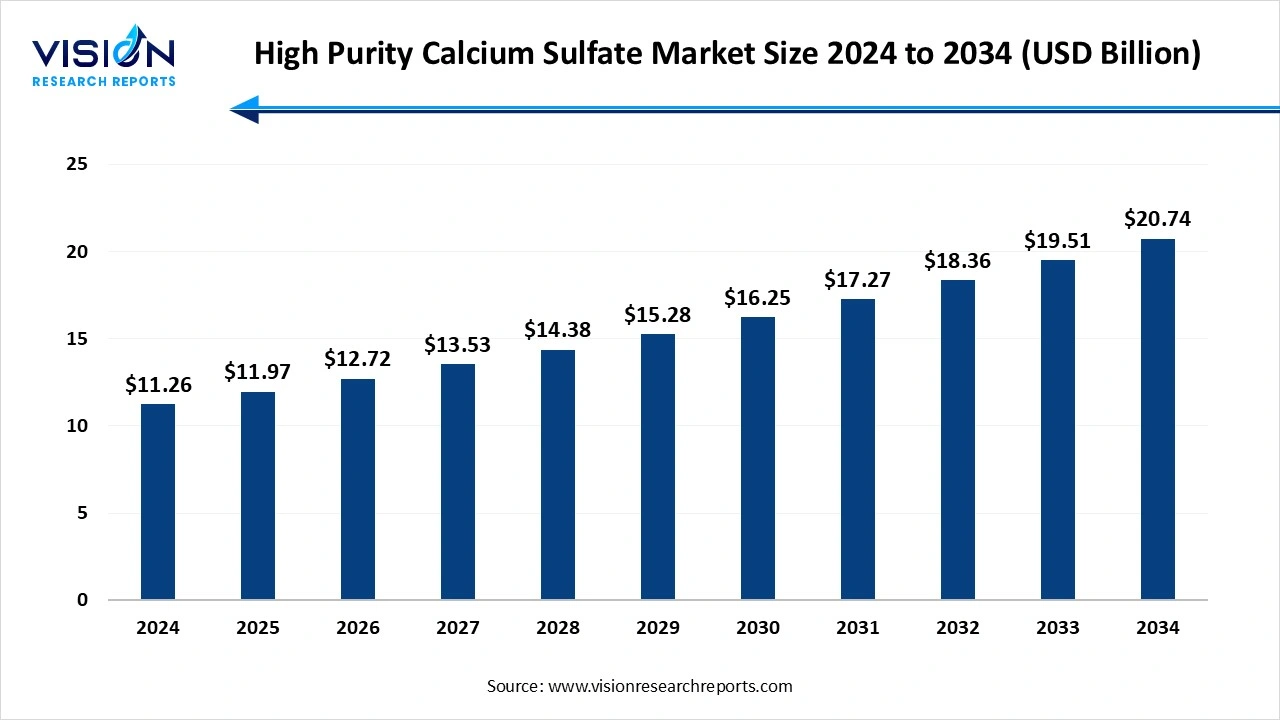

The global high purity calcium sulfate narket was size reached at USD 11.26 billion in 2024 and it is expected to surpass around USD 20.74 billion by 2034, poised to grow at a CAGR of 6.30% from 2025 to 2034.

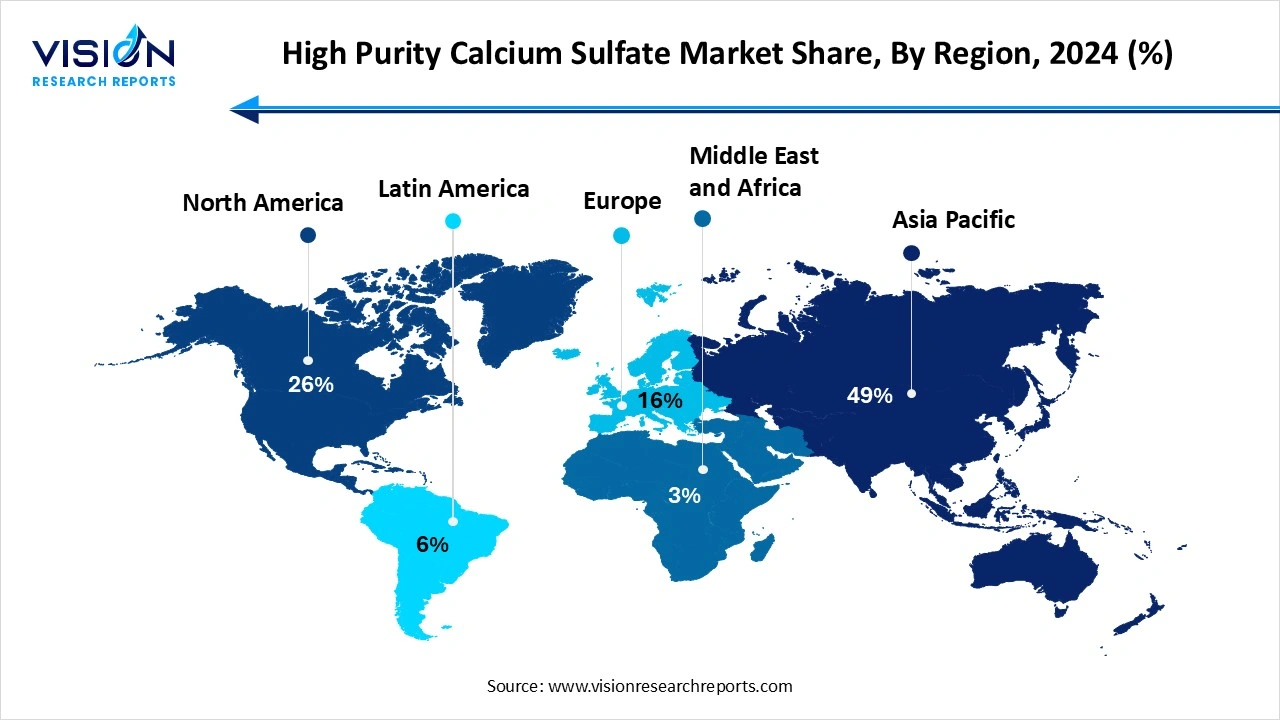

The global high purity calcium Sulfate market is witnessing steady growth, driven by increasing demand across diverse sectors such as pharmaceuticals, food & beverage, construction, and laboratory applications. Known for its superior purity and consistent performance, high purity calcium sulfate is widely utilized as a diluent in tablets, a coagulant in tofu processing, and as a specialty additive in plasters and cements. The market is further propelled by advancements in manufacturing technologies, stringent quality standards, and rising awareness regarding product traceability and regulatory compliance. Asia-Pacific holds a significant share due to industrial expansion and healthcare growth, while North America and Europe follow closely with strong pharmaceutical and food processing industries.

One of the primary growth drivers of the high purity calcium sulfate market is its expanding application base across industries that demand stringent quality and safety standards. In the pharmaceutical sector, it is extensively used as an excipient due to its inert nature and chemical stability, contributing to its increased adoption in drug formulation. Similarly, in the food and beverage industry, the material serves as a coagulant and additive, particularly in health-conscious and organic food products. As consumers increasingly prioritize product safety and regulatory compliance, the demand for high-purity ingredients is rising a trend that favors the growth of this market.

The construction and industrial sectors are contributing significantly to market expansion, particularly with the growing emphasis on sustainable and high-performance building materials. High purity calcium sulfate is used in specialty plasters, dental molds, and precision casting, all of which require consistent chemical properties. The rise in infrastructure development, technological advancements in material processing, and the global shift toward eco-friendly building solutions have amplified the relevance of high-purity mineral compounds. Combined with supportive regulations and increased R&D investments, these factors are expected to sustain long-term growth in the market.

The Asia Pacific region dominated the market, capturing a revenue share of 49% in 2024. Asia-Pacific holds a dominant position, driven largely by rapid industrialization, expanding pharmaceutical and food processing sectors, and increasing infrastructure development in countries such as China, India, and Japan. The region benefits from a growing population and rising healthcare awareness, which collectively fuel demand for high-quality pharmaceutical excipients and food additives. Additionally, cost advantages and government initiatives to support manufacturing and exports further strengthen the region’s market presence.

The Middle East and African market is projected to experience substantial growth during the forecast period. This expansion is largely driven by the increasing construction and infrastructure projects, especially within the Gulf Cooperation Council (GCC) countries. Rapid urban development in cities like Dubai, Riyadh, and Doha is fueling a growing demand for gypsum products, which depend heavily on high purity calcium sulfate. The ongoing construction surge, supported by government-funded initiatives across residential and commercial sectors, is boosting the consumption of premium-quality building materials.

The Middle East and African market is projected to experience substantial growth during the forecast period. This expansion is largely driven by the increasing construction and infrastructure projects, especially within the Gulf Cooperation Council (GCC) countries. Rapid urban development in cities like Dubai, Riyadh, and Doha is fueling a growing demand for gypsum products, which depend heavily on high purity calcium sulfate. The ongoing construction surge, supported by government-funded initiatives across residential and commercial sectors, is boosting the consumption of premium-quality building materials.

The powder segment held the largest revenue market share, accounting for 54% in 2024. Among these, the powder form dominates a significant portion of the market due to its versatility, ease of integration into manufacturing processes, and high solubility. It is widely utilized in the pharmaceutical industry as a diluent in tablet formulations, where uniform particle size and purity are critical for ensuring dosage accuracy and product stability. Additionally, the food industry relies heavily on powdered high purity calcium sulfate as a firming agent and dietary calcium source, particularly in fortified and processed foods.

Granules are expected to achieve the fastest CAGR of 6.6% during the forecast period and rank as the second-largest revenue contributors in the global form market. It is often used in agricultural formulations, industrial desiccants, and specialty building materials. The granular form provides better handling and storage benefits, reducing loss during transportation and improving the efficiency of application in various industrial processes. As industries continue to shift towards cleaner and safer production practices, both powder and granule forms of high purity calcium sulfate are seeing increased adoption. However, the choice between the two often depends on specific end-user requirements, processing compatibility, and regulatory standards.

The pharmaceuticals segment led the market, capturing a 30% share in 2024. Due to its chemical inertness, consistent particle size, and excellent compressibility, high purity calcium sulfate is extensively used as a filler or diluent in tablets and capsules. Its biocompatibility and stability under varying environmental conditions make it an ideal choice for pharmaceutical manufacturers who are required to meet stringent regulatory standards for product safety and efficacy. The growing demand for high-quality excipients, coupled with the expansion of the global pharmaceutical industry especially in emerging economies is contributing to the rising consumption of high purity calcium sulfate in this sector.

The construction sector is projected to achieve the highest CAGR of 6.4% throughout the forecast period. It is commonly used in high-performance plasters, flooring compounds, and wall panels where consistency, setting time control, and mechanical strength are critical. Its thermal insulation properties and compatibility with eco-friendly formulations make it particularly valuable in sustainable construction practices. As the construction sector increasingly embraces green building technologies and stricter quality standards, the use of refined materials like high purity calcium sulfate is expected to rise. This growing emphasis on durable, lightweight, and environmentally responsible construction materials is a major factor driving demand within the industry.

By Form

By End Use

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on High Purity Calcium Sulfate Market

5.1. COVID-19 Landscape: High Purity Calcium Sulfate Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. High Purity Calcium Sulfate Market, By Form

8.1. High Purity Calcium Sulfate Market, by Form

8.1.1. Powder

8.1.1.1. Market Revenue and Forecast

8.1.2. Granules

8.1.2.1. Market Revenue and Forecast

8.1.3. Others

8.1.3.1. Market Revenue and Forecast

Chapter 9. High Purity Calcium Sulfate Market, By End Use

9.1. High Purity Calcium Sulfate Market, by End Use

9.1.1. Pharmaceuticals

9.1.1.1. Market Revenue and Forecast

9.1.2. Food & Beverage

9.1.2.1. Market Revenue and Forecast

9.1.3. Construction

9.1.3.1. Market Revenue and Forecast

9.1.4. Agriculture

9.1.4.1. Market Revenue and Forecast

9.1.5. Cosmetics & Personal Care

9.1.5.1. Market Revenue and Forecast

9.1.6. Others

9.1.6.1. Market Revenue and Forecast

Chapter 10. High Purity Calcium Sulfate Market, Regional Estimates and Trend Forecast

10.1. U.S.

10.1.1. Market Revenue and Forecast, by Form

10.1.2. Market Revenue and Forecast, by End Use

Chapter 11. Company Profiles

11.1. Lhoist Group

11.1.1. Company Overview

11.1.2. Product Offerings

11.1.3. Financial Performance

11.1.4. Recent Initiatives

11.2. Imerys Group

11.2.1. Company Overview

11.2.2. Product Offerings

11.2.3. Financial Performance

11.2.4. Recent Initiatives

11.3. United States Gypsum Company (USG Corporation)

11.3.1. Company Overview

11.3.2. Product Offerings

11.3.3. Financial Performance

11.3.4. Recent Initiatives

11.4. Mineral Technologies Inc.

11.4.1. Company Overview

11.4.2. Product Offerings

11.4.3. Financial Performance

11.4.4. LTE Scientific

11.5. Solvay S.A.

11.5.1. Company Overview

11.5.2. Product Offerings

11.5.3. Financial Performance

11.5.4. Recent Initiatives

11.6. Gypsum Resources Limited

11.6.1. Company Overview

11.6.2. Product Offerings

11.6.3. Financial Performance

11.6.4. Recent Initiatives

11.7. Nouryon (formerly AkzoNobel Specialty Chemicals)

11.7.1. Company Overview

11.7.2. Product Offerings

11.7.3. Financial Performance

11.7.4. Recent Initiatives

11.8. Sibelco Group

11.8.1. Company Overview

11.8.2. Product Offerings

11.8.3. Financial Performance

11.8.4. Recent Initiatives

11.9. Martin Marietta Materials, Inc.

11.9.1. Company Overview

11.9.2. Product Offerings

11.9.3. Financial Performance

11.9.4. Recent Initiatives

11.10. National Gypsum Company

11.10.1. Company Overview

11.10.2. Product Offerings

11.10.3. Financial Performance

11.10.4. Recent Initiatives

Chapter 12. Research Methodology

12.1. Primary Research

12.2. Secondary Research

12.3. Assumptions

Chapter 13. Appendix

13.1. About Us

13.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others