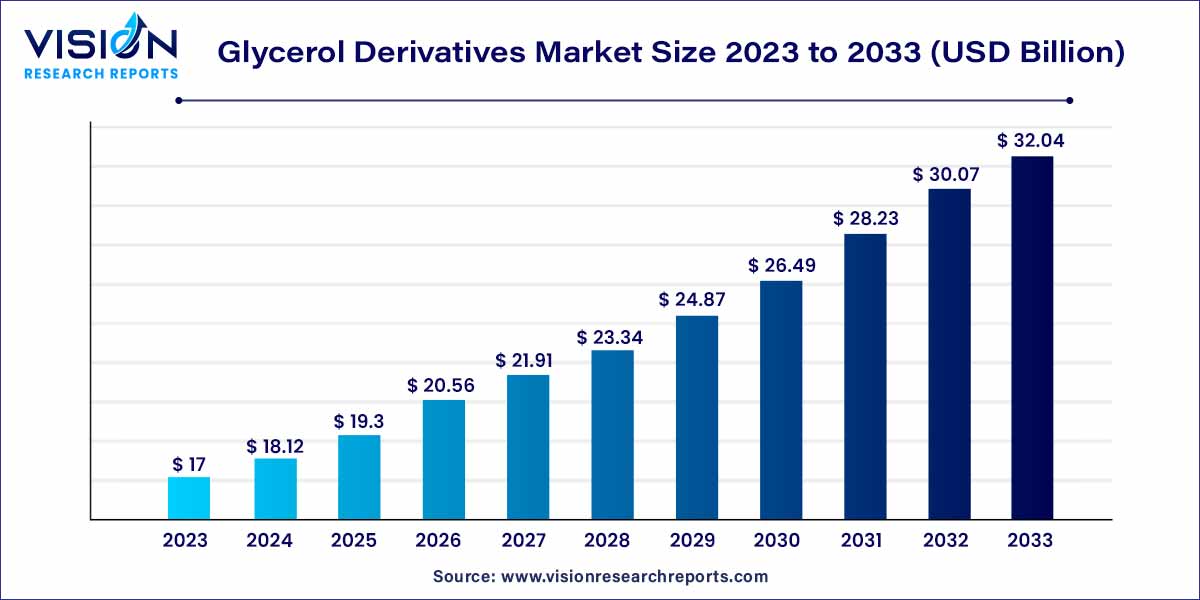

The global glycerol derivatives market size was estimated at around USD 17 billion in 2023 and it is projected to hit around USD 32.04 billion by 2033, growing at a CAGR of 6.54% from 2024 to 2033. The glycerol derivatives market is witnessing significant growth and transformation, driven by diverse applications across various industries.

The growth of the glycerol derivatives market is propelled by several key factors contributing to its expansion. Firstly, the increasing demand for sustainable and eco-friendly solutions has positioned glycerol derivatives as viable alternatives in various industries. Their versatile applications in pharmaceuticals, personal care, and food and beverages have significantly contributed to market growth. Additionally, the rising awareness among consumers regarding the benefits of glycerol derivatives, particularly in skincare and cosmetic products, has fueled their adoption. Moreover, the ongoing trend towards bio-based innovations has spurred research and development activities, leading to the creation of environmentally friendly glycerol derivatives. These factors collectively contribute to the market's positive trajectory, indicating a sustained upward growth in the glycerol derivatives sector.

| Report Coverage | Details |

| Market Revenue by 2032 | USD 32.04 billion |

| Growth Rate from 2024 to 2033 | CAGR of 6.54% |

| Revenue Share of Asia Pacific in 2023 | 40% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

The bio-based grade segment held the largest revenue share of 56% in 2023. This supremacy is attributed to the escalating demand for products that align with sustainability and ecological considerations. Derived from renewable sources like vegetable oils, bio-based glycerol derivatives are recognized for their enhanced sustainability and eco-friendly profile.

Bio-based glycerol derivatives are gaining widespread acceptance across diverse industries such as cosmetics, personal care, food and beverage, pharmaceuticals, and others. This surge in popularity is attributed to their distinctive characteristics, including high viscosity, moisturizing effects, and emulsifying properties. Furthermore, the heightened awareness regarding the detrimental effects of petrochemicals, coupled with the growing inclination towards natural and organic products, propels the expansion of the bio-based glycerol derivatives market.

Concurrently, the petroleum-based grade segment is experiencing notable growth, driven by mounting concerns about the environmental repercussions of petroleum-derived products. The escalating demand for sustainable and eco-friendly alternatives has prompted a notable shift towards bio-based glycerol derivatives. Despite this shift, the market for petroleum-based glycerol derivatives is anticipated to maintain significance, buoyed by sustained demand in existing applications and the exploration of new applications across various industries.

The polyglycerol segment had the largest market share of 33% in 2023. This prevalence can be attributed to the increasing utilization of polyglycerols as emulsifiers, solubilizing agents, and moisturizing agents. Recognized for their sustainability and environmental friendliness, polyglycerols stand out as a safer alternative to conventional petroleum-based emulsifiers, including ingredients like propylene glycol.

The food and beverage industry significantly contributes to the widespread use of polyglycerols, particularly as emulsifiers and solubilizing agents. Their application in baked goods, dairy products, and sauces enhances texture and stability. Furthermore, the escalating demand for natural and organic cosmetics and personal care products is a key driver propelling the growth of polyglycerols in the cosmetics and personal care industry.

The 1, 3-propanediol (PDO) product segment is experiencing noteworthy growth, primarily fueled by the expanding personal care and cosmetics industry. In this sector, PDO serves as a crucial component, employed as a moisturizing agent, solubilizer, and carrier in various skincare and hair care products. PDO also finds application in the food and beverage industry, where it serves as a humectant and emulsifier, enhancing the texture and stability of diverse products. As the demand for PDO continues its ascent, the overall market is expected to witness substantial growth in tandem with the increasing utilization of this versatile product.

Asia Pacific region dominated the market with the largest market share of 40% in 2023. This ascendancy is attributed to the surging demand for bio-based products, coupled with the increased need for personal care and pharmaceutical items, particularly in countries like China and India. Asia-Pacific stands out as a major hub for glycerol production and consumption, with China, India, and Indonesia ranking among the largest producers of both biodiesel and glycerol.

The robust growth of the food and beverage industry has been a significant catalyst for the market, especially as the food processing sector anticipates lucrative expansion in China. The Chinese market is poised for profitable growth in food manufacturing, boasting over 35,000 processing and manufacturing facilities. This growth is propelled by changing consumer lifestyles, increasing purchasing power, and a burgeoning middle-class population. These factors contribute to the rising demand for food additives, consequently driving the demand for glycerol derivatives in the country throughout the forecast period.

Europe, holding the position as a key global producer of glycerol and biodiesel, secures the second-largest share in the global market. Noteworthy producers in Europe include Germany, Italy, France, and the Netherlands. The continent exhibits a substantial demand for biofuels, with an expected increase in biodiesel production over the forecast period, positively influencing the glycerol derivatives market. The first quarter of 2022 witnessed an improved supply of glycerol derivatives, attributed to the availability of feedstock and large-scale biodiesel production.

By Grade

By Product

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Glycerol Derivatives Market

5.1. COVID-19 Landscape: Glycerol Derivatives Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Glycerol Derivatives Market, By Grade

8.1. Glycerol Derivatives Market, by Grade, 2024-2033

8.1.1. Bio-based

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Petroleum-based

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Glycerol Derivatives Market, By Product

9.1. Glycerol Derivatives Market, by Product, 2024-2033

9.1.1. 4-(hydroxymethyl)-1 3-dioxolan-2-one

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Polyglycerol

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Propane-1 2 3-triyl triacetate

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. 1 3 propanediol

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Propylene Glycol

9.1.5.1. Market Revenue and Forecast (2021-2033)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Glycerol Derivatives Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Grade (2021-2033)

10.1.2. Market Revenue and Forecast, by Product (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Grade (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Product (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Grade (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Product (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Grade (2021-2033)

10.2.2. Market Revenue and Forecast, by Product (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Grade (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Product (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Grade (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Product (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Grade (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Product (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Grade (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Product (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Grade (2021-2033)

10.3.2. Market Revenue and Forecast, by Product (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Grade (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Product (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Grade (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Product (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Grade (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Product (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Grade (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Product (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Grade (2021-2033)

10.4.2. Market Revenue and Forecast, by Product (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Grade (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Product (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Grade (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Product (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Grade (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Product (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Grade (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Product (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Grade (2021-2033)

10.5.2. Market Revenue and Forecast, by Product (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Grade (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Product (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Grade (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Product (2021-2033)

Chapter 11. Company Profiles

11.1. Zhangjiagang Glory Biomaterial Co., Ltd.

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Shell Chemical Lp

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Tokyo Chemical Industry Co., Ltd.

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. DuPont

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Solvay

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Croda International Plc

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Cargill, Incorporated

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Primient Covation LLC

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Haihang Industry Co., Ltd

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Sakamoto Yakuhin kogyo Co., Ltd.

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others