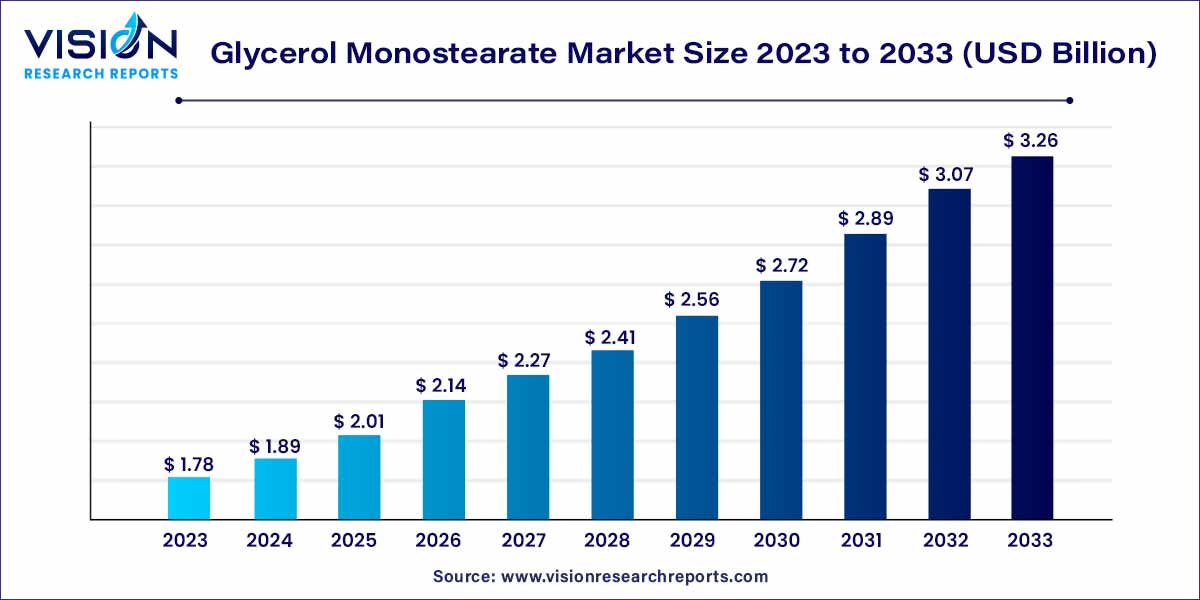

The global glycerol monostearate market size was estimated at USD 1.78 billion in 2023 and it is expected to surpass around USD 3.26 billion by 2033, poised to grow at a CAGR of 6.25% from 2024 to 2033. The glycerol monostearate market is driven by the demand for bio-based emulsifiers is on the rise, accompanied by a growing awareness of the advantages of glycerol monostearate across several key industries. These include personal care and cosmetics, food and beverages, and pharmaceuticals.

The glycerol monostearate market is witnessing significant growth and evolving trends driven by various factors such as increasing demand from the food and beverage industry, rising awareness regarding the benefits of glycerol monostearate in cosmetics and personal care products, and expanding applications in pharmaceuticals. This overview aims to provide insights into the current state of the glycerol monostearate market, key drivers influencing its growth, major players, and future prospects.

The growth of the glycerol monostearate market is propelled by several key factors. Firstly, increasing demand from the food and beverage industry serves as a primary driver. Glycerol monostearate's multifunctional properties as an emulsifier, stabilizer, and thickening agent make it indispensable in various food products, including baked goods, confectionery, and dairy items. Additionally, the rising preference for convenience foods and the need for enhanced texture and shelf life further boost its utilization in the food sector. Furthermore, expanding applications in cosmetics and personal care products contribute significantly to market growth. Glycerol monostearate serves as an effective emollient, emulsifier, and viscosity modifier in skincare formulations, aligning with the growing consumer demand for natural and functional ingredients. Lastly, emerging opportunities in pharmaceuticals, particularly in controlled-release formulations and lipid-based drug delivery systems, underscore the versatility and potential of glycerol monostearate in diverse industries. These growth factors collectively drive the expansion of the glycerol monostearate market, promising continued development and innovation in the years ahead.

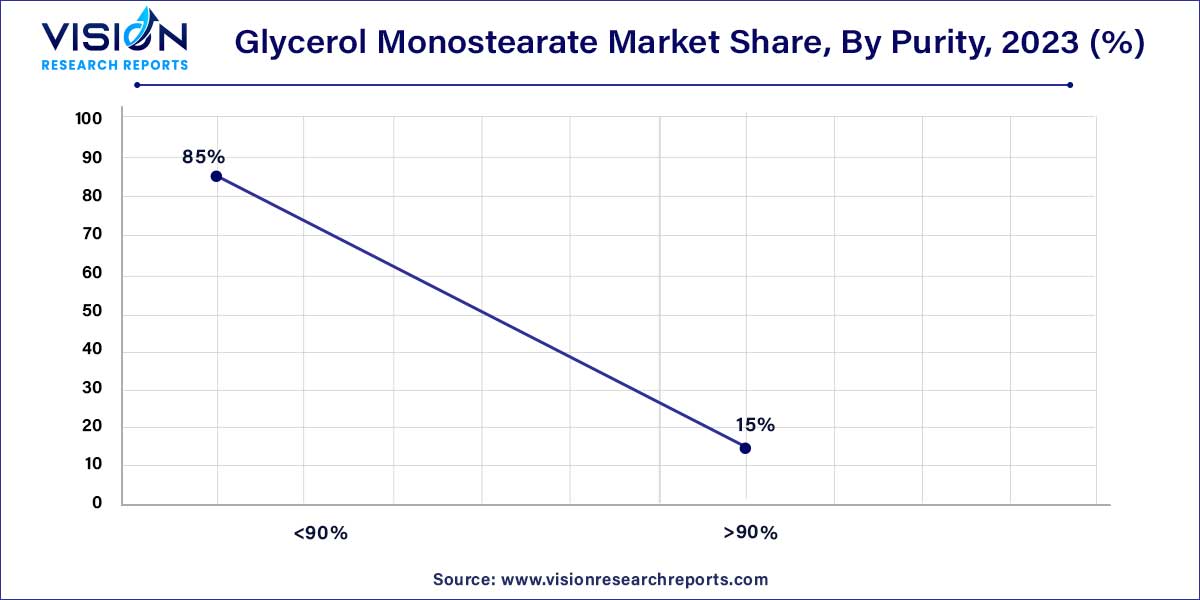

The <90% segment dominated the market and accounted for a revenue share of 85% in 2023. GMS with less than 90% purity typically contains impurities or lower levels of the desired compound. The presence of impurities, which can vary depending on production processes and quality control measures, results in altered physical properties such as melting and boiling points compared to pure GMS. Despite this, applications for GMS with less than 90% purity may still be found in industries where stringent purity requirements are not necessary.

On the other hand, the >90% pure GMS is the other major segment in GMS Market. This form of GMS consists primarily of glycerol and stearic acid, exhibiting a distinctive white color, waxy texture, and subtle fragrance. It is insoluble in water but soluble in organic solvents. Widely utilized across industries including food, pharmaceuticals, and cosmetics, >90% pure GMS serves essential functions as a stabilizer, thickening agent, and emulsifier.

In the food industry, <90% pure glycerol monostearate finds applications in improving the texture, consistency, and shelf life of various food products. For instance, in the baked goods segment, GMS is utilized in the production of bread, cakes, and pastries to enhance volume and moisture retention. It also plays a role in dairy products and confectionery items, preventing the formation of ice crystals and separation of cocoa solids and cocoa butter, respectively.

Emulsifiers dominated the market, representing a substantial revenue share of 41% in 2023. Glycerol monostearate (GMS), an ester of stearic acid and glycerol, possesses both hydrophilic and lipophilic characteristics, rendering it an effective emulsifier. Its molecular structure, comprising a hydrophilic head and a lipophilic tail, enables GMS to form stable oil-in-water emulsions by blending with oily substances. This unique feature not only stabilizes oil-water mixtures but also provides valuable thickening properties suitable for diverse applications.

Widely employed as a preservative in the food and cosmetics industries, glycerol monostearate interacts with both oil and water, exhibiting its dual hydrophilic and lipophilic nature. This enables GMS to create stable emulsions, thereby contributing to product preservation. Its capacity to inhibit microbial growth and prevent spoilage makes it indispensable in food, pharmaceutical, and cosmetic formulations.

Furthermore, GMS serves as an efficient thickener across various sectors owing to its distinct properties and mode of action. By aligning its hydrophilic head towards water and its lipophilic tail towards oil, GMS establishes a stable interface between the two phases, reducing interfacial tension.

Food and beverages dominated the market, comprising a substantial revenue share of 34% in 2023. Glycerol monostearate (GMS) serves a multitude of functions in the food and beverage industry, acting as a thickening agent, emulsifier, preservative, and anticaking agent. Its versatility has led to widespread adoption across various sub-industries within the food and beverages sector, including bakeries, beverages, packaged food, and others.

In the personal care and cosmetics industry, GMS is primarily utilized as a thickening agent, enhancing the texture and consistency of products such as lotions, creams, and moisturizers. By providing a thicker and more luxurious feel, GMS contributes to the stability and aesthetic appeal of these formulations. Additionally, glycerol monostearate acts as a moisture agent, functioning as a humectant that draws moisture from the environment and binds it to the skin, thereby enhancing hydration.

In 2023, Asia Pacific emerged as the dominant force in the market, capturing a significant revenue share of 31%. This substantial presence is attributed to the diverse industries thriving in the region. Glycerol monostearate (GMS) finds extensive application across various sectors in Asia Pacific, including pharmaceuticals, textiles, and paints & coatings. The region's remarkable industrial and economic growth, led by powerhouse economies such as India, China, and Japan, as well as emerging markets like Bangladesh and Vietnam, has bolstered the demand for GMS in Asia Pacific.

Meanwhile, North America stands out as another pivotal market for glycerol monostearate. The region boasts major end-users and a well-established food processing landscape, driven by increased consumption of processed foods. Additionally, the robust pharmaceutical industry in North America serves as a significant consumer of glycerol monostearate. Here, GMS is utilized to enhance the emulsifying properties of drugs and medicines, further solidifying its importance in the region's market landscape.

Europe serves as a significant market for glycerol monostearate (GMS), renowned for its widespread application as an emulsifier and stabilizer across diverse industries. Commonly utilized in the food and beverages sector, personal care products, pharmaceuticals, and various industrial applications, GMS plays a pivotal role in enhancing product quality and performance. The growth trajectory of the regional market is propelled by increasing demand for GMS, particularly driven by Europe's extensive personal care products and cosmetics industry.

By Purity

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Purity Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Glycerol Monostearate Market

5.1. COVID-19 Landscape: Glycerol Monostearate Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Glycerol Monostearate Market, By Purity

8.1. Glycerol Monostearate Market, by Purity, 2024-2033

8.1.1 <90%

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. >90%

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Glycerol Monostearate Market, By Application

9.1. Glycerol Monostearate Market, by Application, 2024-2033

9.1.1. Emulsifier

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Thickener

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Preservative

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Other Applications

9.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global Glycerol Monostearate Market, By End-use

10.1. Glycerol Monostearate Market, by End-use, 2024-2033

10.1.1. Food & Beverages

10.1.1.1. Market Revenue and Forecast (2021-2033)

10.1.2. Personal Care & Cosmetics

10.1.2.1. Market Revenue and Forecast (2021-2033)

10.1.3. Pharmaceuticals

10.1.3.1. Market Revenue and Forecast (2021-2033)

10.1.4. Other End-Uses

10.1.4.1. Market Revenue and Forecast (2021-2033)

Chapter 11. Global Glycerol Monostearate Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Purity (2021-2033)

11.1.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Purity (2021-2033)

11.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Purity (2021-2033)

11.1.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.1.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Purity (2021-2033)

11.2.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Purity (2021-2033)

11.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Purity (2021-2033)

11.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Purity (2021-2033)

11.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Purity (2021-2033)

11.2.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.2.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Purity (2021-2033)

11.3.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Purity (2021-2033)

11.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Purity (2021-2033)

11.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Purity (2021-2033)

11.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Purity (2021-2033)

11.3.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.3.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Purity (2021-2033)

11.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Purity (2021-2033)

11.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Purity (2021-2033)

11.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Purity (2021-2033)

11.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.6.3. Market Revenue and Forecast, by End-use (2021-2033)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Purity (2021-2033)

11.4.7.2. Market Revenue and Forecast, by Application (2021-2033)

11.4.7.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Purity (2021-2033)

11.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Purity (2021-2033)

11.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.4.3. Market Revenue and Forecast, by End-use (2021-2033)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Purity (2021-2033)

11.5.5.2. Market Revenue and Forecast, by Application (2021-2033)

11.5.5.3. Market Revenue and Forecast, by End-use (2021-2033)

Chapter 12. Company Profiles

12.1. Alpha Chemicals Private Limited.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Kao Corporation.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Evonik Industries AG.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. ACM Chemicals.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. BASF SE.

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others