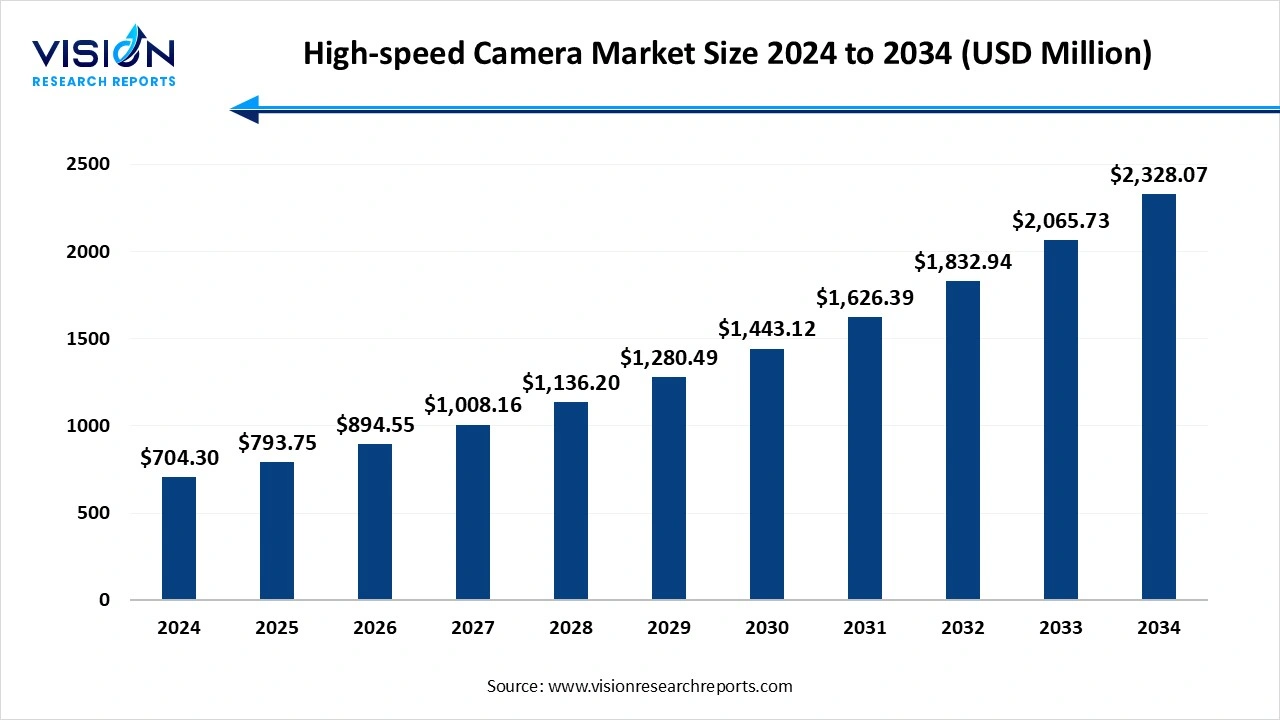

The global high-speed camera market size was evaluated at around USD 704.30 million in 2024 and it is projected to hit around USD 2,328.07 million by 2034, growing at a CAGR of 12.70% from 2025 to 2034.

The high-speed camera market is witnessing steady growth due to increasing demand across diverse sectors such as automotive testing, manufacturing, aerospace, media, and healthcare. High-speed cameras are capable of capturing rapid sequences of images with great clarity, which makes them essential for analyzing fast-moving events that are too quick for the human eye. These cameras are widely used in crash testing, product testing, scientific research, and even sports broadcasting to capture every microsecond of activity.

Technological advancements such as improved resolution, higher frame rates, and better data storage solutions are further driving the adoption of high-speed cameras. Industries are leveraging these innovations to enhance efficiency, improve safety, and support R&D activities.

The growth of the high-speed camera market is primarily driven by the rising demand for advanced imaging solutions in industrial and scientific applications. In sectors such as automotive, aerospace, and defense, high-speed cameras are vital for capturing rapid processes like crash tests, combustion analysis, and high-speed fluid dynamics, allowing engineers and researchers to conduct in-depth analysis and enhance product safety and performance.

The entertainment and sports industries are contributing significantly to market growth, where high-speed cameras are used to create slow-motion visuals that enhance viewer experience. The expansion of applications in life sciences, where high-speed imaging aids in cell research and biomechanical studies, is another key factor. Coupled with advancements in sensor technology, image processing software, and data transfer speeds, these developments are making high-speed cameras more accessible and efficient, supporting broader adoption across multiple sectors.

One of the notable trends in the high-speed camera market is the increasing integration of artificial intelligence (AI) and machine learning (ML) for real-time analysis and automated decision-making. Modern high-speed cameras are no longer just image-capturing devices; they are being paired with intelligent software that can instantly process large volumes of visual data. This trend is particularly beneficial in industrial automation, quality inspection, and predictive maintenance, where rapid image processing can lead to faster and more accurate assessments.

Another emerging trend is the miniaturization and portability of high-speed cameras without compromising on performance. With the demand growing in fields like biomechanics, wildlife research, and mobile journalism, manufacturers are focusing on developing compact, lightweight devices with high frame rates and resolution. Moreover, the market is seeing a shift toward wireless and cloud-based systems, which allow users to store, access, and analyze high-speed footage remotely.

One of the primary challenges faced by the high-speed camera market is the high cost of these advanced imaging systems. Due to their specialized components such as ultra-fast sensors, advanced processors, and high-capacity storage, high-speed cameras are significantly more expensive than conventional cameras. This makes them less accessible for smaller businesses or academic institutions with limited budgets. The overall investment also includes additional equipment like lighting systems, cooling solutions, and high-speed data transfer hardware, further increasing the total cost of ownership.

Another major challenge is the enormous volume of data generated during high-speed recordings. Capturing thousands of frames per second results in substantial data that requires efficient storage, processing, and analysis. Managing this data demands robust infrastructure and software capabilities, which may not always be available or affordable for all users.

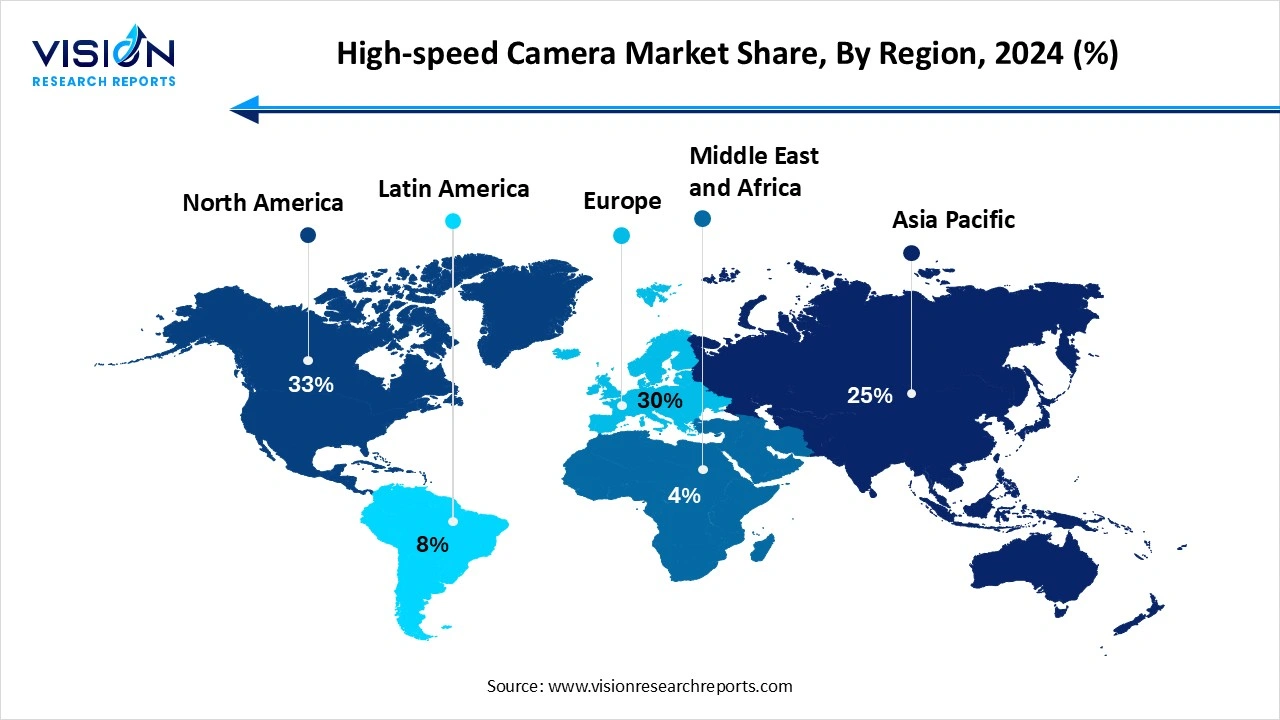

North America led the high-speed camera market, capturing a revenue share of over 33% in 2024. The region benefits from a strong presence of key industry players, well-established research institutions, and robust investment in sectors like aerospace, defense, automotive, and medical research. The United States, in particular, plays a pivotal role in market growth due to its high demand for precision imaging technologies and continued innovation in high-speed imaging solutions. The integration of high-speed cameras in military applications, crash testing, and industrial automation has further fueled the market in this region.

The Asia Pacific region is witnessing the fastest growth in the high-speed camera market, supported by rapid industrialization, rising investments in R&D, and expanding applications in electronics, automotive, and medical fields. Countries like China, Japan, South Korea, and India are key players due to their growing demand for advanced manufacturing technologies and increasing government support for innovation. In particular, China's robust electronics and automotive industries have accelerated the adoption of high-speed imaging systems for product testing and quality assurance.

The image sensors segment accounted for the largest market share, exceeding 29% in 2024. The performance of a high-speed camera largely depends on the type and quality of image sensors used, such as CMOS (complementary metal-oxide semiconductor) and CCD (charge-coupled device) sensors. CMOS sensors are increasingly favored due to their lower power consumption, higher speed, and improved integration with digital processing systems. These sensors allow for high-resolution imaging at faster frame rates, making them suitable for applications in automotive crash testing, scientific research, and industrial automation.

The memory segment is projected to record the highest CAGR of over 15.1% during the period from 2025 to 2034. Since these devices capture thousands of frames per second, they require high-speed, high-capacity memory systems to store large volumes of data efficiently and without loss. In-camera memory is essential for buffering images before transferring them to external storage or processing systems. The demand for advanced memory solutions is growing in parallel with the rising need for higher resolution and faster frame rates, as this combination generates even more data per second. Innovations in memory technology, such as the development of ultra-fast RAM and solid-state drives (SSDs), are helping to address these requirements by enabling quicker data access and improved storage management.

The aerospace and defense segment held the largest market share in 2024. These cameras are used extensively in applications such as missile testing, projectile tracking, aircraft safety evaluations, and explosion analysis. The ability to record at thousands of frames per second allows engineers and defense professionals to assess the dynamics of fast-moving objects and understand the performance and safety of advanced defense systems. High-speed imaging helps in identifying mechanical failures, studying impact forces, and enhancing the overall reliability of mission-critical components.

The healthcare segment is anticipated to experience the highest CAGR between 2025 and 2034. These cameras are used to capture intricate biological movements, such as the motion of muscles, heartbeats, or the dynamics of blood flow, which are difficult to observe with the naked eye. In biomechanics and physiology studies, high-speed imaging supports the detailed analysis of body mechanics and aids in the development of more effective treatments or prosthetics. Furthermore, high-speed cameras are being integrated into advanced surgical tools and robotic systems to enhance precision and improve outcomes in minimally invasive procedures.

The visible RGB segment accounted for the largest market share in 2024. Cameras operating in the RGB (red, green, blue) spectrum capture images in true-to-life color, making them ideal for applications that require detailed visual analysis. Industries such as automotive, manufacturing, sports, and media rely heavily on visible spectrum imaging for tasks like motion tracking, quality inspection, crash testing, and high-speed recording of live events.

The X-ray segment is anticipated to record the highest compound annual growth rate (CAGR) from 2025 to 2034. These cameras are crucial in applications such as material testing, ballistics analysis, medical diagnostics, and security inspections. Unlike traditional imaging, X-ray high-speed cameras allow users to capture internal structural changes in real time, which is invaluable for understanding stress distribution, fracture propagation, and internal failure mechanisms.

The 1000 - 10000 FPS segment held the largest market share in 2024. Cameras operating within this FPS range are commonly used in manufacturing, quality control, biomechanics, and research laboratories, where moderate to high-speed phenomena need to be recorded with clarity and accuracy. This range strikes a balance between resolution and speed, making it cost-effective and suitable for tasks like assembly line inspection, motion analysis, and material testing. The affordability and versatility of cameras in this FPS category have led to widespread adoption among users seeking reliable performance without the complexity or cost of ultra-high-speed systems.

The 30000 - 50000 FPS segment is projected to register the highest CAGR from 2025 to 2034. This performance range is particularly valuable in advanced research fields such as ballistics, explosion analysis, microfluidics, and high-impact physics, where minute temporal details are critical for analysis. Cameras in this category are engineered to deliver exceptional frame rates while maintaining image integrity, even under extreme conditions.

By Component

By Application

By Spectrum

By Frame Rate

By Regional

Chapter 1. Introduction

1.1. Research Objective

1.2. Scope of the Study

1.3. Definition

Chapter 2. Research Methodology

2.1. Research Approach

2.2. Data Sources

2.3. Assumptions & Limitations

Chapter 3. Executive Summary

3.1. Market Snapshot

Chapter 4. Market Variables and Scope

4.1. Introduction

4.2. Market Classification and Scope

4.3. Industry Value Chain Analysis

4.3.1. Raw Material Procurement Analysis

4.3.2. Sales and Distribution Channel Analysis

4.3.3. Downstream Buyer Analysis

Chapter 5. COVID 19 Impact on High-speed Camera Market

5.1. COVID-19 Landscape: High-speed Camera Industry Impact

5.2. COVID 19 - Impact Assessment for the Industry

5.3. COVID 19 Impact: Global Major Government Policy

5.4. Market Trends and Opportunities in the COVID-19 Landscape

Chapter 6. Market Dynamics Analysis and Trends

6.1. Market Dynamics

6.1.1. Market Drivers

6.1.2. Market Restraints

6.1.3. Market Opportunities

6.2. Porter’s Five Forces Analysis

6.2.1. Bargaining power of suppliers

6.2.2. Bargaining power of buyers

6.2.3. Threat of substitute

6.2.4. Threat of new entrants

6.2.5. Degree of competition

Chapter 7. Competitive Landscape

7.1.1. Company Market Share/Positioning Analysis

7.1.2. Key Strategies Adopted by Players

7.1.3. Vendor Landscape

7.1.3.1. List of Suppliers

7.1.3.2. List of Buyers

Chapter 8. Global High-speed Camera Market, By Component

8.1. High-speed Camera Market, by Component

8.1.1. Image Sensors

8.1.1.1. Market Revenue and Forecast

8.1.2. Processors

8.1.2.1. Market Revenue and Forecast

8.1.3. Lens

8.1.3.1. Market Revenue and Forecast

8.1.4. Memory

8.1.4.1. Market Revenue and Forecast

8.1.5. Fans and Cooling

8.1.5.1. Market Revenue and Forecast

8.1.6. Others

8.1.6.1. Market Revenue and Forecast

Chapter 9. Global High-speed Camera Market, By Application

9.1. High-speed Camera Market, by Application

9.1.1. Automotive & Transportation

9.1.1.1. Market Revenue and Forecast

9.1.2. Consumer Electronics

9.1.2.1. Market Revenue and Forecast

9.1.3. Aerospace & Defense

9.1.3.1. Market Revenue and Forecast

9.1.4. Healthcare

9.1.4.1. Market Revenue and Forecast

9.1.5. Media & Entertainment

9.1.5.1. Market Revenue and Forecast

Chapter 10. Global High-speed Camera Market, By Spectrum

10.1. High-speed Camera Market, by Spectrum

10.1.1. Infrared

10.1.1.1. Market Revenue and Forecast

10.1.2. X-Ray

10.1.2.1. Market Revenue and Forecast

10.1.3. Visible RGB

10.1.3.1. Market Revenue and Forecast

Chapter 11. Global High-speed Camera Market, By Frame Rate

11.1. High-speed Camera Market, by Frame Rate

11.1.1. 250 – 1000 FPS

11.1.1.1. Market Revenue and Forecast

11.1.2. 1000 – 10000 FPS

11.1.2.1. Market Revenue and Forecast

11.1.3. 10000 – 30000 FPS

11.1.3.1. Market Revenue and Forecast

11.1.4. 30000 – 50000 FPS

11.1.4.1. Market Revenue and Forecast

11.1.5. Above 50000 FPS

11.1.5.1. Market Revenue and Forecast

Chapter 12. Global High-speed Camera Market, Regional Estimates and Trend Forecast

12.1. North America

12.1.1. Market Revenue and Forecast, by Component

12.1.2. Market Revenue and Forecast, by Application

12.1.3. Market Revenue and Forecast, by Spectrum

12.1.4. Market Revenue and Forecast, by Frame Rate

12.1.5. U.S.

12.1.5.1. Market Revenue and Forecast, by Component

12.1.5.2. Market Revenue and Forecast, by Application

12.1.5.3. Market Revenue and Forecast, by Spectrum

12.1.5.4. Market Revenue and Forecast, by Frame Rate

12.1.6. Rest of North America

12.1.6.1. Market Revenue and Forecast, by Component

12.1.6.2. Market Revenue and Forecast, by Application

12.1.6.3. Market Revenue and Forecast, by Spectrum

12.1.6.4. Market Revenue and Forecast, by Frame Rate

12.2. Europe

12.2.1. Market Revenue and Forecast, by Component

12.2.2. Market Revenue and Forecast, by Application

12.2.3. Market Revenue and Forecast, by Spectrum

12.2.4. Market Revenue and Forecast, by Frame Rate

12.2.5. UK

12.2.5.1. Market Revenue and Forecast, by Component

12.2.5.2. Market Revenue and Forecast, by Application

12.2.5.3. Market Revenue and Forecast, by Spectrum

12.2.5.4. Market Revenue and Forecast, by Frame Rate

12.2.6. Germany

12.2.6.1. Market Revenue and Forecast, by Component

12.2.6.2. Market Revenue and Forecast, by Application

12.2.6.3. Market Revenue and Forecast, by Spectrum

12.2.6.4. Market Revenue and Forecast, by Frame Rate

12.2.7. France

12.2.7.1. Market Revenue and Forecast, by Component

12.2.7.2. Market Revenue and Forecast, by Application

12.2.7.3. Market Revenue and Forecast, by Spectrum

12.2.7.4. Market Revenue and Forecast, by Frame Rate

12.2.8. Rest of Europe

12.2.8.1. Market Revenue and Forecast, by Component

12.2.8.2. Market Revenue and Forecast, by Application

12.2.8.3. Market Revenue and Forecast, by Spectrum

12.2.8.4. Market Revenue and Forecast, by Frame Rate

12.3. APAC

12.3.1. Market Revenue and Forecast, by Component

12.3.2. Market Revenue and Forecast, by Application

12.3.3. Market Revenue and Forecast, by Spectrum

12.3.4. Market Revenue and Forecast, by Frame Rate

12.3.5. India

12.3.5.1. Market Revenue and Forecast, by Component

12.3.5.2. Market Revenue and Forecast, by Application

12.3.5.3. Market Revenue and Forecast, by Spectrum

12.3.5.4. Market Revenue and Forecast, by Frame Rate

12.3.6. China

12.3.6.1. Market Revenue and Forecast, by Component

12.3.6.2. Market Revenue and Forecast, by Application

12.3.6.3. Market Revenue and Forecast, by Spectrum

12.3.6.4. Market Revenue and Forecast, by Frame Rate

12.3.7. Japan

12.3.7.1. Market Revenue and Forecast, by Component

12.3.7.2. Market Revenue and Forecast, by Application

12.3.7.3. Market Revenue and Forecast, by Spectrum

12.3.7.4. Market Revenue and Forecast, by Frame Rate

12.3.8. Rest of APAC

12.3.8.1. Market Revenue and Forecast, by Component

12.3.8.2. Market Revenue and Forecast, by Application

12.3.8.3. Market Revenue and Forecast, by Spectrum

12.3.8.4. Market Revenue and Forecast, by Frame Rate

12.4. MEA

12.4.1. Market Revenue and Forecast, by Component

12.4.2. Market Revenue and Forecast, by Application

12.4.3. Market Revenue and Forecast, by Spectrum

12.4.4. Market Revenue and Forecast, by Frame Rate

12.4.5. GCC

12.4.5.1. Market Revenue and Forecast, by Component

12.4.5.2. Market Revenue and Forecast, by Application

12.4.5.3. Market Revenue and Forecast, by Spectrum

12.4.5.4. Market Revenue and Forecast, by Frame Rate

12.4.6. North Africa

12.4.6.1. Market Revenue and Forecast, by Component

12.4.6.2. Market Revenue and Forecast, by Application

12.4.6.3. Market Revenue and Forecast, by Spectrum

12.4.6.4. Market Revenue and Forecast, by Frame Rate

12.4.7. South Africa

12.4.7.1. Market Revenue and Forecast, by Component

12.4.7.2. Market Revenue and Forecast, by Application

12.4.7.3. Market Revenue and Forecast, by Spectrum

12.4.7.4. Market Revenue and Forecast, by Frame Rate

12.4.8. Rest of MEA

12.4.8.1. Market Revenue and Forecast, by Component

12.4.8.2. Market Revenue and Forecast, by Application

12.4.8.3. Market Revenue and Forecast, by Spectrum

12.4.8.4. Market Revenue and Forecast, by Frame Rate

12.5. Latin America

12.5.1. Market Revenue and Forecast, by Component

12.5.2. Market Revenue and Forecast, by Application

12.5.3. Market Revenue and Forecast, by Spectrum

12.5.4. Market Revenue and Forecast, by Frame Rate

12.5.5. Brazil

12.5.5.1. Market Revenue and Forecast, by Component

12.5.5.2. Market Revenue and Forecast, by Application

12.5.5.3. Market Revenue and Forecast, by Spectrum

12.5.5.4. Market Revenue and Forecast, by Frame Rate

12.5.6. Rest of LATAM

12.5.6.1. Market Revenue and Forecast, by Component

12.5.6.2. Market Revenue and Forecast, by Application

12.5.6.3. Market Revenue and Forecast, by Spectrum

12.5.6.4. Market Revenue and Forecast, by Frame Rate

Chapter 13. Company Profiles

13.1. Photron Limited

13.1.1. Company Overview

13.1.2. Product Offerings

13.1.3. Financial Performance

13.1.4. Recent Initiatives

13.2. Vision Research Inc. (a part of AMETEK Inc.)

13.2.1. Company Overview

13.2.2. Product Offerings

13.2.3. Financial Performance

13.2.4. Recent Initiatives

13.3. NAC Image Technology Inc.

13.3.1. Company Overview

13.3.2. Product Offerings

13.3.3. Financial Performance

13.3.4. Recent Initiatives

13.4. Mikrotron GmbH

13.4.1. Company Overview

13.4.2. Product Offerings

13.4.3. Financial Performance

13.4.4. Recent Initiatives

13.5. Optronis GmbH

13.5.1. Company Overview

13.5.2. Product Offerings

13.5.3. Financial Performance

13.5.4. Recent Initiatives

13.6. DEL Imaging Systems LLC

13.6.1. Company Overview

13.6.2. Product Offerings

13.6.3. Financial Performance

13.6.4. Recent Initiatives

13.7. Fastec Imaging Corporation

13.7.1. Company Overview

13.7.2. Product Offerings

13.7.3. Financial Performance

13.7.4. Recent Initiatives

13.8. PCO AG (a part of Excelitas Technologies Corp.)

13.8.1. Company Overview

13.8.2. Product Offerings

13.8.3. Financial Performance

13.8.4. Recent Initiatives

13.9. Weisscam GmbH

13.9.1. Company Overview

13.9.2. Product Offerings

13.9.3. Financial Performance

13.9.4. Recent Initiatives

13.10. AOS Technologies AG

13.10.1. Company Overview

13.10.2. Product Offerings

13.10.3. Financial Performance

13.10.4. Recent Initiatives

Chapter 14. Research Methodology

14.1. Primary Research

14.2. Secondary Research

14.3. Assumptions

Chapter 15. Appendix

15.1. About Us

15.2. Glossary of Terms

Cross-segment Market Size and Analysis for

Mentioned Segments

Cross-segment Market Size and Analysis for

Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Country/Region-specific Report

Go To Market Strategy

Go To Market Strategy

Region Specific Market Dynamics

Region Specific Market Dynamics Region Level Market Share

Region Level Market Share Import Export Analysis

Import Export Analysis Production Analysis

Production Analysis Others

Others