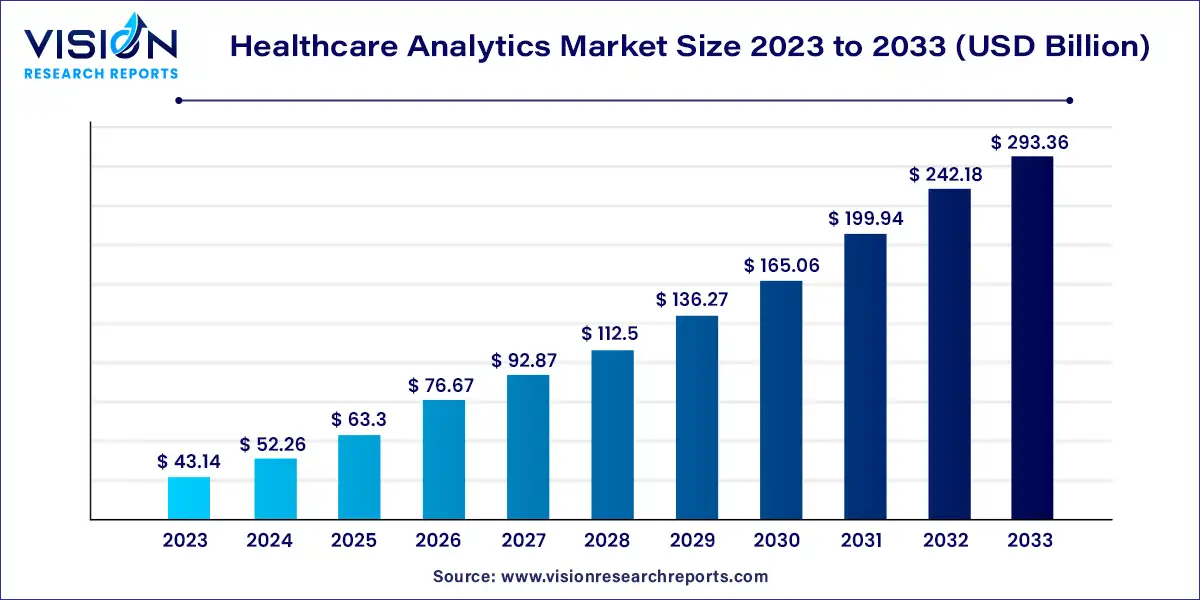

The global healthcare analytics market size was estimated at around USD 43.14 billion in 2023 and it is projected to hit around USD 293.36 billion by 2033, growing at a CAGR of 21.13% from 2024 to 2033. The healthcare analytics market is experiencing dynamic growth driven by advancements in technology, increasing demand for data-driven decision-making, and the need for improved patient outcomes. As healthcare systems worldwide transition from traditional methods to more sophisticated, data-centric approaches, the integration of analytics is becoming crucial for enhancing operational efficiency, reducing costs, and personalizing patient care.

The growth of the healthcare analytics market is driven by an increasing volumes of healthcare data generated from electronic health records (EHRs), wearable devices, and other digital health tools are propelling the need for advanced analytics solutions. These technologies enable healthcare providers to manage vast amounts of data efficiently and derive actionable insights to enhance patient care. Additionally, the rise in chronic diseases and the focus on value-based care are pushing healthcare organizations to adopt analytics for better disease management and outcome improvement. The integration of artificial intelligence (AI) and machine learning (ML) further amplifies the market growth by offering predictive capabilities and personalized treatment options. Moreover, the growing emphasis on reducing healthcare costs and improving operational efficiencies continues to drive investment in analytics solutions, underscoring their critical role in transforming healthcare delivery and management.

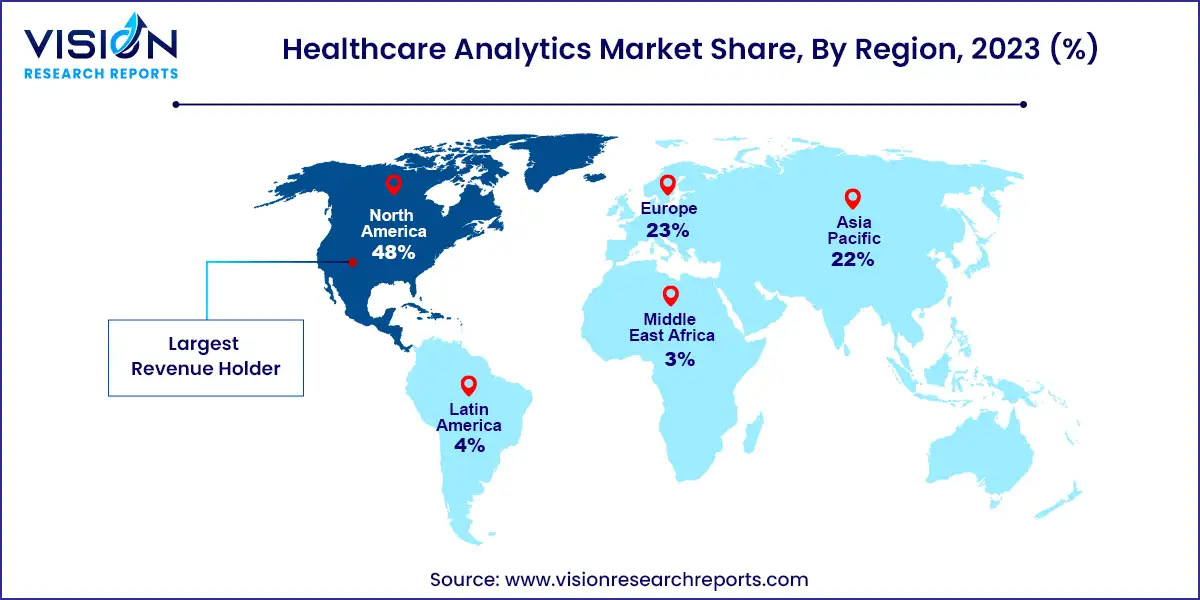

North America North America led the market with a 48% share in 2023, thanks to advanced healthcare facilities, widespread technology adoption, and the presence of key players. The rising prevalence of chronic conditions and an aging population further necessitate the adoption of analytics tools. For example, Microsoft's launch of Microsoft Cloud for Healthcare in March 2022 exemplifies regional leadership in leveraging technology for improved patient care.

Asia Pacific The Asia Pacific region is expected to grow at the fastest rate of 22.93% from 2024 to 2033. Rapid development, increased spending capacity, and a growing population contribute to this growth. Advancements in the region’s healthcare industry and rising IT adoption are driving the expansion. For instance, the Australian healthcare analytics start-up Prospection’s expansion into Japan highlights the region's increasing role in global healthcare analytics.

Descriptive analysis led the market with a 36% share in 2023. Its significant role during the pandemic, where it was used extensively to analyze historical data and track virus spread, has driven growth in this segment. Descriptive analytics helps organizations interpret past data to gain actionable insights, proving essential for understanding historical trends. Additionally, hospitals leverage descriptive analysis to monitor insurance claim performance, identifying anomalies and errors. The broad adoption of these tools by various organizations continues to enhance their market growth potential.

Predictive analysis is the fastest-growing segment, utilizing datasets from descriptive analytics to generate actionable future insights. Its growth is driven by the increasing adoption of analytics tools aimed at forecasting future market trends. Businesses are increasingly turning to predictive analytics to anticipate future developments, enabling them to implement strategies that support overall growth.

In 2023, the services segment dominated the market with a 38% share. The healthcare sector has been investing heavily in IT to develop and digitize data platforms for analytics. Many companies outsource their data analytics needs, contributing to the growth of service-oriented data analytics firms. The expansion of services offered by these companies has fueled this segment’s growth.

The services segment is projected to grow at the fastest rate of 21.83% due to rising patient volumes and disease prevalence. The increased generation of clinical data and the pressure to provide high-quality, cost-effective care are key drivers for this growth. The adoption of analytical tools for improved patient monitoring and treatment is expected to further propel this segment.

Life science companies led the market with a 45% revenue share in 2023. These companies are major users of analytical tools to reduce product costs, enhance profit margins, and accelerate growth. Investments in product development and market understanding drive the need for analytics to support value-based decision-making.

Healthcare providers are expected to experience the fastest growth rate of 25.83% through 2033. The demand for cost-effective care and efficient patient management, exacerbated by the pandemic, has driven this segment's expansion. Effective management of patient records and disease surveillance are key factors boosting the adoption of healthcare analytics.

The on-premises segment held a 48% revenue share in 2023. Many institutions prefer on-premises solutions for their ease of access and security, leading to a significant market share. While practical for smaller organizations, scaling up on-premises systems can require substantial investment in data storage and security.

The cloud-based segment is projected to grow at the fastest rate of 24.43%. Advantages such as ease of storage, lower capital investment, and increased flexibility contribute to its rapid growth. However, issues like privacy concerns and data security risks associated with public cloud solutions present challenges.

By Type

By Component

By Delivery Mode

By Application

By End-use

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Healthcare Analytics Market

5.1. COVID-19 Landscape: Healthcare Analytics Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market TrEnd-uses and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and TrEnd-uses

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. VEnd-useor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Healthcare Analytics Market, By Type

8.1. Healthcare Analytics Market, by Type

8.1.1. Descriptive Analysis

8.1.1.1. Market Revenue and Forecast

8.1.2. Predictive Analysis

8.1.2.1. Market Revenue and Forecast

8.1.3. Prescriptive Analysis

8.1.3.1. Market Revenue and Forecast

Chapter 9. Global Healthcare Analytics Market, By Component

9.1. Healthcare Analytics Market, by Component

9.1.1. Software

9.1.1.1. Market Revenue and Forecast

9.1.2. Hardware

9.1.2.1. Market Revenue and Forecast

9.1.3. Services

9.1.3.1. Market Revenue and Forecast

Chapter 10. Global Healthcare Analytics Market, By Delivery Mode

10.1 Healthcare Analytics Market, by Delivery Mode

10.1.1. On-premises

10.1.1.1. Market Revenue and Forecast

10.1.2. Web-hosted

10.1.2.1. Market Revenue and Forecast

10.1.3. Cloud-based

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global Healthcare Analytics Market, By Application

11.1. Healthcare Analytics Market, by Application

11.1.1. Clinical

11.1.1.1. Market Revenue and Forecast

11.1.2 Financial

11.1.2.1. Market Revenue and Forecast

11.1.3 Operational and Administrative

11.3.1. Market Revenue and Forecast

Chapter 12. Global Healthcare Analytics Market, By End-use

12.1. Healthcare Analytics Market, by End-use

12.1.1. Healthcare Payers

12.1.1.1. Market Revenue and Forecast

12.1.2. Healthcare Providers

12.1.2.1. Market Revenue and Forecast

12.1.3. Life Science Companies

12.1.3.1. Market Revenue and Forecast

Chapter 13. Global Healthcare Analytics Market, Regional Estimates and TrEnd-use Forecast

13.1. North America

13.1.1. Market Revenue and Forecast, by Type

13.1.2. Market Revenue and Forecast, by Component

13.1.3. Market Revenue and Forecast, by Delivery Mode Mode

13.1.4. Market Revenue and Forecast, by Application Size

13.1.5. Market Revenue and Forecast, by End-use Use

13.1.6. U.S.

13.1.6.1. Market Revenue and Forecast, by Type

13.1.6.2. Market Revenue and Forecast, by Component

13.1.6.3. Market Revenue and Forecast, by Delivery Mode Mode

13.1.6.4. Market Revenue and Forecast, by Application Size

13.1.7. Market Revenue and Forecast, by End-use Use

13.1.8. Rest of North America

13.1.8.1. Market Revenue and Forecast, by Type

13.1.8.2. Market Revenue and Forecast, by Component

13.1.8.3. Market Revenue and Forecast, by Delivery Mode

13.1.8.4. Market Revenue and Forecast, by Application

13.1.8.5. Market Revenue and Forecast, by End-use

13.2. Europe

13.2.1. Market Revenue and Forecast, by Type

13.2.2. Market Revenue and Forecast, by Component

13.2.3. Market Revenue and Forecast, by Delivery Mode

13.2.4. Market Revenue and Forecast, by Application

13.2.5. Market Revenue and Forecast, by End-use

13.2.6. UK

13.2.6.1. Market Revenue and Forecast, by Type

13.2.6.2. Market Revenue and Forecast, by Component

13.2.6.3. Market Revenue and Forecast, by Delivery Mode

13.2.7. Market Revenue and Forecast, by Application

13.2.8. Market Revenue and Forecast, by End-use

13.2.9. Germany

13.2.9.1. Market Revenue and Forecast, by Type

13.2.9.2. Market Revenue and Forecast, by Component

13.2.9.3. Market Revenue and Forecast, by Delivery Mode

13.2.10. Market Revenue and Forecast, by Application

13.2.11. Market Revenue and Forecast, by End-use

13.2.12. France

13.2.12.1. Market Revenue and Forecast, by Type

13.2.12.2. Market Revenue and Forecast, by Component

13.2.12.3. Market Revenue and Forecast, by Delivery Mode

13.2.12.4. Market Revenue and Forecast, by Application

13.2.13. Market Revenue and Forecast, by End-use

13.2.14. Rest of Europe

13.2.14.1. Market Revenue and Forecast, by Type

13.2.14.2. Market Revenue and Forecast, by Component

13.2.14.3. Market Revenue and Forecast, by Delivery Mode

13.2.14.4. Market Revenue and Forecast, by Application

13.2.15. Market Revenue and Forecast, by End-use

13.3. APAC

13.3.1. Market Revenue and Forecast, by Type

13.3.2. Market Revenue and Forecast, by Component

13.3.3. Market Revenue and Forecast, by Delivery Mode

13.3.4. Market Revenue and Forecast, by Application

13.3.5. Market Revenue and Forecast, by End-use

13.3.6. India

13.3.6.1. Market Revenue and Forecast, by Type

13.3.6.2. Market Revenue and Forecast, by Component

13.3.6.3. Market Revenue and Forecast, by Delivery Mode

13.3.6.4. Market Revenue and Forecast, by Application

13.3.7. Market Revenue and Forecast, by End-use

13.3.8. China

13.3.8.1. Market Revenue and Forecast, by Type

13.3.8.2. Market Revenue and Forecast, by Component

13.3.8.3. Market Revenue and Forecast, by Delivery Mode

13.3.8.4. Market Revenue and Forecast, by Application

13.3.9. Market Revenue and Forecast, by End-use

13.3.10. Japan

13.3.10.1. Market Revenue and Forecast, by Type

13.3.10.2. Market Revenue and Forecast, by Component

13.3.10.3. Market Revenue and Forecast, by Delivery Mode

13.3.10.4. Market Revenue and Forecast, by Application

13.3.10.5. Market Revenue and Forecast, by End-use

13.3.11. Rest of APAC

13.3.11.1. Market Revenue and Forecast, by Type

13.3.11.2. Market Revenue and Forecast, by Component

13.3.11.3. Market Revenue and Forecast, by Delivery Mode

13.3.11.4. Market Revenue and Forecast, by Application

13.3.11.5. Market Revenue and Forecast, by End-use

13.4. MEA

13.4.1. Market Revenue and Forecast, by Type

13.4.2. Market Revenue and Forecast, by Component

13.4.3. Market Revenue and Forecast, by Delivery Mode

13.4.4. Market Revenue and Forecast, by Application

13.4.5. Market Revenue and Forecast, by End-use

13.4.6. GCC

13.4.6.1. Market Revenue and Forecast, by Type

13.4.6.2. Market Revenue and Forecast, by Component

13.4.6.3. Market Revenue and Forecast, by Delivery Mode

13.4.6.4. Market Revenue and Forecast, by Application

13.4.7. Market Revenue and Forecast, by End-use

13.4.8. North Africa

13.4.8.1. Market Revenue and Forecast, by Type

13.4.8.2. Market Revenue and Forecast, by Component

13.4.8.3. Market Revenue and Forecast, by Delivery Mode

13.4.8.4. Market Revenue and Forecast, by Application

13.4.9. Market Revenue and Forecast, by End-use

13.4.10. South Africa

13.4.10.1. Market Revenue and Forecast, by Type

13.4.10.2. Market Revenue and Forecast, by Component

13.4.10.3. Market Revenue and Forecast, by Delivery Mode

13.4.10.4. Market Revenue and Forecast, by Application

13.4.10.5. Market Revenue and Forecast, by End-use

13.4.11. Rest of MEA

13.4.11.1. Market Revenue and Forecast, by Type

13.4.11.2. Market Revenue and Forecast, by Component

13.4.11.3. Market Revenue and Forecast, by Delivery Mode

13.4.11.4. Market Revenue and Forecast, by Application

13.4.11.5. Market Revenue and Forecast, by End-use

13.5. Latin America

13.5.1. Market Revenue and Forecast, by Type

13.5.2. Market Revenue and Forecast, by Component

13.5.3. Market Revenue and Forecast, by Delivery Mode

13.5.4. Market Revenue and Forecast, by Application

13.5.5. Market Revenue and Forecast, by End-use

13.5.6. Brazil

13.5.6.1. Market Revenue and Forecast, by Type

13.5.6.2. Market Revenue and Forecast, by Component

13.5.6.3. Market Revenue and Forecast, by Delivery Mode

13.5.6.4. Market Revenue and Forecast, by Application

13.5.7. Market Revenue and Forecast, by End-use

13.5.8. Rest of LATAM

13.5.8.1. Market Revenue and Forecast, by Type

13.5.8.2. Market Revenue and Forecast, by Component

13.5.8.3. Market Revenue and Forecast, by Delivery Mode

13.5.8.4. Market Revenue and Forecast, by Application

13.5.8.5. Market Revenue and Forecast, by End-use

Chapter 14. Company Profiles

14.1. McKesson Corporation

14.1.1. Company Overview

14.1.2. Product Offerings

14.1.3. Financial Performance

14.1.4. Recent Initiatives

14.2. Optum, Inc.

14.2.1. Company Overview

14.2.2. Product Offerings

14.2.3. Financial Performance

14.2.4. Recent Initiatives

14.3. IBM

14.3.1. Company Overview

14.3.2. Product Offerings

14.3.3. Financial Performance

14.3.4. Recent Initiatives

14.4. Oracle

14.4.1. Company Overview

14.4.2. Product Offerings

14.4.3. Financial Performance

14.4.4. Recent Initiatives

14.5. SAS Institute, Inc.

14.5.1. Company Overview

14.5.2. Product Offerings

14.5.3. Financial Performance

14.5.4. Recent Initiatives

14.6. IQVIA

14.6.1. Company Overview

14.6.2. Product Offerings

14.6.3. Financial Performance

14.6.4. Recent Initiatives

14.7. Verisk Analytics, Inc.

14.7.1. Company Overview

14.7.2. Product Offerings

14.7.3. Financial Performance

14.7.4. Recent Initiatives

14.8. Elsevier

14.8.1. Company Overview

14.8.2. Product Offerings

14.8.3. Financial Performance

14.8.4. Recent Initiatives

14.9. Medeanalytics, Inc.

14.9.1. Company Overview

14.9.2. Product Offerings

14.9.3. Financial Performance

14.9.4. Recent Initiatives

14.10. Truven Health Analytics, Inc.

14.10.1. Company Overview

14.10.2. Product Offerings

14.10.3. Financial Performance

14.10.4. Recent Initiatives

Chapter 15. Research Methodology

15.1. Primary Research

15.2. Secondary Research

15.3. Assumptions

Chapter 16. AppEnd-useix

16.1. About Us

16.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others