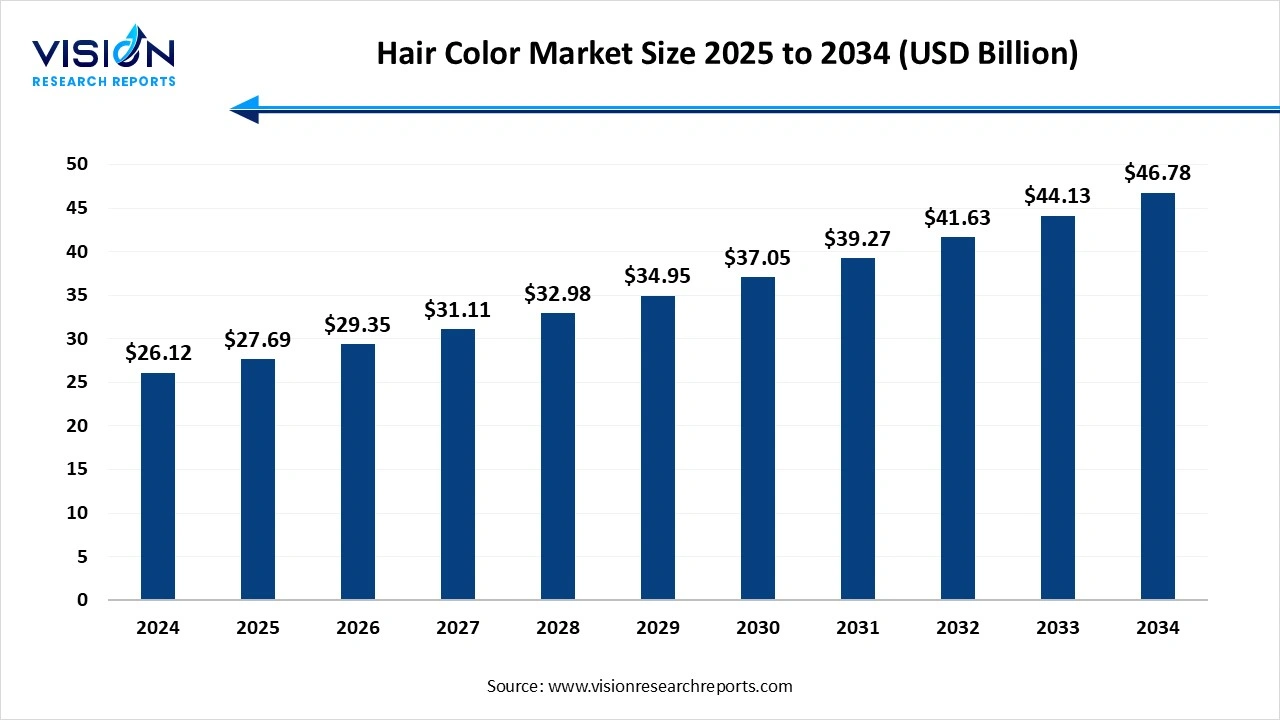

The global hair color market size was accounted at around USD 26.12 billion in 2024 and it is projected to hit around USD 46.78 billion by 2034, growing at a CAGR of 6% from 2025 to 2034. Market growth is driven by rising consumer interest in personal grooming and fashion trends, the hair color market is experiencing significant growth.

The global hair color market has been witnessing steady growth, driven by rising consumer interest in personal grooming, evolving beauty trends, and increasing demand for at-home hair coloring solutions. With a growing inclination toward fashion and self-expression, consumers especially among younger demographics are experimenting with a variety of hair shades, ranging from natural tones to bold and vibrant colors. Furthermore, the rise of social media influence, along with celebrity endorsements, has significantly fueled product awareness and brand engagement. Advancements in ammonia-free and organic formulations have also attracted health-conscious buyers, supporting sustained growth across both developed and emerging regions.

One of the key growth factors driving the hair color market is the increasing focus on personal appearance and self-expression, especially among millennials and Gen Z. As social media platforms continue to shape beauty standards, more individuals are embracing frequent hair transformations, including unconventional and seasonal shades. This trend is supported by the growing accessibility of DIY hair coloring kits, allowing users to experiment from home with ease.

Another major contributor to market expansion is the rising demand for natural, organic, and ammonia-free hair color products. Health-conscious consumers are increasingly seeking products with clean-label ingredients and fewer chemical additives. In response, manufacturers are investing in R&D to develop plant-based or less damaging formulations, broadening their appeal across age groups.

One of the primary challenges in the hair color market is the growing concern over chemical-based formulations and their potential side effects. Many conventional hair dyes contain ammonia, parabens, and other harsh ingredients that can cause scalp irritation, hair damage, or allergic reactions. This has led to consumer skepticism, especially among those with sensitive skin or pre-existing health conditions. As awareness increases, customers are demanding safer alternatives, putting pressure on manufacturers to reformulate products without compromising on color quality or longevity.

Another significant hurdle is intense market competition and price sensitivity, particularly in emerging economies. With numerous local and international brands vying for consumer attention, maintaining brand loyalty has become difficult. Additionally, counterfeit products and low-cost alternatives can damage brand reputation and reduce profit margins for established players.

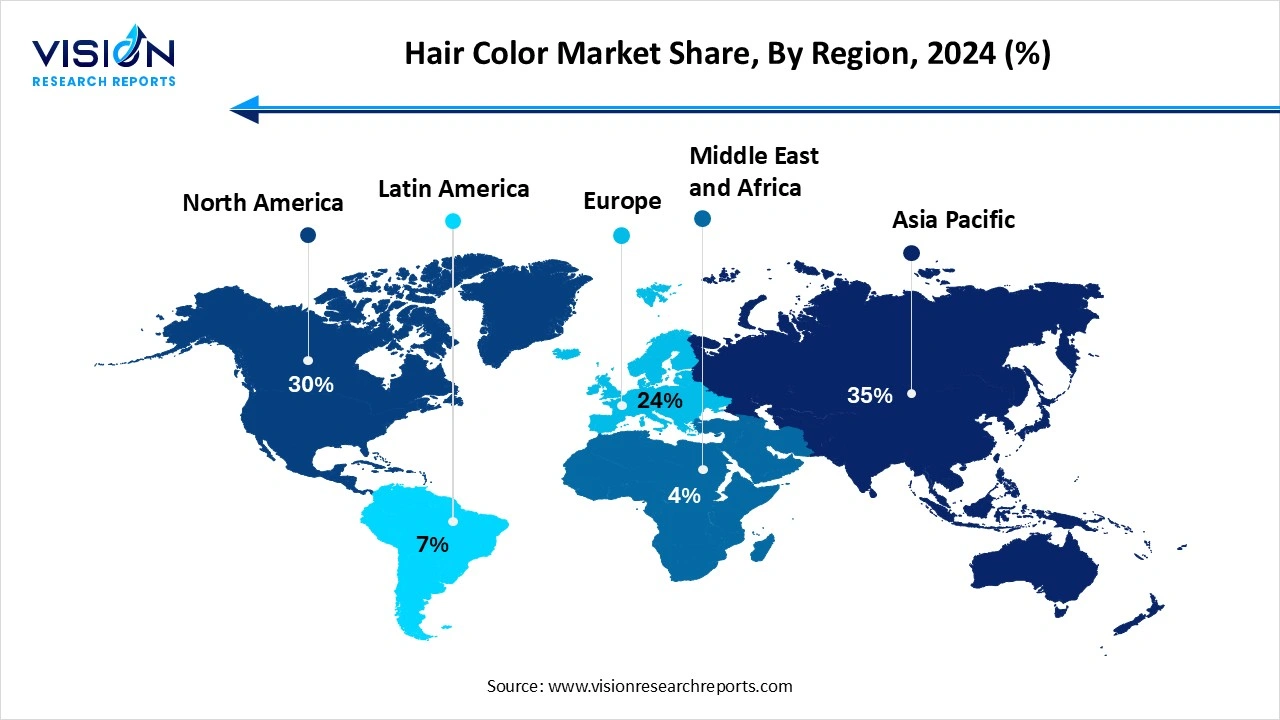

The Asia Pacific hair color market accounted for the highest revenue share, capturing 35% of the total market in 2024. Changing lifestyle preferences, combined with greater exposure to global fashion trends, have led to increased acceptance and experimentation with hair coloring among both men and women. The rapid growth of e-commerce and the popularity of K-beauty and J-beauty influences are further propelling market demand in the region.

The Europe hair color market is projected to experience the fastest growth, with a CAGR of 6.1% during the forecast period. The European market benefits from a strong tradition of hair coloring and a mature beauty industry that encourages regular use of color treatments across diverse age groups. Increasing consumer interest in sustainable, eco-friendly products is also influencing purchasing decisions, prompting companies to focus on natural and cruelty-free hair color solutions.

The Europe hair color market is projected to experience the fastest growth, with a CAGR of 6.1% during the forecast period. The European market benefits from a strong tradition of hair coloring and a mature beauty industry that encourages regular use of color treatments across diverse age groups. Increasing consumer interest in sustainable, eco-friendly products is also influencing purchasing decisions, prompting companies to focus on natural and cruelty-free hair color solutions.

The permanent hair color segment held a dominant revenue share of 72% in the overall hair color market. These products typically work by penetrating the hair shaft and altering the natural pigment through oxidative chemical reactions, offering color longevity that can last for several weeks. Consumers prefer permanent hair dyes for their durability, wide shade options, and the ability to dramatically transform hair color in a single application. This segment is particularly popular among the aging population, professionals, and individuals who prefer low-maintenance routines, making it a reliable and recurring revenue stream for manufacturers.

The temporary hair color segment is anticipated to expand at a CAGR of 6.4% between 2025 and 2034. Unlike permanent dyes, temporary hair colors coat the outer layer of the hair without altering its natural pigment, making them ideal for short-term use or special occasions. These products are especially popular for their ease of application and removal, often fading after one or two washes. The surge in fashion-forward trends and social media influence has led to a rise in the popularity of bold, non-traditional colors like pastel blue, neon green, and rose gold, which are often introduced as wash-out or spray-on variants.

The women represented the majority of hair color users, accounting for 73% of the total market revenue. Hair coloring has long been associated with female beauty routines, both as a means of enhancing appearance and expressing personal style. From covering greys to experimenting with trendy hues, women across all age groups drive consistent demand for both permanent and temporary hair color products. The expansion of women’s participation in the workforce and growing influence of fashion and social media platforms have further fueled this segment.

The adoption of hair color among men is projected to grow at a CAGR of 6.3% between 2025 and 2034. Men are increasingly open to using hair color not only to cover greys but also to enhance their overall appearance and maintain a youthful look. This shift has led to a surge in demand for hair coloring products designed specifically for men, including quick-application kits and discreet, natural-looking shades. The influence of media, celebrities, and social influencers has played a significant role in normalizing hair color use among men, especially in urban areas.

The offline channels accounted for 71% of the total revenue in the hair color industry in 2024. The offline distribution channel continues to dominate the global hair color market, largely due to consumer preference for in-store product assessment and immediate purchase options. Supermarkets, hypermarkets, drugstores, and specialty beauty retailers provide a wide array of brands and product types, allowing customers to compare shades, read labels, and seek expert advice before making a purchase.

The online sale of hair color is projected to grow at a CAGR of 6.3% from 2025 to 2034. Consumers are increasingly drawn to the ease of browsing a wide selection of products from the comfort of their homes, often accompanied by detailed descriptions, reviews, and tutorials. The online channel also enables direct-to-consumer sales, allowing brands to build stronger customer relationships and offer personalized shopping experiences. Discounts, subscription models, and influencer-driven marketing campaigns on social platforms have significantly boosted online sales, especially among younger and tech-savvy consumers.

By Product

By End user

By Distribution Channel

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Product Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Hair Color Market

5.1. COVID-19 Landscape: Hair Color Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Hair Color Market, By Product

8.1. Hair Color Market, by Product

8.1.1 Permanent

8.1.1.1. Market Revenue and Forecast

8.1.2. Temporary

8.1.2.1. Market Revenue and Forecast

8.1.3. Others

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Hair Color Market, By End user

9.1. Hair Color Market, by End user

9.1.1. Men

9.1.1.1. Market Revenue and Forecast

9.1.2. Women

9.1.2.1. Market Revenue and Forecast

Chapter 10. Global Hair Color Market, By Distribution Channel

10.1. Hair Color Market, by Distribution Channel

10.1.1. Offline

10.1.1.1. Market Revenue and Forecast

10.1.2. Online

10.1.2.1. Market Revenue and Forecast

Chapter 11. Global Hair Color Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Product

11.1.2. Market Revenue and Forecast, by End user

11.1.3. Market Revenue and Forecast, by Distribution Channel

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Product

11.1.4.2. Market Revenue and Forecast, by End user

11.1.4.3. Market Revenue and Forecast, by Distribution Channel

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Product

11.1.5.2. Market Revenue and Forecast, by End user

11.1.5.3. Market Revenue and Forecast, by Distribution Channel

11.2. Europe

11.2.1. Market Revenue and Forecast, by Product

11.2.2. Market Revenue and Forecast, by End user

11.2.3. Market Revenue and Forecast, by Distribution Channel

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Product

11.2.4.2. Market Revenue and Forecast, by End user

11.2.4.3. Market Revenue and Forecast, by Distribution Channel

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Product

11.2.5.2. Market Revenue and Forecast, by End user

11.2.5.3. Market Revenue and Forecast, by Distribution Channel

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Product

11.2.6.2. Market Revenue and Forecast, by End user

11.2.6.3. Market Revenue and Forecast, by Distribution Channel

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Product

11.2.7.2. Market Revenue and Forecast, by End user

11.2.7.3. Market Revenue and Forecast, by Distribution Channel

11.3. APAC

11.3.1. Market Revenue and Forecast, by Product

11.3.2. Market Revenue and Forecast, by End user

11.3.3. Market Revenue and Forecast, by Distribution Channel

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Product

11.3.4.2. Market Revenue and Forecast, by End user

11.3.4.3. Market Revenue and Forecast, by Distribution Channel

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Product

11.3.5.2. Market Revenue and Forecast, by End user

11.3.5.3. Market Revenue and Forecast, by Distribution Channel

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Product

11.3.6.2. Market Revenue and Forecast, by End user

11.3.6.3. Market Revenue and Forecast, by Distribution Channel

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Product

11.3.7.2. Market Revenue and Forecast, by End user

11.3.7.3. Market Revenue and Forecast, by Distribution Channel

11.4. MEA

11.4.1. Market Revenue and Forecast, by Product

11.4.2. Market Revenue and Forecast, by End user

11.4.3. Market Revenue and Forecast, by Distribution Channel

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Product

11.4.4.2. Market Revenue and Forecast, by End user

11.4.4.3. Market Revenue and Forecast, by Distribution Channel

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Product

11.4.5.2. Market Revenue and Forecast, by End user

11.4.5.3. Market Revenue and Forecast, by Distribution Channel

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Product

11.4.6.2. Market Revenue and Forecast, by End user

11.4.6.3. Market Revenue and Forecast, by Distribution Channel

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Product

11.4.7.2. Market Revenue and Forecast, by End user

11.4.7.3. Market Revenue and Forecast, by Distribution Channel

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Product

11.5.2. Market Revenue and Forecast, by End user

11.5.3. Market Revenue and Forecast, by Distribution Channel

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Product

11.5.4.2. Market Revenue and Forecast, by End user

11.5.4.3. Market Revenue and Forecast, by Distribution Channel

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Product

11.5.5.2. Market Revenue and Forecast, by End user

11.5.5.3. Market Revenue and Forecast, by Distribution Channel

Chapter 12. Company Profiles

12.1. L'Oréal S.A.

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Coty Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. Henkel AG & Co. KGaA.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Revlon, Inc.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5 Kao Corporation

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6 Unilever PLC

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Godrej Consumer Products Limited.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. Shiseido Company, Limited

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9 Hoyu Co., Ltd.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10 Amorepacific Corporation

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others