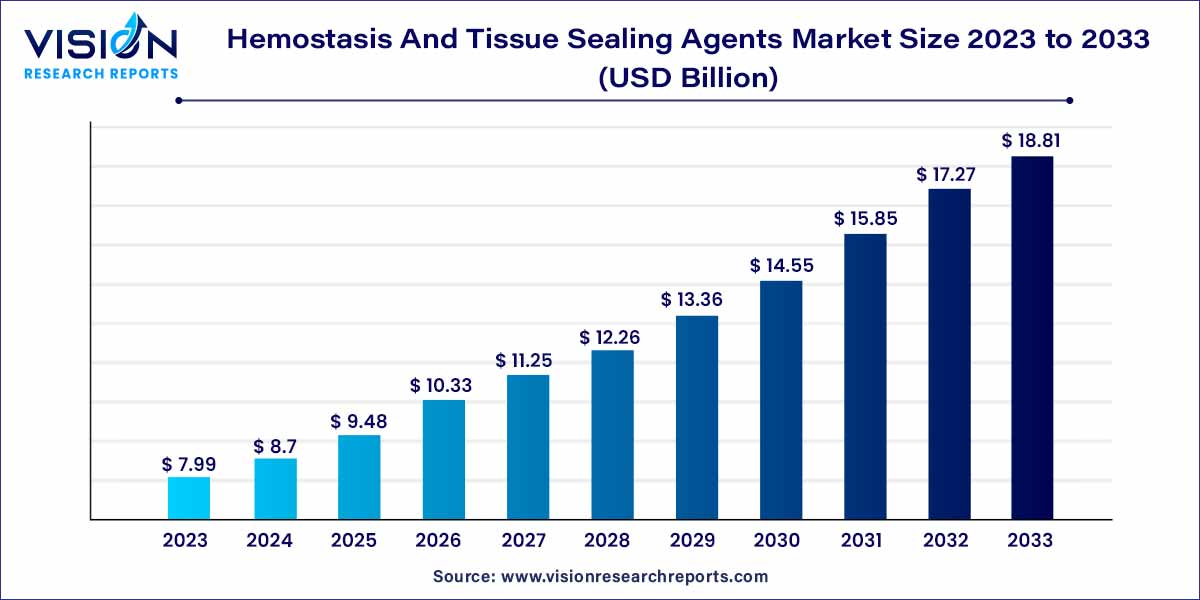

The global hemostasis and tissue sealing agents market size was estimated at USD 7.99 billion in 2023 and it is expected to surpass around USD 18.81 billion by 2033, poised to grow at a CAGR of 8.94% from 2024 to 2033. The hemostasis and tissue sealing agents market is witnessing unprecedented growth, driven by advancements in medical science and the increasing demand for innovative solutions in surgical procedures.

Hemostasis refers to the process of stopping bleeding, and tissue sealing agents play a crucial role in promoting wound healing and preventing complications after surgery. This market encompasses a wide array of products, including hemostatic agents, tissue adhesives and sealants, each designed to address specific medical needs across various specialties.

The growth of the hemostasis and tissue sealing agents market is propelled by several key factors. Firstly, the increasing number of surgical procedures globally, both elective and emergency, drives the demand for these agents, as they play a vital role in ensuring controlled bleeding and promoting faster wound healing. Secondly, the aging population, which often requires surgeries related to chronic diseases, contributes significantly to the market growth. As the elderly population increases, so does the need for effective hemostasis and tissue sealing solutions. Thirdly, continuous advancements in technology have led to the development of innovative and more efficient hemostatic agents and tissue sealants. These advancements enhance the overall efficacy and safety profiles of these products, further fueling market expansion. Lastly, the growing trend toward minimally invasive surgeries necessitates specialized sealing agents, driving the market's demand as these procedures become more common. These factors combined create a robust market environment, fostering the growth of hemostasis and tissue sealing agents worldwide.

| Report Coverage | Details |

| Growth Rate from 2024 to 2033 | CAGR of 8.94% |

| Market Revenue by 2033 | USD 18.81 billion |

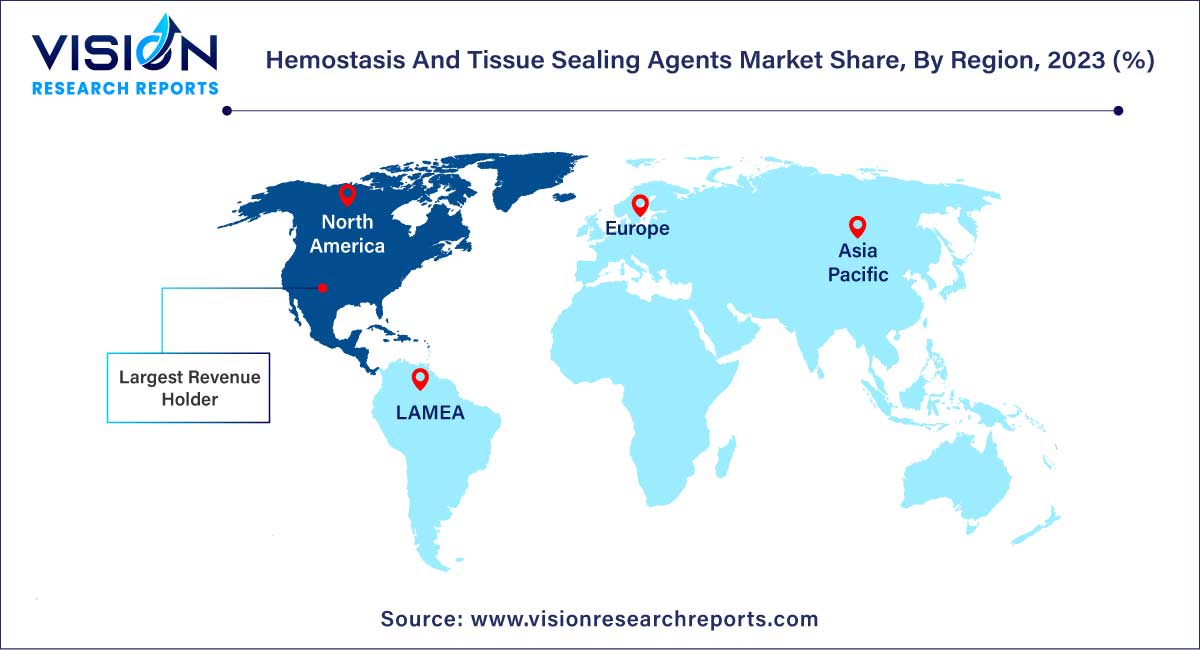

| Revenue Share of North America in 2023 | 35% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

The topical hemostat segment accounted for the largest revenue share of 69% in 2023. Topical hemostats, essential in controlling bleeding during surgeries and traumatic injuries, are witnessing significant advancements in formulation and application. These hemostats, often derived from biological sources or synthetically engineered, are designed to be applied directly to the bleeding site. They work by accelerating the clotting process, staunching bleeding effectively. As the demand for minimally invasive surgical techniques increases, topical hemostats are becoming integral in managing surface bleeding, allowing for precise and targeted application.

The adhesive & tissue sealant segment is expected to grow at a CAGR of 8.17% over the forecast period. Adhesives and tissue sealants have revolutionized the way surgeons approach wound closure and tissue bonding. These products serve a dual purpose: sealing tissues to prevent leakage and promoting the natural healing process. Adhesives, often bioengineered, create a strong bond between tissues, eliminating the need for sutures in certain cases. Tissue sealants, enriched with biocompatible materials, function as a barrier and support tissue repair simultaneously. They find extensive applications in cardiovascular, orthopedic, and general surgeries. The development of adhesive and sealant products with enhanced flexibility, durability, and biodegradability is a testament to ongoing research and development efforts in this field.

North America dominated the market with largest revenue share of 35% in 2023. In North America, particularly in the United States, the market benefits from advanced healthcare facilities and significant research and development activities. The region witnesses a robust demand for hemostasis and tissue sealing agents, driven by an aging population and a high prevalence of chronic diseases. Moreover, stringent regulatory standards and a strong emphasis on technological advancements contribute to the growth of the market.

Europe held the second-largest market share of 30% in 2023. In Europe, the market dynamics are influenced by well-established healthcare systems and a focus on patient safety. European countries prioritize innovative medical technologies, encouraging the adoption of cutting-edge hemostasis and tissue sealing solutions. Stringent regulatory approvals ensure the quality and efficacy of products, fostering trust among healthcare professionals and patients. Additionally, increasing healthcare expenditures and a rising emphasis on minimally invasive surgical techniques fuel market growth in the region.

By Product

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on Hemostasis And Tissue Sealing Agents Market

5.1. COVID-19 Landscape: Hemostasis And Tissue Sealing Agents Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global Hemostasis And Tissue Sealing Agents Market, By Product

8.1.Hemostasis And Tissue Sealing Agents Market, by Product Type, 2024-2033

8.1.1. Topical Hemostat

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Adhesive & Tissue Sealant

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global Hemostasis And Tissue Sealing Agents Market, Regional Estimates and Trend Forecast

9.1. North America

9.1.1. Market Revenue and Forecast, by Product (2021-2033)

9.1.2. U.S.

9.1.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.1.3. Rest of North America

9.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.2. Europe

9.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.2.2. UK

9.2.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.2.3. Germany

9.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.2.4. France

9.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

9.2.5. Rest of Europe

9.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

9.3. APAC

9.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.3.2. India

9.3.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.3.3. China

9.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.3.4. Japan

9.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

9.3.5. Rest of APAC

9.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

9.4. MEA

9.4.1. Market Revenue and Forecast, by Product (2021-2033)

9.4.2. GCC

9.4.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.4.3. North Africa

9.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

9.4.4. South Africa

9.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

9.4.5. Rest of MEA

9.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

9.5. Latin America

9.5.1. Market Revenue and Forecast, by Product (2021-2033)

9.5.2. Brazil

9.5.2.1. Market Revenue and Forecast, by Product (2021-2033)

9.5.3. Rest of LATAM

9.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

Chapter 10. Company Profiles

10.1. Johnson & Johnson

10.1.1. Company Overview

10.1.2. Product Offerings

10.1.3. Financial Performance

10.1.4. Recent Initiatives

10.2. Artivion, Inc

10.2.1. Company Overview

10.2.2. Product Offerings

10.2.3. Financial Performance

10.2.4. Recent Initiatives

10.3. Pfizer

10.3.1. Company Overview

10.3.2. Product Offerings

10.3.3. Financial Performance

10.3.4. Recent Initiatives

10.4. C R Bard

10.4.1. Company Overview

10.4.2. Product Offerings

10.4.3. Financial Performance

10.4.4. Recent Initiatives

10.5. B Braun

10.5.1. Company Overview

10.5.2. Product Offerings

10.5.3. Financial Performance

10.5.4. Recent Initiatives

10.6. Covidien

10.6.1. Company Overview

10.6.2. Product Offerings

10.6.3. Financial Performance

10.6.4. Recent Initiatives

10.7. Advance Medical Solutions Group

10.7.1. Company Overview

10.7.2. Product Offerings

10.7.3. Financial Performance

10.7.4. Recent Initiatives

10.8. Smith & Nephew

10.8.1. Company Overview

10.8.2. Product Offerings

10.8.3.Financial Performance

10.8.4. Recent Initiatives

Chapter 11. Research Methodology

11.1. Primary Research

11.2. Secondary Research

11.3. Assumptions

Chapter 12. Appendix

12.1. About Us

12.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others