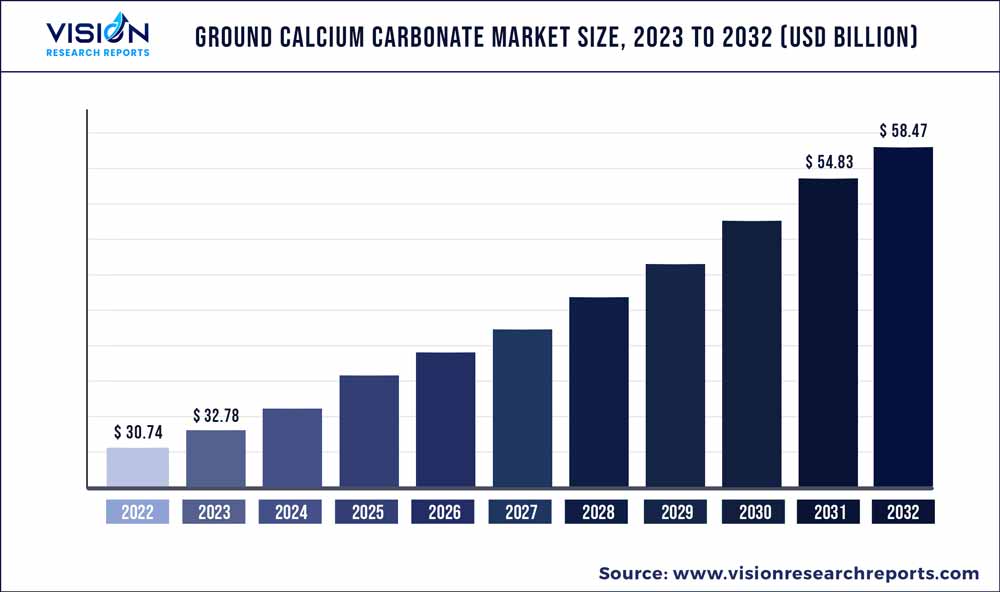

The global ground calcium carbonate market was valued at USD 30.74 billion in 2022 and it is predicted to surpass around USD 58.47 billion by 2032 with a CAGR of 6.64% from 2023 to 2032. The ground calcium carbonate market in the United States was accounted for USD 7.8 billion in 2022.

Key Pointers

Report Scope of the Ground Calcium Carbonate Market

| Report Coverage | Details |

| Revenue Share of Asia Pacific in 2022 | 41% |

| CAGR of North America from 2023 to 2032 | 6.93% |

| Revenue Forecast by 2032 | USD 58.47 billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.64% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Carmeuse; GCCP Resources Limited; Imerys; GLC Minerals; Gulshan Polyols Limited; US Aggregates; J.M. Huber Corporation; Omya AG; Mississippi Lime Company |

This is attributable to the increasing utilization of ground calcium carbonate (GCC) as a filler in the plastic, rubber, paper, paint, and ink industries. It is most commonly used in polymer composites to enhance physical properties and improve workability. Additionally, the cost of polymer composites can be reduced significantly by replacing expensive resins with affordable ground calcium carbonate fillers. The paper sector is one of the largest consumers of ground calcium carbonate products. Kaolin is a key substitute for calcium carbonate filler in paper applications. Calcium carbonate filler is gaining importance in the paper sector owing to the growing demand for brighter and bulkier papers.

The growing demand for calcium carbonate in the paper sector can be attributed to the particle size of GCC which helps in better water drainage compared to kaolin fillers. GCC filler material is used in the wood-free papermaking process. The advantages of the product such as cheap price and high brightness are contributing to the growth of GCC-based fillers.

GCC is widely used in adhesive and sealant applications. It is used to control shrinkage and reduce costs during production activity. In various formulations, it helps the product maintain physical strength, viscosity, and other properties. One of the key applications is in the hygiene industry. It comprises of feminine hygiene products, baby diapers, and adult incontinence products. In addition, it is also used in dietary supplements for maintaining the strength of bones, muscles, heart, and nervous system.

Ground calcium carbonate is manufactured by crushing and processing limestone to obtain the powder form of the product, which is classified based on specifications and properties. During the extraction of limestone from reserves, criteria such as color, purity, homogeneity, and thickness are taken into account to further process them. Processes involved in the production of GCC include removal of contamination, washing, classification based on particle size, and possibly drying. In the last stage, the calcium carbonate products are packed and delivered through various modes of transport.

Application Insights

The pulp & paper segment dominated the market with a revenue share of over 37% in 2022. This is attributed to the growing e-commerce industry that has increased demand for hygiene, food, and lightweight packaging products. Although calcium carbonate has various other mineral substitutes in pulp & paper applications, the product outperforms the rest. Ground calcium carbonate is used as a filler for manufacturing paper. Some factors favoring the usage of ground calcium carbonate for applications in the paper industry are high brightness and relatively low price, attainment of a porous surface of the paper sheet due to the rhombohedral particle shape.

The building & construction segment held the second-largest market share and is predicted to grow at the highest CAGR of 6.5% over the forecast period. The growth is attributed to the high demand for better public infrastructure including rail transport systems, airports, roadways, and harbors. Thus, driving the demand for calcium carbonate over the forecast period. Calcium carbonate is extensively used in the construction industry, both as a standalone building material and a cement additive. It is used in making mortar, joining bricks, roofing shingles, concrete blocks, stones, and tiles. Calcium carbonate decomposes to produce carbon dioxide and lime, both of which are used in the production of paper, glass, and steel. It is used in pipes and cables, roofing & flooring, siding & fencing, window profiling, and flooring, among others.

The product can be used as an additive or filler for several other applications, such as polymer, carpet backing, fiber cement, stucco, asphalt sealers, joint compounds, rubber, citric acid production, water treatment, and rock dust. It can also be used in textured plasters requiring coarse particles with high brightness to match the optical needs of end-use applications.

Regional Insights

The Asia Pacific region dominated the market with a revenue share of over 41% in 2022. The growth is attributed to the growing product demand owing to various factors such as economic growth, urbanization, and infrastructure development which has led to the growth of various industries such as building & construction, pulp & paper, and others. The Asia Pacific region with its diverse and growing industrial base has a significant demand for ground calcium carbonate across various sectors. The increasing population, rising health awareness, and growing pharmaceutical markets in countries like China, India, and Southeast Asian nations drive the demand for GCC in this sector.

China is considered a global manufacturing hub owing to favorable government regulations. The country has the advantage of easy availability of advanced manufacturing facilities and a skilled workforce, which are essential for the growth of the manufacturing sector. The growth of various end-use industries such as construction, automotive, and electronics in the country is anticipated to drive the demand for ground calcium carbonate-based products in China in the coming years.

North America accounted for a revenue share of over 32% in 2022 and is predicted to grow at a CAGR of 6.93% over the predicted years. The North American region has a thriving paints and coatings industry. GCC is used as a functional filler and pigment extender in the production of paints and coatings, improving durability, opacity, and rheological properties. The demand for architectural coatings, industrial coatings, and other surface finishing applications in the United States and Canada drives the consumption of GCC in this sector.

Ground Calcium Carbonate Market Segmentations:

By Application

By Regional

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Ground Calcium Carbonate Market

5.1. COVID-19 Landscape: Ground Calcium Carbonate Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Global Ground Calcium Carbonate Market, By Application

8.1.Ground Calcium Carbonate Market, by Application Type, 2023-2032

8.1.1. Automotive

8.1.1.1.Market Revenue and Forecast (2020-2032)

8.1.2. Building & Construction

8.1.2.1.Market Revenue and Forecast (2020-2032)

8.1.3. Pharmaceutical

8.1.3.1.Market Revenue and Forecast (2020-2032)

8.1.4. Agriculture

8.1.4.1.Market Revenue and Forecast (2020-2032)

8.1.5. Pulp & Paper

8.1.5.1.Market Revenue and Forecast (2020-2032)

8.1.6. Others

8.1.6.1.Market Revenue and Forecast (2020-2032)

Chapter 9. Global Ground Calcium Carbonate Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Application (2020-2032)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Application (2020-2032)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Application (2020-2032)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Application (2020-2032)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Application (2020-2032)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Application (2020-2032)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Application (2020-2032)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Application (2020-2032)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Application (2020-2032)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Application (2020-2032)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Application (2020-2032)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Application (2020-2032)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Application (2020-2032)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Application (2020-2032)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Application (2020-2032)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Application (2020-2032)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Application (2020-2032)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Application (2020-2032)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Application (2020-2032)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Application (2020-2032)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Application (2020-2032)

Chapter 10.Company Profiles

10.1. Carmeuse

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2. GCCP Resources Limited

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3. Imerys

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4. GLC Minerals

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5. Gulshan Polyols Limited

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6. US Aggregates

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7. J.M. Huber Corporation

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8. Omya AG

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9. Mississippi Lime Company

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others