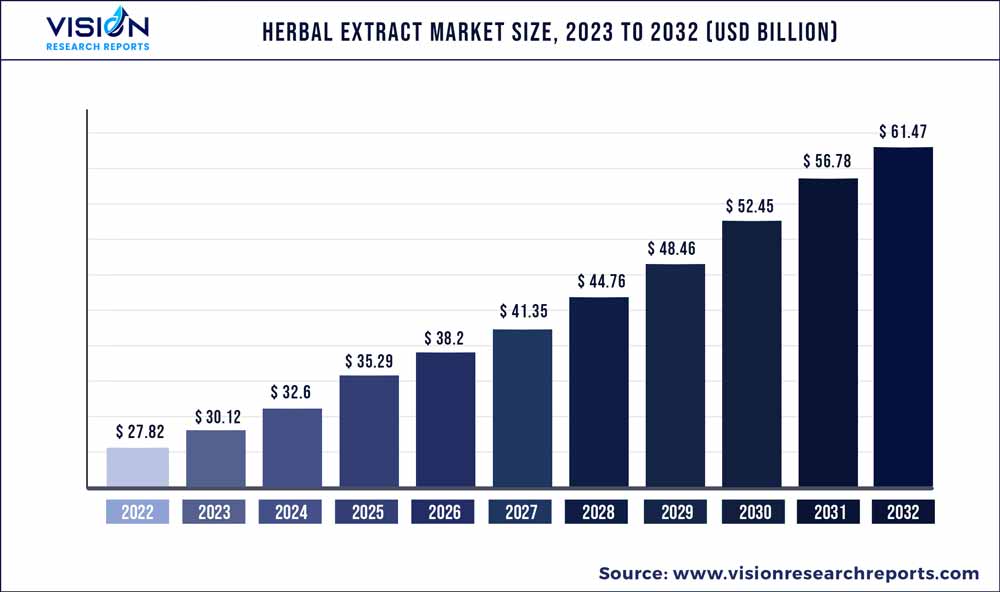

The global herbal extract market was valued at USD 27.82 billion in 2022 and it is predicted to surpass around USD 61.47 billion by 2032 with a CAGR of 8.25% from 2023 to 2032.

Key Pointers

Report Scope of the Herbal Extract Market

| Report Coverage | Details |

| Market Size in 2022 | USD 27.82 billion |

| Revenue Forecast by 2032 | USD 61.47 billion |

| Growth rate from 2023 to 2032 | CAGR of 8.25% |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Companies Covered | Botanic Healthcare; VIDYA HERBS Pvt. Ltd; Allicin Pharm; HerbalHills; Acara bioherb PVt. LTD.; Pioneer Enterprises (I) Private Limited; Sydler India Pvt. Ltd; Herbal Creations; Alpspure Lifesciences Private Limited; IDOBIO CO., LTD.; Döhler GMB; MartinBauer |

The global personal care & cosmetics industry offers a broad range of bio-based/plant-based products to consumers owing to a surge in demand for such products, especially in developed economies such as the U.S. and the UK. This also presents lucrative growth opportunities for the companies engaged in organic cultivation and extraction of herbs in emerging economies such as China and India for exporting their products to North America and Europe.

Personal care & cosmetics, food & beverages, and nutraceuticals industries prefer natural, eco-friendly, and organic ingredients. This, in turn, fuels the demand for herbal extracts, thereby driving the growth of the market for them over the forecast period.

Moreover, factors such as increasing adoption of anti-aging products, men’s grooming products, online and at-home beauty and personal care services, and holistic bridal services, as well as the presence of an expanded repertoire of products, boutiques, and retail stores with increased shelf space, have positively influenced the demand for herbal extracts.

With the implementation of the plan “Healthy China 2030” China is projected to be a well-established health country with lucrative growth in the next five years. The huge demand for fragrances coupled with the presence of a large consumer base for the skincare market is expected to propel the demand for natural fragrance ingredients in the country. Thus, in turn, propelling the demand for the product market.

Product Insights

Cherry dominated the market with a revenue share of more than 10.04% in 2022. This is attributable to its increasing usage in skin care products as it helps to control the ageing of the skin. Moreover, it has a wide application in the pharmaceutical industry owing to its anti-inflammatory properties. Curcumin is a component of the spice turmeric, a type of ginger. It is insoluble in water; however, it is soluble in ethanol. It has excellent anti-inflammatory and antioxidant properties.

Curcumin is obtained from turmeric and its antioxidant and anti-inflammatory characteristics make it popular in the pharmaceuticals, cosmetics, and food industries. Curcumin, also known as turmeric, is commonly used in the formulation of cosmetics. Turmeric is a prominent element in various Ayurveda treatments in India. It is used to treat acne and eczema, as well as to slow down the aging process and prevent and repair dry skin.

Recent advancements in nano- and micro-formulations of curcumin for better absorption in the gastrointestinal tract have opened a wide range of opportunities for the segment in tissue protection and pain management applications. Duly certified USDA organic 95% curcumin extracts are highly preferred by health-conscious consumers, especially in developed countries.

The demand for fenugreek seed extract is expected to be driven by changing dietary trends of consumers as well as increased demand for health supplements from athletes. The rising prevalence of diabetes, particularly type 2 diabetes, owing to obesity and the hectic lifestyle of consumers, as well as the rising consumption of nutrient-dense foods and energy-rich foods, is likely to drive the demand for fenugreek seeds.

Growing demand for natural ingredient-based medicines is fueling R&D initiatives by various firms and researchers. Furthermore, the rising usage of fenugreek seed extract in Ayurvedic medicinal formulations is anticipated to propel its demand over the forecast period.

Anise seed extract is used in baked goods and as a flavoring in beverages. Owing to increasing awareness regarding the health benefits associated with herbs and spices, the demand for anise seed-based culinary products is likely to rise over the forecast period. In the Asia Pacific region, anise seeds are consumed after meals to aid digestion. Additionally, the demand for anise seed extracts is rising owing to the surging demand for spices and herbs for use in herbal teas, sauces, non-alcoholic beverages, and dressings, as well as bread and confectionery items.

Application Insights

The personal care and cosmetics application segment dominated the market with a revenue share of over 47.06% in 2022 owing to the anti-inflammatory, anti-bacterial, and other properties of herbal extracts. These properties have fueled the demand for herbal extracts in the formulation of personal care & cosmetic applications.

The ongoing development of new products and the increasing usage of natural ingredients such as essential oils in personal care products and cosmetics are expected to fuel the demand for natural herbal extracts used in them. These ingredients are also used for cleaning teeth. They are also incorporated into baby products, soaps, and shampoos. General hygiene is a major application of essential oils in the personal care & cosmetics segment of the market. In addition, essential oils are widely used in perfumes, body sprays, and air fresheners.

Major brands such as JÄ€SÖN, Melvita, Annemarie Borlind, and Avalon Organics are continuously making efforts to increase consumer awareness by organizing educational and promotional campaigns focused on communicating the benefits of using organic personal care & cosmetics products. Such trends signify the strong growth of personal care & cosmetics segment of the market in the coming years. This is due to the rising consumer awareness about ensuring their health and beauty, coupled with surging disposable income of consumers in emerging economies such as India, and Mexico among others that enable consumers to spend increasingly on innovative products.

Increasing global demand for natural, safe, and minimally processed food products & beverages has emerged as a major factor driving the growth of the food & beverages segment of the market during the forecast period. The antimicrobial properties of herbal extracts help preserve food products and beverages for a long duration. This is expected to contribute to the increased usage of herbal extracts in food products and beverages to increase their shelf life without compromising on their quality.

Regional Insights

Asia Pacific region dominated the market with a revenue share of more than 43.1% in 2022. Factors such as the wide availability of herbal plants, the age-old tradition of people using natural herbs, the therapeutic effect of herbal products, adoption of healthy lifestyle after pandemic, awareness about the harmful effects of synthetic ingredients, use of herbal cosmetics products, government policies, and business sustainability programs are expected to influence the demand for herbal extract in the region.

In Asia Pacific, countries like India and China are projected to lead the herbal extracts market and have emerged as the largest exporters of some of the most precious extracts in the world such as curcumin, ashwagandha, kale, and others. China and Japan historically are among the largest markets of nutraceuticals in the entire region. The market is witnessed healthy growth with increased use in pharmaceutical products and nutraceutical supplements in Japan, China, and other countries.

China is the world’s largest consumer market for food & beverages, making it highly appealing for foreign brands and players in the food & beverages industry. The growing food & beverages industry is expected to significantly impact the herbal extracts industry in China during the forecast period.

India is considered the largest market for herbal extracts; it is one of the key producers of herbs worldwide and holds a dominant position in the global market. India is among the major exporters of herbal extracts for the European and American markets. In addition, the products manufactured in this country are highly preferred over those produced in China owing to the high degree of stability under variable light and heat conditions.

Herbal Extract Market Segmentations:

By Type

By Application

By Regional

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others