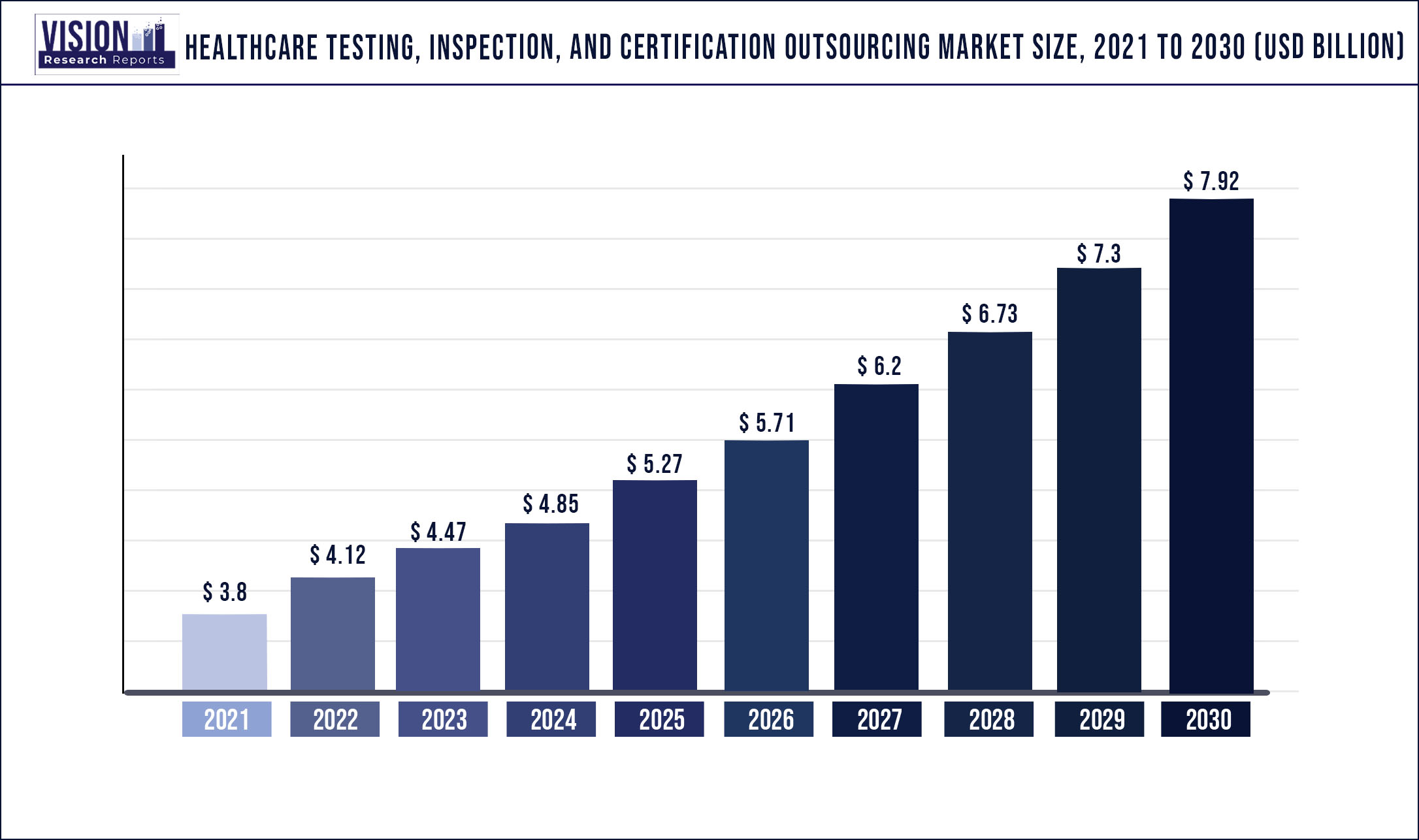

The global healthcare testing, inspection, and certification outsourcing market was estimated at USD 3.8 billion in 2021 and it is expected to surpass around USD 7.92 billion by 2030, poised to grow at a CAGR of 8.5% from 2022 to 2030

Report Highlights

The main drivers of this market are that it helps in improving safety standards of medical devices and pharmaceuticals, there is the rise in strict regulations imposed by the government to make sure that the product is safe, and the increasing use of advanced technology for TIC services.

The COVID-19 pandemic significantly impacted the market. The healthcare testing, inspection, and certification companies are collaborating to reduce the prices to provide safe, quick, and efficient products that will be used to fight the coronavirus. Also, medical devices are producing a lot of opportunities for the healthcare TIC market. For instance, in October 2020, CSA announced the testing, inspection, and certification of PPE kits that are used to fight against COVID-19 in Canada.

As healthcare TIC service providers are capitalizing on the promise of new technologies to revolutionize the industry, frequently by forming partnerships with specialized providers, capital investment is expected to rise even more. Market expansion is being aided by the growth of the middle class in emerging nations, a rise in the need for safety, and rising infrastructure spending. For instance, in December 2021, SGS SA acquired Quay Pharma, a pharma R&D organization, to expand its capability in biopharmaceutical analytical testing.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 3.8 billion |

| Revenue Forecast by 2030 | USD 7.92 billion |

| Growth rate from 2022 to 2030 | CAGR of 8.5% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Services, type, region |

| Companies Covered | SGS SA, Intertek Group plc, Eurofins Scientific, DEKRA CERTIFICATION B.V., UL LLC, Nemko, TÜV SÜD, Element Materials Technology, CSA Group Testing & Certification Inc., ALS, Applus+ |

Services Insights

The services segment is segmented into testing, inspection, and certification. The testing services segment accounted for the largest share of 52.4% in 2021 during the forecast period. The growth of the market is owing to the increasing influence of strict regulations by the government that has led to a rise in verification, validation, and certification. This also helped companies in maintaining the quality parameters and fulfilling the demands of customers, promoting the expansion of testing facilities and equipment by various companies. For instance, in December 2021, Labcorp completely acquired Toxikon Corp. (TC) to expand Labcorp’s development testing capabilities for biotech, pharmaceutical, and medical device clients.

The inspection services are anticipated to register the second fastest CAGR during the forecast period. This is a very important regulatory practice in gaining market approval and checking the safety of the product. Nowadays, inspection services have collaborated along with the prequalification application (laboratory information file, product dossier, and product streams) for promising and organizing inspections.

Type Insights

The medical devices segment dominated the market with a share of 79.3% during the forecast period. This is due to an increase in the manufacturing of medical device equipment that requires TIC services, which will create new opportunities for TIC services. Also, due to COVID-19, there is an increase in the production of medical devices for the prevention and treatment of diseases. For instance, in April 2020, Eurofins announced that its testing facility would support and ensure the safety of medical devices used in COVID-19.

The pharmaceutical segment accounted for the fastest growth rate during the forecast period. TIC services are in high demand because of increased demand for low-cost drugs, increased regulatory pressure, and consumer awareness about pharmaceutical safety. These are some of the driving factors in this market.

Regional Insights

Europe dominated the market with a revenue share of 44.5% in 2021. The high revenue share can be attributed to the majority of healthcare testing, inspection, and certification players in the market. Also, there is a rise in mergers and acquisitions among the market players in this region, leading to the growth of the market. For instance, in February 2022, Eurofins BPT Italy announced an expansion of its biologics testing capacity. The total laboratory space that has increased is 1000 m2 of BSL2 GMP laboratory space.

The Asia-Pacific region is expected to grow at a lucrative rate with a CAGR of 10.08% during the forecast period owing to the rising economic development in countries such as China, India, Japan, and South Korea. This has led to an increase in manufacturing activity in the region, which in turn has created new opportunities for testing, inspection, and certification. For instance, in November 2021, Labcorp expanded its footprint in the Asia-Pacific with the addition of a new integrated bioanalytical laboratory in Singapore.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Healthcare Testing, Inspection, And Certification Outsourcing Market

5.1. COVID-19 Landscape: Healthcare Testing, Inspection, And Certification Outsourcing Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Healthcare Testing, Inspection, And Certification Outsourcing Market, By Services

8.1. Healthcare Testing, Inspection, And Certification Outsourcing Market, by Services, 2022-2030

8.1.1. Testing

8.1.1.1. Market Revenue and Forecast (2017-2030)

8.1.2. Inspection

8.1.2.1. Market Revenue and Forecast (2017-2030)

8.1.3. Certification

8.1.3.1. Market Revenue and Forecast (2017-2030)

Chapter 9. Global Healthcare Testing, Inspection, And Certification Outsourcing Market, By Type

9.1. Healthcare Testing, Inspection, And Certification Outsourcing Market, by Type, 2022-2030

9.1.1. Medical Devices

9.1.1.1. Market Revenue and Forecast (2017-2030)

9.1.2. Pharmaceutical

9.1.2.1. Market Revenue and Forecast (2017-2030)

Chapter 10. Global Healthcare Testing, Inspection, And Certification Outsourcing Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Services (2017-2030)

10.1.2. Market Revenue and Forecast, by Type (2017-2030)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Services (2017-2030)

10.1.3.2. Market Revenue and Forecast, by Type (2017-2030)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Services (2017-2030)

10.1.4.2. Market Revenue and Forecast, by Type (2017-2030)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Services (2017-2030)

10.2.2. Market Revenue and Forecast, by Type (2017-2030)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Services (2017-2030)

10.2.3.2. Market Revenue and Forecast, by Type (2017-2030)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Services (2017-2030)

10.2.4.2. Market Revenue and Forecast, by Type (2017-2030)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Services (2017-2030)

10.2.5.2. Market Revenue and Forecast, by Type (2017-2030)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Services (2017-2030)

10.2.6.2. Market Revenue and Forecast, by Type (2017-2030)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Services (2017-2030)

10.3.2. Market Revenue and Forecast, by Type (2017-2030)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Services (2017-2030)

10.3.3.2. Market Revenue and Forecast, by Type (2017-2030)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Services (2017-2030)

10.3.4.2. Market Revenue and Forecast, by Type (2017-2030)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Services (2017-2030)

10.3.5.2. Market Revenue and Forecast, by Type (2017-2030)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Services (2017-2030)

10.3.6.2. Market Revenue and Forecast, by Type (2017-2030)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Services (2017-2030)

10.4.2. Market Revenue and Forecast, by Type (2017-2030)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Services (2017-2030)

10.4.3.2. Market Revenue and Forecast, by Type (2017-2030)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Services (2017-2030)

10.4.4.2. Market Revenue and Forecast, by Type (2017-2030)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Services (2017-2030)

10.4.5.2. Market Revenue and Forecast, by Type (2017-2030)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Services (2017-2030)

10.4.6.2. Market Revenue and Forecast, by Type (2017-2030)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Services (2017-2030)

10.5.2. Market Revenue and Forecast, by Type (2017-2030)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Services (2017-2030)

10.5.3.2. Market Revenue and Forecast, by Type (2017-2030)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Services (2017-2030)

10.5.4.2. Market Revenue and Forecast, by Type (2017-2030)

Chapter 11. Company Profiles

11.1. SGS SA

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Intertek Group plc

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. Eurofins Scientific

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. DEKRA CERTIFICATION B.V.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. UL LLC

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Nemko

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. TÜV SÜD

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Element Materials Technology

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. CSA Group Testing & Certification Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. ALS

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others