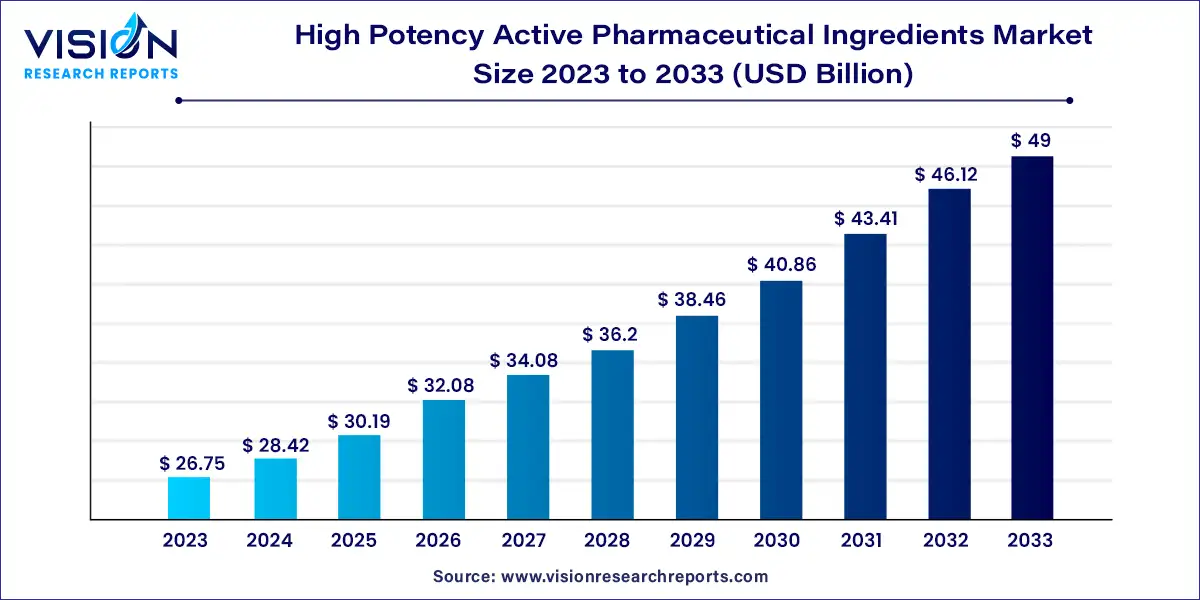

The global high potency active pharmaceutical ingredients market was estimated at USD 26.75 billion in 2023 and it is expected to surpass around USD 49 billion by 2033, poised to grow at a CAGR of 6.24% from 2024 to 2033.

The global market for high potency active pharmaceutical ingredients (HPAPI) has witnessed remarkable growth in recent years. HPAPIs are substances that exhibit pharmacological activity at low doses, typically measured in micrograms or even nanograms. Due to their high potency, these ingredients require stringent handling procedures and specialized containment facilities to ensure safety for both workers and the environment.

The growth of the high potency active pharmaceutical ingredients (HPAPI) market is propelled by several key factors. Firstly, the escalating incidence of chronic diseases like cancer, autoimmune disorders, and cardiovascular conditions necessitates the development of potent therapeutic agents, thus driving demand for HPAPIs. Secondly, advancements in pharmaceutical manufacturing technologies have facilitated the production of HPAPIs with enhanced efficacy and reduced side effects, further fueling market expansion. Moreover, the increasing adoption of targeted therapies and personalized medicine approaches has surged demand for HPAPIs, owing to their precise disease targeting capabilities. Additionally, significant investments in research and development activities by pharmaceutical firms and academic institutions have led to the discovery and development of novel HPAPIs, contributing to market growth.

In 2023, the synthetic segment emerged as the dominant revenue generator in the HPAPI market. This segment's growth is primarily fueled by the heightened efficacy of synthetic HPAPIs in treating a diverse array of diseases at minimal dosages. Additionally, the expiration of patents associated with synthetic molecules has facilitated the entry of generics into the market, further bolstering segment growth. The FDA's generic drug program, particularly active during the COVID-19 pandemic, has played a crucial role in ensuring the availability of high-quality and cost-effective drugs in the U.S. This initiative not only reduces overall healthcare costs but also alleviates the financial burden on patients by promoting the use of generic products. Notably, in 2020, the FDA approved 948 ANDA applications, including 72 first generic drugs.

The biotech segment is poised to exhibit the most rapid growth during the forecast period. This surge is attributable to technological advancements within the biotech sector, coupled with the remarkable efficacy of biotech HPAPIs. Predominantly comprising peptides and various enzyme forms, these HPAPIs offer promising therapeutic potential. Moreover, the growth of the biotech segment is propelled by substantial investments in biotechnology and biopharmaceutical sectors, fostering the innovation of novel molecules for disease treatment, notably in areas such as cancer. However, it's worth noting that the production cost of biotechnological products is relatively high due to the requirement for specialized facilities and skilled personnel. Consequently, pharmaceutical companies are increasingly turning to third-party manufacturers, enhancing the bargaining power of suppliers within the HPAPI market.

In 2023, the in-house segment commanded the largest market share in the HPAPI market. This dominance is primarily attributed to the strategic initiatives undertaken by key players, indicating a strong emphasis on in-house manufacturing over outsourcing. Notably, in August 2021, Cipla, Inc. launched an "API re-imagination" program aimed at expanding its manufacturing capabilities leveraging recent government incentives such as production subsidies.

The outsourced segment is expected to witness the most rapid growth over the forecast period. This growth can be attributed to the escalating adoption of outsourcing within the high potency APIs market. Outsourced manufacturing offers advantages including risk mitigation, reduced resource commitment, and simplified product complexity for companies. Moreover, developing countries present a cost-effective option for outsourcing due to lower manufacturing costs, enabling companies to realize higher profits and driving market demand. An illustrative example is the expansion of Wuxi STA's HPAPI facility in China announced in June 2023, enabling the company to cater to CDMO customers seeking complex manufacturing setups.

In the HPAPI market, innovative drugs claimed the largest revenue share, driven by the increasing emphasis on personalized and precision medicines such as Antibody-Drug Conjugates (ADCs). The development of innovative HPAPIs tailored to target specific diseases among patient populations has emerged as a significant market driver. Notably, the introduction of innovative drugs like the biosimilar antibody-drug conjugate trastuzumab emtansine under the brand name Ujvira by Zydus Cadila in May 2021 exemplifies this trend.

The generic medicine segment is poised to experience the fastest growth rate. This growth is fueled by the pivotal role generics play in facilitating access to life-saving medications, with the U.S. FDA prioritizing generics as a public health imperative to conserve healthcare funding. As of November 2021, there are already over 10,000 FDA-approved generic medications on the market, with generics filling nine out of ten prescriptions in the U.S. This underscores the significance of the generic medicine segment in driving market expansion and enhancing patient access to affordable healthcare solutions.

The oncology segment emerged as the dominant force in the HPAPI market, boasting the largest market share in 2023, and is projected to sustain its position as the fastest-growing segment. This dominance can be attributed to the escalating global prevalence of cancer. According to GLOBOCAN 2020, approximately 19.3 million new cancer cases and nearly 10.0 million cancer-related deaths were recorded in 2020 alone. Notably, breast and lung cancers were identified as the most prevalent cancer types worldwide. In response to the surge in cancer incidence, key market players are expanding their manufacturing capacities to address the growing demand for cancer treatment components. For example, in June 2023, Merck announced a twofold expansion of its U.S.-based Verona HPAPI facility to meet the escalating demand for cancer therapeutics.

The hormonal segment is poised to witness significant growth in the forecast period. This growth trajectory is fueled by the increasing prevalence of the geriatric population coupled with growing awareness of hormonal therapy. Common hormone-dependent conditions in women, such as Alzheimer's disease, osteoporosis, coronary atherosclerosis, and urinary incontinence, underscore the importance of hormonal treatments. The rising prevalence of hormonal disorders is expected to further drive segmental growth, presenting lucrative opportunities in the HPAPI market.

In 2023, North America asserted its dominance in the high potency active pharmaceutical ingredients (HPAPI) market, securing a significant share. This regional supremacy can be attributed to several factors, including the rising prevalence of cancer, well-developed infrastructure, and the presence of key market players. For instance, in 2021, the United States alone witnessed approximately 1.9 million new cancer cases and around 608,570 deaths, underscoring the pressing need for advanced pharmaceutical solutions. North America is poised for further growth, driven by increasing regulatory support and the escalating incidence of chronic diseases, leading to a rising demand for fast-acting and high-efficacy drugs.

The Asia Pacific region is poised to exhibit the fastest growth over the forecast period. This growth trajectory is fueled by the presence of emerging economies within the region, notably India and China, which serve as major suppliers of HPAPIs across various global markets. The availability of API and HPAPI at lower costs in the region further amplifies market growth. Additionally, the emergence of generics and enhancements in healthcare infrastructure contribute to the region's growth momentum, facilitating increased accessibility to advanced pharmaceutical treatments.

By Product

By Manufacturer Type

By Drug Type

By Application

By Region

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others