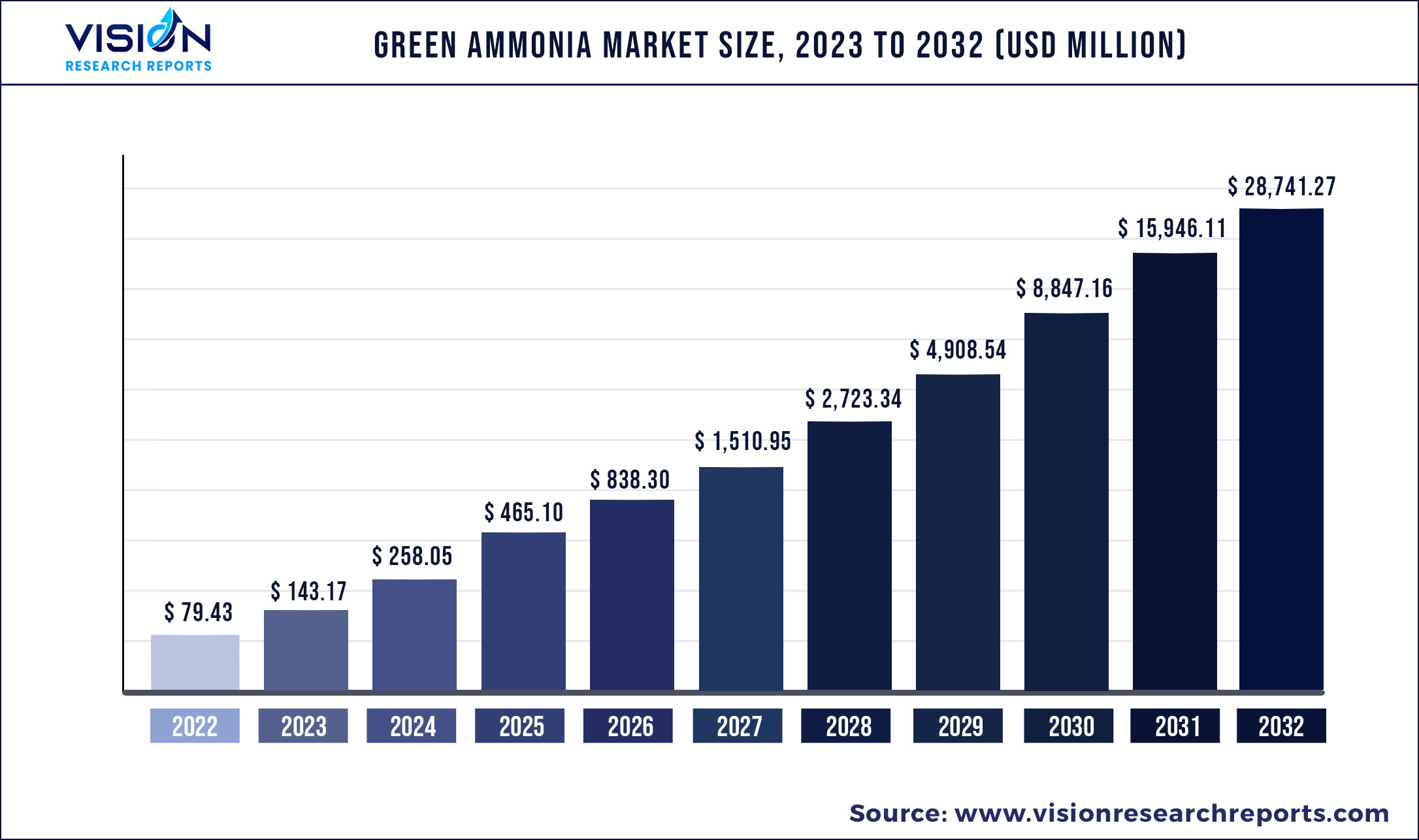

The global green ammonia market was surpassed at USD 79.43 million in 2022 and is expected to hit around USD 28,741.27 million by 2032, growing at a CAGR of 80.24% from 2023 to 2032.

Key Pointers

| Report Coverage | Details |

| Market Size in 2022 | USD 79.43 million |

| Revenue Forecast by 2032 | USD 28,741.27 million |

| Growth rate from 2023 to 2032 | CAGR of 80.24% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | MAN Energy Solutions; Siemens Energy; ITM Power PLC; Nel Hydrogen; Hydrogenics; ThyssenKrupp AG; McPhy Energy; Green Hydrogen Systems; EXYTRON; Electrochaea; Enapter; AquaHydrex; Yara International; BASF SE; Uniper ENGIE; Star fire Energy; Haldor Topsoe; Hiringa Energy; Queensland Nitrates Pty Ltd |

The increasing prevalence of green ammonia due to growing awareness of producing clean energy and reducing carbon footprint is expected to boost demand in the coming years. The increasing popularity of the product as marine fuel and shipping in the transportation industry as it emits zero carbon and leaves no sulfur traces which leads to improved air quality is further anticipated to drive market growth in the near future. Green ammonia is produced by hydrogen that comes from water and nitrogen from the air. It is a resourceful fuel for heat and power, especially for marine transport that can be used in gas turbines, internal combustion engines, generator sets, industrial furnaces, and fuel cells.

Due to pressure on the shipping sector to reduce carbon emissions, green ammonia is the best alternative, as it has less volumetric energy density, which makes storage feasible, as compared to other fuels. Additionally, the favorable rules and regulations related to low-carbon emissions and growing fuel demand from the marine industry are also propelling market growth.

Renewable ammonia is expected to become a commodity chemical by 2040. This is due to increasing initiatives by several governments towards low to zero carbon emissions. In the forecast period, the product is likely to become a prime commodity for transporting renewable energy across the regions. Further, the growing demand for green ammonia in various end-use industries including fertilizer, power generation, refrigeration transportation, and others is expected to propel industry growth. In addition, increasing demand for green ammonia in industrial feedstock products including pharmaceutical products is expected to trigger market growth.

The value chain depicts the vertical integration of key players, whose business operations range from raw material suppliers to the distribution of finished products. BASF SE, Yara International, ThyssenKrupp AG, and ITM Power PLC are the key players integrated across the value chain. Among these, Haldor Topsoe, Green Fuel, Yara International ASA, Statkraft AS, and Aker Clean Hydrogen are the key players undertaking R&D activities for the development of required green ammonia in respective markets.

Green Ammonia Market Segmentations:

| By Technology | By End-Use |

|

Solid Oxide Electrolysis Proton Exchange Membrane Alkaline Water Electrolysis |

Power Generation Transportation Fertilizer Refrigeration Others |

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Green Ammonia Market

5.1. COVID-19 Landscape: Green Ammonia Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Green Ammonia Market, By Technology

8.1. Green Ammonia Market, by Technology, 2023-2032

8.1.1. Solid Oxide Electrolysis

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Proton Exchange Membrane

8.1.2.1. Market Revenue and Forecast (2020-2032)

8.1.3. Alkaline Water Electrolysis

8.1.3.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Green Ammonia Market, By End-Use

9.1. Green Ammonia Market, by End-Use, 2023-2032

9.1.1. Power Generation

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Transportation

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Fertilizer

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Refrigeration

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Others

9.1.5.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Green Ammonia Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Technology (2020-2032)

10.1.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.1.3.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.1.4.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.3.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.4.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.5.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Technology (2020-2032)

10.2.6.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.3.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.4.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.5.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Technology (2020-2032)

10.3.6.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.3.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.4.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.5.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Technology (2020-2032)

10.4.6.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Technology (2020-2032)

10.5.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Technology (2020-2032)

10.5.3.2. Market Revenue and Forecast, by End-Use (2020-2032)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Technology (2020-2032)

10.5.4.2. Market Revenue and Forecast, by End-Use (2020-2032)

Chapter 11. Company Profiles

11.1. MAN Energy Solutions

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Siemens Energy

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. ITM Power PLC

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Nel Hydrogen

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Hydrogenics

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. ThyssenKrupp AG

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. McPhy Energy

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Green Hydrogen Systems

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. EXYTRON

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Electrochaea

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others