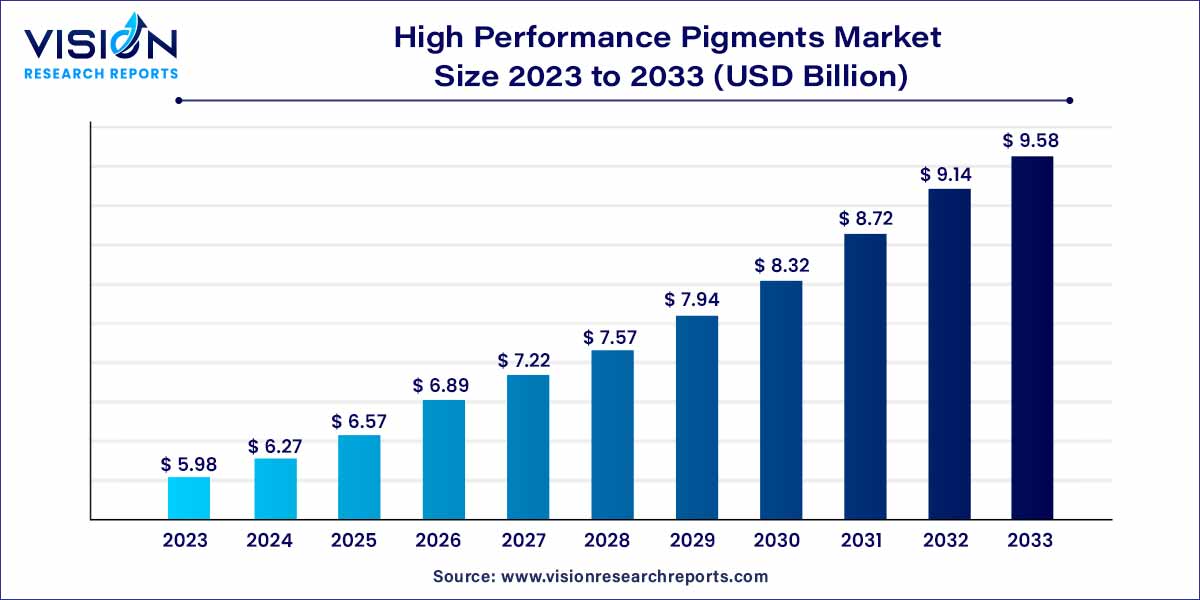

The global high performance pigments market size was estimated at around USD 5.98 billion in 2023 and it is projected to hit around USD 9.58 billion by 2033, growing at a CAGR of 4.83% from 2024 to 2033. The high-performance pigments (HPPs) market is a thriving sector within the global pigment industry, distinguished by its innovative and advanced pigment offerings. High-performance pigments are engineered to deliver exceptional color quality and stability, making them indispensable in a multitude of applications across various industries.

The high-performance pigments market is experiencing robust growth due to several key factors. One of the primary drivers is the escalating demand from industries such as automotive, cosmetics, and coatings, where vibrant and long-lasting colors are essential. The superior properties of high-performance pigments, including excellent lightfastness, heat stability, and resistance to chemicals, have made them indispensable in applications requiring color durability. Additionally, the market growth is further propelled by innovations in environmentally friendly pigment formulations, aligning with global sustainability goals. Advancements in nanotechnology, leading to the development of nano-sized high-performance pigments, have also expanded their applications, fostering market expansion. Furthermore, collaborations between manufacturers and end-users, coupled with ongoing research and development efforts, continue to drive innovation, further fueling the market's upward trajectory.

| Report Coverage | Details |

| Market Revenue by 2033 | USD 9.58 billion |

| Growth Rate from 2024 to 2033 | CAGR of 4.83% |

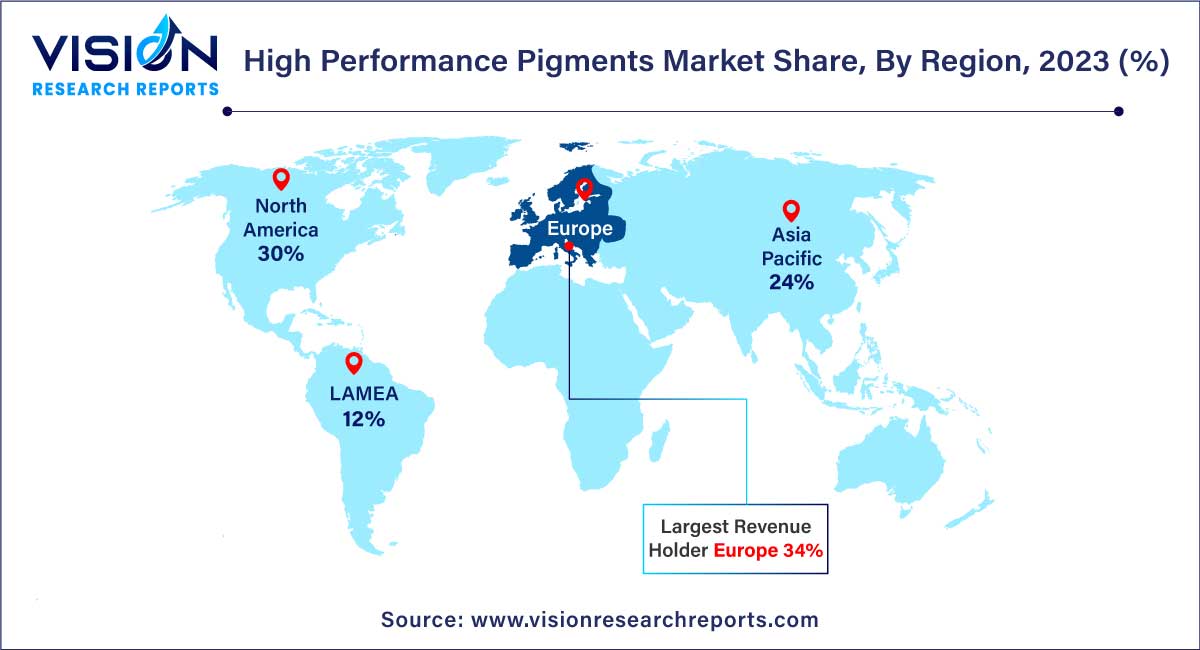

| Revenue Share of Europe in 2023 | 33% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units)Companies Covered |

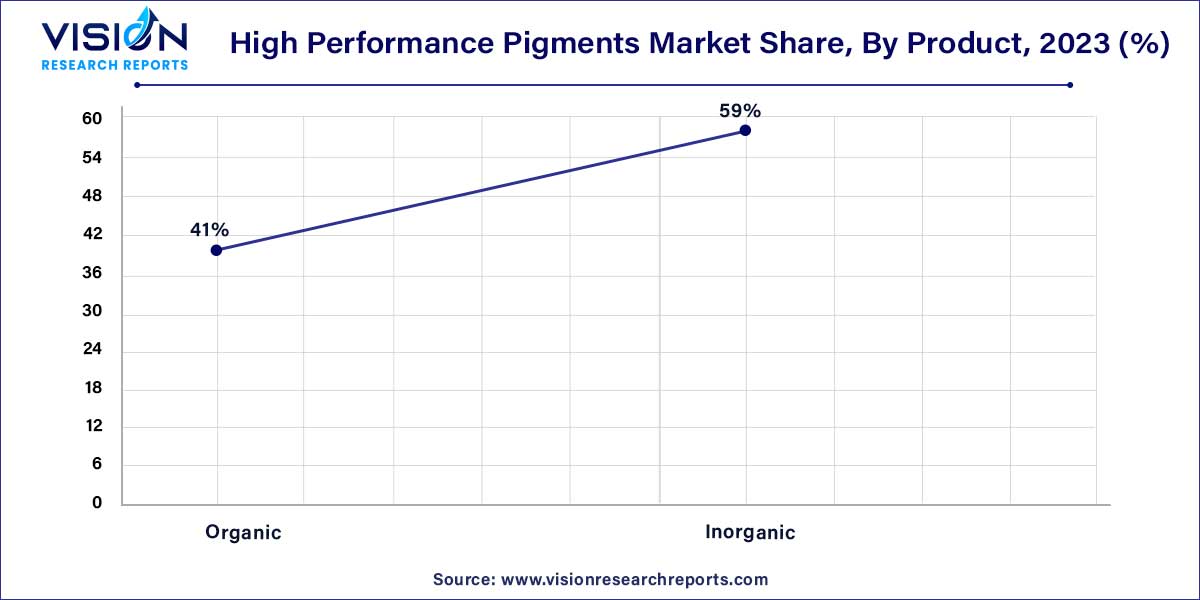

The inorganic segment accounted for the largest revenue share of 59% in 2023. Inorganic high-performance pigments, derived from minerals and metallic compounds, are known for their excellent heat stability, lightfastness, and chemical resistance. These pigments find extensive usage in demanding applications, including automotive coatings, industrial coatings, and high-temperature plastics. Inorganic high-performance pigments are favored for their ability to withstand harsh environmental conditions, making them ideal for outdoor applications where color durability is essential. Industries such as aerospace and automotive rely on inorganic pigments to achieve vibrant and long-lasting finishes, ensuring the durability and aesthetic appeal of their products.

The organic segment is expected to grow at the fastest CAGR of 4.95% over the forecast period. Organic high-performance pigments are synthesized from carbon-based molecules and offer a wide range of color options, including reds, yellows, blues, and greens. Organic pigments are valued for their high color strength and versatility, making them suitable for various applications such as paints, inks, plastics, and textiles. These pigments are preferred in applications where a diverse and vibrant color palette is required. Organic high-performance pigments are widely used in the cosmetic industry for producing vivid makeup products and in the printing industry for creating vibrant and eye-catching prints.

The coating segment dominated the market with largest revenue share of 61% in 2023. Automotive coatings, in particular, benefit from the superior properties of these pigments, including excellent color retention, resistance to weathering, and protection against corrosion. High-performance pigments enhance the overall aesthetic appeal and longevity of automotive and industrial coatings, ensuring that painted surfaces maintain their brilliance and integrity even in challenging environmental conditions. Moreover, these pigments are integral to architectural coatings, enabling buildings and infrastructures to withstand harsh weather, UV radiation, and chemical exposure while retaining their vibrant colors over time.

The plastics segment held the second largest revenue share in 2023. In the plastics sector, high-performance pigments play a crucial role in providing an extensive color range to plastic products. Plastics, used in diverse applications such as packaging, consumer goods, and automotive components, benefit from the vivid and stable colors offered by high-performance pigments. These pigments are engineered to withstand the high processing temperatures involved in plastic molding and extrusion processes, ensuring that the color remains consistent and vibrant throughout the product's lifecycle. Additionally, high-performance pigments enhance the visual appeal of plastic products, making them more attractive to consumers while maintaining their integrity and colorfastness.

Europe dominated the market with the largest market share of 34% in 2023. In Europe, the high-performance pigments market benefits from a strong emphasis on environmental sustainability and stringent regulations governing the use of pigments in different applications.

European countries prioritize eco-friendly formulations, leading to the development and adoption of sustainable high-performance pigments. This focus aligns with the region's commitment to reducing environmental impact, driving the market towards innovative, green pigment solutions. Furthermore, the well-established automotive and coatings industries in Europe fuel the demand for high-performance pigments, ensuring a steady market growth trajectory.

By Product

By Application

By Region

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on High Performance Pigments Market

5.1. COVID-19 Landscape: High Performance Pigments Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global High Performance Pigments Market, By Product

8.1. High Performance Pigments Market, by Product, 2024-2033

8.1.1. Organic

8.1.1.1. Market Revenue and Forecast (2021-2033)

8.1.2. Organic

8.1.2.1. Market Revenue and Forecast (2021-2033)

Chapter 9. Global High Performance Pigments Market, By Application

9.1. High Performance Pigments Market, by Application, 2024-2033

9.1.1. Coating

9.1.1.1. Market Revenue and Forecast (2021-2033)

9.1.2. Plastics

9.1.2.1. Market Revenue and Forecast (2021-2033)

9.1.3. Inks

9.1.3.1. Market Revenue and Forecast (2021-2033)

9.1.4. Cosmetics

9.1.4.1. Market Revenue and Forecast (2021-2033)

9.1.5. Cosmetics

9.1.5.1. Market Revenue and Forecast (2021-2033)

Chapter 10. Global High Performance Pigments Market, Regional Estimates and Trend Forecast

10.1. North America

10.1.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.3. U.S.

10.1.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.1.4. Rest of North America

10.1.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.1.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2. Europe

10.2.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.3. UK

10.2.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.4. Germany

10.2.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.5. France

10.2.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.2.6. Rest of Europe

10.2.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.2.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.3. APAC

10.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.3. India

10.3.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.4. China

10.3.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.5. Japan

10.3.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.3.6. Rest of APAC

10.3.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.3.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.4. MEA

10.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.3. GCC

10.4.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.4. North Africa

10.4.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.4.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.5. South Africa

10.4.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.4.6. Rest of MEA

10.4.6.1. Market Revenue and Forecast, by Product (2021-2033)

10.4.6.2. Market Revenue and Forecast, by Application (2021-2033)

10.5. Latin America

10.5.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.3. Brazil

10.5.3.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.3.2. Market Revenue and Forecast, by Application (2021-2033)

10.5.4. Rest of LATAM

10.5.4.1. Market Revenue and Forecast, by Product (2021-2033)

10.5.4.2. Market Revenue and Forecast, by Application (2021-2033)

Chapter 11. Company Profiles

11.1. Sun Chemical

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Clariant

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. BASF SE

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Ferro Corporation

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Vijay Chemical Industries

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Meghmani Organics Ltd.

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. VOXCO India

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Heubach GmbH

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. ALTANA AG

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. Trust

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others