joint health. Additionally, stringent regulatory standards ensure the quality and safety of Glucosamine products, bolstering consumer confidence and market growth.

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Glucosamine Market

5.1. COVID-19 Landscape: Glucosamine Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Glucosamine Market, By Product

8.1. Glucosamine Market, by Product, 2024-2033

8.1.1. Glucosamine Sulfate

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Glucosamine Hydrochloride

8.1.2.1. Market Revenue and Forecast (2021-2033)

8.1.3. N-acetyl glucosamine

8.1.3.1. Market Revenue and Forecast (2021-2033)

8.1.4. Others

8.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Glucosamine Market, By Application

9.1. Glucosamine Market, by Application, 2024-2033

9.1.1. Supplement

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Food and Beverage

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Others

9.1.3.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Glucosamine Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Koyo Chemical Industry Co., Ltd

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Laboratoires Expanscience

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Nutramax Laboratories Consumer Care, Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Amway

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. CELLMARK AB.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Alfa Chemical Group

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Cargill Incorporated

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Golden-Shell Pharmaceutical

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. SimplySupplements

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others