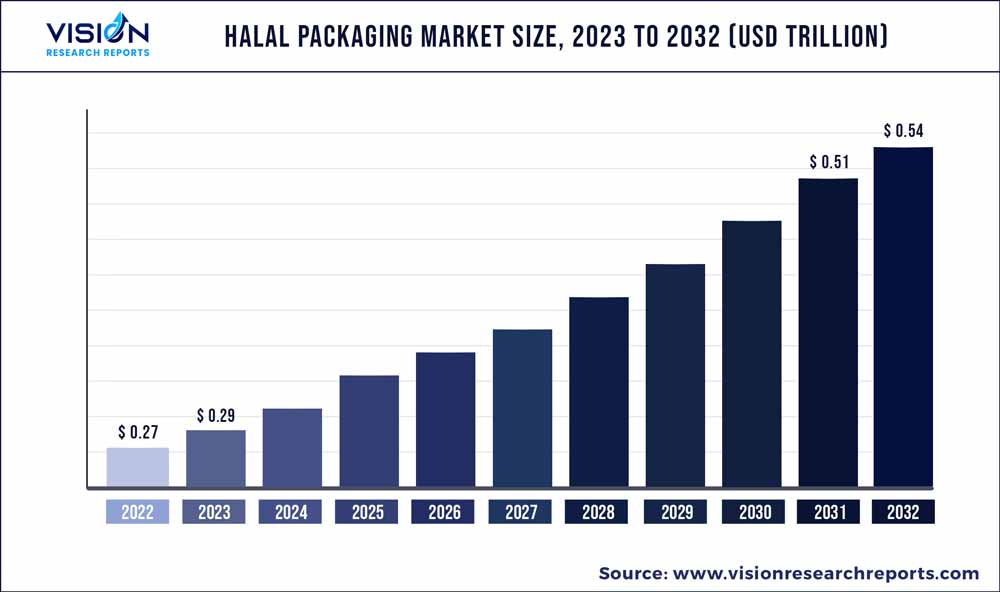

The global halal packaging market was valued at USD 0.27 trillion in 2022 and it is predicted to surpass around USD 0.54 trillion by 2032 with a CAGR of 7.25% from 2023 to 2032. The halal packaging market in the United States was accounted for USD 27.9 billion in 2022.

Key Pointers

Report Scope of the Halal Packaging Market

| Report Coverage | Details |

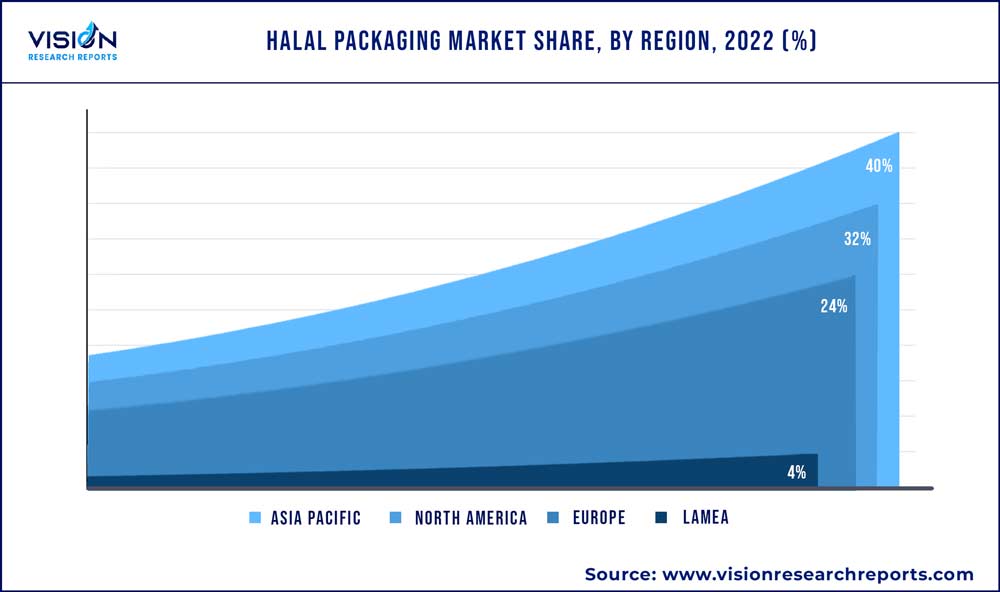

| Revenue Share of Asia Pacific in 2022 | 40% |

| Revenue Forecast by 2032 | USD 0.54 trillion |

| Growth Rate from 2023 to 2032 | CAGR of7.25% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Companies Covered | Amcor plc; Pacmoore Products Inc.; AIE Pharmaceuticals, Inc.; Rootree; Cardia Bioplastics; Albea Indonesia; Asia Pulp and Paper (APP) Indonesia; PT Champion Pacific Indonesia Tbk; Avesta Continental Pack; MM Karton; Huhtamaki Group; and Constantia Flexibles |

This market growth is attributed to the growing consumer awareness regarding Halal-Certified packaging products and increased consumer demand for organic packaging solutions. Halal packaging refers to packaging solutions that are manufactured using halal raw ingredients which exclude animal derivatives from its composition. The materials are not just limited to raw material used for packaging but also the lubricants used in the equipment used for manufacturing of the packaging.

The implementation of halal certification in the U.S. traces back to 1915 in New York, following the issuance of the Kosher Certificate, which certifies compliance with Jewish kosher dietary requirements and laid the foundation for the development of halal certification in the country. The halal packaging market in the country is dominated by major certification bodies such as the Islamic Society of North America (ISNA), Islamic Food and Nutrition Council of America (IFANCA), American Halal Foundation (AHF), and Islamic Services of America (ISA), which play a significant role in providing halal certifications to ensure compliance with Islamic dietary laws and regulations for products.

Furthermore, the growing exports of products to countries such as Dubai, Oman, United Arab Emirates, Qatar, Pakistan, Malaysia, and Indonesia have increased the demand for halal packaging certified by regulatory bodies in the U.S. These countries have their own specific regulatory standards for halal products, and the certification helps U.S. packaging manufacturers to meet those halal standards and access these export markets.

Type insights

Based on type, the halal packaging market is categorized into rigid and flexible packaging. Among which rigid packaging accounted for a significant share of over 55% in the base year 2022. This is attributed to the fact that rigid packaging ensures that the packaged products remain uncontaminated and maintain their integrity throughout the supply chain. Rigid packaging materials like bottles, jars, cans, and blister packs provide protection against external factors, such as moisture, light, and physical damage, which could compromise the halal status of the products.

The flexible packaging segment is expected to grow owing to its lightweight, portability, and easy-to-handle features. Flexible packaging often requires less material and transportation space, resulting in lower production and shipping costs. This cost efficiency is appealing to both producers and consumers, which further contributes to the growing demand for flexible halal packaging market.

Product Insights

Based on product, the halal packaging market is further segmented into bottles & jars, bags & pouches, films & labels, trays, pails & bucket, tubes & blisters, and others. Among these, the bottles & jars recorded the highest market share of over 27% in 2022. This can be attributed to their extensive application in various end-use industries, including food & beverage, personal care, and pharmaceutical products that comply with halal requirements. Packaging manufacturers are focusing on meeting the evolving demands of consumers seeking halal-compliant products by offering halal-certified packaging materials and investing in innovative designs. For instance, Albéa Services S.A.S., a cosmetics and personal care packaging solutions manufacturer, provides halal-certified bottles & jars to cater to the growing consumer demand for halal cosmetic packaging solutions.

The bags and pouches segment is driven by additional features that enhance product protection and user-friendliness, such as resealable zippers, spouts, tear notches, and handles. These features provide convenience and ensure the integrity of halal-certified products. Several companies, including Rootree, Core Pax (M) Sdn. Bhd, and Nsix Industry Sdn. Bhd, offer halal bags and pouches to cater to the food & beverage, and pharmaceuticals sectors. Halal certified bags can be used for packaging of Modest Fashion falling under modest fashion.

The films & labels segment is driven by a wide demand in the personal care and food & beverages industry. Halal-certified films are extensively used in the packaging of food & beverage items including meats, snacks, and frozen foods. These films provide essential barrier properties that effectively preserve the freshness and quality of these products. They offer protection against moisture, oxygen, and other external factors that can potentially compromise the halal status of the packaged food, thereby driving the demand for halal packaging in the market.

End-use Insights

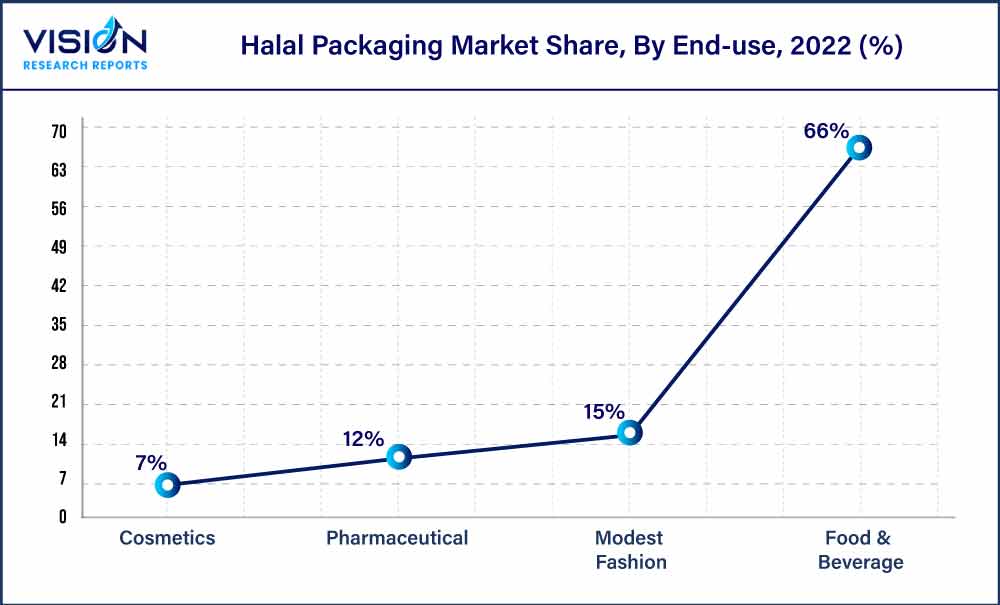

Based on end-use, the halal packaging market is classified into food & beverages, pharmaceutical, cosmetics, and Modest Fashion. Among these, the food & beverage recorded a higher market share of over 66% in 2022 owing to the increasing popularity of halal food & beverages among Muslim consumers. The rise in consumer awareness regarding packaging adhesives that may contain animal fats has led to a shift in demand towards halal-certified food packaging solutions. Consequently, food packaging manufacturers are actively pursuing halal certifications to meet the requirements of a large population of halal food & beverages consumers.

The pharmaceutical packaging market in Malaysia is experiencing significant growth, driven by regulatory bodies such as the Department of Islamic Development in Malaysia (JAKIM), Malaysian Standards Department, and the Halal Development Corporation. These bodies set halal standards for manufacturing halal pharmaceutical packaging, ensuring that it does not contain animal derivatives or other impure ingredients. Additionally, the adoption of serialization and track-and-trace technologies is increasing in the halal pharmaceutical packaging sector as they help ensure the authenticity and integrity of halal-certified products throughout the supply chain. By implementing these technologies in halal packaging, manufacturers can enhance consumer trust, improve product safety, and contribute to the growth of the halal packaging market.

The demand for halal cosmetic packaging is driven by various government regulations implemented in different countries. For instance, the GCC countries, including Saudi Arabia, United Arab Emirates, Qatar, Oman, Bahrain, and Kuwait, have their own regulations for halal cosmetics. Regulatory bodies like the Emirates Authority for Standardization and Metrology (ESMA) in the UAE require cosmetic companies to obtain halal certification to market their products as halal. These government regulations have led to the emergence of packaging companies, such as Albéa and Meiyume, that specialize in offering halal cosmetic packaging solutions, thereby driving the demand for halal packaging in the market cosmetics segment.

The demand for halal Modest Fashion is experiencing significant growth due to the increasing consumer awareness regarding halal principles and the rising number of vegan consumers. Halal Modest Fashion excludes materials such as cashmere, silk, leather, and wool, which are derived from animals and may involve animal cruelty. Instead, halal Modest Fashion products focus on using synthetic fibers that are entirely man-made and serve as suitable substitutes for non-halal Modest Fashion materials. This shift towards synthetic fibers allows for the production of Modest Fashion items that align with halal standards and cater to the preferences of ethical and environmentally conscious consumers.

Regional Insights

The Asia Pacific region accounted for a significant market share of over 40% 2022 owing to several countries in the region such as Indonesia, Malaysia, Singapore, and Thailand, have established halal certification bodies or government agencies to oversee and regulate halal products, including packaging. Packaging manufacturers need to obtain halal certification to ensure their products meet the required standards. For instance, the Islamic Religious Council of Singapore (MUIS) is responsible for regulating, certifying, and providing guidelines for halal products, including packaging, through its Halal Certification Program. This proactive approach by regulatory bodies drives the growth of the halal packaging market in the region.

Indonesia plays a significant role in the halal packaging market in the Asia Pacific region. This is attributed to the Indonesian government implementing strict policies and regulations, such as the Halal Product Law introduced in 2019. According to this law, all consumer goods entering the country must obtain halal certification for sale and distribution without which the products could lead to bans and legal actions. For instance, a Korean instant noodles brand, Samyang entered the Indonesian market without clear labeling of its non-halal contents on the packaging. This led to the product being pulled off the shelves until it obtained the necessary halal certification and added the halal logo on its packaging to regain consumer trust in the country.

The Middle East & Africa with its predominantly Islamic culture drives significant demand for halal packaging. The rise in disposable income among consumers in the region has led to a substantial demand for cosmetics and personal care products. Consumers are increasingly willing to spend more on organic and halal-certified cosmetics and their packaging. To meet this growing demand, cosmetic manufacturers are adopting halal certification for their products and packaging. Companies such as Clara International Beauty Group, LLC, FX Cosmetics, Inika, One Pure, LLC, and Samina Pure Minerals Makeup Ltd are actively contributing to the halal packaging in the region.

Moreover, several government regulations in the regions varying from country-to-country fuel the market growth for halal packaging market. For instance, the Saudi Food and Drug Authority (SFDA) oversees the regulation of halal products, including packaging, in Saudi Arabia. The SFDA ensures that products meet halal requirements, and packaging materials and processes are in accordance with halal principles.

The demand for halal packaging is on the rise in North America due to growing consumer awareness and recognition of the benefits it offers. Consumers in the region are increasingly valuing halal-certified products, which provide assurance of quality, safety, and ethical production practices. Furthermore, North America is one of the major exporters of halal meat to the Middle East which further drives the demand for halal packaging in the region. Packaging manufacturers in North America such as Rootree and Cardia Bioplastics are obtaining halal certifications and adopting standardized labeling practices to clearly communicate the halal status of their products. This strategic approach not only ensures compliance with consumer preferences but also provides a competitive edge in the market. As a result, the market for halal packaging continues to grow steadily in North America.

The demand for halal packaging in Europe is experiencing significant growth as consumers prioritize the reliability and hygiene of products. This trend has prompted renowned food manufacturers like Nestlé and Ferrero to obtain halal certification for their products, thereby meeting the increasing consumer demand for halal packaging. To ensure compliance with European halal standards, regulatory bodies such as Halal Certification Europe (HCE) play a crucial role. HCE acts as a certification body, providing halal certification for various products, including packaging. Their certification process ensures that packaging materials and processes adhere to the required halal criteria, bolstering the growth of the halal packaging market in Europe.

The Central & South America market for halal packaging is driven by regulatory bodies and certification organizations across the region actively involved in setting standards and guidelines for halal certification, including packaging regulations. For instance, in Brazil, Instituto Halal is a halal certification and inspection body that offers certification services for various industries, including food & beverage, cosmetics & personal care, and pharmaceuticals. They ensure that the packaging solutions and its materials comply with halal standards. Moreover, the Halal Institute of Argentina promotes and regulates halal certification in Argentina. They work closely with various end-user industries to certify their products, including packaging, ensuring they meet halal standards and requirements.

Halal Packaging Market Segmentations:

By Type

By Product

By End-use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Type Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Halal Packaging Market

5.1. COVID-19 Landscape: Halal Packaging Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Halal Packaging Market, By Type

8.1. Halal Packaging Market, by Type, 2023-2032

8.1.1 Flexible

8.1.1.1. Market Revenue and Forecast (2020-2032)

8.1.2. Rigid

8.1.2.1. Market Revenue and Forecast (2020-2032)

Chapter 9. Global Halal Packaging Market, By Product

9.1. Halal Packaging Market, by Product, 2023-2032

9.1.1. Bottles & Jars

9.1.1.1. Market Revenue and Forecast (2020-2032)

9.1.2. Bags & Pouches

9.1.2.1. Market Revenue and Forecast (2020-2032)

9.1.3. Tubes & Blisters

9.1.3.1. Market Revenue and Forecast (2020-2032)

9.1.4. Trays, Cups, and Bucket

9.1.4.1. Market Revenue and Forecast (2020-2032)

9.1.5. Films & Labels

9.1.5.1. Market Revenue and Forecast (2020-2032)

9.1.6. Others

9.1.6.1. Market Revenue and Forecast (2020-2032)

Chapter 10. Global Halal Packaging Market, By End-use

10.1. Halal Packaging Market, by End-use, 2023-2032

10.1.1. Food & Beverage

10.1.1.1. Market Revenue and Forecast (2020-2032)

10.1.2. Pharmaceutical

10.1.2.1. Market Revenue and Forecast (2020-2032)

10.1.3. Cosmetics

10.1.3.1. Market Revenue and Forecast (2020-2032)

10.1.4. Modest Fashion

10.1.4.1. Market Revenue and Forecast (2020-2032)

Chapter 11. Global Halal Packaging Market, Regional Estimates and Trend Forecast

11.1. North America

11.1.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.2. Market Revenue and Forecast, by Product (2020-2032)

11.1.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.4. U.S.

11.1.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.1.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.1.5. Rest of North America

11.1.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.1.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.1.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2. Europe

11.2.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.4. UK

11.2.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.5. Germany

11.2.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.6. France

11.2.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.6.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.2.7. Rest of Europe

11.2.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.2.7.2. Market Revenue and Forecast, by Product (2020-2032)

11.2.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3. APAC

11.3.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.4. India

11.3.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.5. China

11.3.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.6. Japan

11.3.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.6.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.3.7. Rest of APAC

11.3.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.3.7.2. Market Revenue and Forecast, by Product (2020-2032)

11.3.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4. MEA

11.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.4. GCC

11.4.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.5. North Africa

11.4.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.6. South Africa

11.4.6.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.6.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.6.3. Market Revenue and Forecast, by End-use (2020-2032)

11.4.7. Rest of MEA

11.4.7.1. Market Revenue and Forecast, by Type (2020-2032)

11.4.7.2. Market Revenue and Forecast, by Product (2020-2032)

11.4.7.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5. Latin America

11.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.5.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.4. Brazil

11.5.4.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.4.2. Market Revenue and Forecast, by Product (2020-2032)

11.5.4.3. Market Revenue and Forecast, by End-use (2020-2032)

11.5.5. Rest of LATAM

11.5.5.1. Market Revenue and Forecast, by Type (2020-2032)

11.5.5.2. Market Revenue and Forecast, by Product (2020-2032)

11.5.5.3. Market Revenue and Forecast, by End-use (2020-2032)

Chapter 12. Company Profiles

12.1. Amcor plc

12.1.1. Company Overview

12.1.2. Product Offerings

12.1.3. Financial Performance

12.1.4. Recent Initiatives

12.2. Pacmoore Products Inc.

12.2.1. Company Overview

12.2.2. Product Offerings

12.2.3. Financial Performance

12.2.4. Recent Initiatives

12.3. AIE Pharmaceuticals, Inc.

12.3.1. Company Overview

12.3.2. Product Offerings

12.3.3. Financial Performance

12.3.4. Recent Initiatives

12.4. Rootree.

12.4.1. Company Overview

12.4.2. Product Offerings

12.4.3. Financial Performance

12.4.4. Recent Initiatives

12.5. Cardia Bioplastics

12.5.1. Company Overview

12.5.2. Product Offerings

12.5.3. Financial Performance

12.5.4. Recent Initiatives

12.6. Albea Indonesia

12.6.1. Company Overview

12.6.2. Product Offerings

12.6.3. Financial Performance

12.6.4. Recent Initiatives

12.7. Asia Pulp and Paper (APP) Indonesia.

12.7.1. Company Overview

12.7.2. Product Offerings

12.7.3. Financial Performance

12.7.4. Recent Initiatives

12.8. PT Champion Pacific Indonesia Tbk

12.8.1. Company Overview

12.8.2. Product Offerings

12.8.3. Financial Performance

12.8.4. Recent Initiatives

12.9. Avesta Continental Pack.

12.9.1. Company Overview

12.9.2. Product Offerings

12.9.3. Financial Performance

12.9.4. Recent Initiatives

12.10. MM Karton

12.10.1. Company Overview

12.10.2. Product Offerings

12.10.3. Financial Performance

12.10.4. Recent Initiatives

Chapter 13. Research Methodology

13.1. Primary Research

13.2. Secondary Research

13.3. Assumptions

Chapter 14. Appendix

14.1. About Us

14.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others