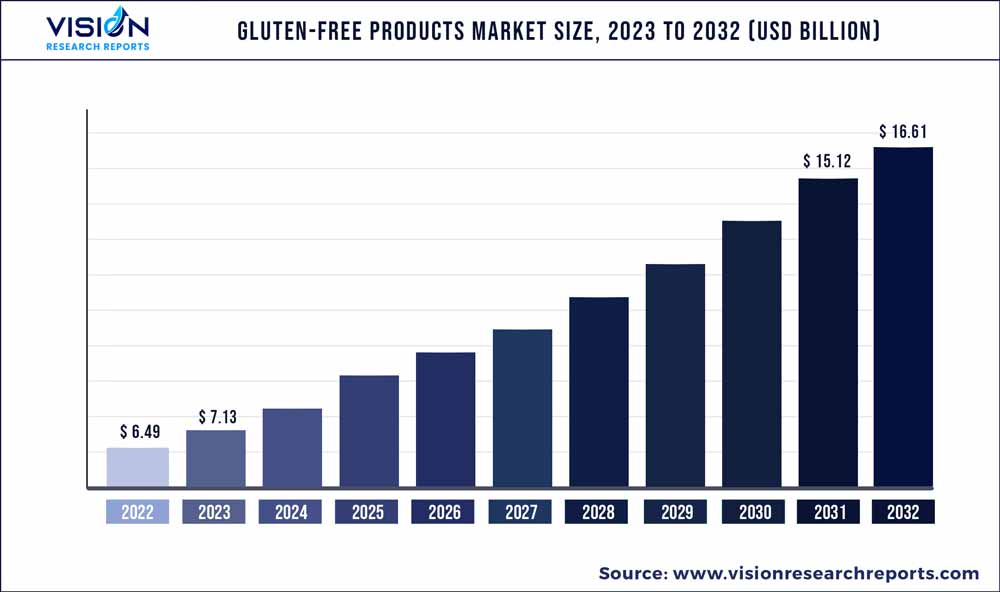

The global gluten-free products market was valued at USD 6.49 billion in 2022 and it is predicted to surpass around USD 16.61 billion by 2032 with a CAGR of 9.85% from 2023 to 2032. The gluten-free products market in the United States was accounted for USD 2 billion in 2022.

Key Pointers

Report Scope of the Gluten-free Products Market

| Report Coverage | Details |

| Revenue Share of North America in 2022 | 37% |

| CAGR of Asia Pacific from 2023 to 2032 | 12.13% |

| Revenue Forecast by 2032 | USD 16.61 billion |

| Growth Rate from 2023 to 2032 | CAGR of 9.85% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Conagra Brands, Inc.; The Hain Celestial Group; General Mills Inc.; Kellogg Co.; The Kraft Heinz Company; Hero Group; Barilla G. e R. Fratelli S.p.A; Seitz glutenfrei; Freedom Foods Group Ltd.; Ecotone |

The rising prevalence of celiac and other diseases owing to unhealthy lifestyles is expected to drive product demand. Prevention of health disorders, such as heart disease, diabetes, obesity, chronic pulmonary disease, and metabolic syndrome, is expected to drive market growth. The advent of the COVID-19 pandemic saw an exponential increase in the consumption of gluten-free products. This surge can be attributed to the increased health and wellness concerns among consumers during this period. Consumer interest in the nutritional functioning of foods has increased owing to the pandemic.

As consumers' definition of "wellness" has grown to include their emotional and mental well-being, food plays an important part in reaching these goals. Along with changing consumer mindset, the closing down of restaurants, cafés, and hotels resulted in increased consumption of home-cooked food and thereby, augmented the usage of gluten-free products including bread, cookies, cakes, and scones. The rising prevalence of irritable bowel syndrome (IBS) and celiac disease is anticipated to boost product demand in both developed and developing countries. Individuals with IBS experience sensitivity to gluten, and the consumption of gluten exacerbates their symptoms. The rising prevalence of these diseases in developed countries from North America and Europe, including the U.S., Canada, Germany, and France, is expected to drive the market demand.

Many consumers have embraced the diet of individuals for whom eating these products is a mandatory medical necessity inspired by those encouraging gluten-free diets for better health. As more people try new diets, such as the paleo or keto diets, individuals needing a gluten-free diet due to their existing medical conditions, as well as those who wish to lead a gluten-free life, are becoming the key drivers of market growth. As the world is witnessing a shift in consumer adoption of healthier food, consumers can now personalize their shopping experience to fit their unique nutritional demands through technological advancements. In-store nutritionists and color-coded shelf tags indicating nutritional properties of certain products, such as heart-healthy and gluten-free, have long been made available to customers by the retailers.

However, these efforts are relying heavily on more sophisticated technology that allows for greater personalization and customization of the consumer experience to fulfill individual nutritional demands. This has played a significant role in promoting the use of dairy-free products in customers’ diets. Technology trends including product innovations make these products more palatable. In addition, manufacturing processes are undergoing technological advancements to reduce product prices. The new manufacturing processes include extrusion cooking and annealing, which help in increasing the firmness of the product and decreasing the cooking loss. The product demand is also driven by the increasing obese population. Hence, pulses have become a major ingredient replacing wheat in gluten-free products. Some of the brands offering pulses in gluten-free foods are Tilda, Manna, Swasth, Dr. Gluten, and others.

Product Insights

The bakery products segment held the largest share of 29% of the overall revenue in 2022 and is expected to maintain its dominance over the forecast period. The increasing awareness about healthy eating, which encompasses natural, organic, and gluten-free foods, is projected to drive the growth of this segment. In addition, the presence of a diverse product portfolio with ongoing innovations is expected to positively influence market growth in the coming years. Increasing demand for gluten-free bread is the primary growth factor driving the bakery product segment growth. To meet this increased demand, packaged bread producers, notably the UK's main player, Warburtons, are developing free-from sub-brands of their flagship brands, which are becoming popular with consumers of all economic strata.

Several new bakery start-ups have emerged, offering gluten-free bread alternatives, such as NUCO's Coconut Wraps, introduced in the U.S., which is not only gluten-free but also checks all the other health terms like raw, paleo, organic, and vegan. The bakery products segment is also projected to register the fastest CAGR of 11.05% from 2023 to 2032 owing to the combination of affordable pricing and a diverse range of products. In addition, the convenience of ready-to-eat foods is expected to contribute to this positive impact on the segment's growth. Furthermore, the increasing recognition of the health advantages associated with baked goods, combined with the rapid pace of urbanization, is expected to propel growth.

Increased consumer awareness about the overall well-being and benefits of consuming natural products contributes to the development of new launches in this segment. Furthermore, the market growth is driven by increased demand from millennials, enhanced marketing efforts, and improvements in distribution channels. Bakery aisles are witnessing this trend going beyond bread to products, such as cakes, biscuits, pastries, pasta, and breakfast cereals. Gluten-free breakfast cereals are gaining immense popularity, and General Mills Inc. is making nearly 90% of its Cheerios breakfast cereals range gluten-free. Moreover, the migrating trend of consuming gluten-free from the West to the East has led to an exponential rise in demand for baked products in recent years.

Distribution channel Insights

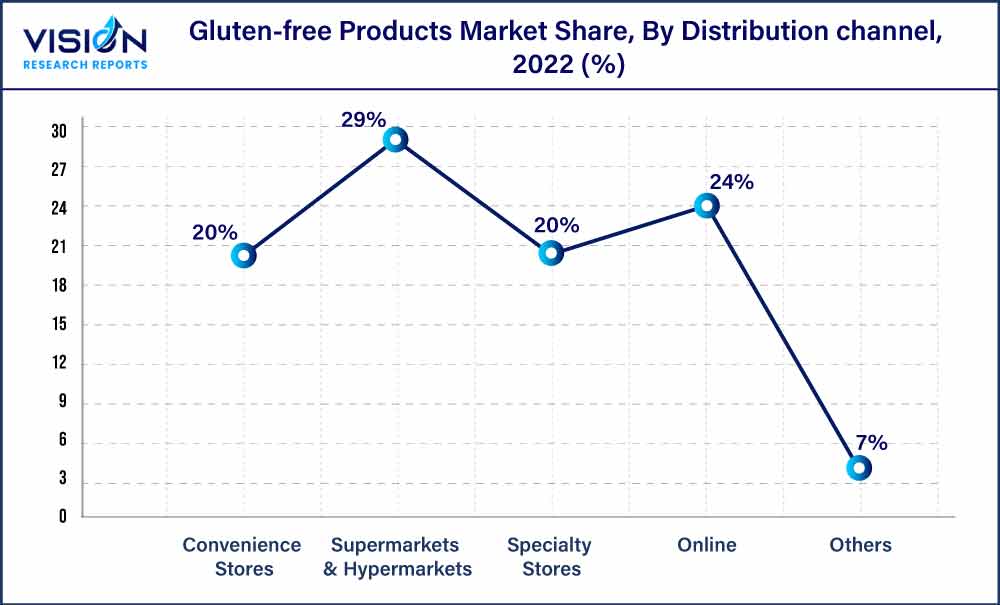

The supermarkets and hypermarkets segment accounted for the largest revenue share of 29% in 2022. As supermarkets & hypermarkets provide easy accessibility to a range of items under one roof, consumers find it easy to choose products from a variety of options. Seasonally driven displays, which include gluten-free products, play a role in promoting new goods and ultimately boosting segment growth. Supermarkets offer the advantage of catering to a single large consumer base, simplifying the operations compared to dealing with numerous smaller independent customers. With access to a substantial consumer base, supermarkets & hypermarkets have significant sales volumes.

Moreover, products that have national distribution benefit from increased brand recognition, resulting in higher sales volumes. Along with this, the supplier benefits from having a contract with big supermarkets, while they seek financial assistance for product development. Hence, manufacturers of these foods prefer selling through supermarkets and hypermarkets, thereby leading to higher penetration. The online segment is anticipated to witness the fastest CAGR of 11.94% from 2023 to 2032. The online channel provides various benefits that are particularly appealing to millennials and the younger generation, such as the convenience of shopping from home, doorstep delivery, free shipping, and discounts.

These advantages serve as key factors driving the preference for online shopping among these demographics. Furthermore, during the COVID-19 pandemic, online channels became a critical avenue for retailers despite a drop in overall retail spending. In addition, newer delivery models are making strides in the retail industry. For instance, customers and retailers equally prefer to click and collect (also known as BOPIS, buying online and picking up in-store) and curbside pickup. Customers may find pickup more convenient than home delivery as it allows them to retrieve their items whenever they choose, rather than having to wait for a delivery to arrive at their home. All these innovations in services are expected to boost segment growth over the forecast period.

Regional Insights

North America dominated the market in 2022 with a maximum revenue share of 37% and is expected to maintain its dominance over the forecast period. Gluten-free foods are perceived to ease digestive ailments, lower cholesterol levels, and be less fattening. These factors are anticipated to boost demand over the forecast period. Furthermore, their easy availability at nearly every grocery store is projected to boost the demand further, most notably in the U.S. The growth of the U.S. market is likely to be in line with the rising public awareness about celiac disease. Asia Pacific is expected to register the fastest CAGR of 12.13% from 2023 to 2032. The regional market exhibits promising conditions driven by factors, such as a growing internet penetration rate, a thriving e-commerce market, and favorable demographics.

Consumers in the region include not only individuals suffering from celiac disease or gluten intolerance/sensitivity but also those who are health-conscious and require these products for weight management. This region holds a potential growth opportunity owing to the increasing consumption of healthy diet foods and the unique marketing strategies adopted by key manufacturers to capture a substantial market share. Another emerging trend in the Asia Pacific regional market is the rise of health and wellness tourism, which is directly promoting the adoption of healthier foods. People are traveling in larger numbers to achieve greater well-being in their life. According to the Global Wellness Institute's recent research, Asia Pacific has the highest number of spas and is the fastest-growing market for wellness visits, and wellness tourism expenditure.

For instance, Bali has become renowned for modern gluten-free dishes, whereas Vietnam is the most popular destination for these foods in Asia. Europe held the second-largest market share of 29.04% in 2022 and is anticipated to show a similar trend during the forecast period. This is owing to changes in consumer demographics and a rise in disposable income levels. Countries, such as Germany, Italy, and the UK, have emerged as potential markets for the region’s growth, as consumers seek healthier food options. Europe has witnessed a significant rise in cases of food allergies and intolerances, including gluten intolerance. Thus, many individuals are opting for dairy-free diets to manage their symptoms and improve their overall well-being. This trend is driving the product demand in the region.

The European market has seen a notable expansion in the availability and variety of gluten-free products. Major food manufacturers and retailers are responding to the growing demand by offering a wider range of gluten-free options across various categories, including baked goods, pasta, snacks, and ready-to-eat meals. This increased accessibility and choice contribute to market growth.

Gluten-free Products Market Segmentations:

By Product

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Gluten-free Products Market

5.1. COVID-19 Landscape: Gluten-free Products Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Gluten-free Products Market, By Product

8.1. Gluten-free Products Market, by Product, 2023-2032

8.1.1. Bakery Products

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Dairy/ Dairy Alternatives

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Meats/ Meats Alternatives

8.1.3.1. Market Revenue and Forecast (2020-2032)

8.1.4. Condiments, Seasonings, Spreads

8.1.4.1. Market Revenue and Forecast (2020-2032)

8.1.5. Desserts & Ice Creams

8.1.5.1. Market Revenue and Forecast (2020-2032)

8.1.6. Prepared Foods

8.1.6.1. Market Revenue and Forecast (2020-2032)

8.1.7. Pasta and Rice

8.1.7.1. Market Revenue and Forecast (2020-2032)

8.1.8. Others

8.1.8.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Gluten-free Products Market, By Distribution Channel

9.1. Gluten-free Products Market, by Distribution Channel, 2023-2032

9.1.1. Convenience Stores

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Supermarkets & Hypermarkets

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Specialty Stores

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Online

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Gluten-free Products Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.1.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.2.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.3.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2020-2032)

10.4.6.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.3.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2020-2032)

10.5.4.2. Market Revenue and Forecast, by Distribution Channel (2020-2032)

Chapter 11. Company Profiles

11.1. Conagra Brands, Inc.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. The Hain Celestial Group

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. General Mills Inc.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Kellogg Co.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. The Kraft Heinz Company; Hero Group

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Barilla G. e R. Fratelli S.p.A

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Seitz glutenfrei

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Freedom Foods Group Ltd.

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Ecotone

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others