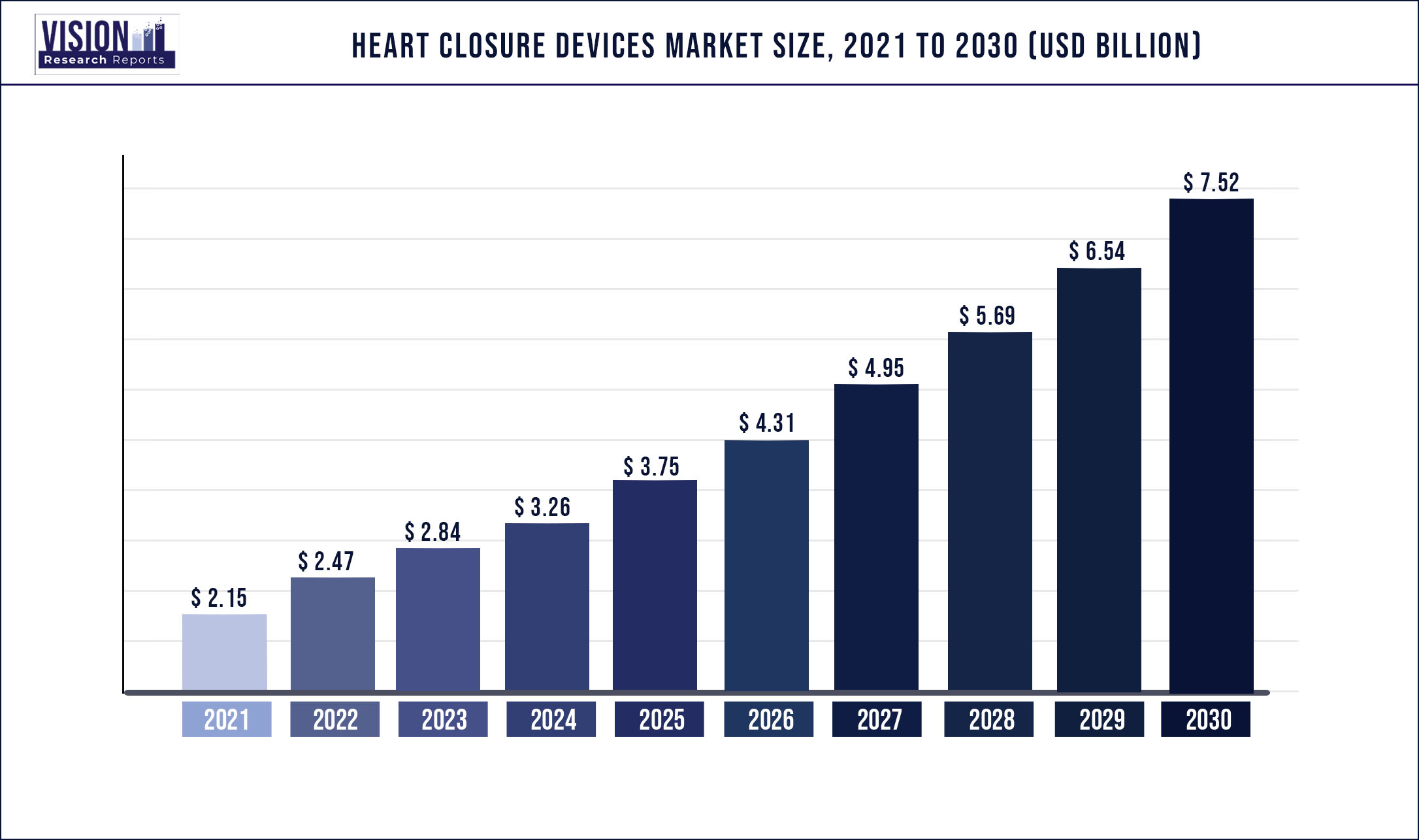

The global heart closure devices market was surpassed at USD 2.15 billion in 2021 and is expected to hit around USD 7.52 billion by 2030, growing at a CAGR of 14.93% from 2022 to 2030.

Report Highlights

Increasing incidence of Atrial Fibrillation (AF), growing prevalence of congenital heart defects, upsurge in geriatric population, and favorable reimbursement policies are expected to boost the heart defect closure devices demand. Constant new product introductions and approvals along with rapid growth of the healthcare industry across emerging economies will further augment the industry growth during the forecast period. The COVID-19 pandemic affected the industry for FY 2020-21. The operations of the corporations were impacted significantly. Moreover, companies faced disruptions in the supply and increases in the prices of certain raw materials and components.

In addition, elective procedures were postponed during this period.However, the industry picked up in 2021, as companies witnessed higher sales across their business segments compared to the pandemic. Abbott’s medical devices sales revenue grew over 21% to $14.367 billion in 2021 over the last twelve months. The sales increase in 2021 was driven by double?digit growth across all of the company’s Medical Devices divisions, led by Diabetes Care, Structural Heart, and Electrophysiology. Heart defect closure devices is highly competitive and are characterized by extensive research and development and rapid technological change. The buyers consider many factors when choosing suppliers, including product reliability, clinical outcomes, product enhancements, breadth of product portfolio, pricing and product services provided by the manufacturer, and product availability.

As a result, the company’s market share can shift owing to technological innovation and other business factors. In addition, product problems, physician advisories, and safety alerts are anticipated to affect the company’s market share and foothold across the regions during the forecast period. Furthermore, the industry has undergone significant consolidation in recent years. Certain market players have been able to expand their portfolio of products and services through this consolidation process, and they can offer customers a broader array of products and services. For instance, in January 2017, Abbott completed the acquisition of St. Jude Medical, Inc. Thus, establishing the company as a leader in the medical device field. St. Jude Medical's solid positions in atrial fibrillation, structural heart, heart failure, and chronic pain added to Abbott's leading positions in mitral valve disease and coronary interventions.

Scope of The Report

| Report Coverage | Details |

| Market Size in 2021 | USD 2.15 billion |

| Revenue Forecast by 2030 | USD 7.52 billion |

| Growth rate from 2022 to 2030 | CAGR of 14.93% |

| Base Year | 2021 |

| Forecast Period | 2022 to 2030 |

| Segmentation | Closure type, region |

| Companies Covered |

Abbott Laboratories; W. L. Gore & Associates, Inc; Boston Scientific Corp.; Occlutech; Heartstitch; SMT; Cardia, Inc.; Lifetech Scientific Corp.; Lepu Medical Technology (Beijing)Co., Ltd.; AtriCure Inc. |

Closure Type Insights

Based on the closure type, the industry has been categorized into Congenital Heart Defect (CHD) closure, Patent Foramen Ovale (PFO) closure, and Left Atrial Appendage Closure (LAAC). The LAAC segment dominated the industry in 2021 and accounted for the largest share of 48.02% of the overall revenue. The growing number of nonvalvular AF patients who have been shown to be at high risk for stroke and also in whom oral anticoagulants are ineffective. For instance, data from the Journal of Arrhythmia from 2017 shows that the number of cases is largest in densely populated nations like China and India, which would eventually increase the demand for LAAC.

The CHD closure segment also accounted for a significant share of the overall revenue in 2021 mainly due to the advancements in the region's facility infrastructure, accessibility of congenital heart defect closure devices, and an increase in the number of qualified physicians, all of which will encourage the use of minimally invasive devices. For instance, due to improved developments in the hospital infrastructure, ASD and PDA closure therapies continue to have major market penetration in the market, consequently resulting in industry expansion.

Regional Insights

North America dominated the global industry in 2021 and accounted for the largest share of more than 51.3% of the overall revenue owing to high R&D investments and trials in this region. For instance, the Lifetech Scientific-sponsored IDE study on LAmbre. To establish safety and effectiveness data, the LAmbre device would be evaluated in this clinical trial among the U.S. population. Positive clinical results might boost the adoption of the LAA closure device in the U.S. as many physicians in the country are influenced by clinical studies. The Asia Pacific region, on the other hand, is expected to register the fastest growth rate during the forecast period.

Heart closure devices have been commercially available for more than a decade, which has allowed for the development of stronger healthcare infrastructure for performing minimally invasive heart defect closure treatments, resulting in further boosting the industry expansion. Many heart defect closure technologies are available in nations like Australia, where minimally invasive heart defect closure technologies were introduced years before it was in other international markets. For instance, W. L. Gore’s GORE CARDIOFORM Septal Occluder was approved in the U.S. in 2018 and in Australia in 2015.

Key Players

Market Segmentation

Chapter 1. Introduction

1.1.Research Objective

1.2.Scope of the Study

1.3.Definition

Chapter 2. Research Methodology

2.1.Research Approach

2.2.Data Sources

2.3.Assumptions & Limitations

Chapter 3. Executive Summary

3.1.Market Snapshot

Chapter 4. Market Variables and Scope

4.1.Introduction

4.2.Market Classification and Scope

4.3.Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5.COVID 19 Impact on Heart Closure Devices Market

5.1. COVID-19 Landscape: Heart Closure Devices Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4.Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1.Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2.Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1.List of Suppliers

7.1.3.2.List of Buyers

Chapter 8. Global Heart Closure Devices Market, By Closure Type

8.1.Heart Closure Devices Market, by Closure Type Type, 2021-2030

8.1.1. Congenital Heart Defect Closure

8.1.1.1.Market Revenue and Forecast (2017-2030)

8.1.2. PFO Closure

8.1.2.1.Market Revenue and Forecast (2017-2030)

8.1.3. LAA Closure

8.1.3.1.Market Revenue and Forecast (2017-2030)

Chapter 9. Global Heart Closure Devices Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Service (2017-2030)

9.1.2. Market Revenue and Forecast, by End-use (2017-2030)

9.1.3. U.S.

9.1.3.1. Market Revenue and Forecast, by Service (2017-2030)

9.1.3.2. Market Revenue and Forecast, by End-use (2017-2030)

9.1.4. Rest of North America

9.1.4.1. Market Revenue and Forecast, by Service (2017-2030)

9.1.4.2. Market Revenue and Forecast, by End-use (2017-2030)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Service (2017-2030)

9.2.2. Market Revenue and Forecast, by End-use (2017-2030)

9.2.3. UK

9.2.3.1. Market Revenue and Forecast, by Service (2017-2030)

9.2.3.2. Market Revenue and Forecast, by End-use (2017-2030)

9.2.4. Germany

9.2.4.1. Market Revenue and Forecast, by Service (2017-2030)

9.2.4.2. Market Revenue and Forecast, by End-use (2017-2030)

9.2.5. France

9.2.5.1. Market Revenue and Forecast, by Service (2017-2030)

9.2.5.2. Market Revenue and Forecast, by End-use (2017-2030)

9.2.6. Rest of Europe

9.2.6.1. Market Revenue and Forecast, by Service (2017-2030)

9.2.6.2. Market Revenue and Forecast, by End-use (2017-2030)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Service (2017-2030)

9.3.2. Market Revenue and Forecast, by End-use (2017-2030)

9.3.3. India

9.3.3.1. Market Revenue and Forecast, by Service (2017-2030)

9.3.3.2. Market Revenue and Forecast, by End-use (2017-2030)

9.3.4. China

9.3.4.1. Market Revenue and Forecast, by Service (2017-2030)

9.3.4.2. Market Revenue and Forecast, by End-use (2017-2030)

9.3.5. Japan

9.3.5.1. Market Revenue and Forecast, by Service (2017-2030)

9.3.5.2. Market Revenue and Forecast, by End-use (2017-2030)

9.3.6. Rest of APAC

9.3.6.1. Market Revenue and Forecast, by Service (2017-2030)

9.3.6.2. Market Revenue and Forecast, by End-use (2017-2030)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Service (2017-2030)

9.4.2. Market Revenue and Forecast, by End-use (2017-2030)

9.4.3. GCC

9.4.3.1. Market Revenue and Forecast, by Service (2017-2030)

9.4.3.2. Market Revenue and Forecast, by End-use (2017-2030)

9.4.4. North Africa

9.4.4.1. Market Revenue and Forecast, by Service (2017-2030)

9.4.4.2. Market Revenue and Forecast, by End-use (2017-2030)

9.4.5. South Africa

9.4.5.1. Market Revenue and Forecast, by Service (2017-2030)

9.4.5.2. Market Revenue and Forecast, by End-use (2017-2030)

9.4.6. Rest of MEA

9.4.6.1. Market Revenue and Forecast, by Service (2017-2030)

9.4.6.2. Market Revenue and Forecast, by End-use (2017-2030)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Service (2017-2030)

9.5.2. Market Revenue and Forecast, by End-use (2017-2030)

9.5.3. Brazil

9.5.3.1. Market Revenue and Forecast, by Service (2017-2030)

9.5.3.2. Market Revenue and Forecast, by End-use (2017-2030)

9.5.4. Rest of LATAM

9.5.4.1. Market Revenue and Forecast, by Service (2017-2030)

9.5.4.2. Market Revenue and Forecast, by End-use (2017-2030)

Chapter 10.Company Profiles

10.1.Abbott

10.1.1.Company Overview

10.1.2.Product Offerings

10.1.3.Financial Performance

10.1.4.Recent Initiatives

10.2.W. L. Gore & Associates, Inc.

10.2.1.Company Overview

10.2.2.Product Offerings

10.2.3.Financial Performance

10.2.4.Recent Initiatives

10.3.Boston Scientific Corp.

10.3.1.Company Overview

10.3.2.Product Offerings

10.3.3.Financial Performance

10.3.4.Recent Initiatives

10.4.Occlutech

10.4.1.Company Overview

10.4.2.Product Offerings

10.4.3.Financial Performance

10.4.4.Recent Initiatives

10.5.Heartstitch

10.5.1.Company Overview

10.5.2.Product Offerings

10.5.3.Financial Performance

10.5.4.Recent Initiatives

10.6.SMT

10.6.1.Company Overview

10.6.2.Product Offerings

10.6.3.Financial Performance

10.6.4.Recent Initiatives

10.7.Cardia, Inc.

10.7.1.Company Overview

10.7.2.Product Offerings

10.7.3.Financial Performance

10.7.4.Recent Initiatives

10.8.Lifetech Scientific Corp.

10.8.1.Company Overview

10.8.2.Product Offerings

10.8.3.Financial Performance

10.8.4.Recent Initiatives

10.9.Lepu Medical Technology (Beijing)Co., Ltd.

10.9.1.Company Overview

10.9.2.Product Offerings

10.9.3.Financial Performance

10.9.4.Recent Initiatives

10.10.AtriCure Inc.

10.10.1. Company Overview

10.10.2. Product Offerings

10.10.3. Financial Performance

10.10.4. Recent Initiatives

Chapter 11.Research Methodology

11.1.Primary Research

11.2.Secondary Research

11.3.Assumptions

Chapter 12.Appendix

12.1.About Us

12.2.Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others